Tariffs Challenge the Interconnected Northeast

New York and New England are heavily interconnected with the Canadian grid, importing cheaper and cleaner power than internal generation. Tariffs are driving uncertainty in both operations and planning.

Please reach out at contact@gridstatus.io if you want early access or have any suggestions on the types of research or content you'd like to see.

In the face of unprecedented tariffs, the heavily interconnected grids of the northeast have seen their international connections with Canada transform into an operational and planning headache, as well as an existential threat.

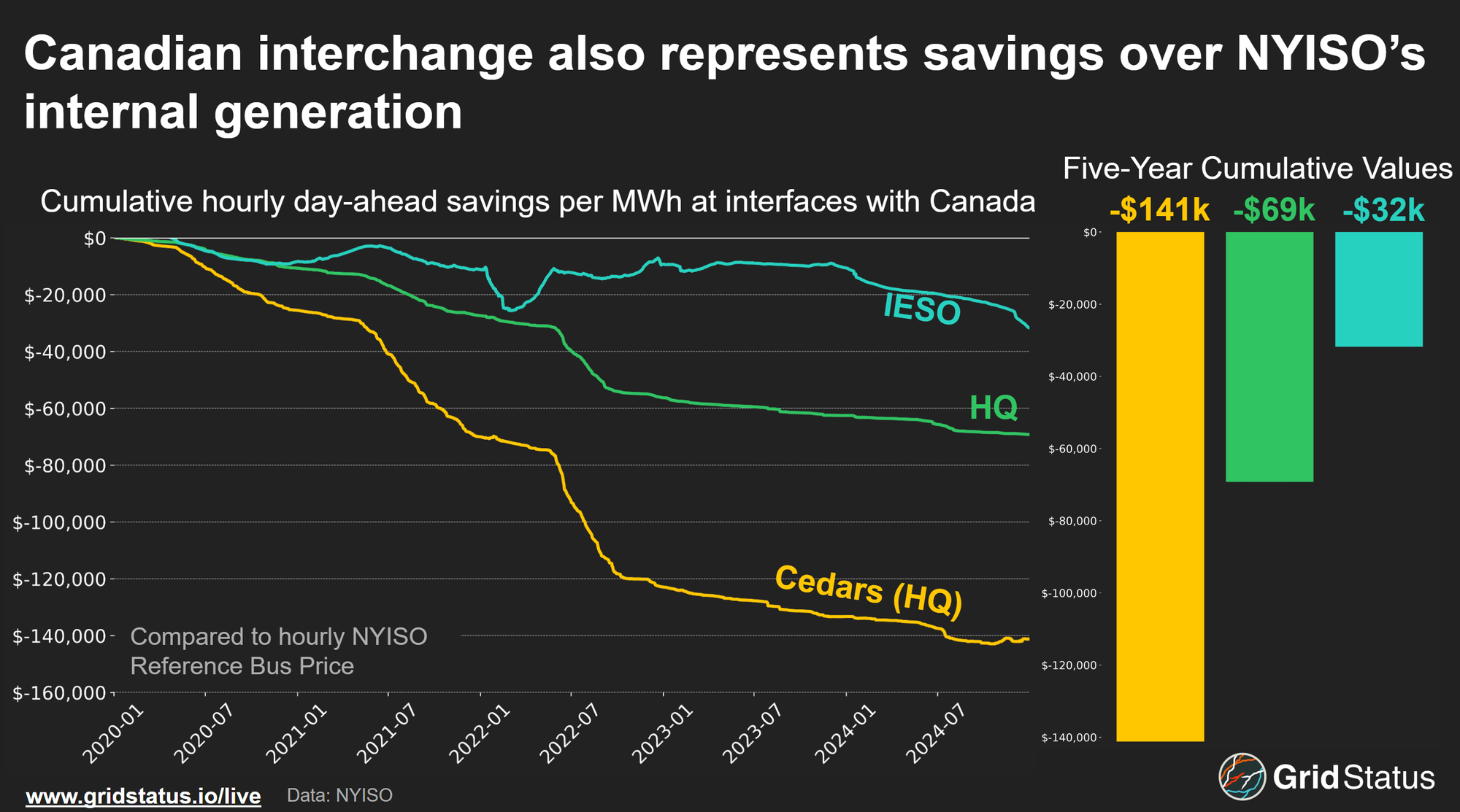

Not only do imports from Canada help states in the Northeast meet carbon reduction goals, these flows help to reduce system energy costs. Both NYISO and ISO-NE are heavily dependent on gas generation to meet demand, leaving markets vulnerable to higher energy prices when spot gas markets spike. Imports have helped to drive cost reductions for consumers, by reducing reliance on internal gas fired generation, particularly during peak demand events in the winter and summer, while also reducing carbon emissions.

ISO New England

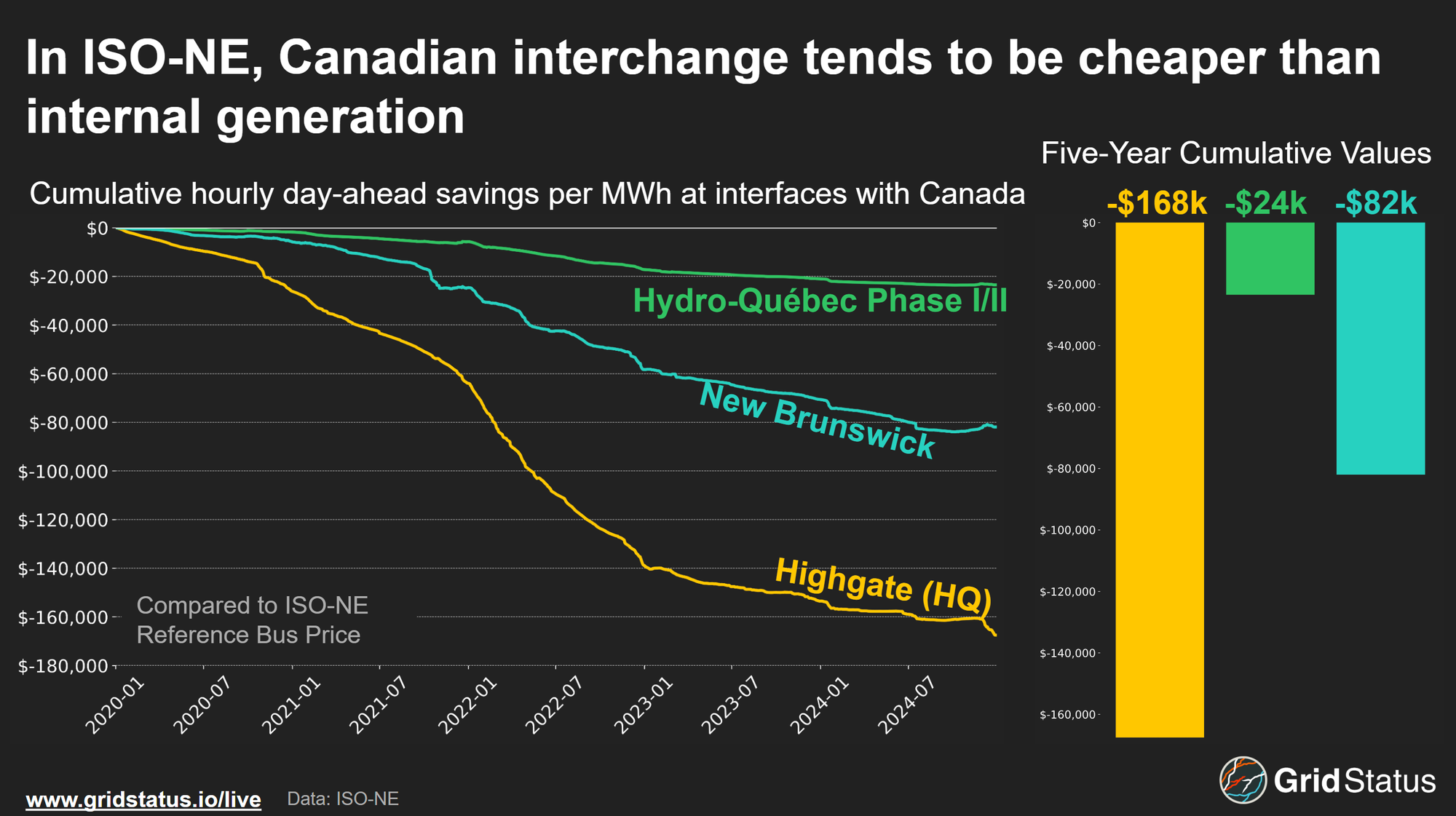

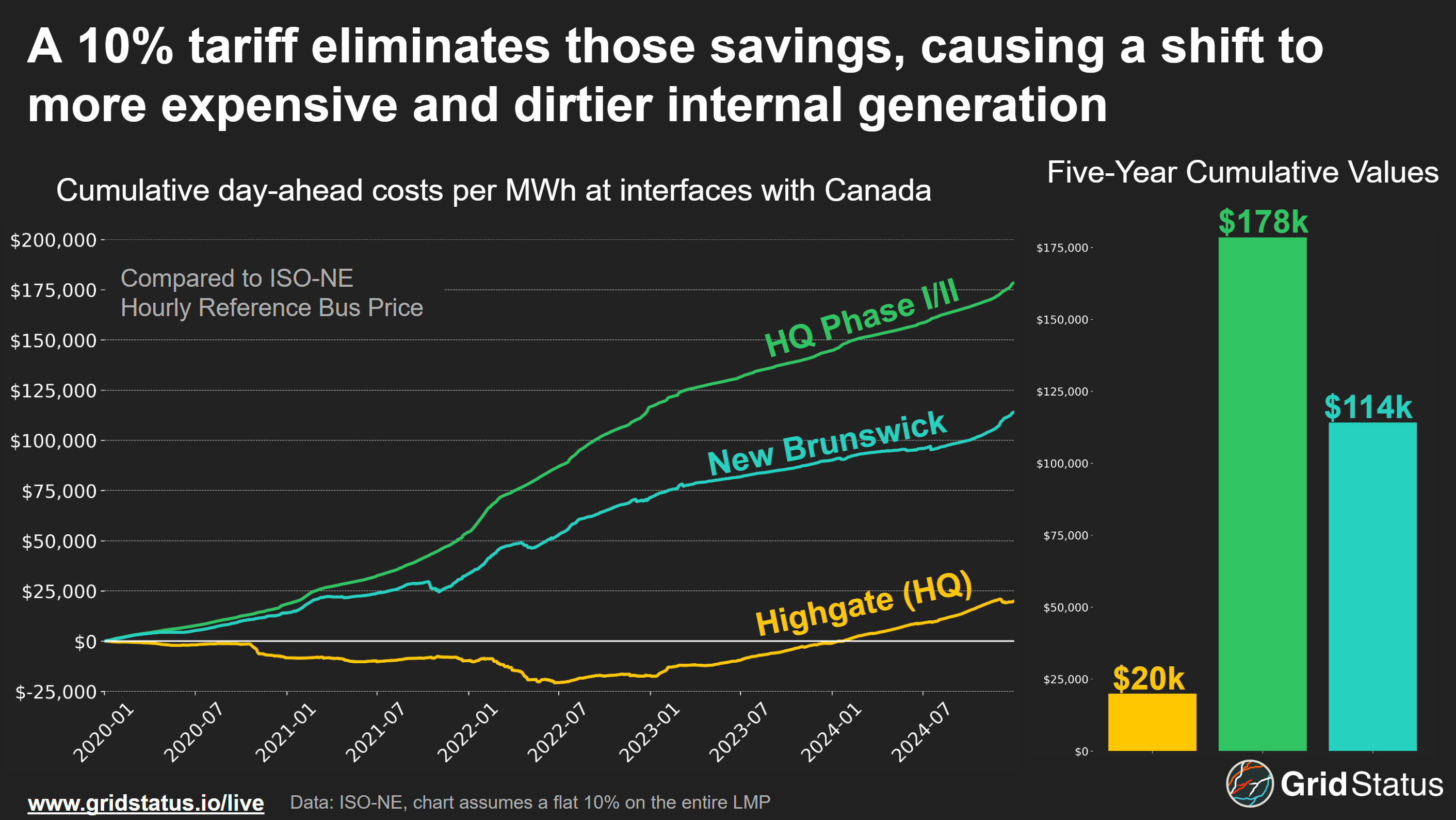

Over the last 5 years, the day-ahead prices at each point of international interchange for ISO-NE have been cheaper than the system's reference bus. Total cost savings from actual flows are much higher, but this representation shows the possible savings associated with the persistent basis between reference and imports.

Just a 10% tariff eliminates that value. Now, Canadian hydropower would often be more expensive than generation in New England, with all three locations shifting to costs as opposed to savings by the end of the five year period.

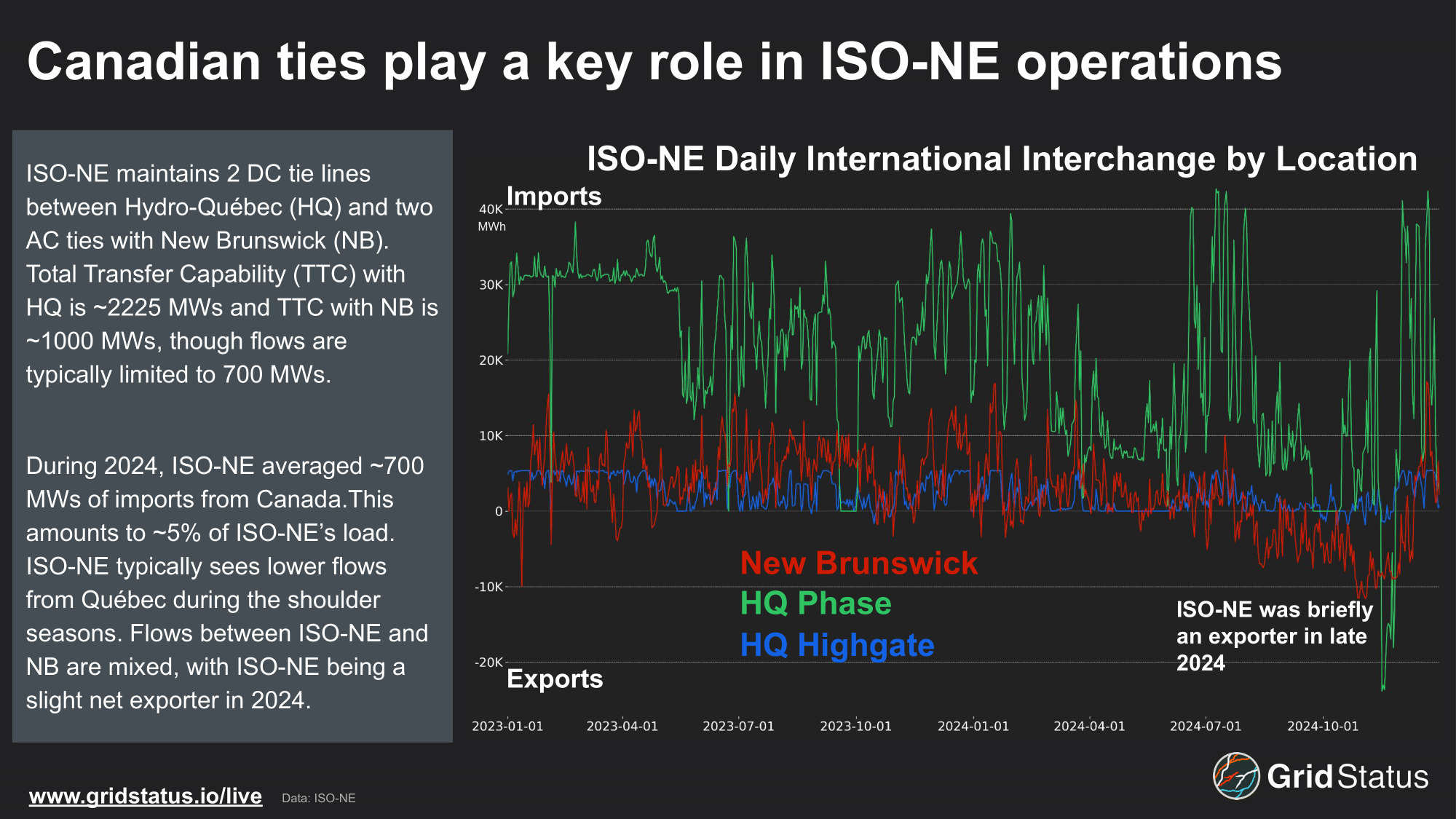

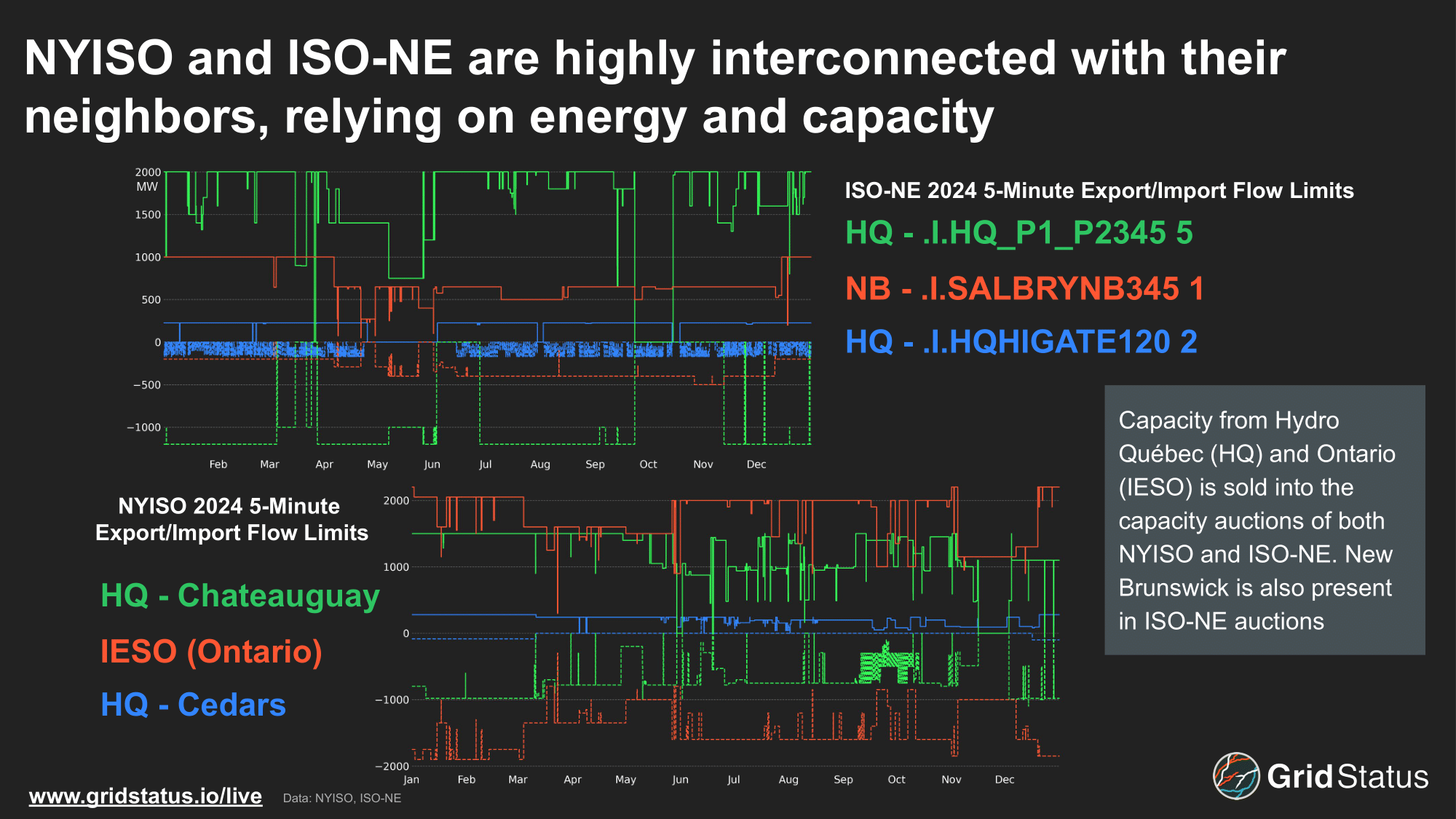

Imports, specifically hydroelectric ties, have long been a foundation of New York and New England’s decarbonization goals. Both regions already have extensive ties with Canada and are actively expanding them. ISO-NE has a total transfer capability (TTC) of ~3,225 MW with Canada, split between two DC ties with Hydro Québec (HQ) and 2 AC ties with New Brunswick (NB). In 2024, net flows from Canada made up ~5% of ISO-NE’s load.

The TTC for these lines is not static, but actively managed with coordination from entities on either side. In fact, equipment on the export side of the interface may not be able to handle the same level of flows as the import. This requires different limits for each side of the interchange equation and leans on the decades of cooperation between grid operators on both sides.

Projects are also underway in both markets to increase TTC with HQ. The New England Clean Energy Connect is currently under construction, adding another 1200 MW DC connection between ISO-NE and HQ. This project has long been subject to legal challenges, as Maine has attempted to revoke permitting for the transmission line, going so far as to put the project’s permitting on the ballot. While the measure passed by a healthy margin, it was later overturned in the courts, and the project is still expected to be completed in 2026, though much delayed.

NYISO is following suit with the Champlain Hudson Power Express (CHPE) project. CHPE is a 1250 MW DC transmission line under construction to bring hydroelectric power directly from Québec into NYC with an anticipated in-service date in 2026 as well. Next year, these two projects are set to increase ties between HQ and the wider Northeast by more than 36%.

New York ISO

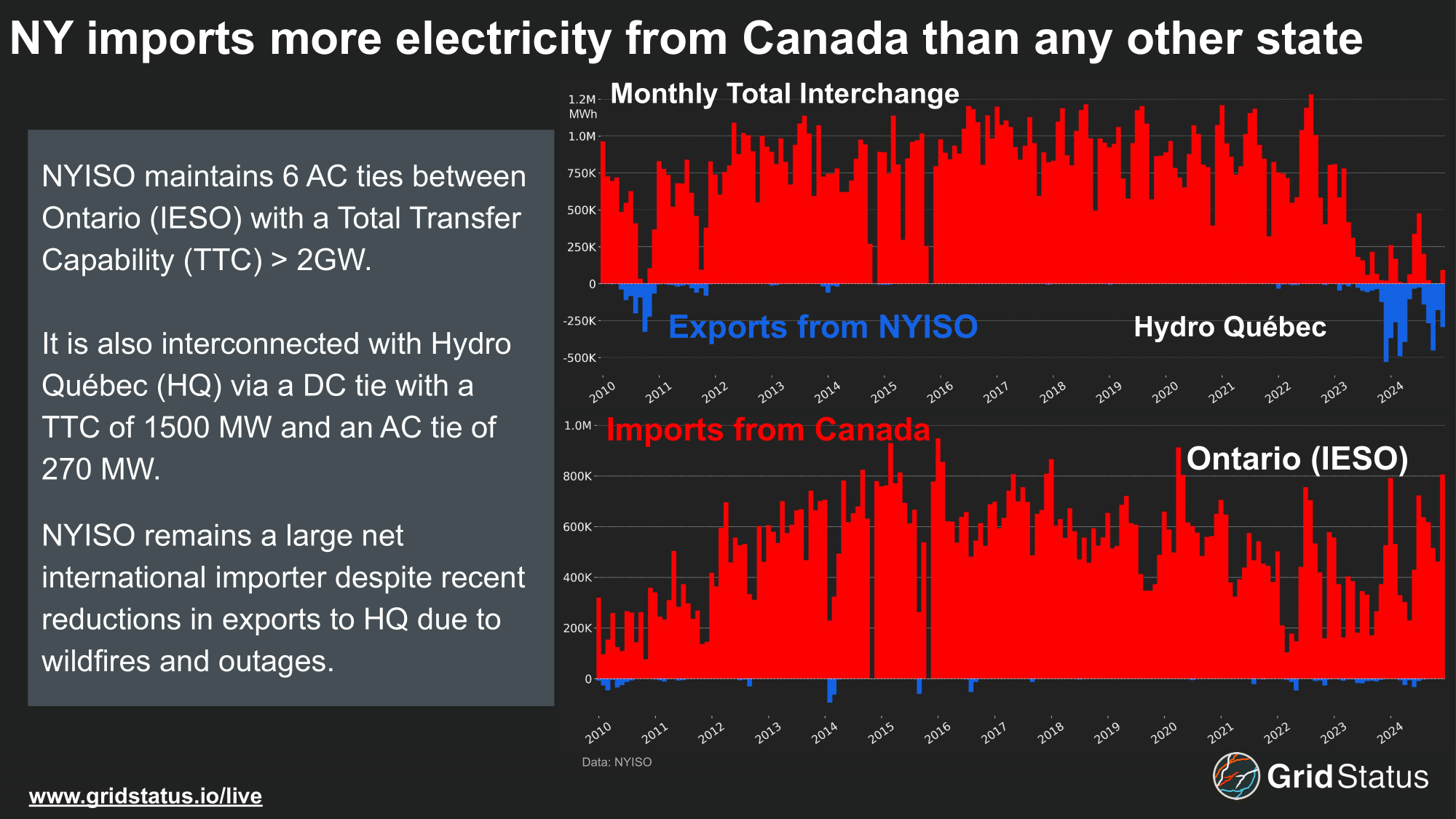

Well-connected to both Ontario and Québec, New York is able to draw on excess generation in both regions for much of each year, and imports more power from Canada than any other state. NYISO has been a net exporter of power to HQ since 2023, driven by a combination of wildfires, drought, and internal outages, although this is unlikely to continue. Notably Ontario (IESO) made up the bulk of the 7.7 TWhs of power imported by New York in 2024.

IESO’s outsized role in NYISO increases the consequences of retaliatory tariffs from Ontario’s provincial government. Ontario Premier Doug Ford has taken a hardline stance against American tariffs, implementing a 25% export tariff on all power out of the province and has reiterated on his threat to cut off all electrical exports from the province, threatening to do so if US tariffs are increased on April 2nd. The impact of these actions will extend beyond New York as IESO has ties with both Michigan and Minnesota as well.

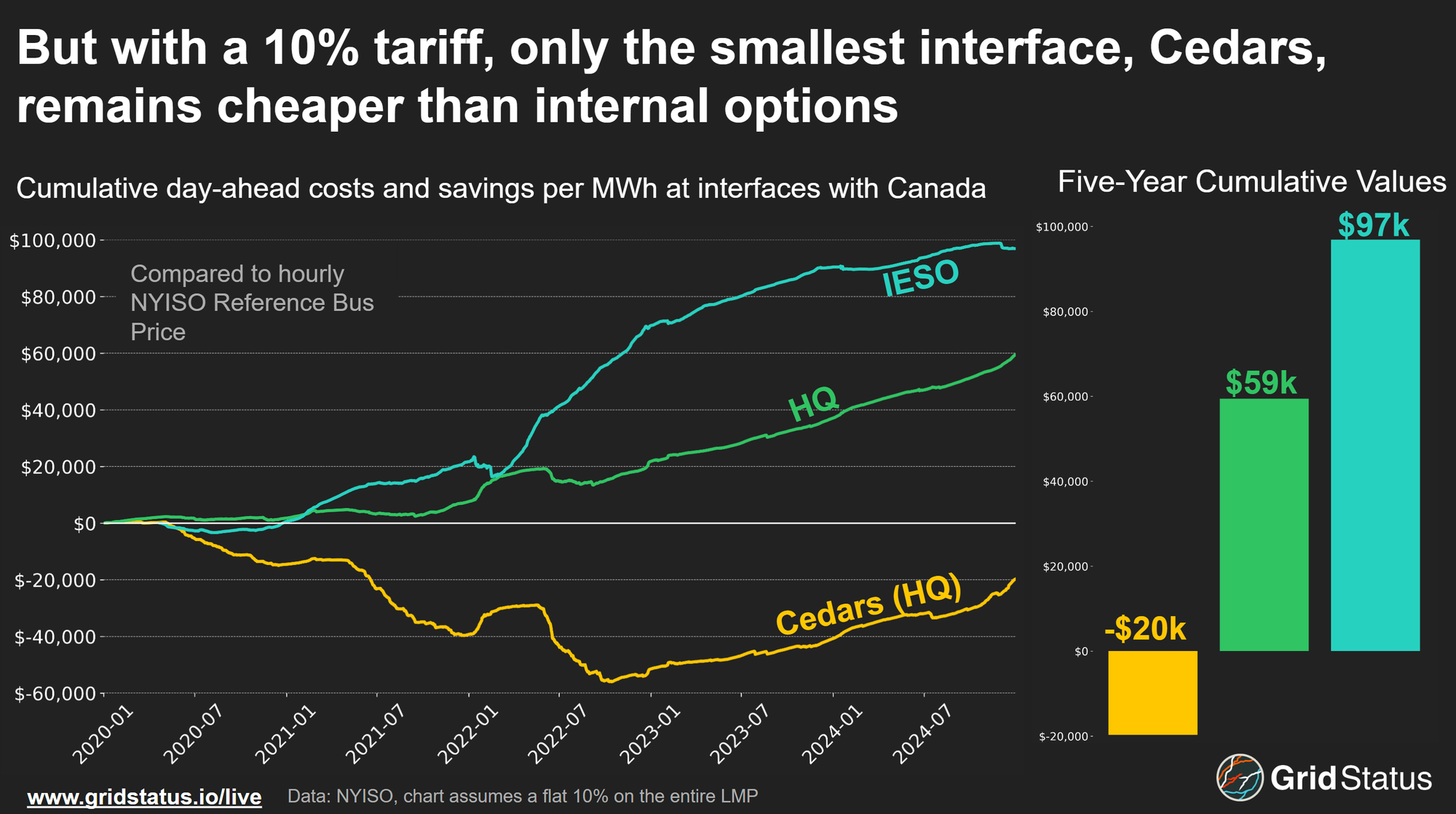

With a 10% tariff applied, NYISO also sees the cost savings of imports all but eliminated. These transactions no longer being economic would likely lead to increased gas burn and drive higher system prices.

Cedars is the only interface that maintains a cumulative savings over the five years, but is also the smallest interface by far, limiting its impact.

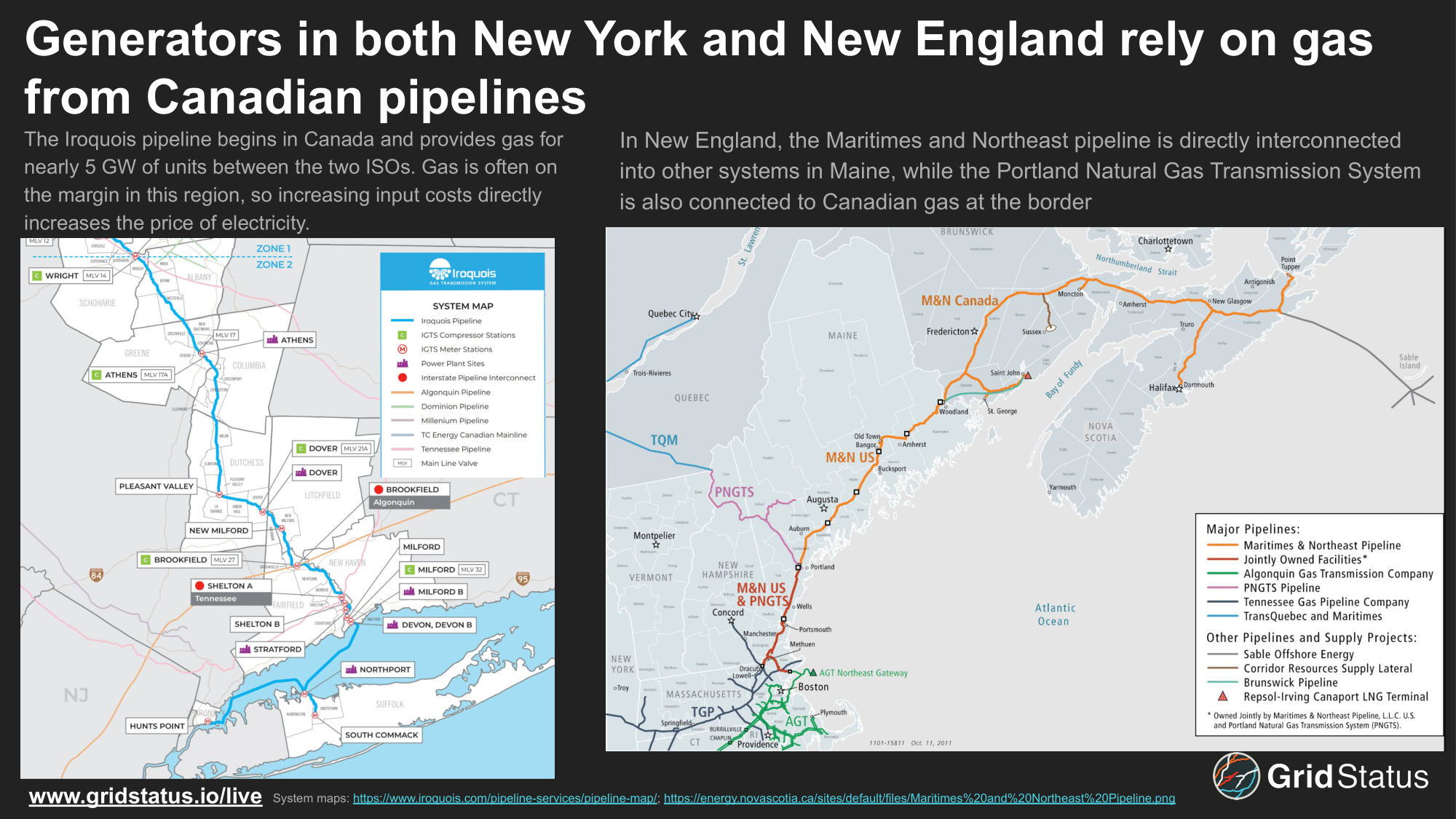

Physical power flows are not the only form of Canadian energy being subjected to tariffs. The US is a net importer of fossil fuels from Canada. Price increases will affect residential consumers directly as well as impact generators. Several East Coast pipelines begin in Canada and will now be subjected to a 10% tariff. One of these pipelines, Iroquois, supplies ~5 GW of gas fired units in both NYISO and ISO-NE.

Gas is often the marginal unit in both markets, meaning an increase in input costs puts upwards pressure on system energy prices. For example, Cricket Valley in New York sources gas from Iroquois.

A History of Cooperation

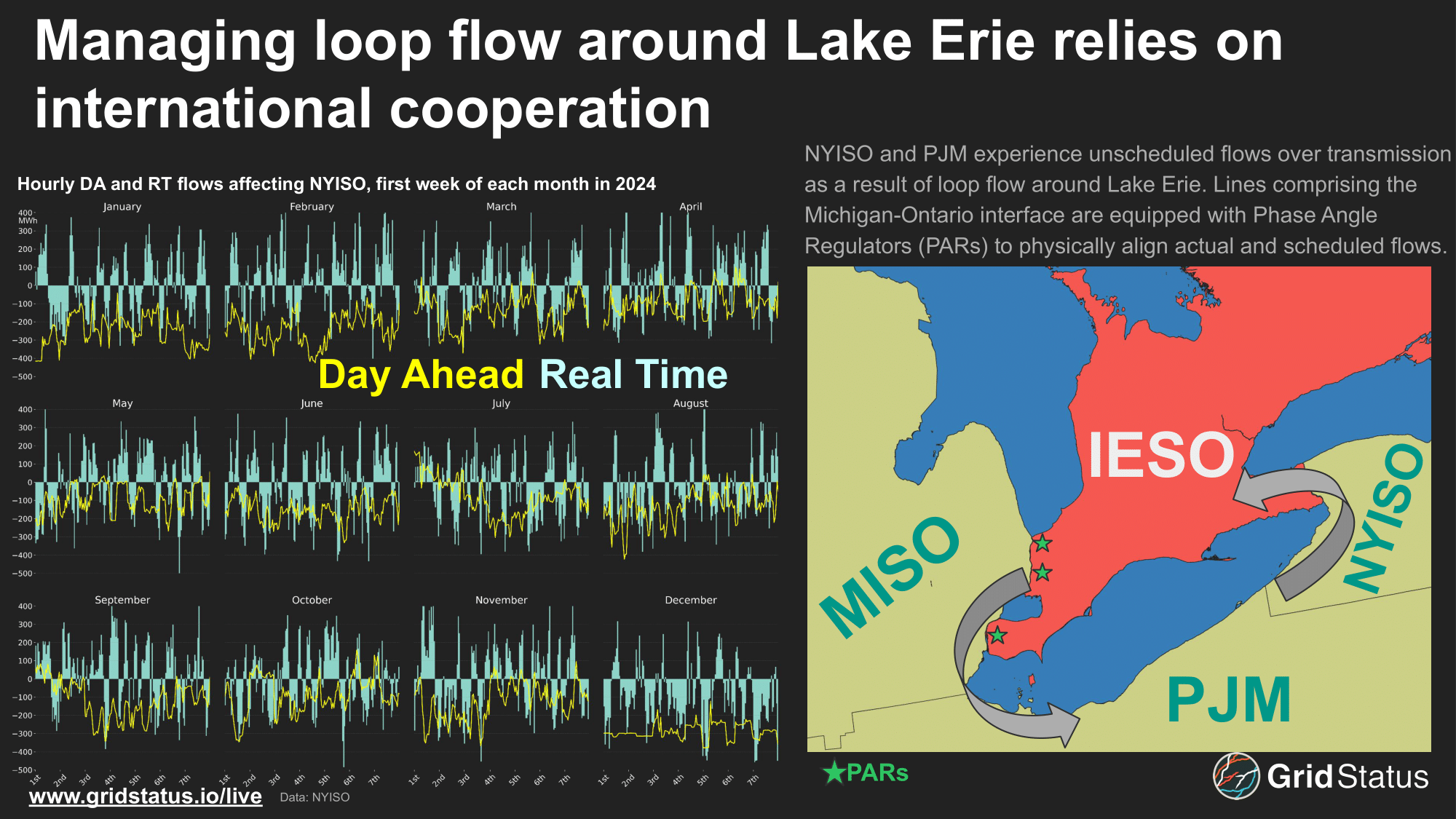

IESO plays an important role in managing the flow of power around Lake Erie, which affects both NYISO and PJM as a result of operations at their border with MISO. As a general rule, power flows along the path of least resistance, and that topology doesn’t respect administrative boundaries on its own. Power flows circulate around Lake Erie, flowing between Ontario, through Michigan, through Ohio and Pennsylvania in PJM, then into New York and back into Ontario.

These regions maintain high levels of collaboration to manage the complex flow of power over this area. We won’t go too deep into loop flow here, but it is important to know that specialized pieces of grid equipment that can direct flows between lines (phase angle regulators) are utilized to manage flows on the MISO-Ontario interface at the Michigan border.

Before these PARs went into effect, NYISO ratepayers were often on the hook for large costs as these unscheduled flows led to congestion and out-of-market actions from operators to manage the grid in western New York.

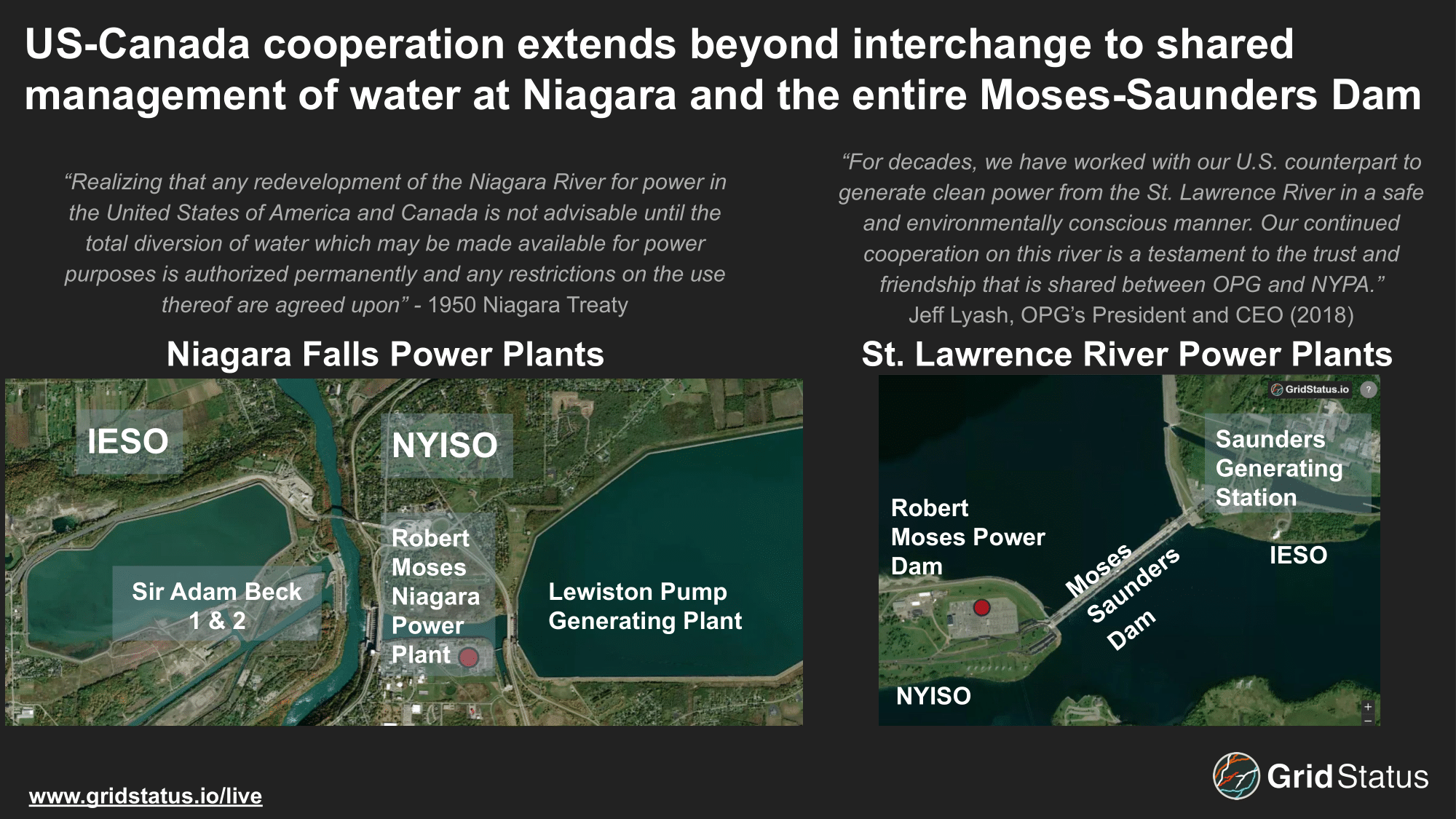

Power market cooperation between the United States and Canada is not only limited to tie flows. The two countries share a long history of collaboration and management along the St Lawrence River and at Niagara Falls. Both utilize the vast hydro potential of the Niagara region, and under the 1950 Niagara Treaty, the nations collaboratively manage the flow of water to balance power generation and the iconic experience of Niagara Falls itself.

The two nations go even further in their cooperation at the Moses-Saunders dam. This facility stretches across the US-Canada border and is managed jointly by both countries as both IESO and NYISO have hydroelectric facilities on both sides of the dam.

Conclusion

With the second tariff deadline pending, ISO-NE and NYISO made exigent circumstances filings with FERC at the end of last week. These filings seek to clarify if electricity is subject to tariffs under the Presidential Executive Order as well as the immediate approval of tariff changes designed to allow the ISOs to begin collecting import tariffs. Without these changes, the ISOs could face insolvency - forced to pay with no mechanism to allocate costs and no retroactive ratemaking. These filings capped more than a month of confusion and uncertainty as potentially debilitating tariffs loomed over decades of mutually beneficial grid operations.

Uncertainty has extended beyond implementation to what should be simple facts of the matter, such as the actual rate, which unlike other goods was unclear for electricity and could have been 25% or the lower 10% applied to Canadian oil and gas. Late in the first day of tariff implementation, Howard Lutnick, the US Commerce Secretary said that the Trump Administration may compromise with Canada by the following morning.

Imprecise regulations and erratic policy are challenging for any industry, but anathema for the grid. ISO/RTOs, IPPs, and traders managing international power flows without clear guidance from FERC, Commerce, or the White House is a recipe for widespread uncertainty and inefficient outcomes.

Please reach out at contact@gridstatus.io if you want early access or have any suggestions on the types of research or content you'd like to see.