PJM's Peninsula Problem

The Delmarva peninsula is penned in by geography with limited internal generation and strong demand. Managing transmission will be key as the region's fuel mix evolves.

The last unit at Delaware’s final coal plant, Indian River, retired at the end of February. This marked the end of a costly Reliability Must Run (RMR) agreement between Indian River’s operator, NRG, and the PJM Interconnection.

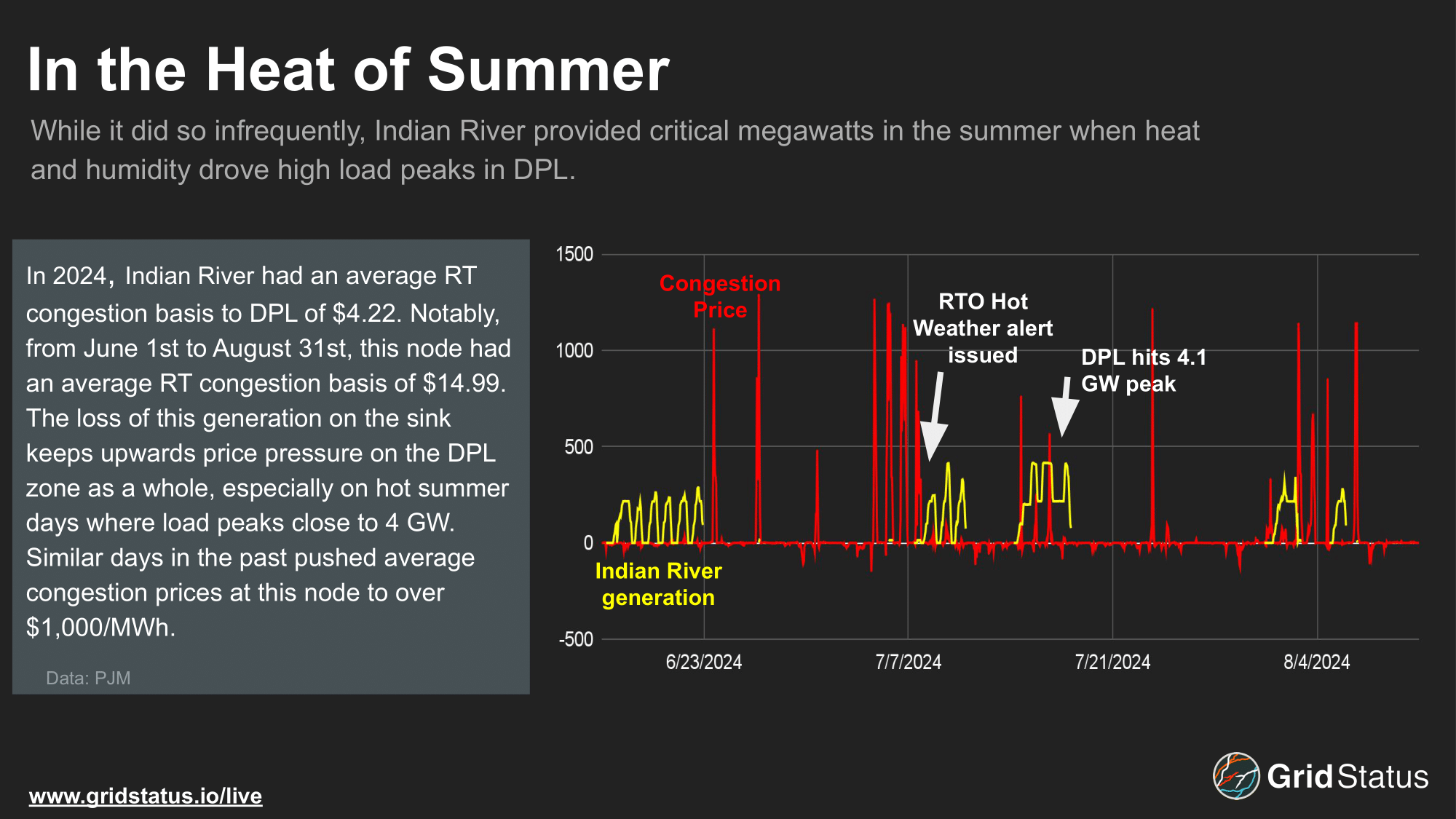

The first summer without Indian River will likely see more consistent price spikes in DPL without the critical MWs that Indian River provided during heat waves.

Please reach out at contact@gridstatus.io if you want early access or have any suggestions on the types of research or content you'd like to see.

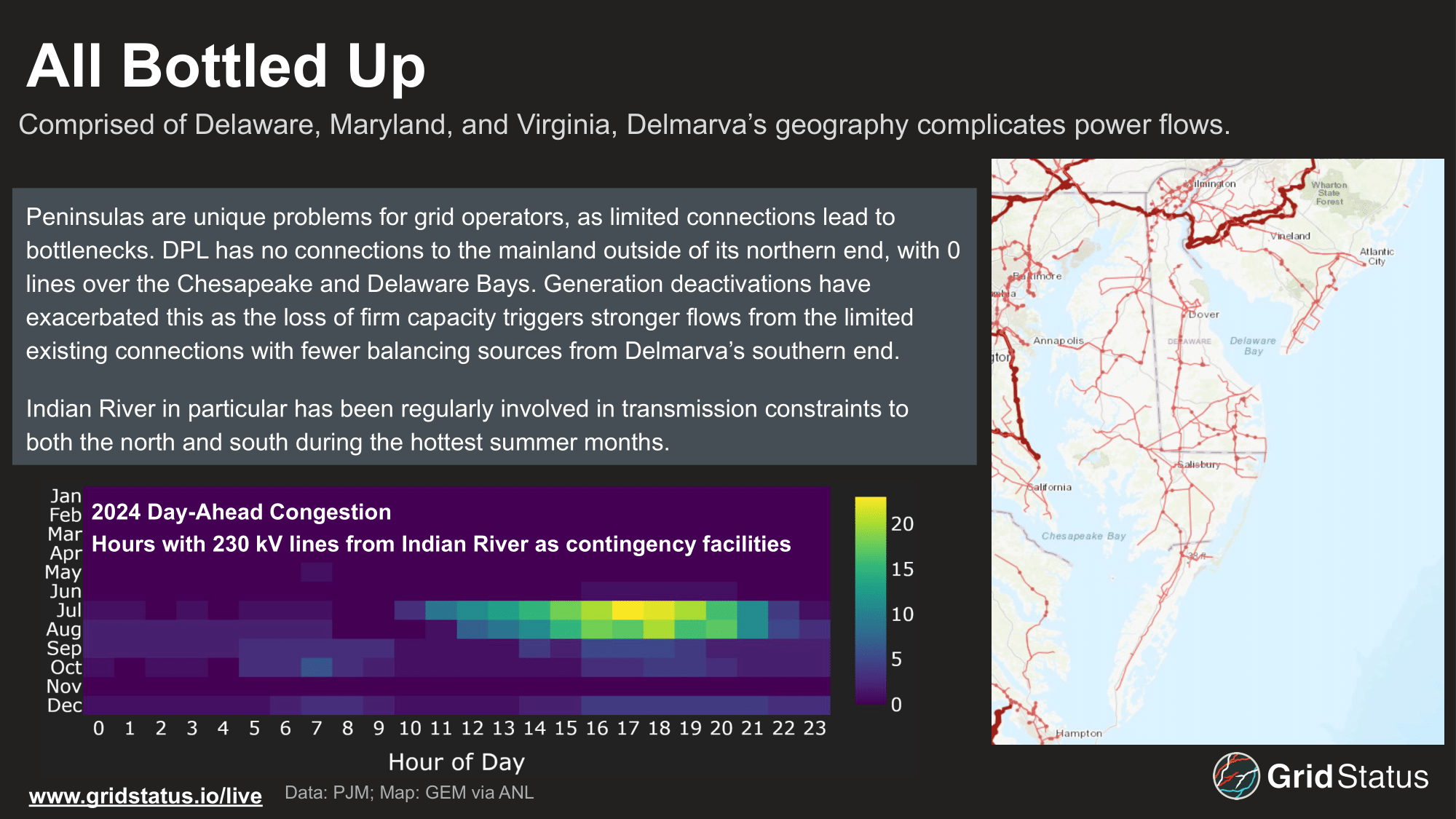

Peninsular Problems

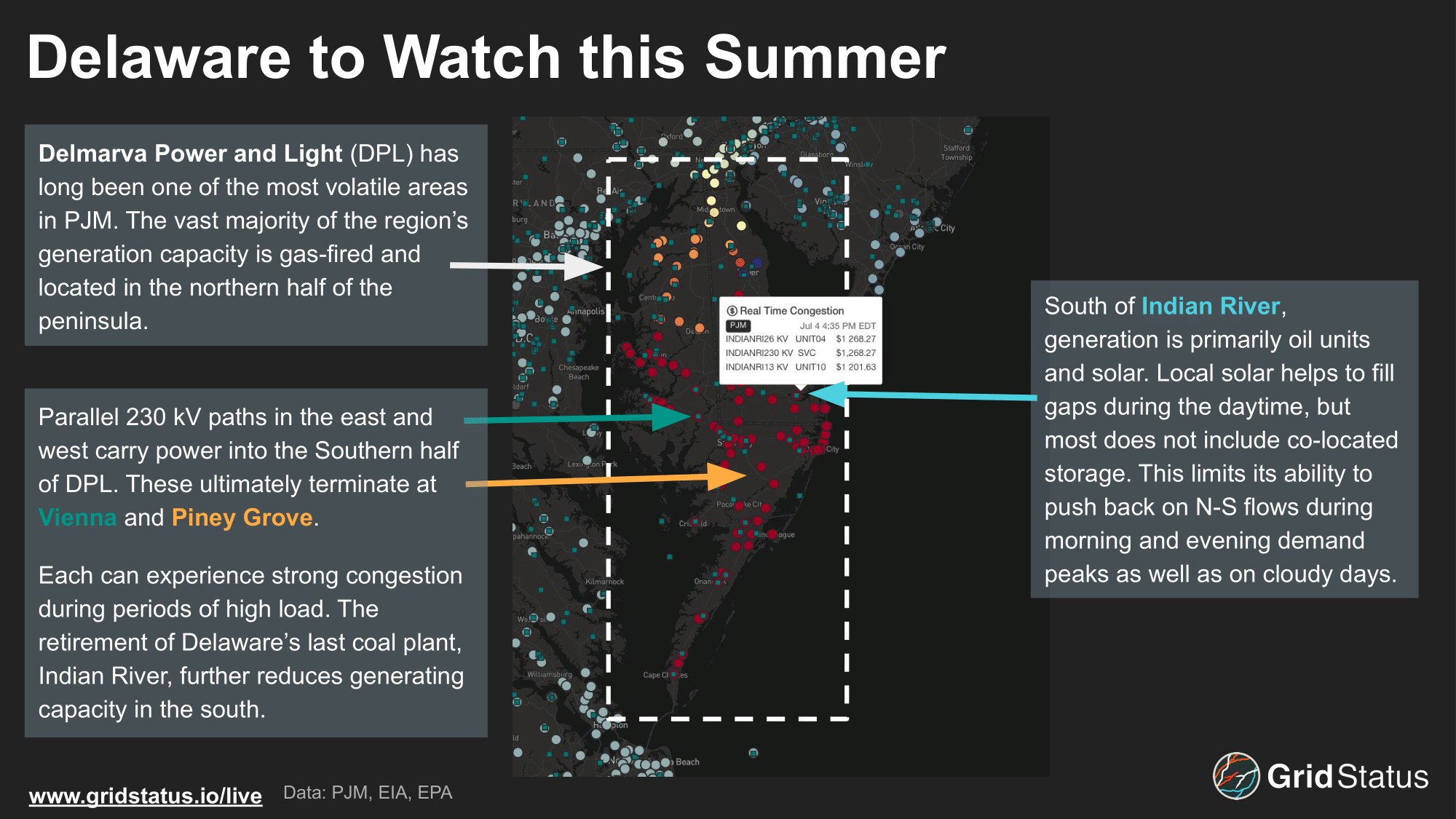

The bulk of generation in DPL is gas fired and concentrated in the Northern half of the peninsula. Only Vermont produces less electricity than Delaware, which sources ~90% of its electricity from natural gas. The state is heavily dependent on flows from neighboring states like New Jersey and Pennsylvania. Outside of its gas-fired fleet, generation is limited to solar and low capacity factor power plants such as Indian River. Limited generation south of Dover and a lack of higher voltage transmission ties to flow power in any direction except for N-S set the stage for explosive congestion during periods of high demand in the Summer and Winter.

The Delmarva Peninsula's natural bottlenecks make it difficult to manage congestion during high load days. Surrounded by water on three sides, DPL has limited access to the wider grid and is heavily dependent on power flowing north to south along 230kV lines, which step down to a wider network of 138kV and 69kV lines in the Southern half of the region. The 230kV lines begin as parallel circuits, but dwindle to single lines as they move south.

Coal's Last Gasp

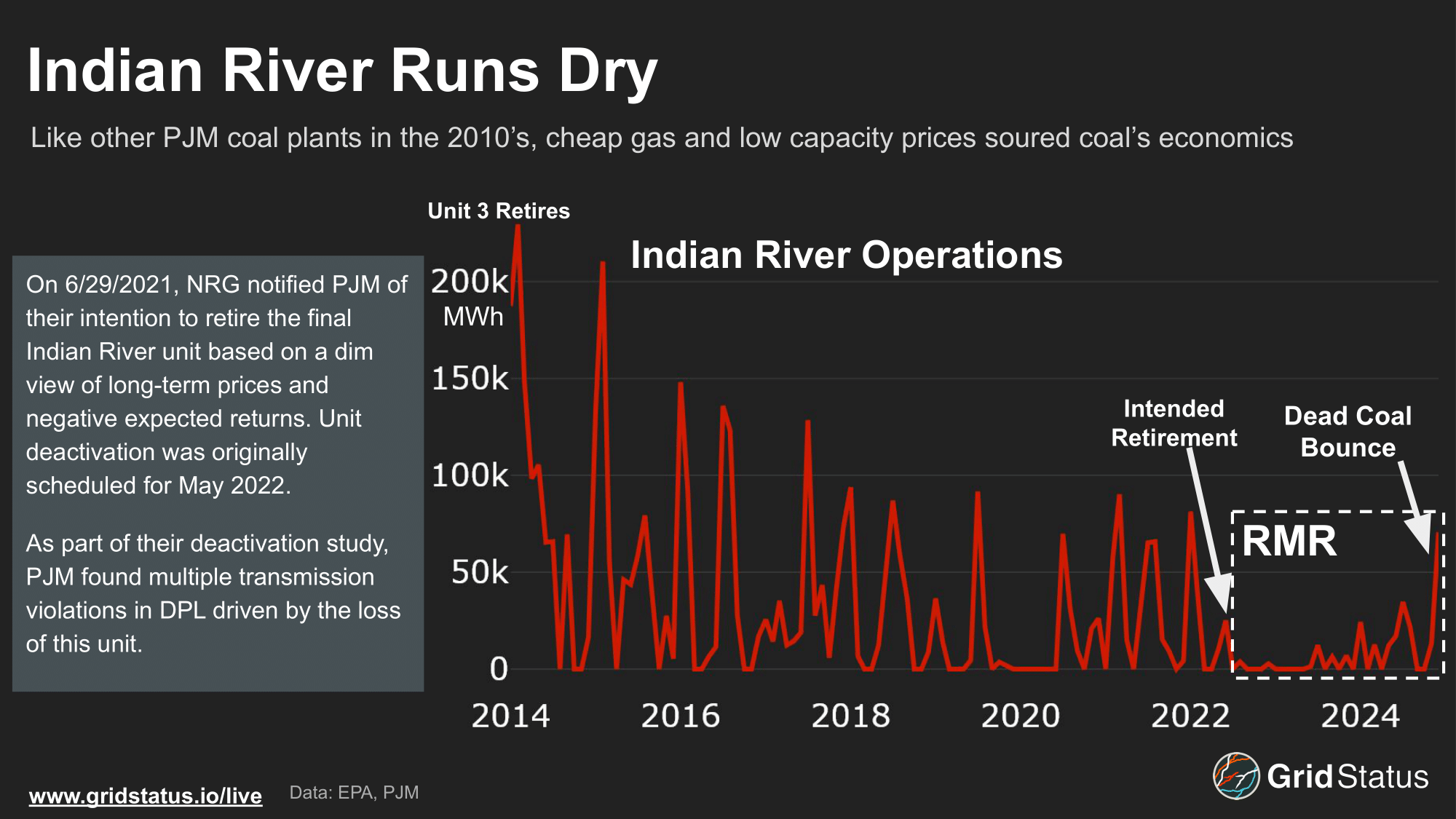

For more than 40 years, unit 4 of Indian River played an important role in balancing flows on the Delmarva Peninsula. Located near the geographic center of Delmarva and connected to the 230kV network, Indian River helped to generate power closer to local load centers, particularly those with large seasonal swings such as Rehoboth Beach and Ocean City. Even as this was the case, the wider generator economics of coal in PJM lead to challenges for NRG. Cheap natural gas, falling energy and capacity prices, and increased environmental regulations saw the three older coal units at Indian River to retire in 2010, 2011, and 2013, leaving just unit 4, a 412 MW coal unit, and a 16 MW oil unit on site. Even though NRG did not retire Unit 4, the underlying conditions that lead to the retirement of other units lead to notable decreases in generation at Unit 4.

After the decline in output and continued negative expected returns, NRG submitted its intent to deactivate Unit 4 to PJM in 2021. Similar to an interconnection process, where the impacts of generation joining the system are studied, PJM conducts retirement studies to analyze the impacts to the grid of generation deactivation. During this process, PJM identified seven transmission violations driven by the loss of Indian River, notably that the Nelson - Vienna 138kV line would violate numerous N-1 and N-2 contingencies.

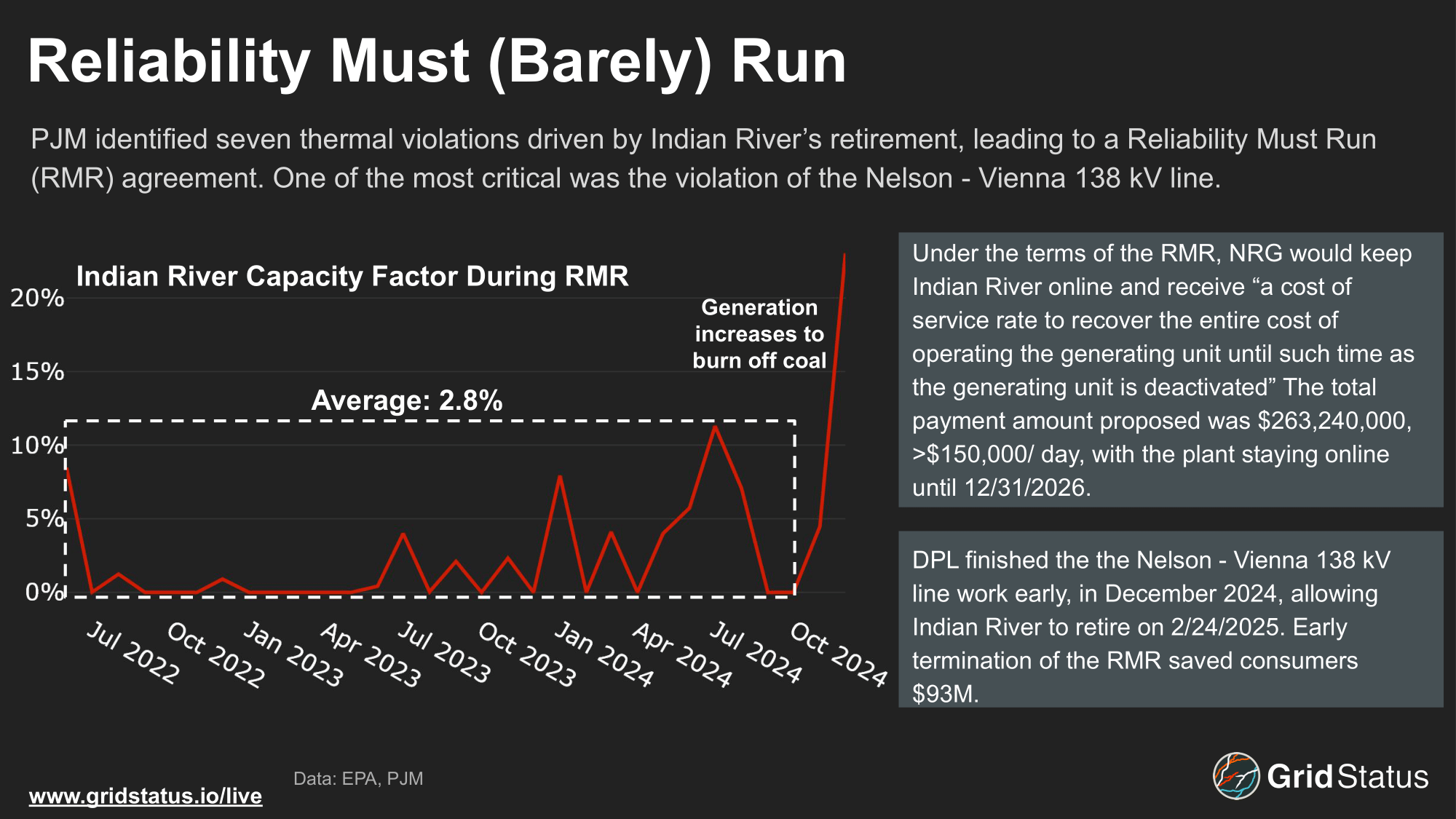

ISOs are often limited in their ability to force generation to remain on line, but many have the ability to enter into out-of-market agreements with plant operators to keep plants online for a set period of time for reliability purposes. In the case of Indian River, PJM and NRG entered into a Reliability Must Run (RMR) contract to keep this unit online until necessary transmission upgrades are completed. Under this agreement, NRG would be compensated for costs related to keeping the plant operational, which would total more than $263 million by the planned end date of 12/31/2026. This agreement was not entered without protest, chiefly from the PJM market monitor. The IMM argued that the payments in the RMR were too high given the fact that NRG effectively treated the plant as a loss. Furthermore, the IMM argued there were inefficiencies in the operating costs provided by NRG and thus the RMR amounted to a partial subsidy from ratepayers for a failed asset.

Under the RMR, Indian River would remain online until necessary transmission upgrades were completed, particularly the Nelson - Vienna line. These upgrades were completed almost two years ahead of schedule in December 2024. Following this, PJM announced that Indian River would be able to exit its RMR agreement and retire in February. This led to a notable increase in generation during December as the plant burned through its coal stockpiles ahead of its retirement.

Even while the plant was active, Indian River experienced periods with high levels of congestion volatility. The DPL zone often sees peaks that approach 4 GW during hot, humid summers and cold winters. During these times, constraints such as Cool Spring - Milford, on which Indian River is a top sink, would be triggered given the strength of north to south power flows. Given the lack of additional generation and the bottlenecks driven by DPL being a peninsula, this constraint would often bind with a shadow price at the market cap of $2,000/MWh, leading to congestion costs of over $1,000 at Indian River. This led to considerable price separation between unit 4 and the zone as a whole. In 2024 Indian River had a $4 congestion basis to DPL and a nearly $15 basis during the summer. While the plant did not have a high capacity overall factor, especially during its RMR, it did operate during periods of high load that corresponded with higher congestion costs.

Something to Cluck About

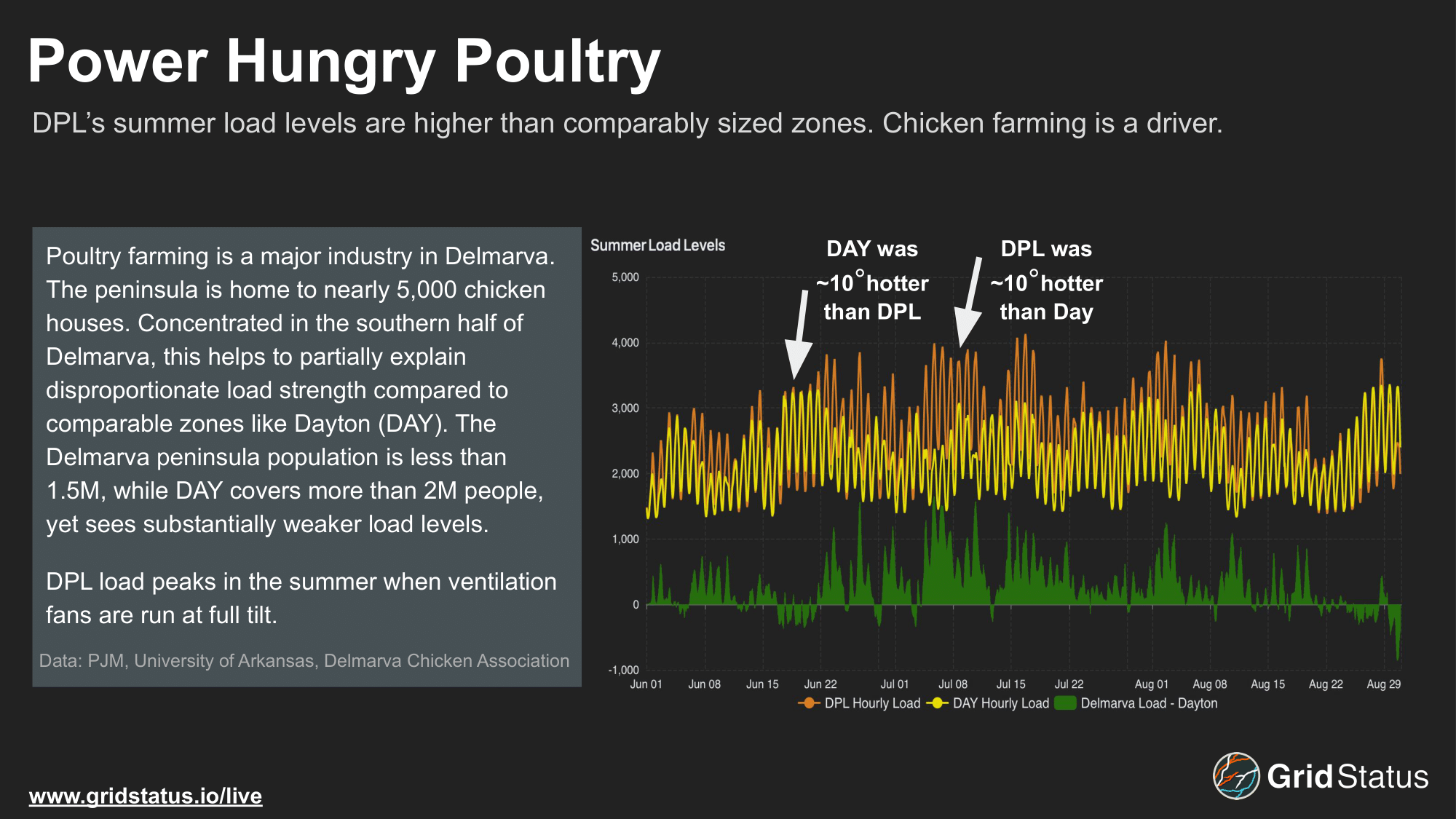

Last summer, DPL saw peaks approaching 4GW during the hottest days of July. These peaks are notably stronger than comparably sized zones like Dayton. Delaware does have some energy intensive heavy industry that may juice these peaks, but chemical manufacturing is primarily located in Northern Delaware. Venturing down the Delmarva peninsula, the landscape is dotted with clusters of boxy structures that require significant power, but unlike Northern Virginia to the west, these aren't datacenters.

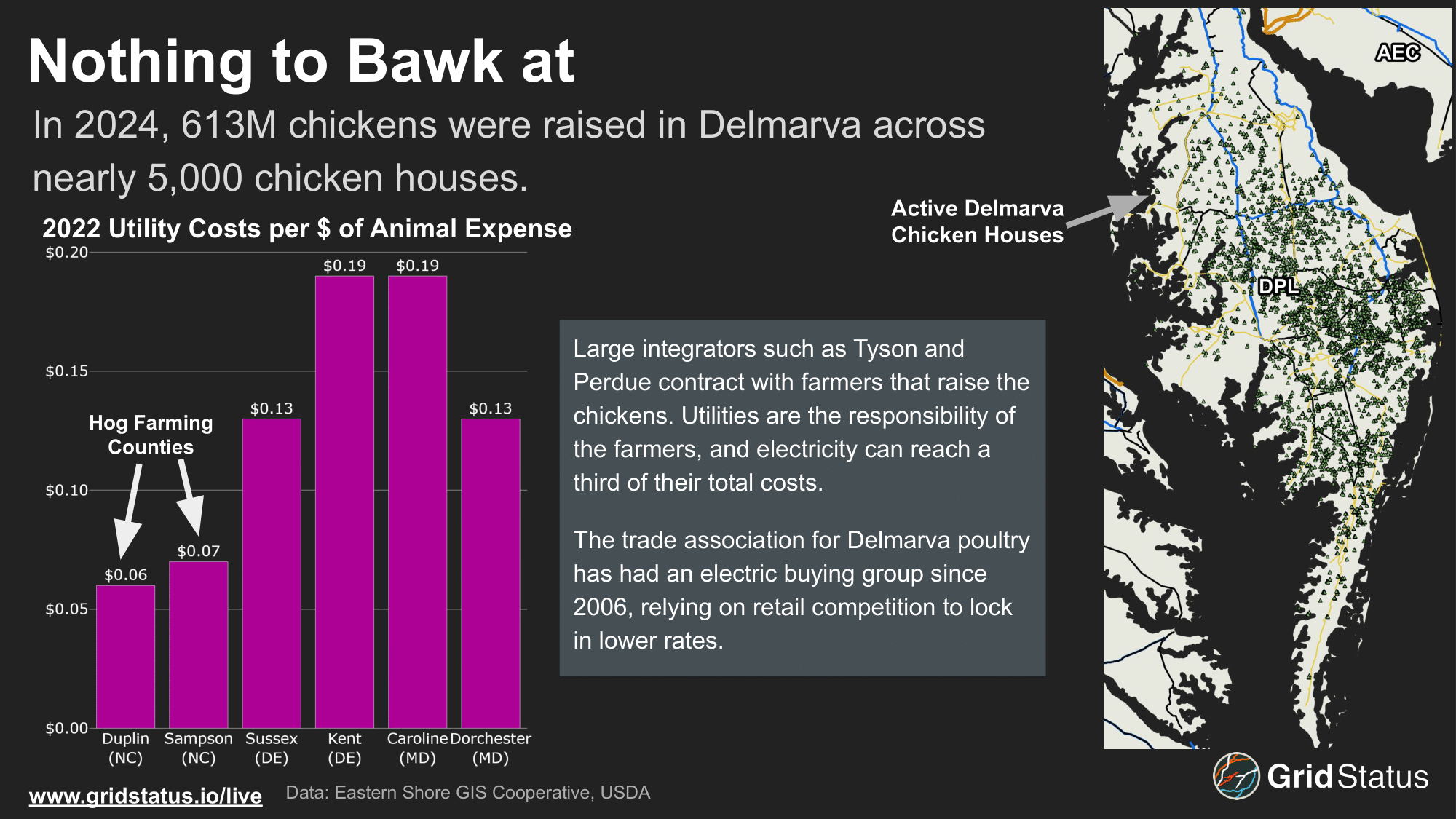

The agriculture industry in Delmarva is concentrated in the Southern half of the region, which may be a contributing factor to the level of congestion the region sees. Delmarva is home to ~5,000 chicken houses, with the highest producing county in the county, Sussex. This production can exacerbate periods of grid stress, as electricity usage at chicken houses is heavily correlated to overall coincident peak load. Poultry farms aim to limit energy expenditure by chickens which leads to higher cooling usage in the summers and heating in the winter. In comparison to the top hog farming counties in the country, chicken farming counties in the northern half of Delmarva have substantially higher utility costs per dollar of animal expense.

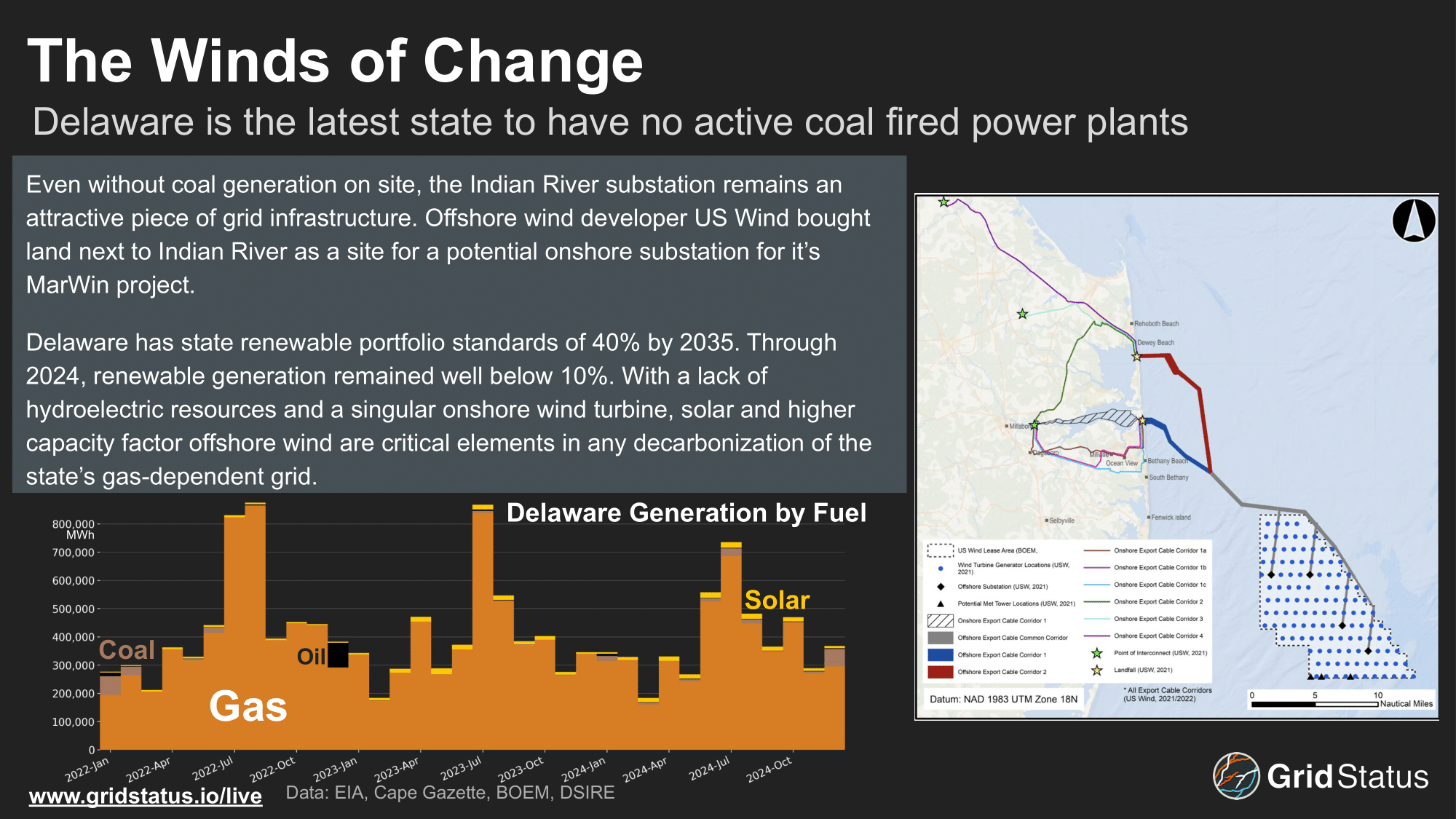

Uncertain Future

The retirement of Delaware’s last coal plant comes at an important time for Delaware’s energy transition. Delaware’s Renewable Energy Portfolio Standards Act mandates 40% of electricity sold by utilities be renewable by 2035, with 10% of that coming from solar. While Delaware may be able to meet these goals with solar, it is nowhere near ready to meet these requirements with onshore wind. Currently, there is a single 2 MW onshore wind turbine in Delaware, located at the University of Delaware. To meet these targets, Delaware will need to develop a meaningful portion of its offshore wind potential. For comparison, if Delaware were developing a project with the capacity of Dominion’s Coastal Virginia Offshore Wind farm, it would have met 50% of the entire DPL zone’s demand in 2024 with a capacity factor of just 40%.

The Marwin offshore wind project anticipates tying into the Indian River substation from their own adjacent infrastructure, but has faced stiff local opposition. Headwinds extend beyond local jurisdictions, as the offshore wind industry throughout the US is facing considerable permitting and political uncertainty. Regardless of which project takes advantage of it, the Indian River substation will likely be repurposed given its favorable grid connection and easy access to offshore lease areas.

Low capacity factor oil peakers, such as as Vienna and Chesapeake, will likely become more important in Delmarva. Simultaneously, solar developers with peninsula projects may co-locate batteries to obtain higher capacity payments and the ability to capture higher prices during the evening peak.

Follow along with the price spikes at Grid Status.

Please reach out at contact@gridstatus.io if you want early access or have any suggestions on the types of research or content you'd like to see.