Balancing Act in California

While CAISO continues to set renewable generation records, there are worrying signs of regional balkanization of flexibility which could increase fossil fuel generation in an era when many BAs in the West are trying to do the opposite.

Record Renewables and Fossil Fuels

April was a banner month for California’s grid. Via the CAISO market, responsible for governing most of the state’s energy generation, the state recorded several records with positive implications for its long sought after low-carbon future:

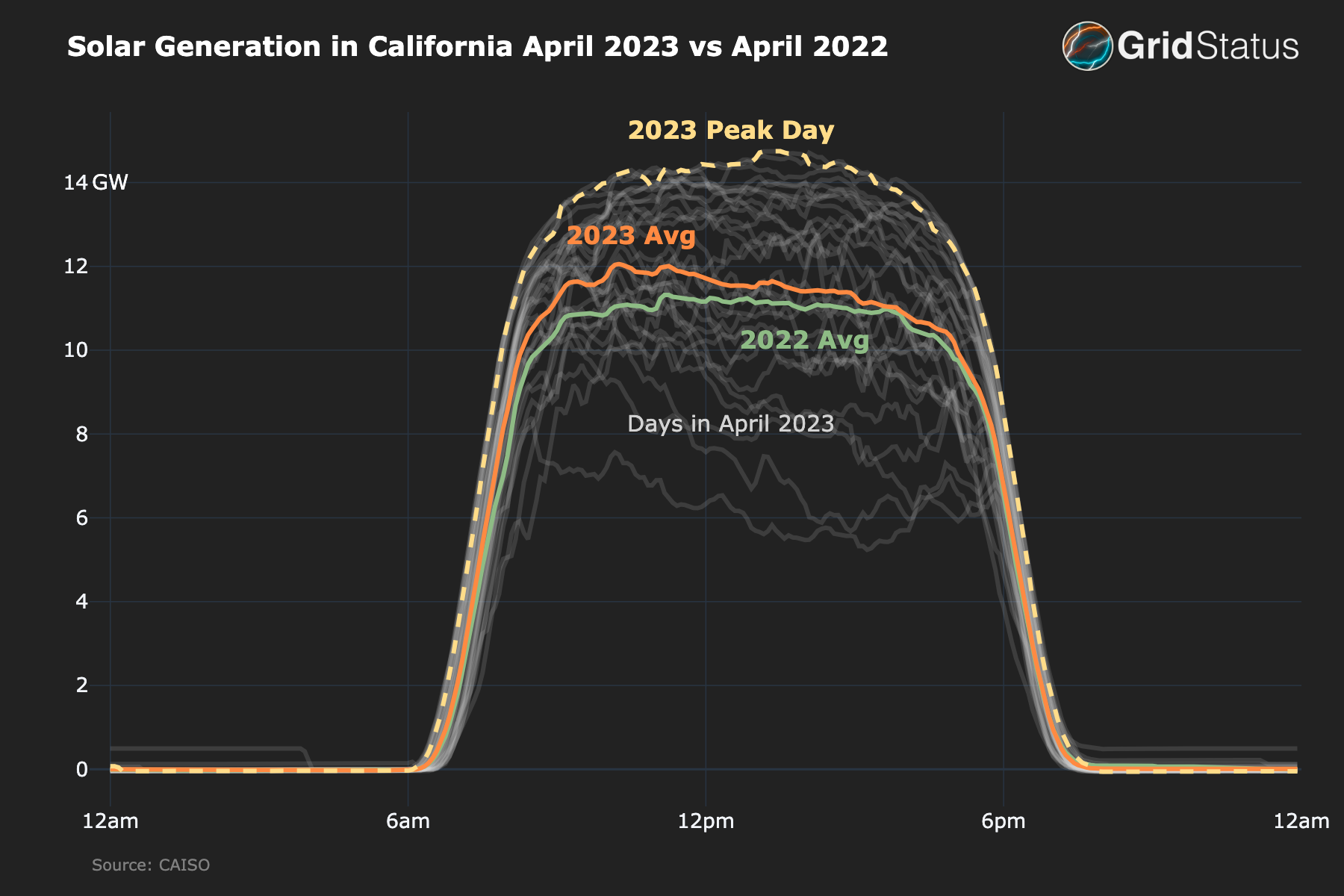

- Solar generation reached its highest production ever in CAISO

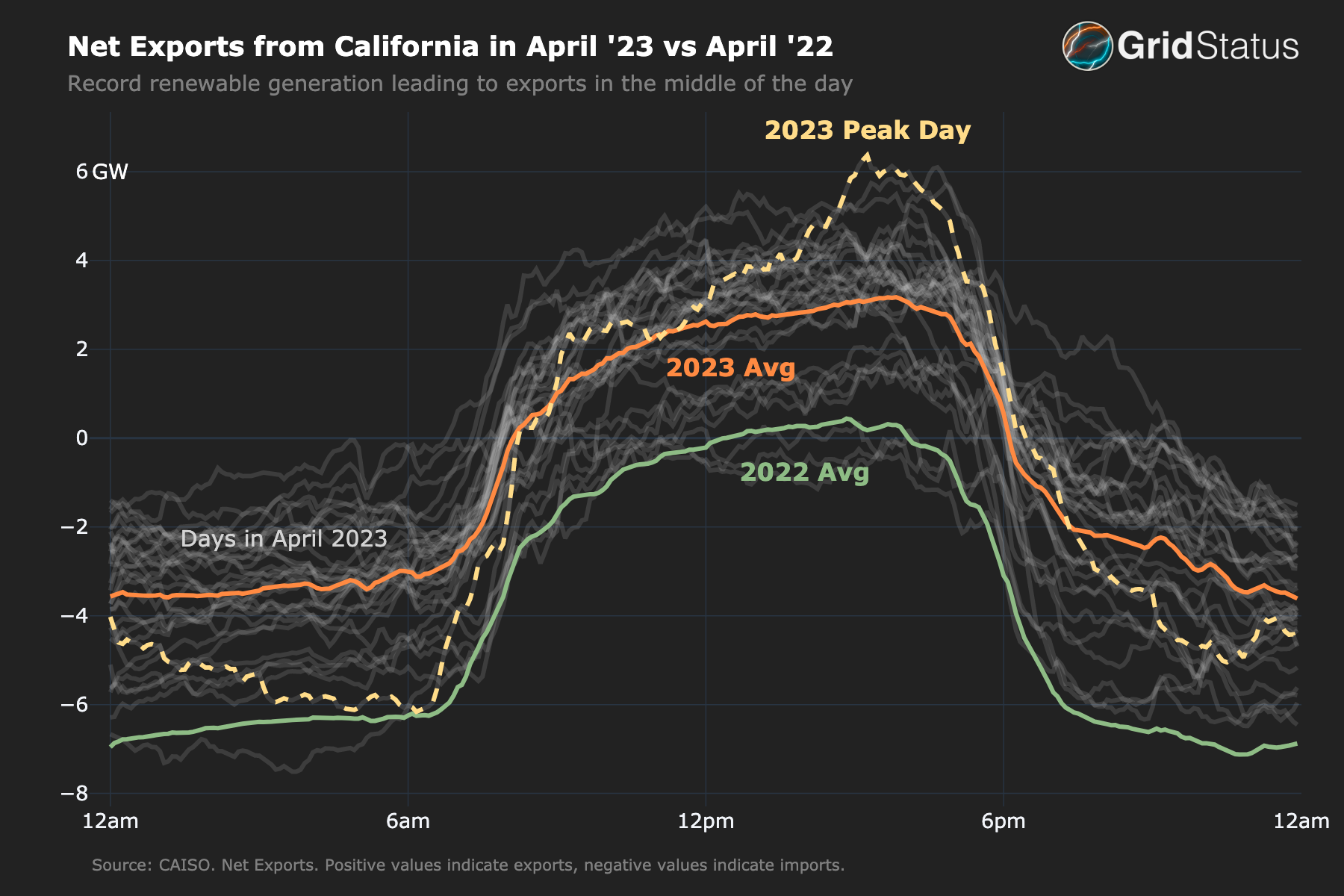

- Net exports from CAISO reached their highest absolute value of all time

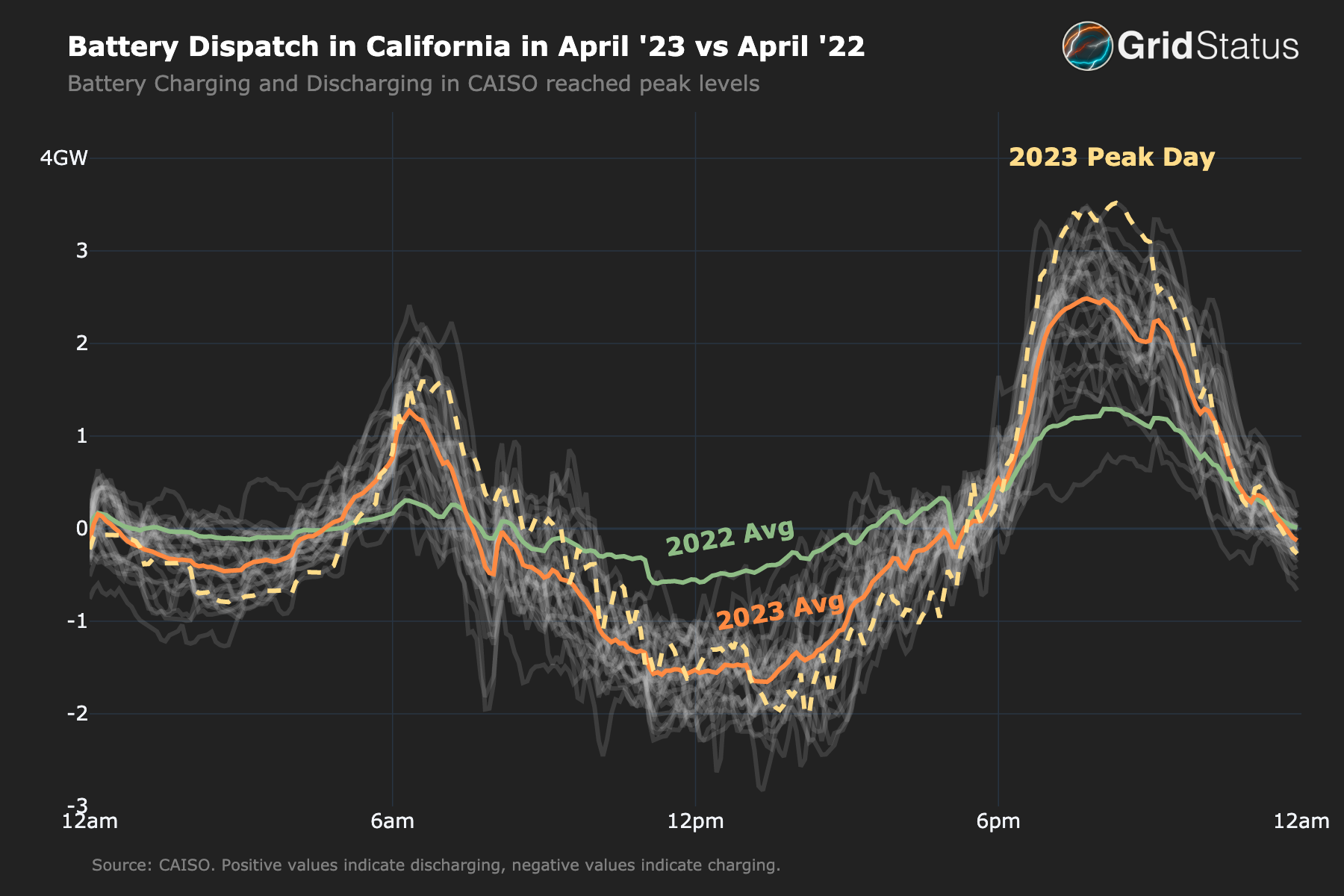

- Battery Charging and Discharging in CAISO reached peak levels

Together, these records speak to (1) record deployments of renewable resources, (2) the ability to support neighboring regions that California has long relied upon, and (3) an accelerated deployment of projects to provide much needed operational flexibility.

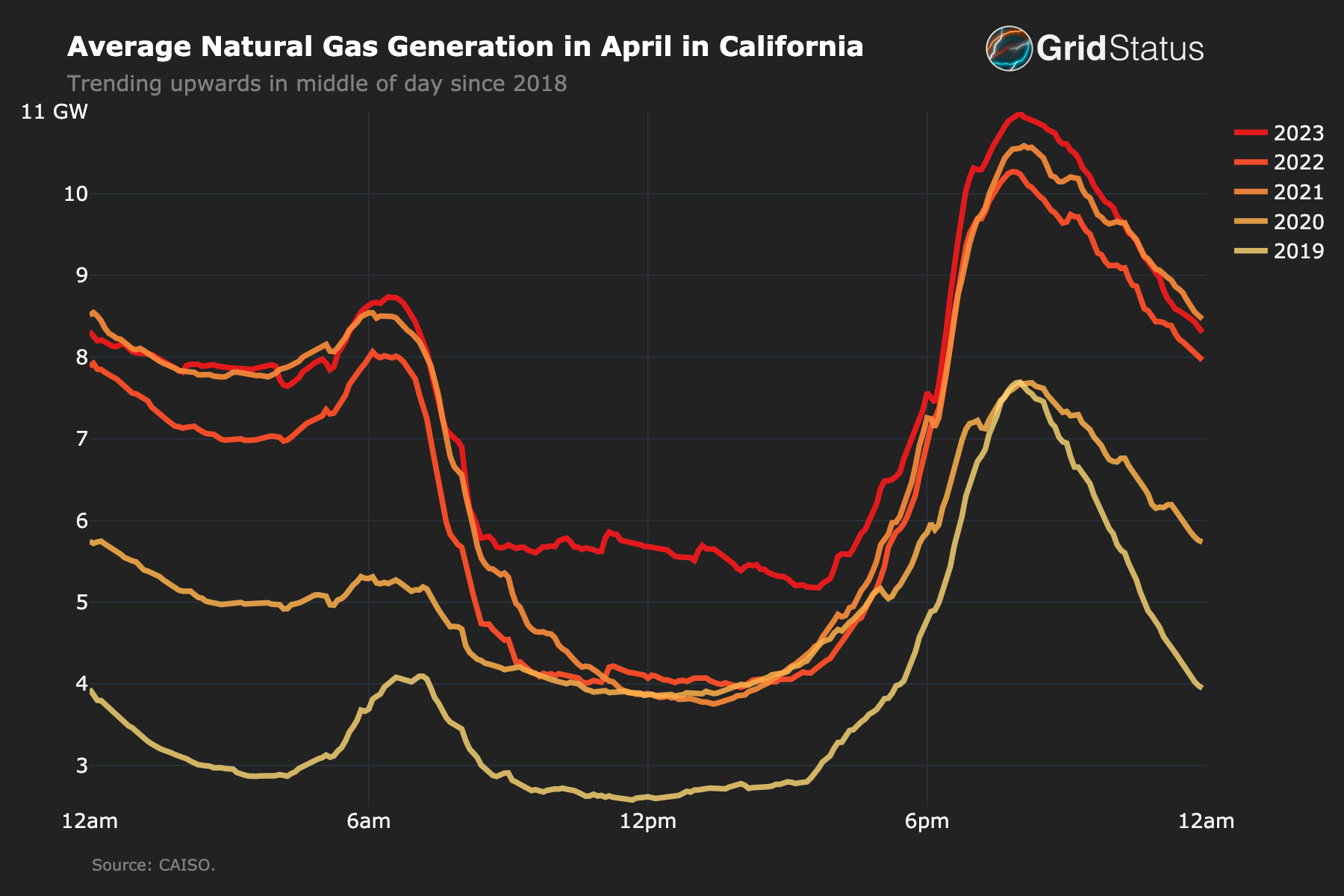

However, renewables and batteries weren’t the only resources setting records. Despite many years of very public effort and expense to reduce dependence on fossil fuels, natural gas generation saw its highest values in at least 6 years. While the total sum of generation from gas resources was not dramatically higher than some previous years, the midday hours increased substantially.

Exploring Reasons for Increased Natural Gas Generation

We believe that a handful of administrative actions related to Resource Adequacy (RA) in recent years have been an under-discussed major driver of this increase.

The California Public Utilities Commission (CPUC) requires suppliers and load-serving entities to have enough contracted capacity to meet system, local, and flexible resource adequacy requirements. Different “flavors” of RA come with different requirements related to availability and the resources’ participation in CAISO markets.

First, however, we should address the duck in the room.

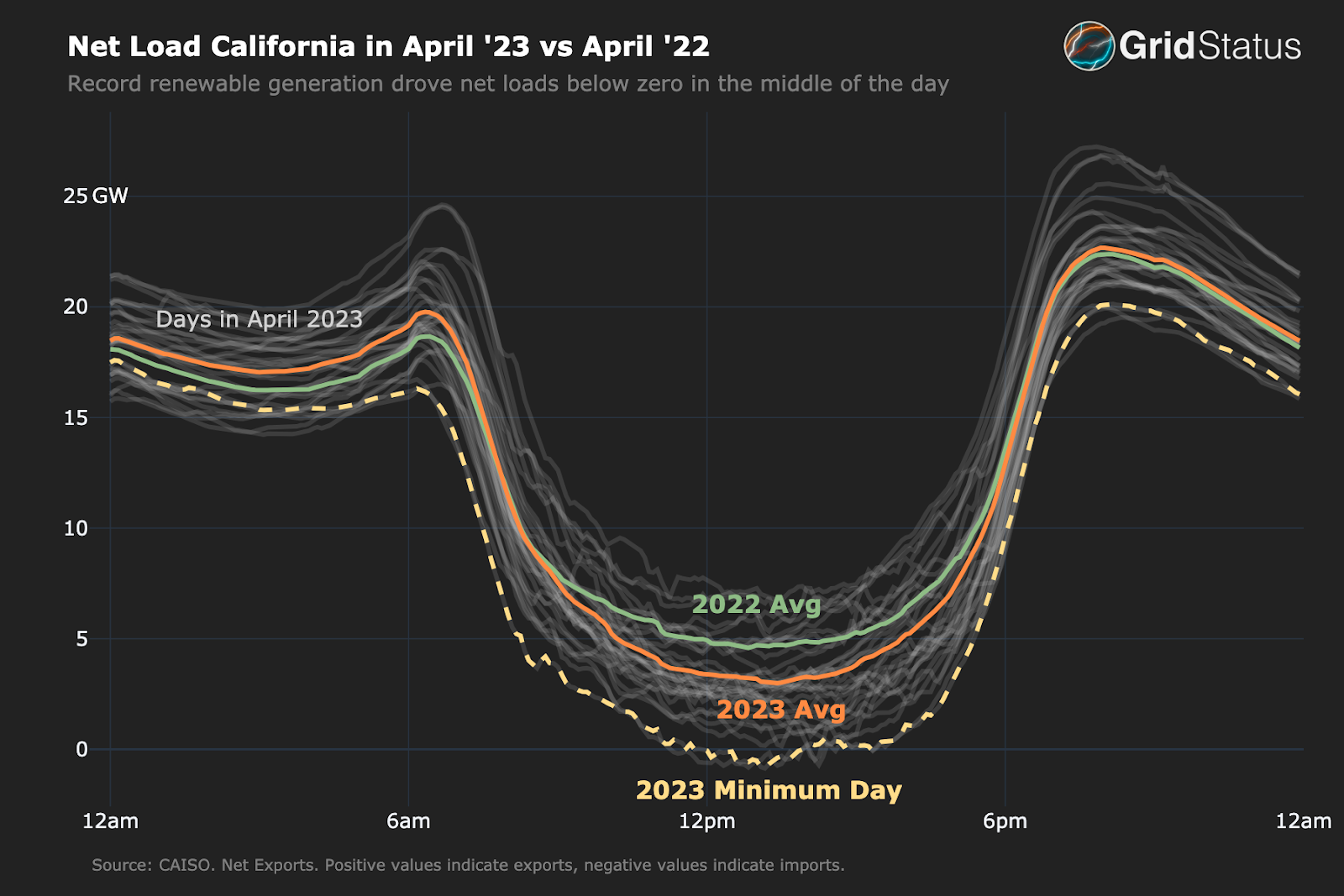

Yes, net load ramps can contribute. No, they are not the only factor causing more natural gas to be online in 2023.

Between 2019 and 2023 the average net load ramp for the period 4-9pm in April went from 11.3 GW to 16.9 GW, but the sharpest increase came between 2020 and 2021 as the net load ramp increased from 11.5 GW to nearly 15 GW.

Natural gas ramping is also inconclusive, averaging slightly higher values in both 2021 and 2022, 5.4 and 5.3 GW, respectively, compared to 5.2 GW in 2023. This is partially explained by the rise of batteries - at 4PM they were consuming more than 300 MW, while at 9PM they were discharging 2GW - a 2.3 GW swing which was more than 150% greater than the same value for 2022.

Batteries are increasingly helping to smooth the duck curve out over time.

Flexible RA

When it comes to RA, recent years have seen the introduction of Flexible RA, and changes to rules for external resources. “Flex RA” is the most recently-established category of required RA procurement. Designed to address the so-called Duck Curve, resources providing Flex RA must meet the requirements of System RA, but in addition must offer economic bids and be available for economic dispatch by CAISO (no self-scheduling).

Flex RA procurement is not subject to any locational requirements, although imports of Flex RA from outside the CAISO BA can be difficult if not impossible to arrange, as the resource must be available for five-minute dispatch by the CAISO in order to qualify. Imports can meet this requirement only via dynamic scheduling.

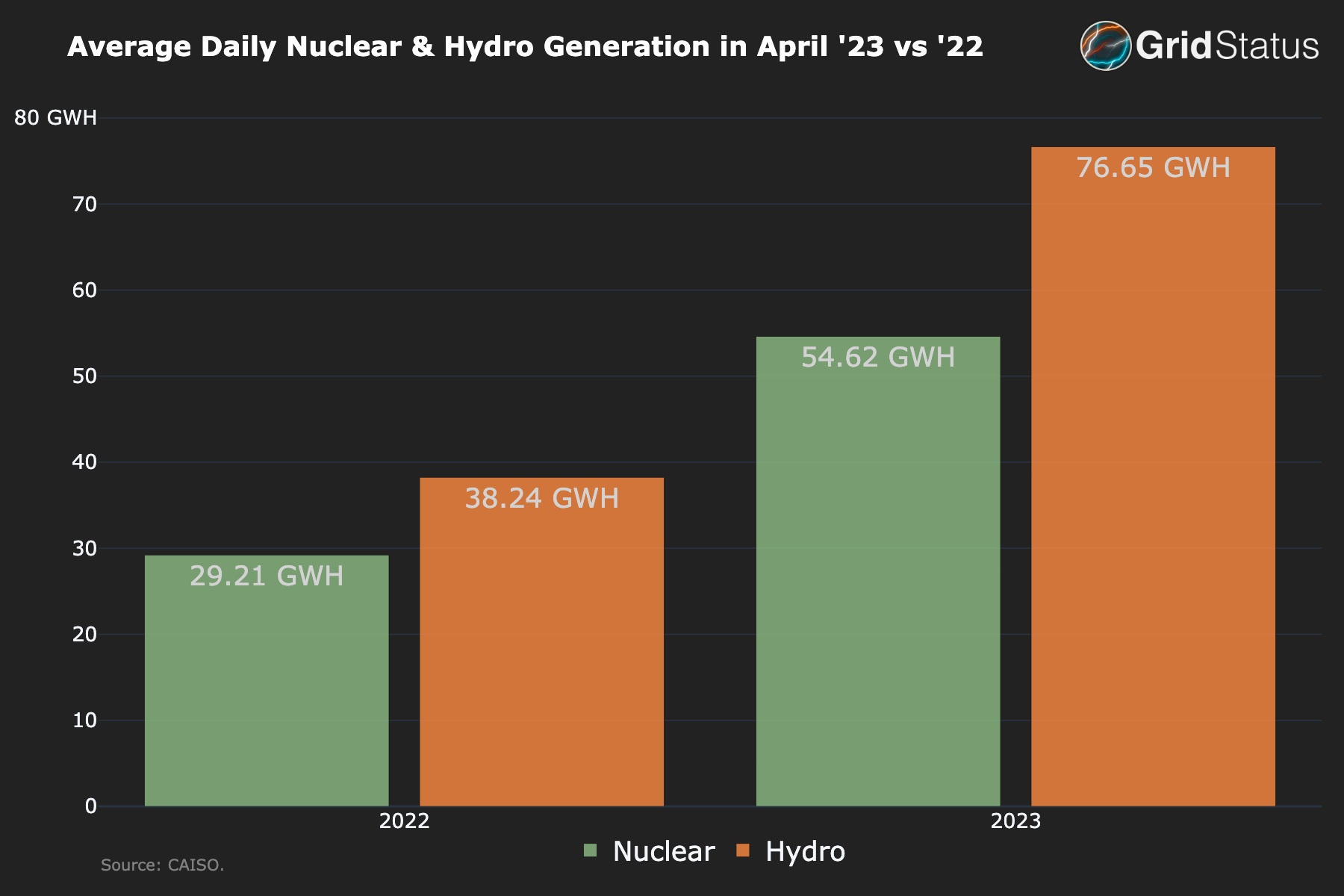

This shift towards procurement of Flex RA means that while generation from hydro and nuclear resources is up, they generally do not fulfill those requirements.

Hydro and Nuclear generation pushes additional exports to the wider western grid, seemingly “greening” CAISO’s neighbors while additional generation from natural gas, which can meet Flex RA requirements, occurs within CAISO itself.

Those with a systems-oriented mindset might think that higher CAISO exports should allow some “banking” of mid-day California solar behind the dams and in the reservoirs of the Pacific Northwest’s hydro fleet. Here, the ideals of a well-engineered physical system run into the constraints of financial and administrative systems placed upon them.

In particular, there is a paucity of commercial arrangements to take advantage of this dichotomy, the commonly-traded 5(days)x16(hours) firm energy blocks that dominate the interstate markets today are not a good fit for peaks that last 3-5 hours and overgeneration export periods that last 5-7 hours. On the administrative side, the CPUC has further complicated an already complex system. The scheduling protocols and rules around external resources for the CAISO market can make it difficult for parties to structure the types of transactions that could meet this emerging need. This brings us to the second rule change.

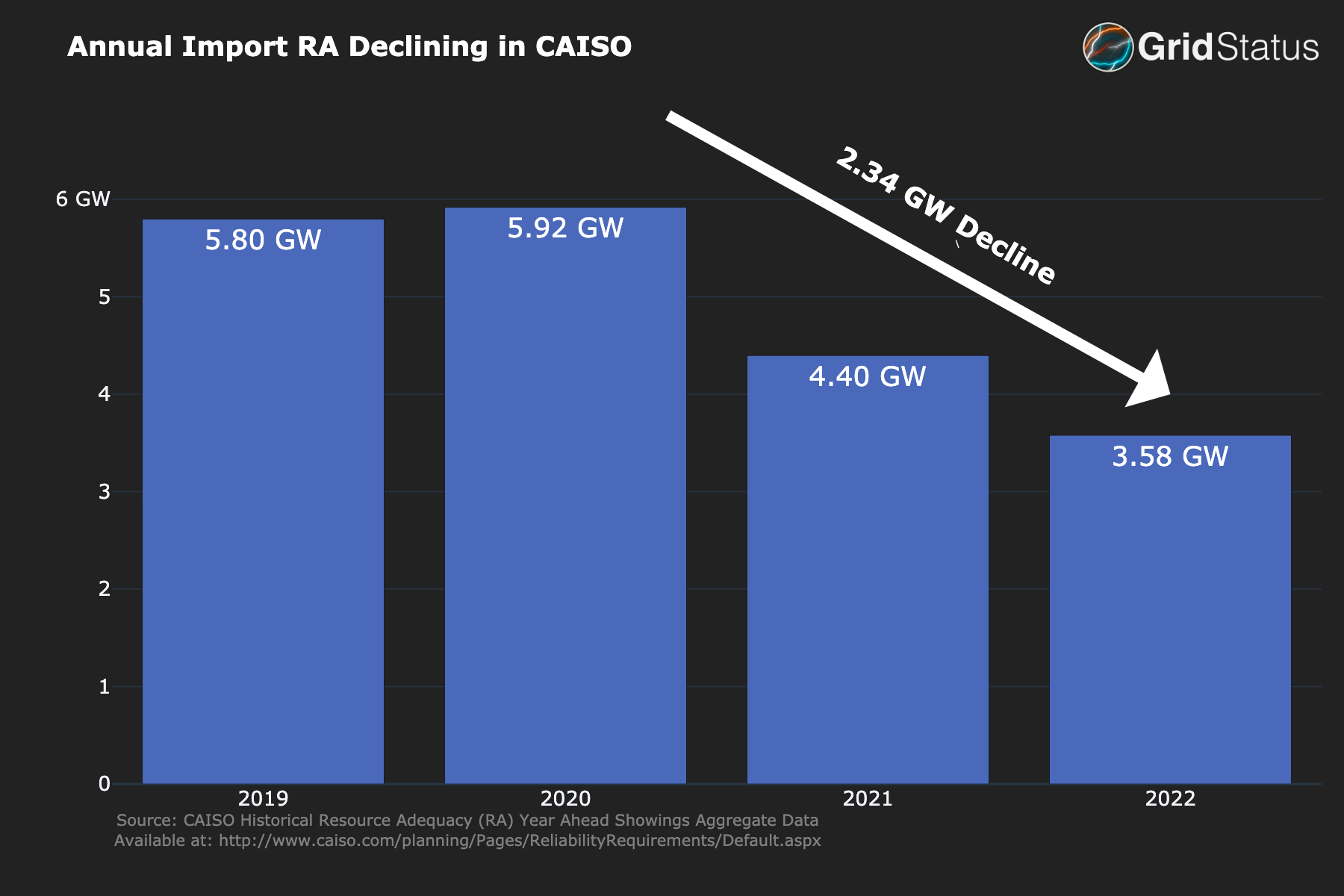

Harder for Imports to Participate in CAISO's RA Market

New CPUC rules require external resources to be at or below $0/MWh to count towards an RA obligation (source). In simple terms, some external resources (RA Imports) will not clear in the CAISO Day Ahead markets as often.

Since this rule has passed, there has been a ~2,340 MW reduction in “import” RA.

For example, gas units have startup, shutdown and fuel costs, so there is no incentive for an external fossil resource to bid into CAISO unless committed to a previous RA obligation, which are rolling off.

Additionally, the opportunity costs of banking CAISO exports as avoided flows from PNW dams don’t result in $0/MWh consistently. The West as a whole is generally short, which means there are plenty of entities interested in relatively cheap RA sourced from power wholesalers in the PNW such as the Bonneville Power Administration (BPA). This relatively strong market for bilateral RA within WECC ensures that those now-onerous external CAISO RA obligations are not being renewed, contributing to the trend upwards in natural gas generation.

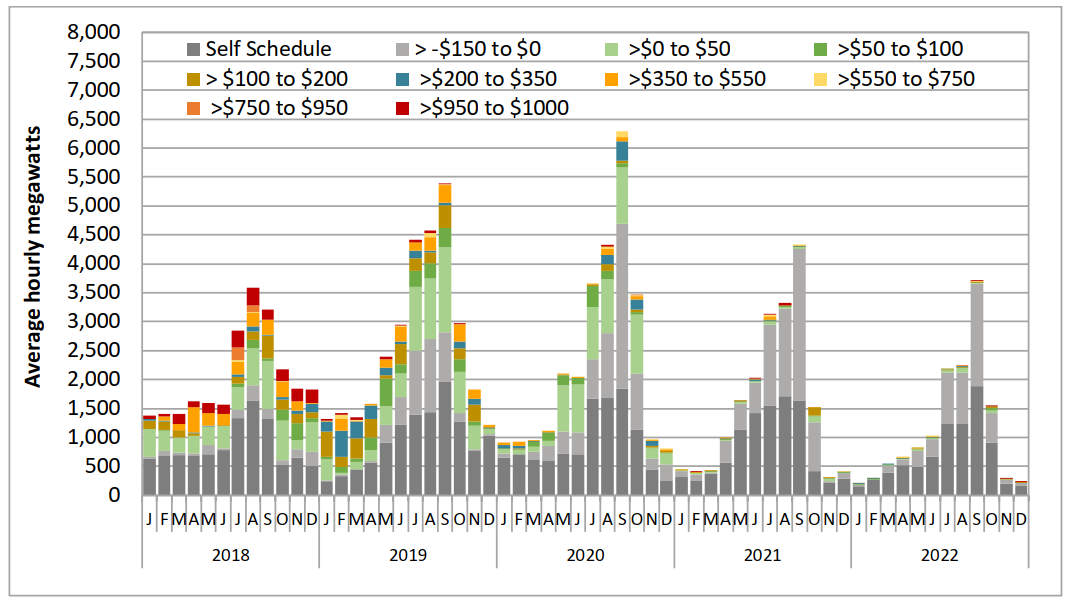

The figure below shows the average hourly volume of self-scheduled and economic bids for resource adequacy import resources in the day-ahead market, during peak hours. The gray bars reflect import capacity that was self-scheduled or bid near the price floor, while the remaining bars summarize the volume of price-sensitive resource adequacy import capacity in the day-ahead market.

Conclusion

With separate policy decisions resulting in declining external supply while increasing requirements for flexibility, it is no surprise that CAISO’s natural gas generation is up significantly in the last few years.

This trend is worrying as it shows the current level of integration between western balancing authorities is no longer sufficient to provide needed flexibility for expanding renewable resources without falling back on legacy fossil generation - even in a region with massive zero carbon “baseload” resources in PNW hydropower. Future efforts may help change this, but for now CAISO faces a period of escalating dependency on internal resources for meeting daily flexibility needs.