Capacity Constraints in PJM have Grown Beyond Dominion

As tech firms snap up clean firm power with PPAs to power data center load growth, Dominion's demand challenges have spread to PPL. Can PJM as a whole keep up?

As the PJM interconnection faces a drought of new generation and a flood of AI-driven demand, Google’s 670 MW hydroelectric PPA with existing Brookfield assets is a sign of the times. Similar deals are on the horizon, but upstream challenges remain in the struggle to power domestic datacenter growth.

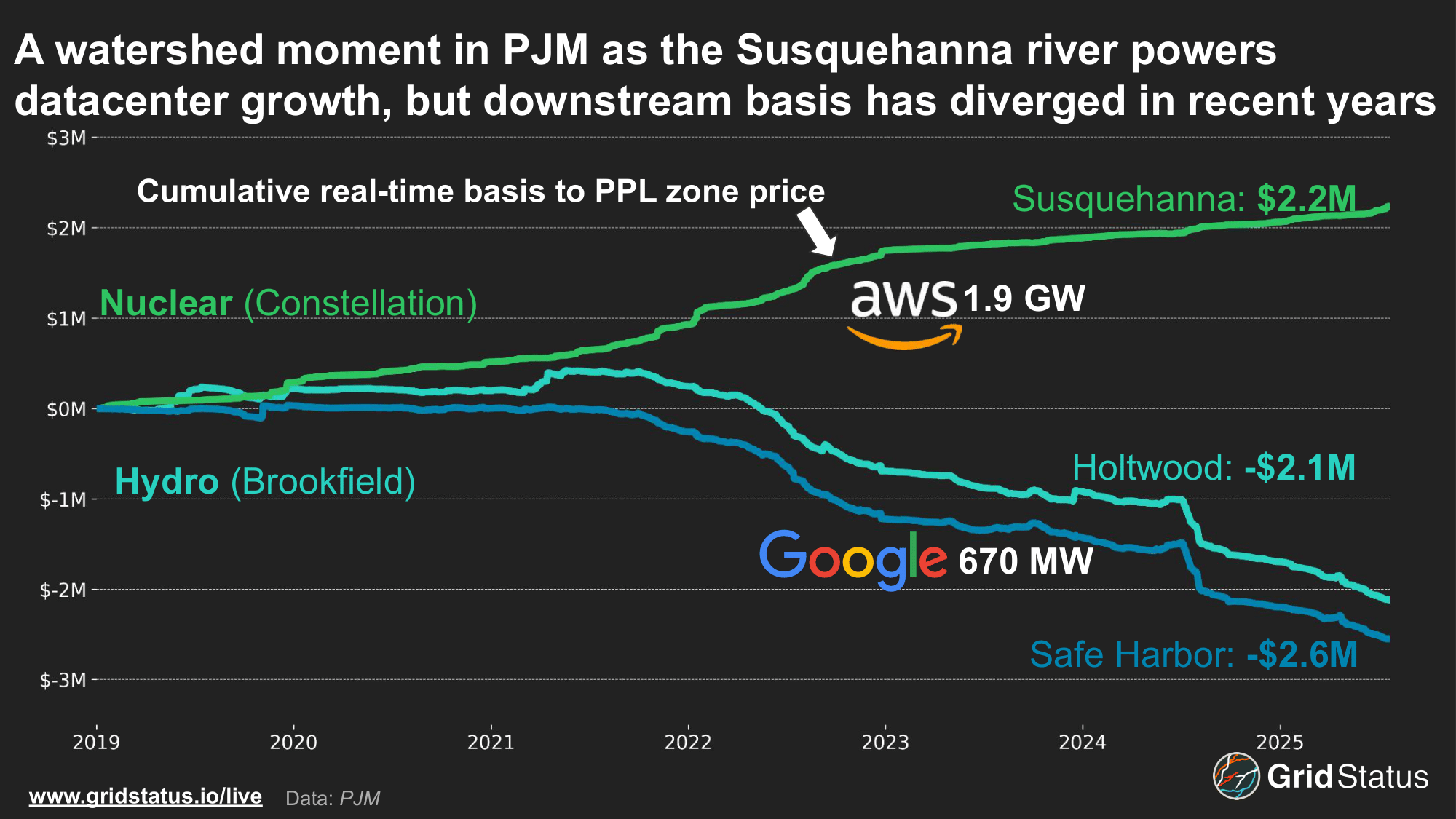

While Dominion is the classic PJM datacenter play, demand has spiked less than 100 miles to the north in Pennsylvania’s PPL zone, where Google and Brookfield aren’t the only ones inking deals. Since last year, Amazon’s attempt to take Talen’s Susquehanna nuclear plant behind-the-meter has been in the news. After FERC rebuffed their BTM-but-still-technically-grid-connected plan, Amazon settled for a more conventional agreement on the plant’s output. From just these two deals, over 2.5 GW of datacenter PPAs have been signed in a single mid-sized zone, dramatically altering PJM’s estimate of future load growth for the area.

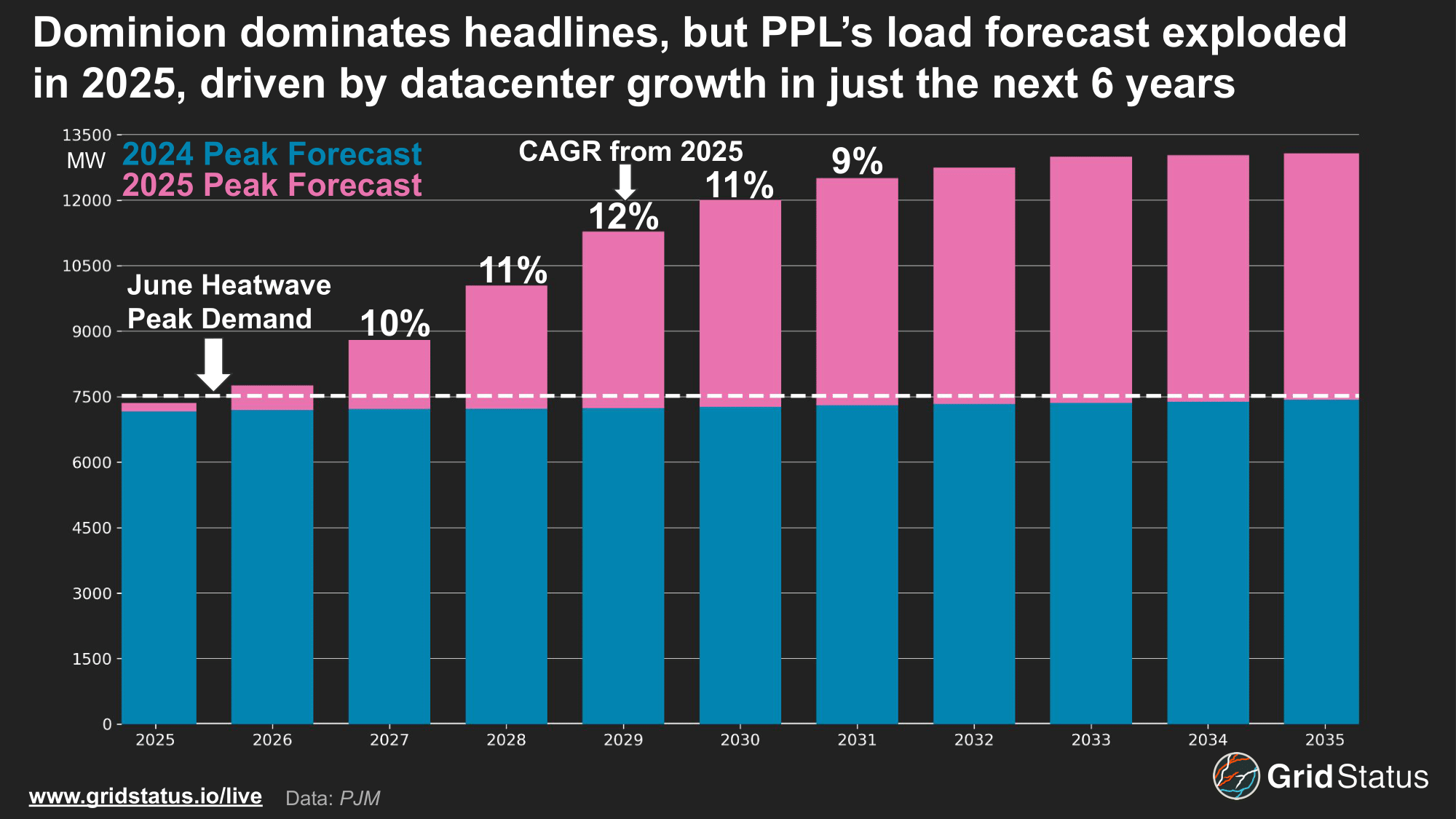

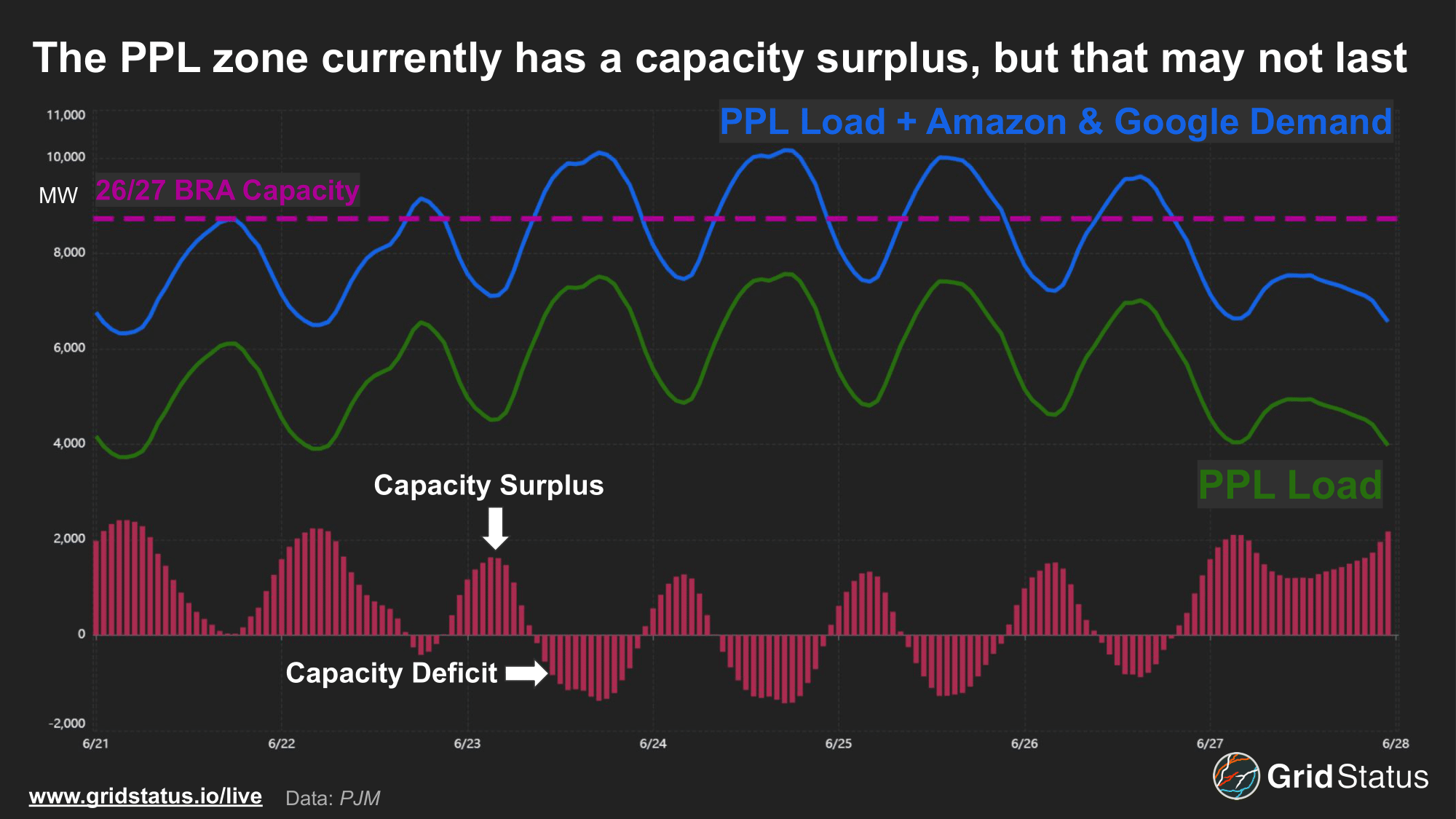

In the 2024 forecast, demand growth was essentially flat, with no year before 2036 predicted to peak above the maximum demand during the recent June heatwave. In contrast, the 2025 outlook portends a massive acceleration in load growth, concentrated in just the next 6 years, and reaching a >70% increase in peak demand by 2031. Amazingly, even this forecast failed to hit the demand we saw in late June.

What Lies Downstream

All three of the PPL plants involved in high profile datacenter PPAs, in addition to GWs of others, rely heavily on the Susquehanna River. Holtwood and Safe Harbor are both run-of-river hydro plants, and in sequence with each other, while Susquehanna uses its namesake as a cooling source. Despite their shared resource, market outcomes have diverged since 2021.

After years of closely tracking the zonal price, Holtwood and Safe Harbor have begun seeing higher nodal prices, unlike Susquehanna. Traditionally, operators like Brookfield would use this as a key leverage point in PPA negotiations, but as tech companies ramp up power consumption, they have become savvy buyers, factoring basis risk into their decision-making. Safe Harbor comes with an additional caveat - legacy capacity carveouts and 2 units that operate at 25Hz to power the southern portion of Amtrak’s Northeastern Corridor.

However, in the case of AI-induced demand growth, the deepest corporate pockets in the world have been more than willing to pay a premium for clean firm power, a resource increasingly in short supply.

Factored In

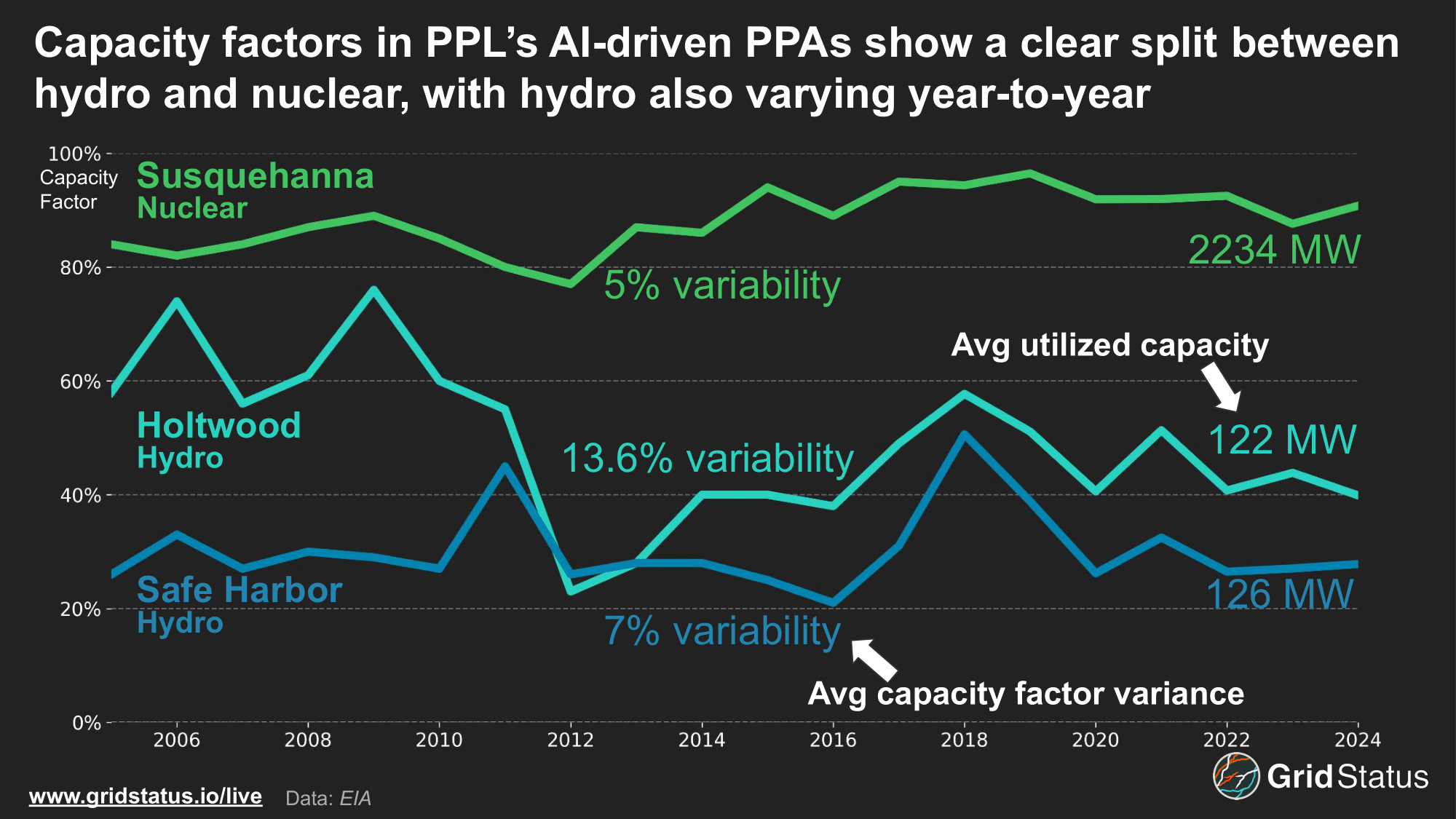

While much of the attention around recent power deals has centered on nameplate capacity, the ability of plants to deliver consistent, around-the-clock power is even more critical. Datacenter flexibility has been heavily touted in recent months as a salve for stressed systems, but as we saw in Virginia last summer, large drops in load require thoughtful operational management. Unsurprisingly, Susquehanna, a nuclear plant, has the highest capacity factor and the lowest variability, while Holtwood and Safe Harbor exhibit more pronounced seasonal and year-to-year swings in output.

The dams are linked in their production, as Safe Harbor is directly upstream of Holtwood. With one owner, the plants can be managed in conjunction with each other, but have additional constraints related to water levels and fish passage depending on the season. These restrictions can also vary. In 2025, the fish passage season was suspended entirely at the behest of Pennsylvania authorities to prevent the spread of invasive species. Further related to these constraints is the subject of relicensing. The license at both facilities is set to expire in 2030, and Brookfield kicked off the relicensing project at FERC earlier this year. With opportunities for public comment and involvement throughout the process, Google’s announcement may draw additional attention that some relicensings avoid.

Even nuclear plants have important caveats. They undergo maintenance and refueling outages roughly every 12 to 18 months, typically lasting a month at a time. Additionally, unplanned events like plant trips, such as the one at Susquehanna on July 22, 2025, can lead to abrupt generation losses. As datacenter expansion accelerates, these reliability nuances are elevated to critical considerations, alongside comparisons of actual unit availability and generation to nameplate capacity.

As legacy units continue to be acquired in the quest for power, reliability will grow in importance, particularly as the grid is put under more strain and for longer periods of time. While Amazon and Talen are advancing small modular reactors as an additional power source, Meta and Constellation have opted to increase capacity at the Clinton nuclear plant in Illinois, a move driven partly by the challenges of bringing new generation online in PJM.

Tighten Up

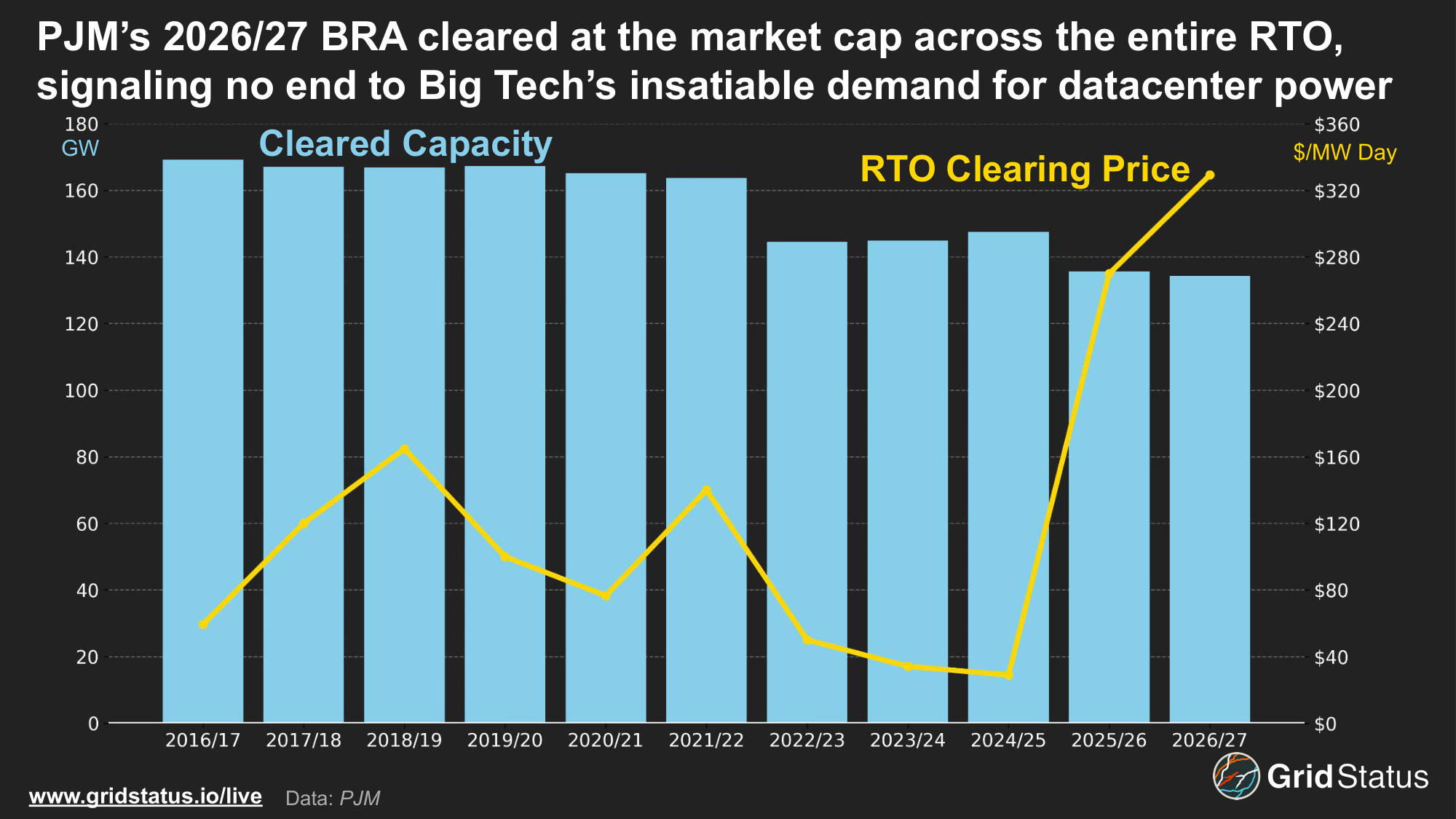

Many saw the 2025/26 PJM Base Residential Auction (BRA) as a flashing warning light that the balance between supply and demand was rapidly tightening, and the recent 2026/27 BRA is unlikely to change any minds.

In this week’s results, PJM cleared less capacity at an even higher price, reaching $329.17/MW-day, the price collar for this auction and the next. This temporary cap prevented prices from clearing even higher, at a PJM-estimated $388.57/MW-day.

PJM has framed these auction results as a clear investment signal that generation should be built and retirements delayed, but this response mechanism hasn’t had time to catch up. Skyrocketing demand forecasts on the heels of freshly implemented interconnection queue reform is a recipe for constrained power. New builds haven’t had the head start on meeting datacenter demand enjoyed by facilities in ERCOT, although retirements have slowed.

The supply side of the equation is important, but these tightening margins are inextricably tied to a mismatch in the cost-benefit equation for new demand centers. Higher capacity costs may increase the bills of rate payers across the region, but Big Tech will have locked in their own power purchase agreements years before the impact is felt. Put another way, for large corporations, the opportunity costs of slowing development are far higher than elevated utility rates (up to a point).

While RTO-wide conditions continue to tighten, individual zones are seeing changes to their supply mix as well, with few as stark as PPL’s.

In the 2025/26 BRA, PPL cleared ~8,757 MW of capacity. In the most recent auction, this fell to ~8,377 MW, a nearly 400 MW decrease. Only COMED, a region whose demand peaks 3x above PPL’s, saw a larger drop.

Without new, firm capacity, PPL is on track to exceed its available supply even sooner than expected.

The continued spike in capacity prices points to a key flaw in market dynamics, one which has been raised by PJM‘s independent market monitor. According to the IMM, these facilities were responsible for nearly 64% of the total costs in the 2025/26 Base Residual Auction, pushing total capacity payments to over $14 billion.

While these tech firms compete for every additional megawatt, consumers are caught in between as utility rates across the RTO undergo double-digit increases, before most of the forecasted load even materializes.

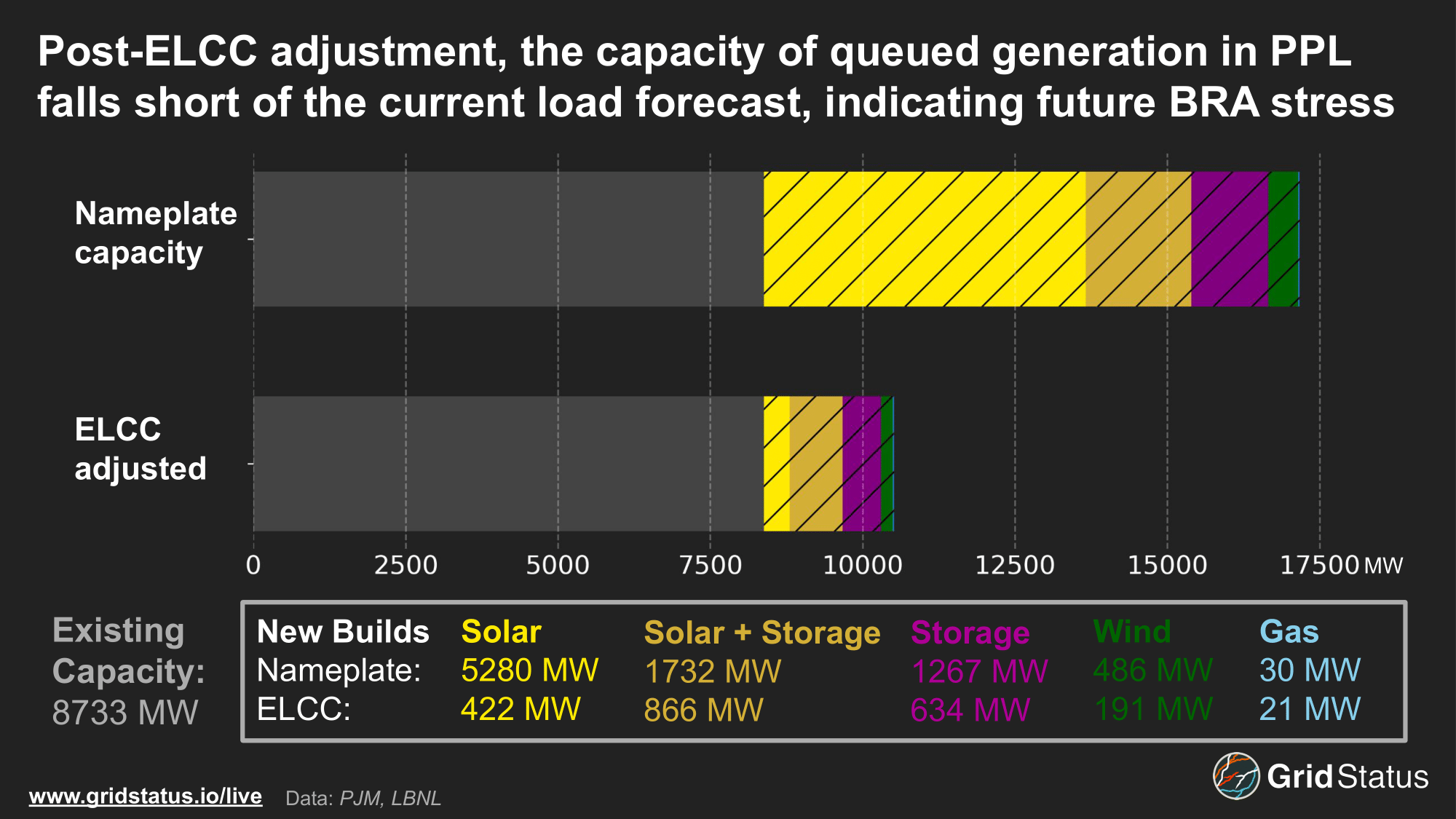

While demand has spiked, new generation build-outs remain limited. The RTO’s now-infamous interconnection freeze slowed generation additions, and the bulk of new capacity has been renewables without storage. Queue reforms are expected to accelerate new projects relative to the status quo, but starting from a low point means there is a long way to go.

Examining PPL, there are currently 9 GWs of generation active in the queue, nearly all solar, storage, and wind. While solar buildout, particularly in PJM, adds needed generation, it lacks the rated capacity needed to meet growing demand forecasts and reduce BRA prices. PJM employs effective load carrying capability (ELCC) to rate the expected output of a generation class during a capacity event, and currently assigns solar an 8% value, the lowest of all resource classes. In a period where most new builds are solar, their contribution to meeting BRA demand is limited. Outside of the auction mechanics, frigid winter mornings continue to portend operational stress, as they combine a lack of sunlight with the possibility for gas interruptions.

Beyond the queue, Blackstone and PPL’s joint venture to develop new gas plants aimed at supporting datacenter expansion may ease PPL’s potential capacity shortfall. Though details are limited, the parties involved have a track record in power infrastructure that tech firms lack.

Heavy Surf

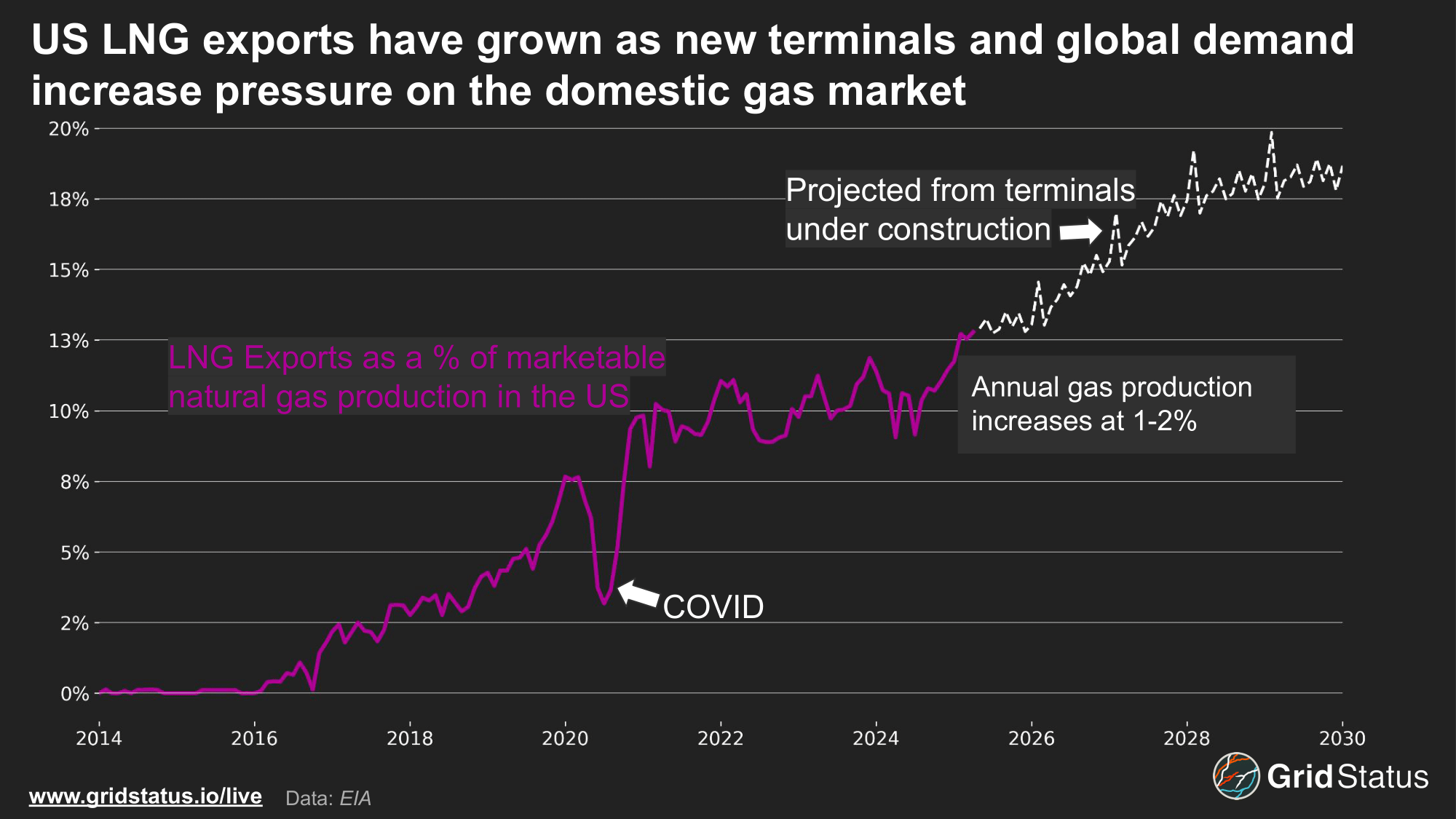

Beyond PJM, the macro environment has made new builds even more challenging. Gas turbines are in short supply, and many manufacturers have years-long wait lists. Simultaneously, increased exposure to global markets through new LNG terminals and fortunes linked to the price of oil via associated gas both portend fuel price volatility. LNG in particular is an underplayed story, as the rush to build additional export capacity relies on an ever-increasing domestic production base.

In the early 2000s, the US exported small amounts of LNG, but was preparing to become a gas importer. The shale revolution flipped the script, and the rapid development of a more fulsome global market for gas has also enabled LNG markets to reflect price events back onto the domestic indices.

This mechanism is likely to become more pronounced as LNG consumes a greater share of marketable gas production in the United States.

Just a decade ago, LNG consumed essentially no marketable gas (a measure of production that takes into account losses such as flaring and venting). Starting in 2016, with the completion of Train 1 at Sabine Pass, this began to change.

Despite increasing gas production over the entire period, LNG export capability has grown even faster, now consuming a double-digit percentage of US gas.

Following a post-COVID plateau, growth seems set to resume as more facilities come online. Assuming global demand stays strong, LNG will increase its consumption of marketable gas in the US at the same time as power demand is also likely to grow. Without a significant uptick in production, it seems possible that US gas could end up back in a period of higher prices and volatility. A boon for producers, but an additional stressor for ratepayers and system operators.

Beyond gas, recent changes to federal incentives have already led to sharp cuts in forecasted wind, solar, and battery additions, and projects face an increasingly challenging permitting environment across the country. Erratic tariffs have done nothing to ease this pressure, and investments in advanced domestic manufacturing have been scrapped under pressure from the White House as well as questionable loan commitment clawbacks.

This supply crunch has resulted in extreme measures. Microsoft and Constellation are working to restart Three Mile Island, while operators are racing to build off-grid supply to limit rate exposure and avoid grid interconnection. Meanwhile, xAI claims to be carrying out what others with stupendous wealth have done in the past - deconstructing a piece of Europe and shipping it to America, albeit this time with a power plant.

Under (Political) Pressure

Another round of high capacity prices and expected cost impacts on consumers may trigger further political blowback for PJM. Pennsylvania Governor Josh Shapiro previously filed complaints with FERC regarding higher capacity costs, ultimately leading to the price collar in this auction and the next. With nearly half of PJM’s states (Illinois, Kentucky, Maryland, Michigan, Pennsylvania, and Virginia) led by governors floated as potential 2028 presidential contenders, the incentive to act is strong. While we expect more political leaders to put pressure on PJM, there is something of a balancing act to calling for additional investments in your state while criticizing the higher capacity prices that follow.

While Northern Virginia has seen the most visible datacenter investment in PJM, growth is expected across the country, and power-hungry tech companies will continue to seek firm power to scale operations. In their announcement touting their Holtwood and Safe Harbor PPAs, Google and Brookfield alluded to gigawatts of future hydroelectric PPAs and expansion into MISO, the same region where Entergy and Meta are partnering to power a datacenter nearly the size of Manhattan with new gas generation, even after blackouts in Louisiana this spring.

As grids across North America continue to see new entrants in oftentimes opaque markets, the importance of real-time and historical data to inform fast-changing operations has never been more important. Track these changes in real time with Grid Status’ live pages and access years of operational data with our easy-to-use API.

If you're an active Grid Status customer, try out the new dynamic toggle on the price map legend to highlight variation, or track coincident peaks with the ERCOT 4CP Monitor.