Two Weeks of Firsts in Texas: ECRS and New Records

Recently, the Texas grid has caught the attention of the energy industry due to unseasonably warm temperatures and ERCOT's release of a new market product, the first in over a decade.

As has often been the case in recent years, the Texas grid has recently been the focus of energy industry onlookers. Over the past two weeks, ERCOT has not only experienced unseasonably warm temperatures, but also has released a new market product for the first time in over a decade.

Due in part to the record-setting conditions it was designed to support, the new ancillary service product — ERCOT Contingency Reserve Service (ECRS) — was deployed soon after its introduction.

In this post, we analyze the data to understand how ECRS is already being utilized to ensure reliability.

Weather driving price swings and new records

In anticipation of tight grid conditions, the week of June 19th saw elevated day-ahead prices early on, and one day with serious real-time price excursions.

Then, over the weekend, ERCOT set its #1 and #2 all-time records for solar production

It didn’t stop there, the current week has notched several new demand records.

Somewhat amazingly, these records came without the same price activity as the prior week, partially due to the contribution of wind and solar, which collectively set a new record for maximum renewables in ERCOT on Wednesday, the 28th.

A lot of records for the Texas grid this week. Add a new one: record amount of renewable production.@ERCOT_ISO was producing over 31,468 MW of combined solar and wind energy at 1:20 PM Central Time today — the most ever.

— Max Kanter (@maxk) June 28, 2023

On heavy load days like today, every MW helps pic.twitter.com/XWf2w1FISg

Despite these records, there was an even more notable ERCOT event in June - the introduction of a new ancillary service.

Introducing: ERCOT Contingency Reserve Service (ECRS)

ERCOT Contingency Reserve Service (ECRS) went into service on June 10th, capping a five year development process. Unlike records related to generation and consumption, which are set on a fairly regular cadence against the backdrop of an evolving grid mix, the development of new market products is a circuitous and contentious process in which the preferences of the state, grid operator, and stakeholders shape and delay the final outcome. ECRS is the first new ancillary service introduced in ERCOT in over a decade.

In contrast to a non-market vertically-integrated region where a single utility can simply decide to run their grid differently (within reliability rules), the deregulated regions attempt to provide products which incentivize the market of generators to provide the needed operational capabilities.

Because this process is so resource intensive and far-reaching, few suggested products make it into a market at all. Typically, operational and reliability needs drive their development. In light of these past two weeks, ECRS is timely indeed as it has unique characteristics relevant to the energy transition.

ECRS is an ancillary service product designed to address medium-term net load uncertainties, which are increasing due to renewables, and reduce pressure on faster responding ancillary service products, such as frequency regulation. We use the term “pressure” to describe the phenomena of increasing reliance on ancillary services for roles they were not designed to perform in traditional fossil dominated electricity market design.

Ancillary services such as frequency regulation were designed to correct for minute to minute over and under forecast errors. However, in markets with high solar penetration, everyday occurrences such as sunrise and sunset tend to cause forecasting errors on any given day in only one direction for longer periods of time. The result of this is ‘regulation exhaustion’, which occurred in a very significant way in CAISO during 2016. Luckily, ERCOT has now implemented a ‘longer duration’ ancillary service to compensate for this.

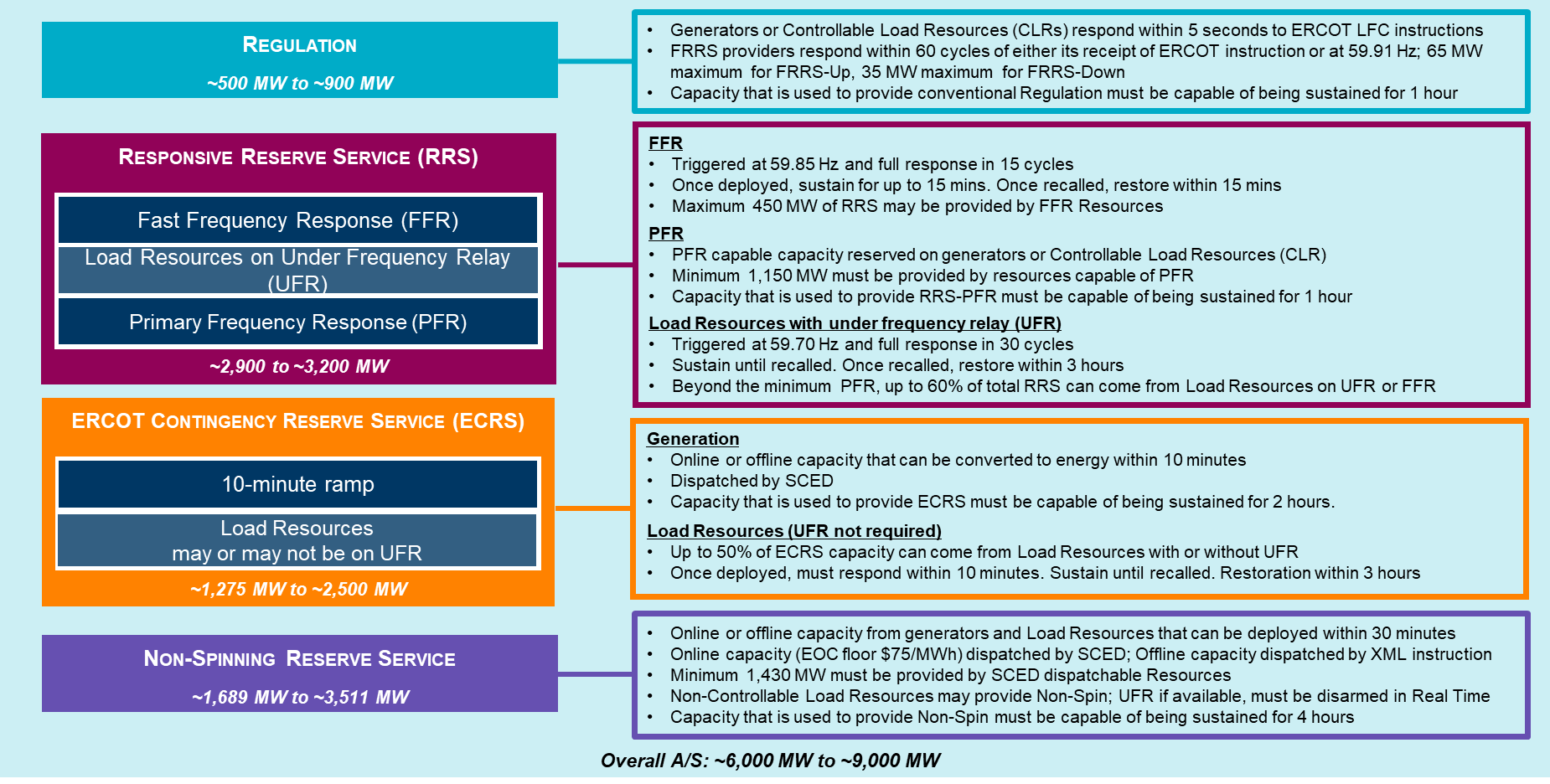

The Design of ECRS

ECRS was implemented to support ERCOT’s capabilities in dealing with two situations that have been posing risks to the Texas grid

1) to recover frequency following a large unit trip and;

2) to provide capacity to support sustained net load ramp.

In this way, ECRS is a product originally defined by the needs of one set of new age energy resources — solar and wind — and then further refined to incentivize the deployment of longer duration storage projects by stunting the dominance of high ultra short duration batteries in the ancillary services (AS) market.

ECRS represents a significant revenue opportunity to flexible generators able to generate for 2 hours and ramp within 10 minutes. Since its introduction, ECRS has consistently cleared higher than all other ancillary services.

The premium paid for ECRS may be high because of the newness of the service, but we expect it to remain until ERCOT has a greater than 3 GW penetration of 2 hour or higher duration batteries, which will exceed the maximum procurement of ECRS.

ECRS is Already Being Deployed

Partly driven by the record conditions of the previous two weeks, ECRS was deployed soon after its introduction. As mentioned above, ECRS was designed to provide frequency support following an unexpected unit outage as well as to compensate for net load ramp uncertainty.

ECRS’ implementation calls for automatic deployment when frequency drops below 59.91 Hz and the power requirement to restore frequency to normal exceeds remaining Regulation Up. When this occurs, ERCOT will deploy the quantity of ECRS needed to maintain compliance with the NERC requirement BAL-003.

ECRS was deployed twice for unit trips shortly after its introduction. On the evening of the 16th we saw it in action after Comanche Peak Unit 1 tripped offline.

This stretch of hot weather also pushed the system to a point where net load uncertainty was driving tight system conditions and high prices.

The specific net load related triggers ERCOT may use to manually release ECRS from SCED Dispatchable Resources are:.

- (Physical Response Capacity (PRC) – 3200 MW) – (projected 10min Net Load Ramp) + Remaining Quick Start Generation Resources (QSGR) capacity < 300 MW

- (10 min Ramp Capacity) – (Projected 10 min Net Load Ramp) < 0 MW

An extended deployment of ECRS on the 20th was carried out under this criteria.

The initial blip of deployment was to account for the possibility of solar intermittency on a short (5-30 minute) timescale. Despite this early hiccup, by peak hours later in the day, solar was carrying a substantial portion of peak load.

Non-Spin to ECRS

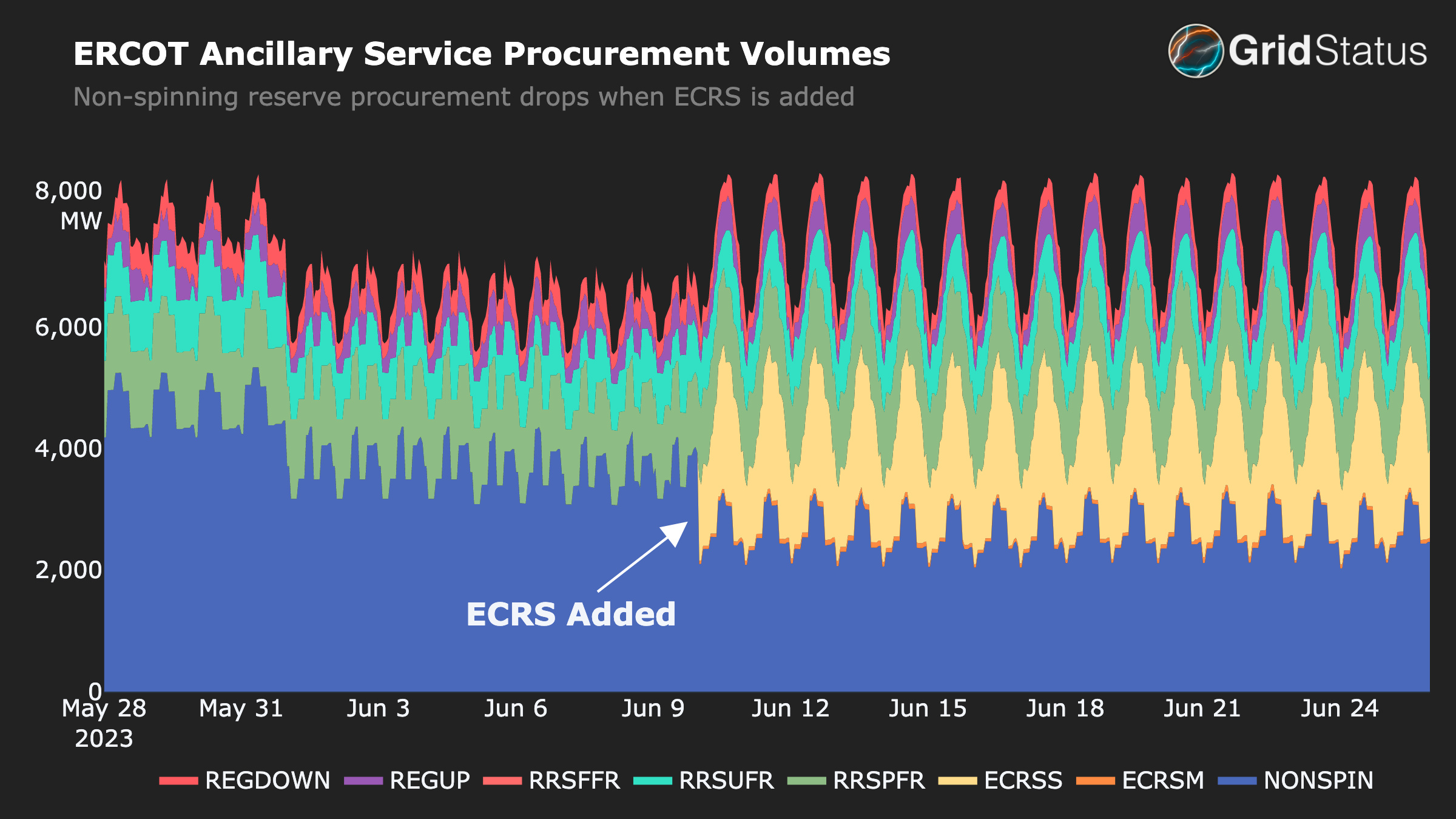

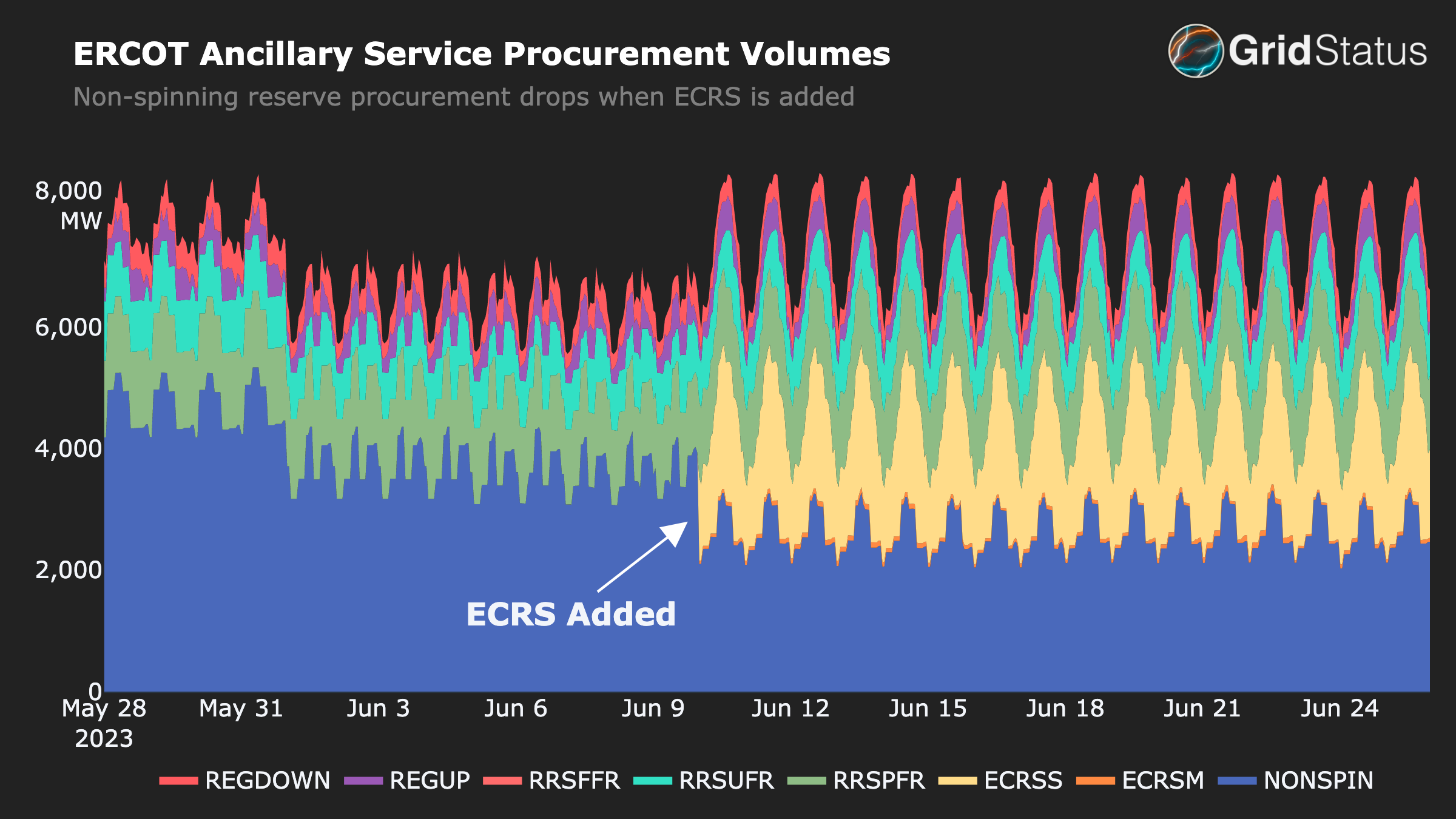

ERCOT’s ancillary services (AS) market has had a bumpy ride in recent years. The market experienced shortages in Uri, sending prices beyond the energy price cap and to over $15,000/MW, which triggered calls for reforms and acceleration of existing plans. Addressing the symptoms first, prices higher than the energy price cap were made impossible through a contentious rulemaking procedure (NPRR1080). Following Uri, ERCOT was also concerned that they were carrying too low levels of operating reserves. Thus, in the summer of 2021, ERCOT also began to procure 4-6x their historical volume of non-spinning reserves. Operationally, they began to use that increased non-spin volume as well, deploying procured resources much more frequently.

Before this change, procurements of non-spin were less than 1,000 MW. With the modification in July 2021, over 4,000 MW of non-spin began to be procured in the day ahead market. It could be deployed in the real time market for energy by operator action or when the LMP (not including adders) exceeded $75/MWh.

Let’s take a look at procurement of ancillary services over the past 30 days.

The introduction of ECRS represents the end of ERCOT’s reliance on excessive non-spin procurement and deployments to manage short duration ‘uncertainty’ contingencies.

Starting at 10 minutes out and extending hours into the future, ERCOT’s stack of ECRS and non-spin overlaps to deal with the known unknown variabilities of market operations.

Non-spinning reserves will continue as a constituent of ERCOT’s ancillary services, but the focus of that product will return to longer duration uncertainties. It is noteworthy that the non-spin procurement volumes are being reduced incrementally in two steps, with the first reduction on June 10th and the second reduction on July 1st 2023. These are notable dates for ERCOT market participants. Fulsome information on ERCS from ERCOT can be found in the zip file at this link, while additional information on the procurement and deployment criteria can be found in this presentation.

Given its centrality to resolving emergent, critical grid conditions, we anticipate ECRS will remain a premium ancillary service for some time.

Bifurcation of duration related uncertainties

The addition of ECRS and accompanying reforms to non-spin are particularly interesting as they represent a new time-based bifurcation of ancillary services related operational uncertainties. This split may previously have been unnecessary as ancillary services were provided by energy generators. However, with batteries providing more and more regulation and responsive reserves, the risk of ancillary service shortages due to insufficient state of charge increases significantly.

Most batteries in ERCOT are only 1-1.5 hours in duration. A way to interpret the above data is that regulation up and responsive reserve procured MW, which exceed 50%, are limited to 1-hour duration events. To help compensate for this risk, post Uri, ERCOT began enforcing a 4-hour duration requirement on non-spin for energy storage participation (1-hour was previously required) and increased non-spin procurement. This was extremely inefficient and had additional market power issues.

Conclusion

The past two weeks have been great demonstrations of both the power of unexpected renewable output to lower costs, and the high prices that can be associated with uncertainty and tight conditions. Unfortunately these peaks and valleys are not as predictable as we would like, precipitating the need for products like ECRS to bridge the gap.

Enhancements to Grid Status

Thank you for making to the end of this post! While writing this post, we made numerous enhancements to the datasets in Grid Status to track conditions of ERCOT’s grid more closely. These include real time ancillary service deployment monitoring, day ahead ancillary service clearing prices, procured volumes and more detailed resource specific market data such as aggregated ancillary service offer curves and the marginal clearing resource.

We are also working on an improved ERCOT dashboard that offers a more comprehensive view of the ERCOT market and its operations.

If you are interested, please fill out this form or send us an email at contact@gridstatus.io

This post is supported by funding from GridLab.