In Dominion, the needs of Data Centers Drive Demand

Parsing Dominion Energy's place in PJM, now and into the future.

As the global data center hotspot, Northern Virginia has regularly been in the news over the last year. Powering that hotspot in PJM is Dominion Energy, which released their 2024 IRP earlier in October. With the spotlight on Dominion, we wanted to take a look at the utility’s demand grown, market impact, and future plans.

In this post:

- Data Centers Now, Electrification Still to Come

- Operational Impacts

- All of the Above Capacity Expansion

- Relying on Neighbors

Data Centers Now, Electrification Still to Come

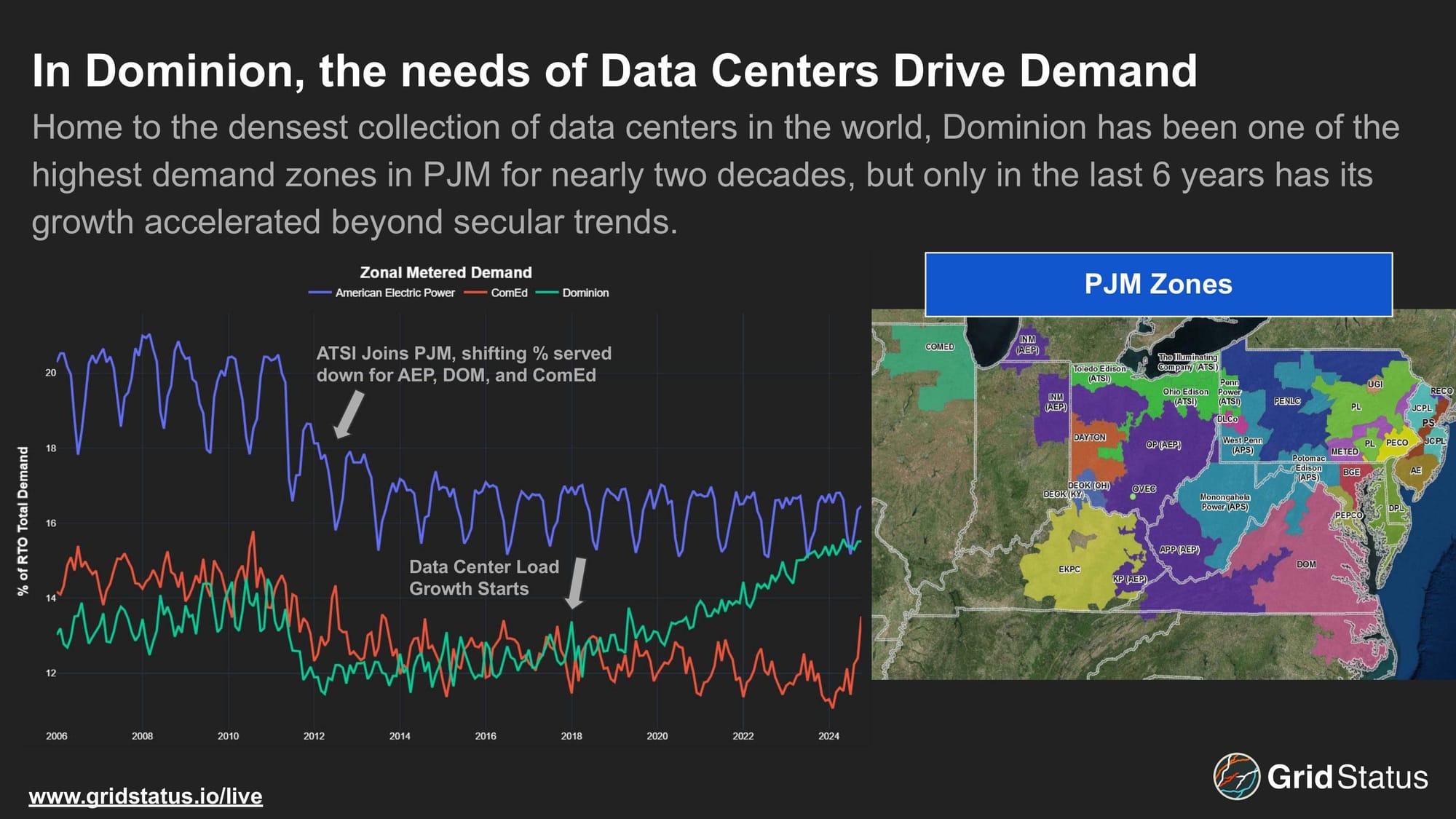

While Dominion has been a significant player since entering the RTO, only in the last 6 years has its trajectory decoupled from its peer, ComEd, and moved towards a band that previously had only contained AEP. This growth has been an outlier nationally, and while driven largely by data centers is something of a harbinger for many regions as electrification of homes and transportation ramps up.

ComEd may narrow this gap as data center locations diversify - powered in part by an extremely high fraction of zero-carbon nuclear generation - but for now data-intensive companies with strong power demand growth are focused on nuclear power in the Mid-Atlantic.

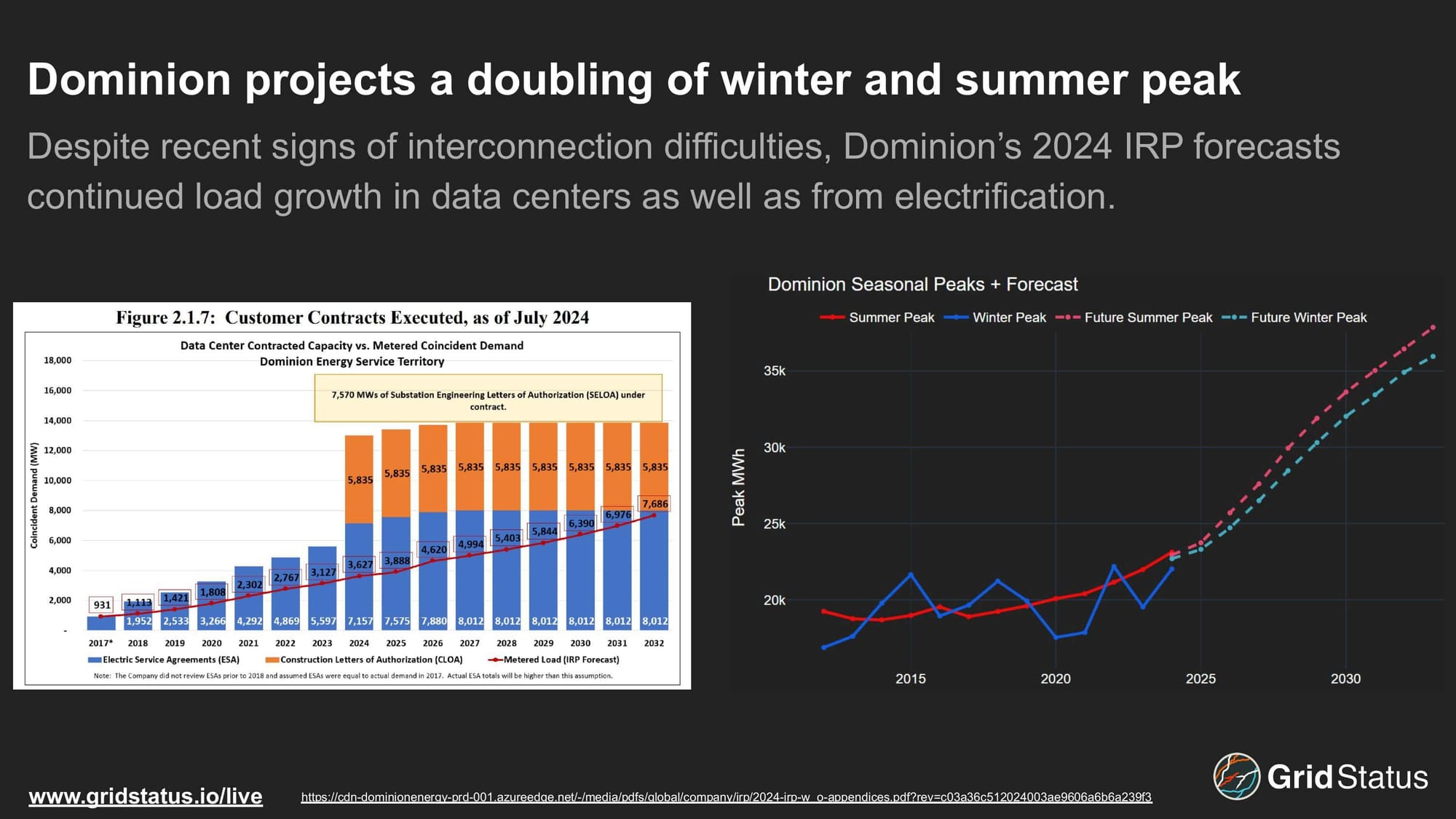

Dominion anticipates continued load growth over the next fifteen years, driven by both data centers and electrification. While historical increases in peak demand across the US were often by driven by AC use as population expanded, these projections have year-round implications.

Growth doesn’t come without challenges. Interconnection timelines for large loads in northern Virginia have grown, and the transmission system is undergoing rapid iteration to keep up with the pace of change. These longer-term challenges can manifest in real-time operational difficulties, leading to intense congestion in pockets in and adjacent to data center alley.

Operational Impacts

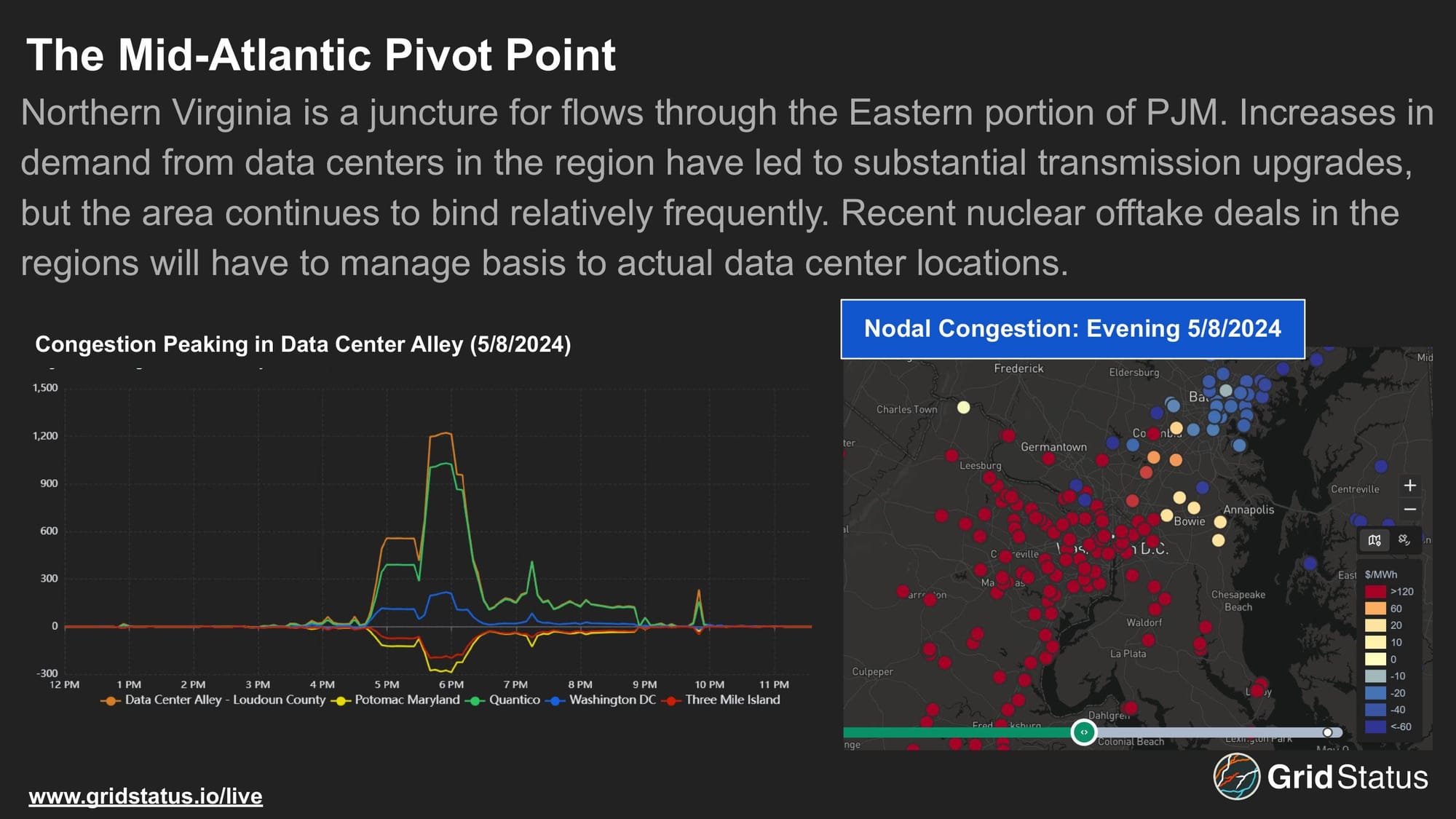

Northern Virginia sits in a particularly important spot within PJM as a load center with close proximity to other demand hotspots on the east coast, tricky geography around the Delmarva peninsula, and net capacity losses in states with strong environmental policies but permitting struggles.

This congestion may prove particularly expensive for the Three Mile Island repowering depending on the amount of exposure to basis risk that Microsoft was willing to take on.

Nodal volatility within Dominion can stand out against the rest of PJM as well. Beyond northern Virginia, Dominion has been engaged in transmission upgrades throughout the state to handle both increasing demand as well as new generation as solar is rapidly deployed from central Virginia into northern North Carolina. The geography of the zone can also contribute to constraints, as the locations of demand and generation shift, the eastern peninsulas of Virginia can end up topologically isolated. This contributed to issues in Northern Neck in recent years.

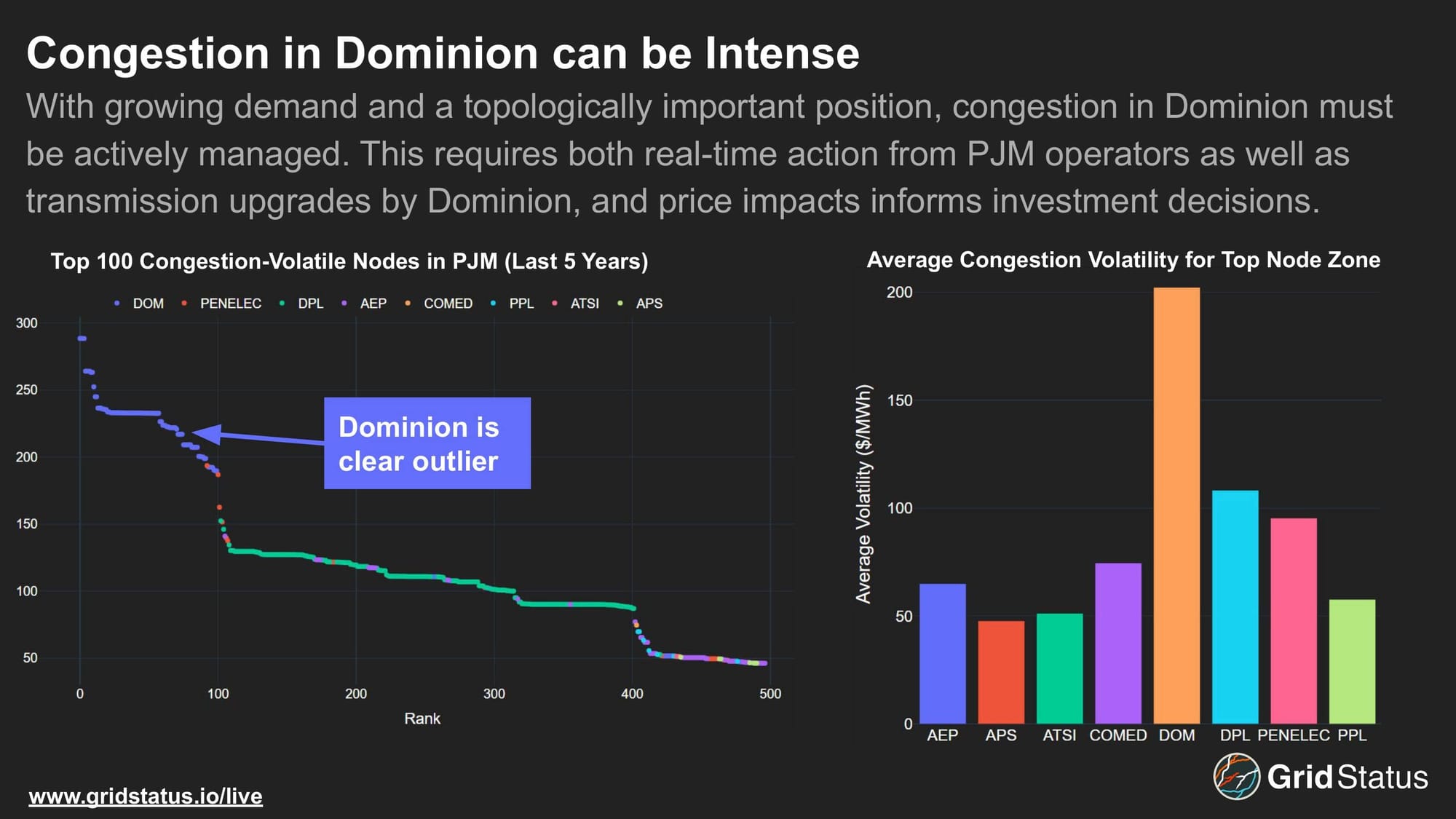

Examining each of the last five years alone and then comparing the 100 most volatile nodes (in terms of congestion) from each year paints a stark picture of Dominion as outlier. Delmarva Power and Light (DPL), a neighbor of Dominion's also claims a substantial portion of the most volatile nodes.

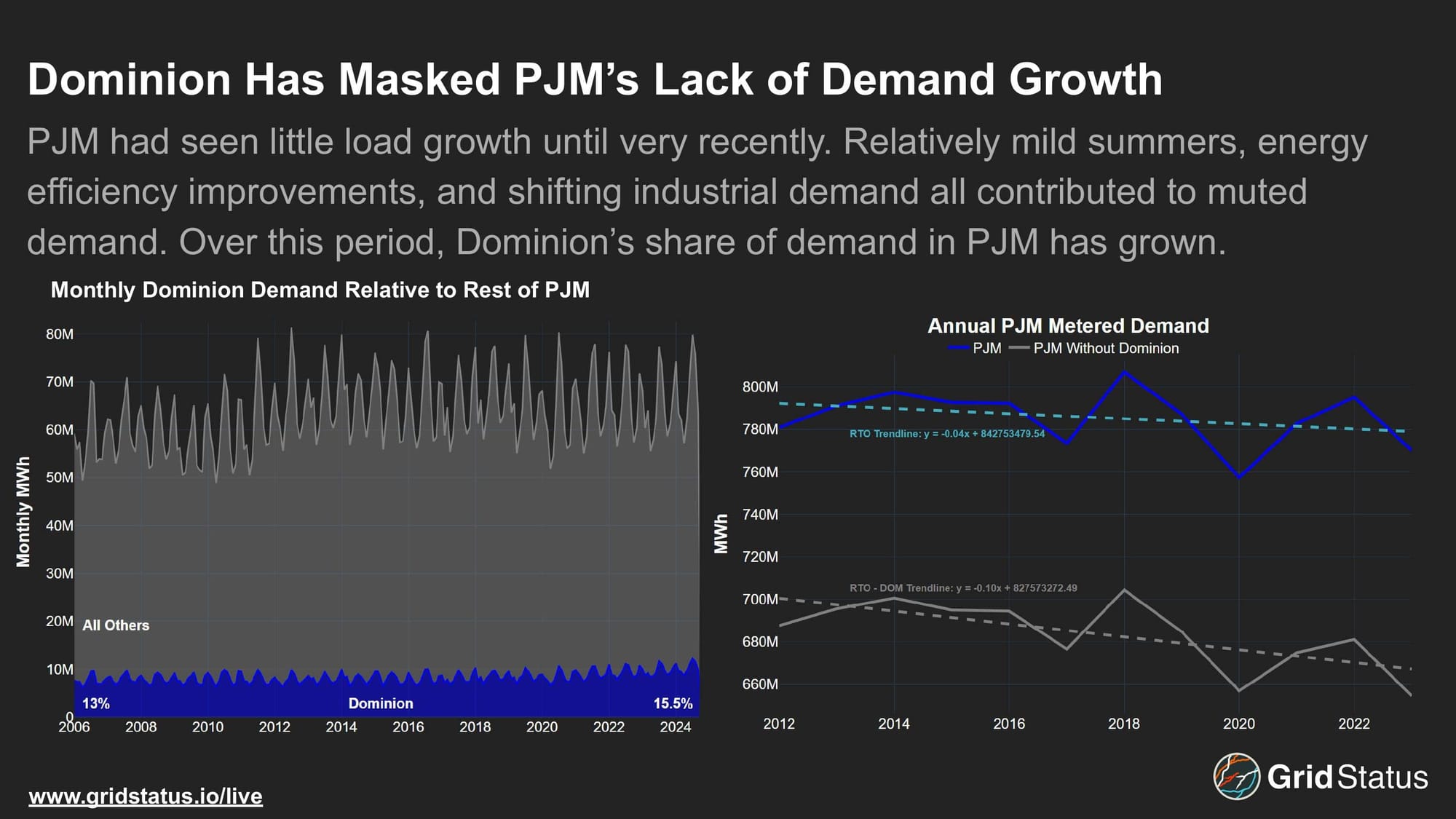

Dominion's outsized impact doesn't end with congestion, its demand growth has been a significant factor in masking a demand plateau throughout the RTO. Unlike ERCOT or SPP, PJM's peak winter demand was nearly a decade ago, while coincident peak summer consumption was in 2006. RTO-wide, through 2023, no summer peak had cracked the top ten list since 2013. This is in sharp contrast to Dominion, where the last 30 peak demand summer records have all been set since 2022.

This growth has managed to somewhat offset PJM as a whole, bringing Dominion's share of total demand up from 13% in early 2006 to more than 15% today.

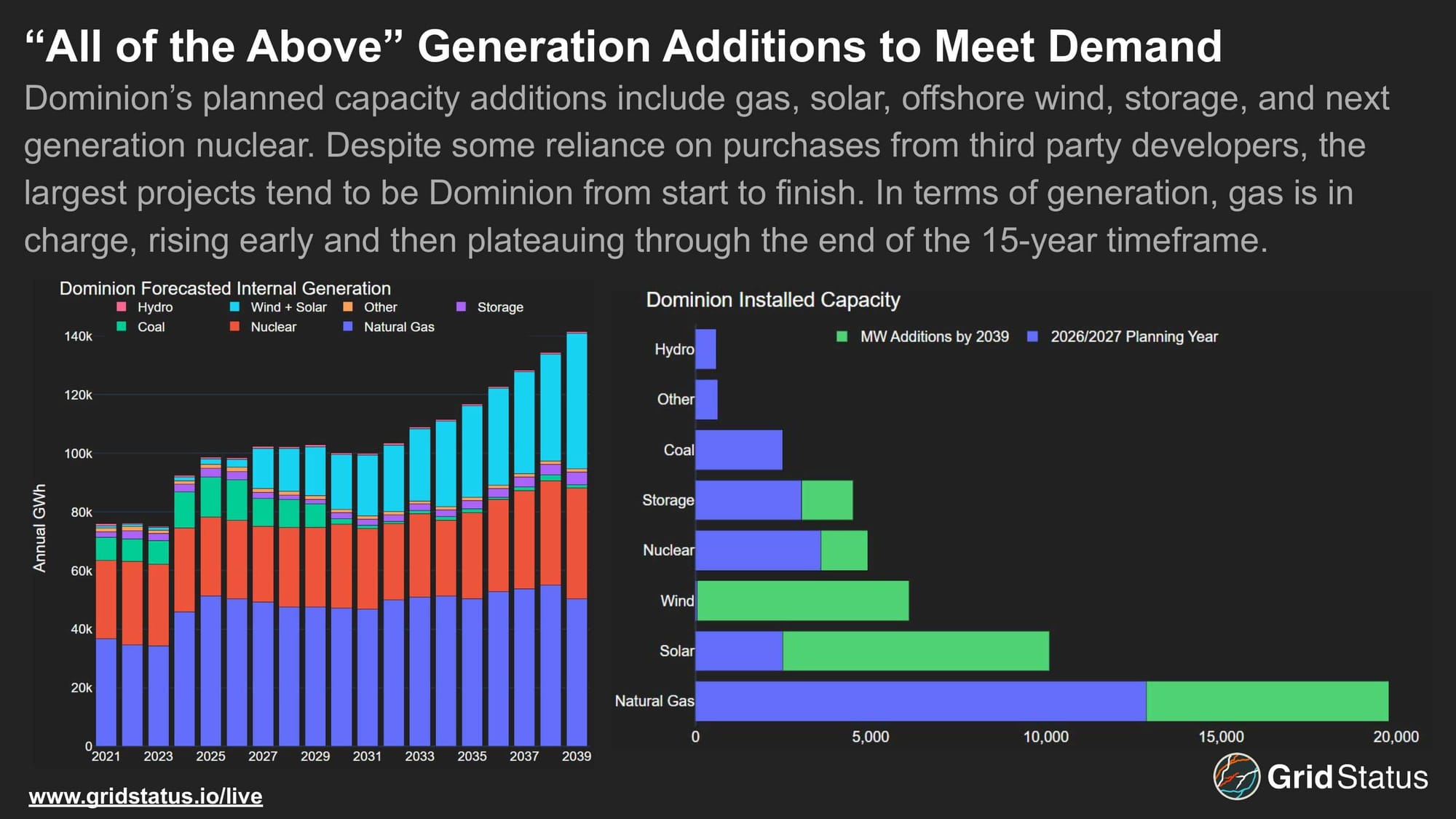

As retirements in neighboring states drive conversation, fund consultants, and divide stakeholder meetings, Dominion is building and planning substantial capacity additions - including technologies already available to them (natural gas and solar), those being deployed in Virginia today (batteries and offshore wind), and even generators of the future (next generation nuclear).

All of The Above Capacity Expansion

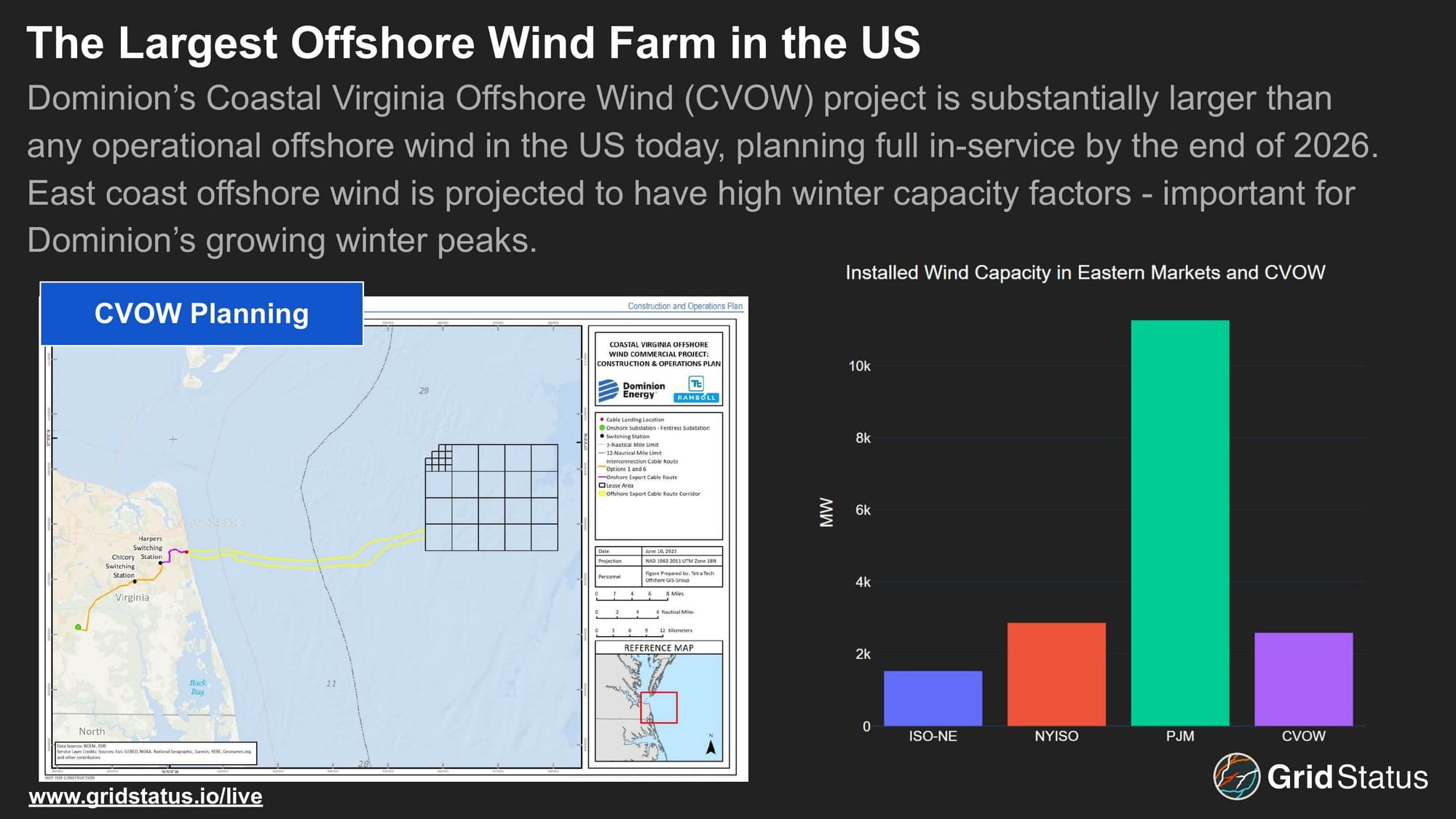

Recently, high profile, deals, lawsuits, and re-negotiations have dominated discussion of offshore wind in the US, but that headline-grabbing drama is further up the eastern seaboard. Dominion’s Coastal Virginia Offshore Wind project remains on schedule for in-service of late 2026, bringing 2.6 GW of new capacity online, more than 16x the combined megawatts of the existing South Fork and Block Island.

This project alone is larger than the currently installed wind capacity in ISO-NE, and only slightly less than the capacity in NYISO. When completed, it will represent a large fraction of the wind capacity in all of PJM, a meaningful shift from today, where nearly all wind capacity in the RTO lies further to the west. This build out is particularly important as a complementary match for rapidly increasing solar capacity in Dominion as the evenings and winter should be capacity factor strengths for offshore wind on the east coast.

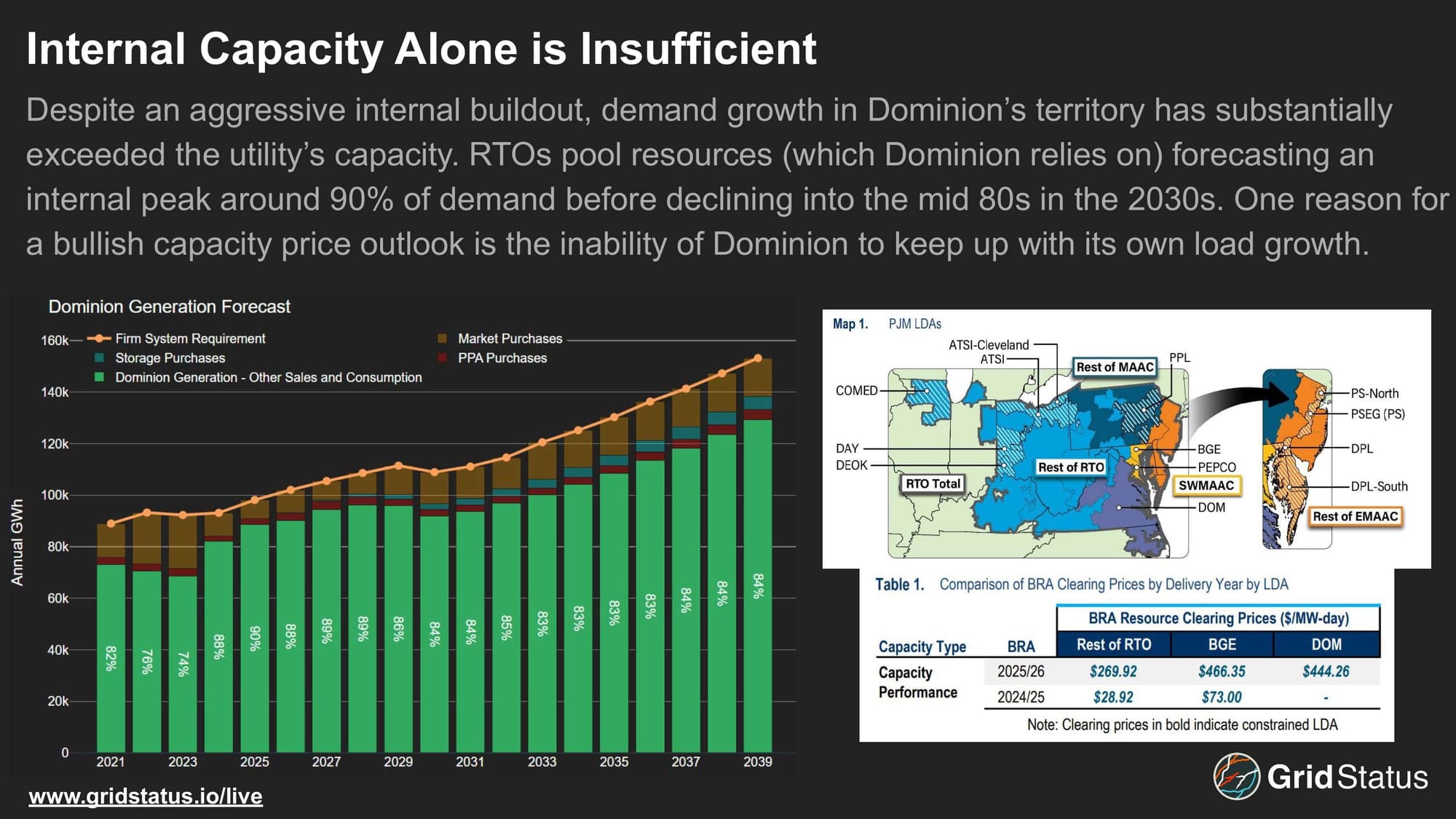

Despite these planned capacity additions, Dominion’s load growth means that the utility relies on the broader PJM market for a substantial portion of its generation.

Relying on Neighbors

Over the next few years, as large projects come online, it expects to be able to cover ~90% of its needs with internal generation, before dropping back to ~85% for most of the study period. With speculative technologies like new nuclear in the plan it's possible the need for generation from the rest of PJM may be even greater than projected.

If load growth is widespread and PJM’s interconnection challenges continue, it seems likely that capacity in PJM will remain tight.

The most recent capacity auction spiked prices RTO-wide, but peaked in Dominion and Baltimore Gas and Electric (BGE) due to a confluence of the trends mentioned above.

Both the grand ambitions of FAANGs and Dominion’s planning exist within the milieu of PJM, a market with no shortage of regulatory obstacles in recent years. From interconnection redesign delaying a vast swathe of projects to capacity market overhauls fraught with delays and challenges, meeting the challenge of demand growth (AI-fueled or not) in an era of change is no easy task.

Wrap Up

Whether Northern Virginia’s data centers, a Mid-Atlantic nuclear revival, and Virginia Beach’s offshore wind represent change nationally, or quirks of local geography and history remains to be seen.

Track this and more at Grid Status.