Batteries have Reshaped ERCOT’s Ancillary Services Procurement

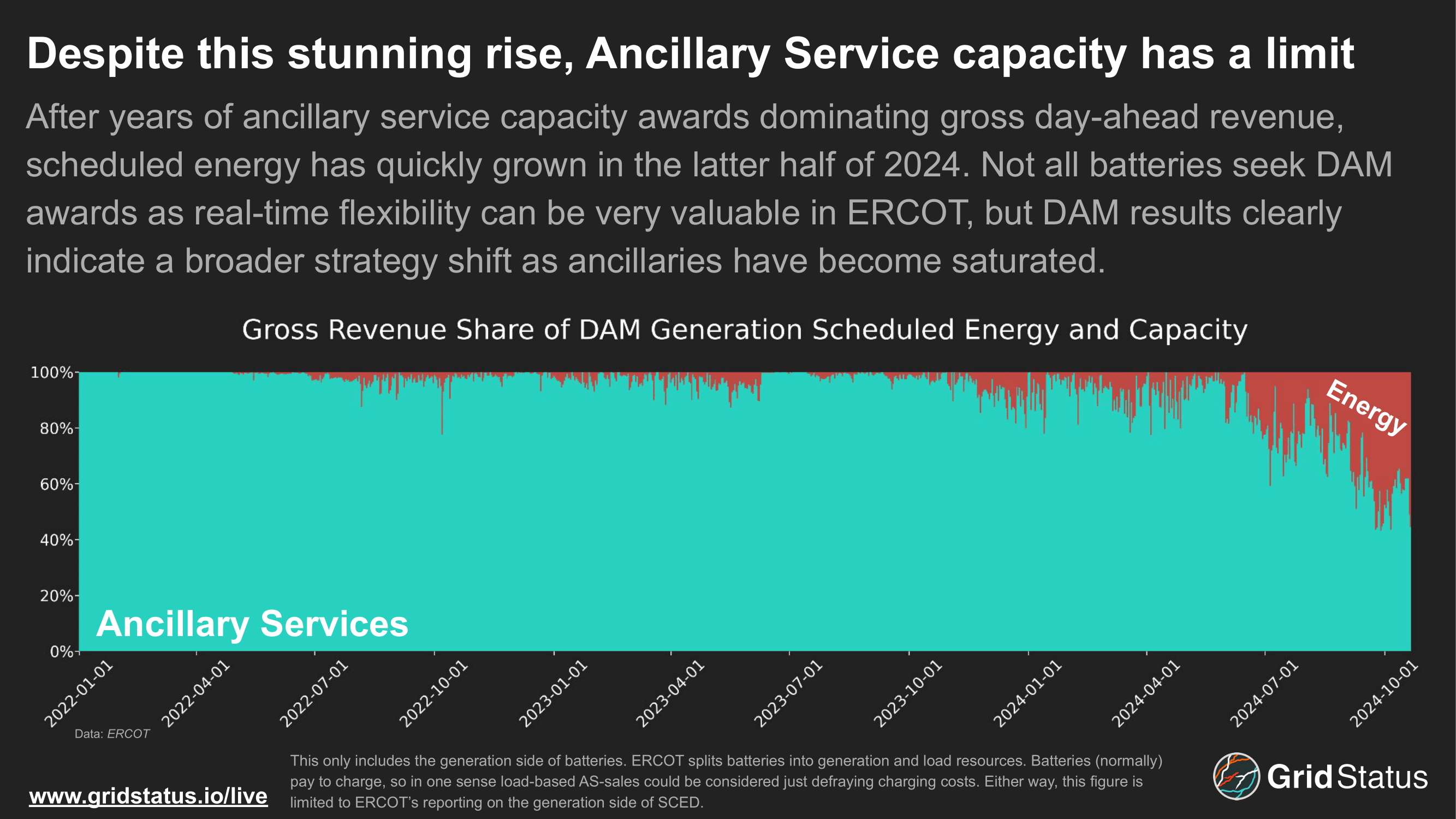

For most of their tenure on the ERCOT grid, batteries have largely made their bones supplying ancillary services as opposed to energy, but that is beginning to change.

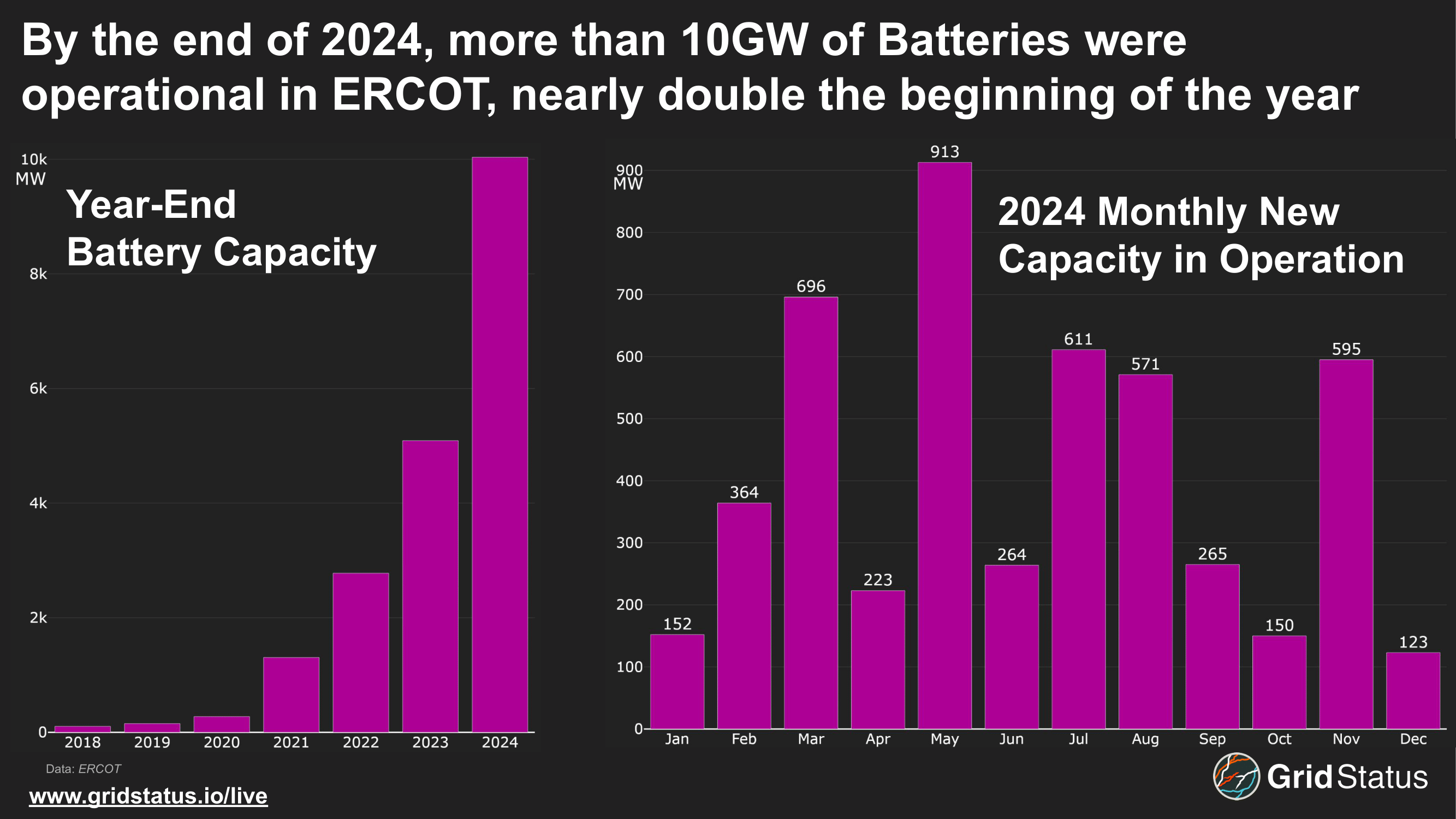

In December of 2018, the ERCOT queue contained 1.8 GW of battery projects looking to interconnect. By the end of 2024, this number was nearly 148 GW. Declining technology costs play a major role, but so has the allure of a gold rush.

Early batteries have generated substantial revenue (as long as they've managed to remain online), and ERCOT's post-Uri milieu of volatility and conservative operational posture opened up market-based opportunities. For a number of developers, merchant risk transformed from something to minimize to an opportunity. Hedges and contracting remain prevalent across assets, but the siren song of uncapped revenues is powerful when the floor appears marginally lower but the ceiling is nearly out of sight.

Aided by permissive permitting, the fastest interconnection queue in the country, Texans' land-deal-friendly vibes, and the surface-level simplicity of "order a box of batteries from China and drop it on the grid", a whirlwind of battery companies and projects has descended on ERCOT.

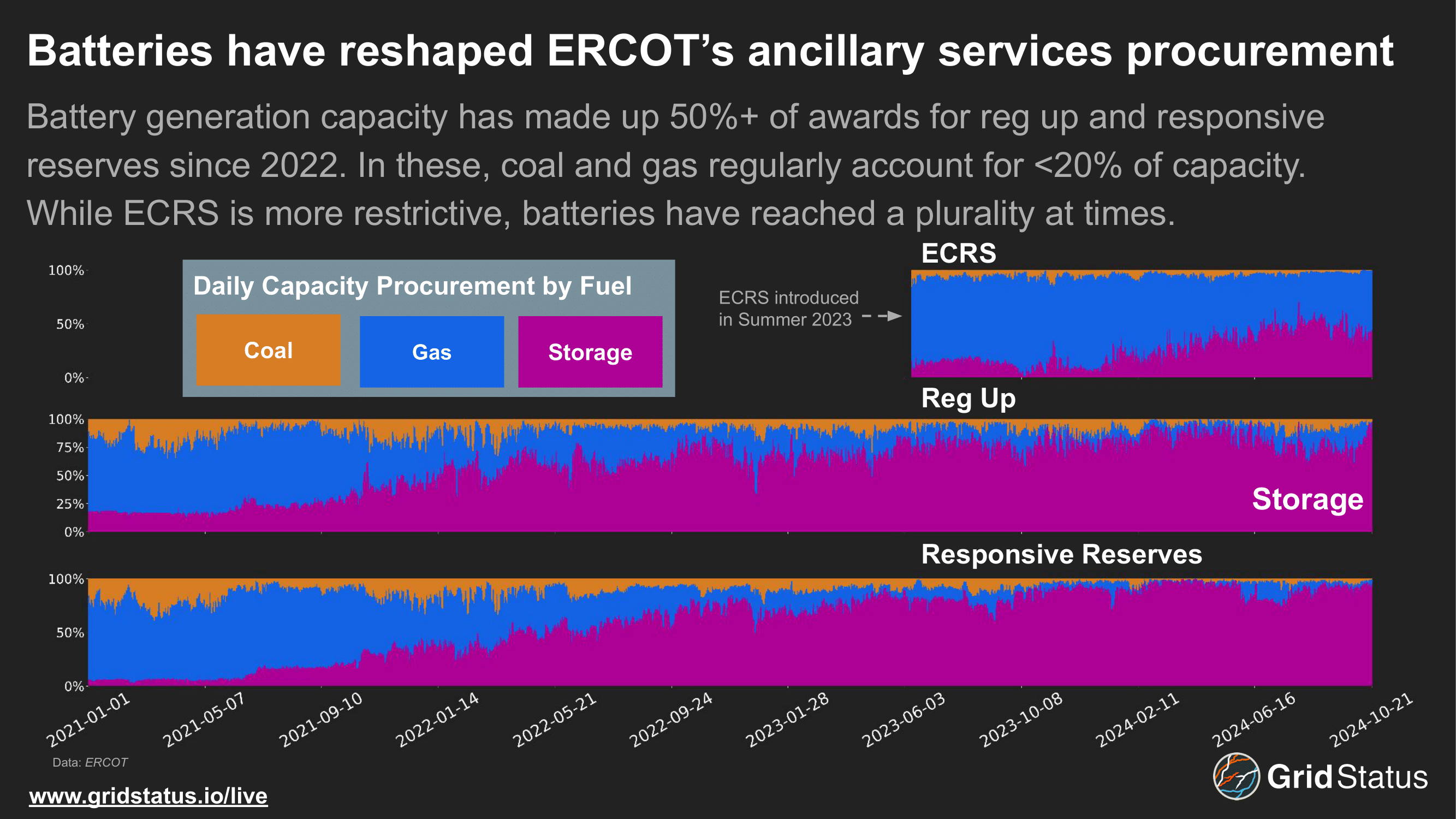

For most of their relatively short tenure on the ERCOT grid, batteries have largely made their bones supplying ancillary services as opposed to energy. Batteries are particularly well suited for products that require a fast response in order to balance or support the grid on timeframes quicker than most baseload generators can manage. This manifested in ruthless competition as they took over Regulation Up and Responsive Reserves, pushing out gas and coal units.

Batteries also benefit from the location-agnostic disposition of ancillary services in ERCOT. While some markets procure these products on a zonal level, ERCOT does so system-wide. This allows battery developers to site projects with an eye towards specific congestion dynamics without losing access to the ancillaries stream of revenue.

This advantage was further enhanced by the relatively small footprint of low-capacity early batteries. It doesn't matter if you can only grab a cheap parcel on some dead end 115kV with limited headroom when you aren't out of pocket on line upgrades and you are counting on ancillary services to generate the lion's share of revenue. On top of that, ERCOT's "one size fits all" basepoint deviation rules were a substantial boon to the early wave of fast-interconnecting DG batteries (look for more from us on unit operations in a blog coming later this year).

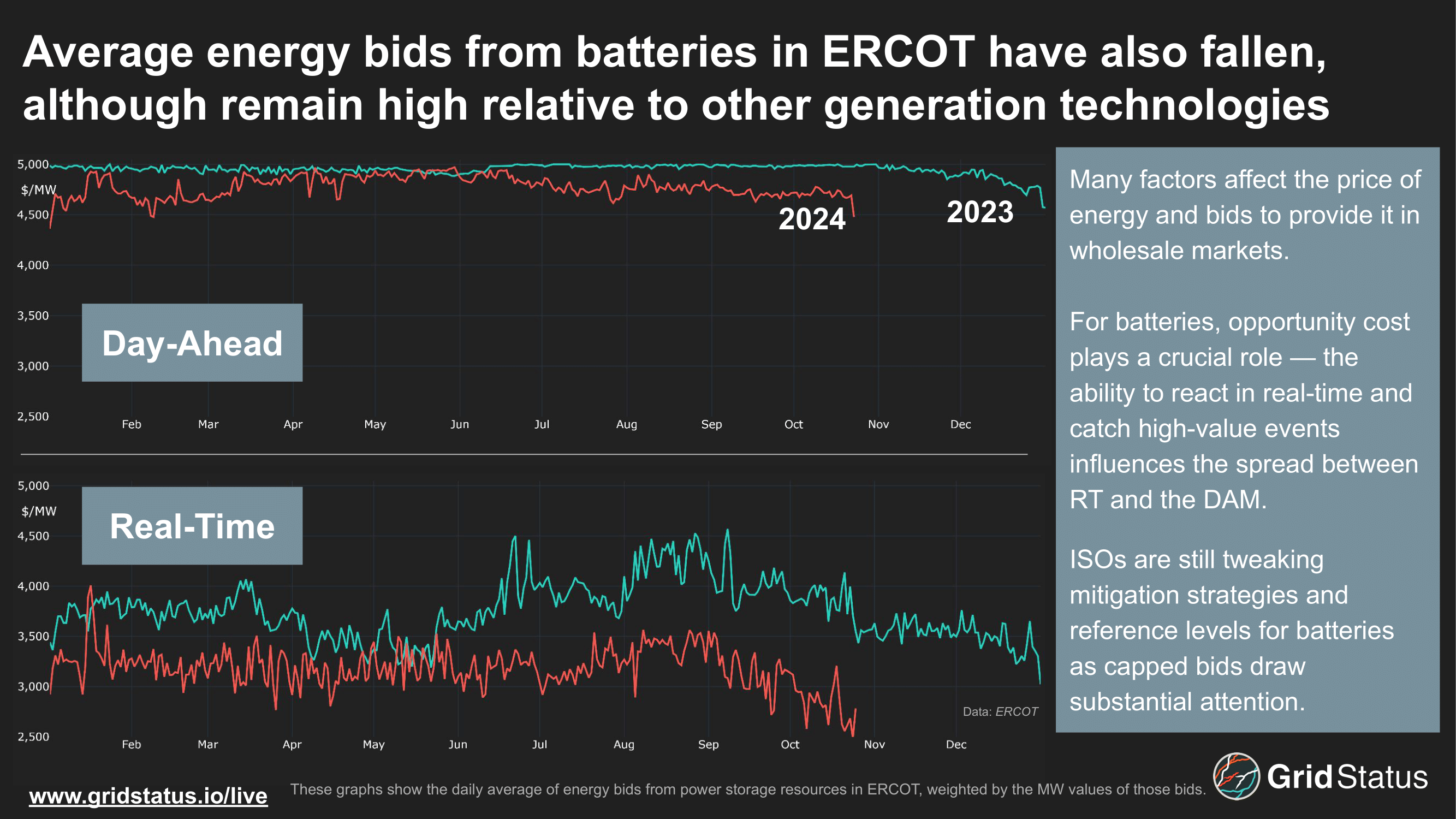

All of the above cemented ancillary services as key to the aforementioned gold rush. Selling capacity into ancillary services alongside very high (often capped) energy bids was a great way to get paid while still managing to capitalize on the highest prices and undergoing fewer cycles. This is an oversimplification of a diverse strategic ecosystem deserving its own (lengthy) discussion, but is enough for a basic understanding.

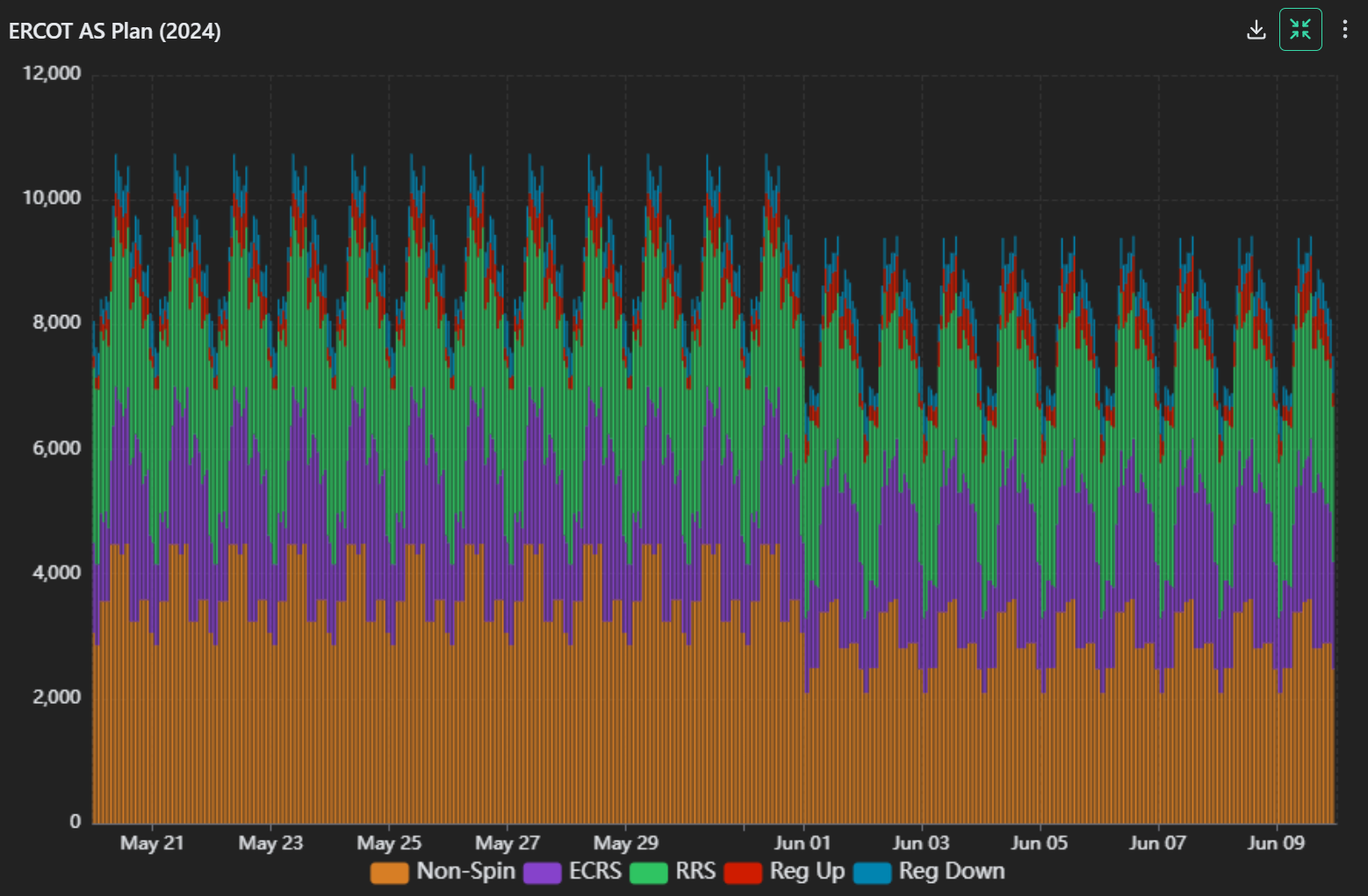

Unlike energy, where demand swings up and down, ERCOT sets an ancillary service procurement plan for the current year all at once. While the values do change depending on the season, hour, and certain conditions, the range is far smaller and more predictable than load. Despite increases to the total capacity procurement following Uri and the introduction of ERCOT Contingency Reserve Service (ECRS), a market-wide capacity limit remains, and that limit informs every battery developer's least favorite topic, saturation.

Saturation has more than one definition, but the simplest is the point at which there is enough battery capacity attempting to provide ancillary services that the price declines and operators begin to shift towards energy. The market moment of saturation would mark the end of a particular, historical, phase of battery operations in ERCOT. That moment may be now.

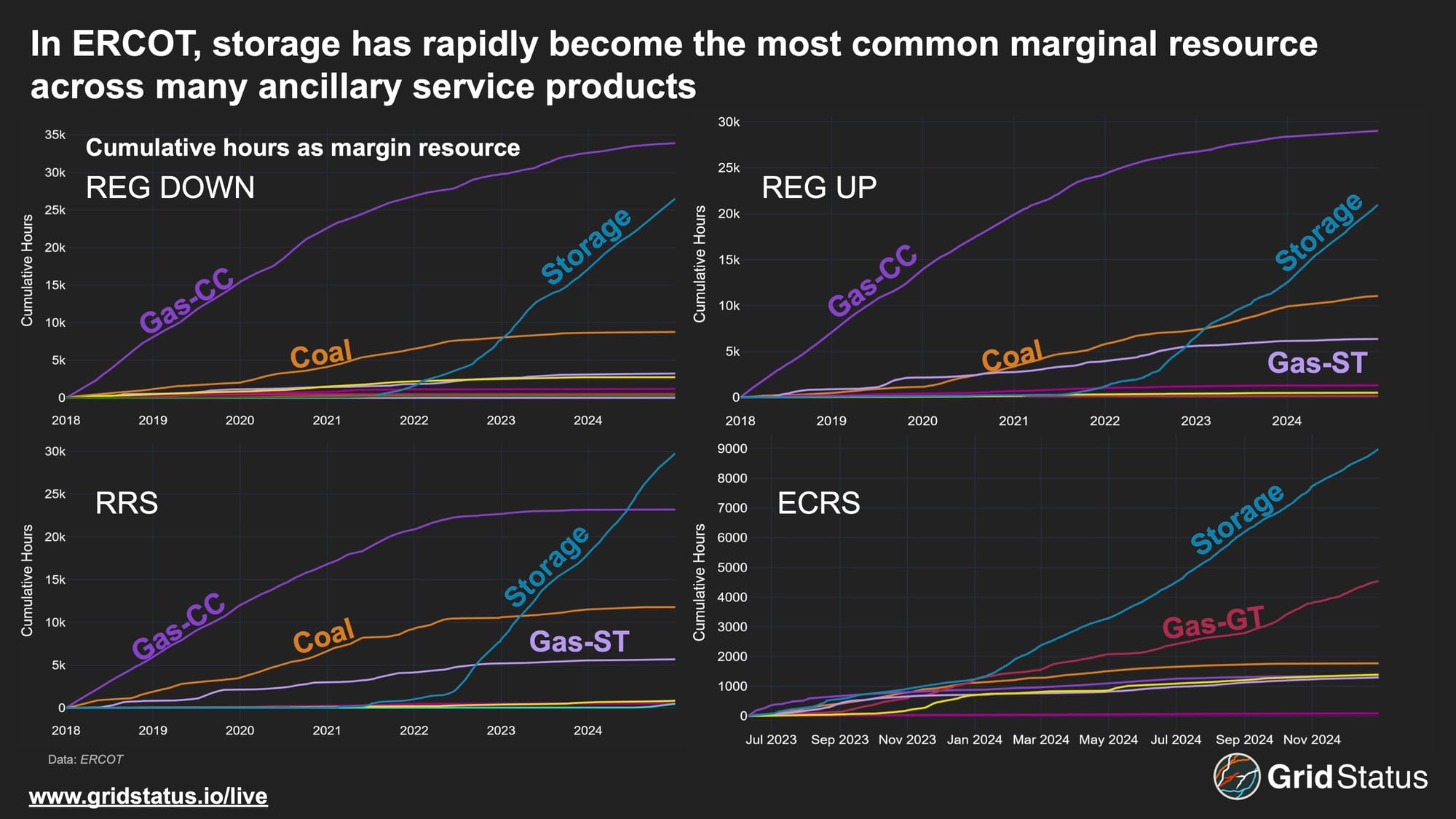

Here we show the cumulative count of hours where each technology was the marginal resource for Regulation Up and Down, Responsive Reserves, and ECRS — ancillary services with meaningful battery participation. Early batteries were rarely the marginal unit, but by mid-2022 batteries began to drive out coal and combined cycle gas plants in earnest, which has led to increased competition between batteries at the margin. Inter-battery competition at the margin of multiple ancillary service products is strong signal of saturation.

It's unlikely that capped bids are the optimal strategy for so many batteries over so many hours, but they are the easiest. Just as competition has changed the disposition of marginal units for ancillary services, so to has it begun to affect energy bids. Batteries shifting capacity into energy, the continuous treadmill of operator optimization, and consistent growth in the ERCOT resource base have all contributed in pushing down average bids.

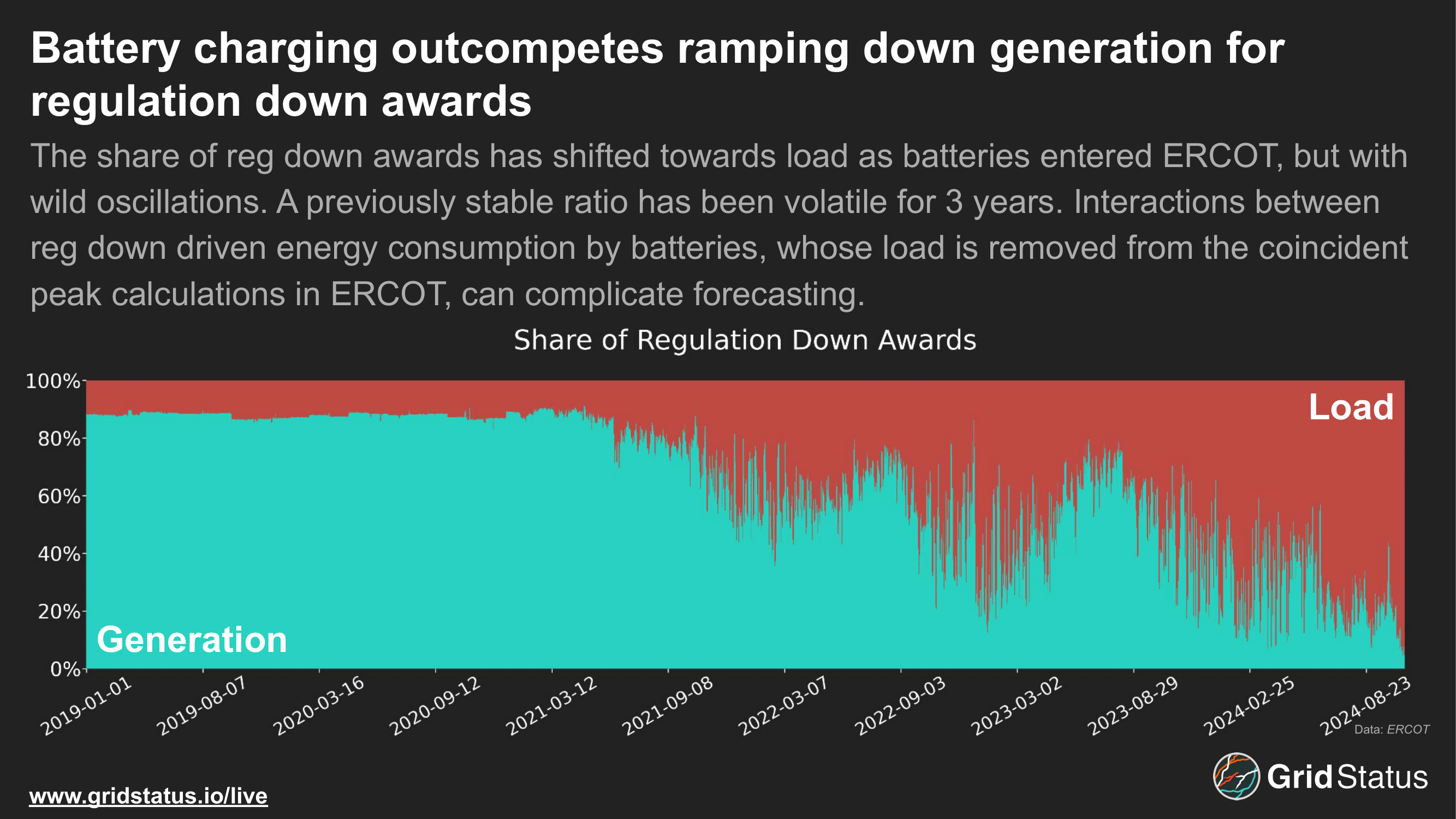

Batteries have not only changed the face of generation-focused ancillary services, but together with large flexible loads have substantially altered the disposition of Regulation Down. We discussed this interaction and its relationship with transmission charges in Predicting Coincident Peaks in ERCOT's 4CP Program. This type of transition, where a product's primary supplier changes technology so rapidly is very rare in power markets and speaks to the need to look beyond topline total energy and into the mechanics keeping everything in balance.

Important to keep in mind through all of this is the potential for big changes year-to-year in power markets. From geopolitics influencing the price of oil with knock-on gas production impacts to solar buildout creating ever more lucrative ramps, we'll be tracking the evolution of batteries and bids across the grid in 2025. Reach out at contact@gridstatus.io if there are particular topics you want to know more about!