West Texas and Northern Virginia, Harbingers of Load Growth

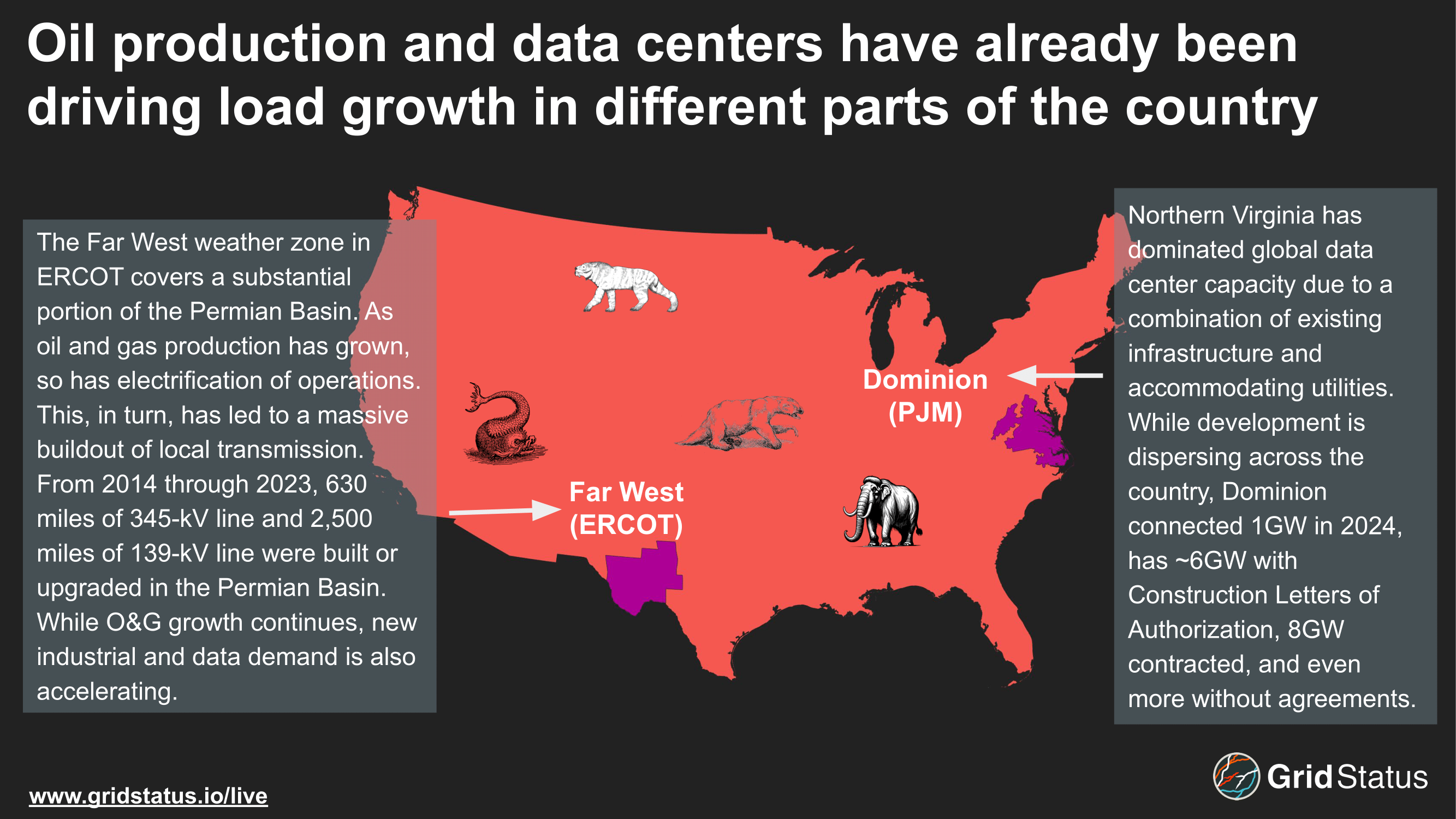

Prior to the current datacenter demand explosion, far west Texas in ERCOT and Dominion in PJM were already experiencing significant demand growth.

While much of the country had been in the wilderness of steady or declining demand, far west Texas in ERCOT and Dominion in PJM were experiencing significant demand growth even prior to the current interest in datacenter development.

Northern Virginia has been the epicenter of global computing capacity for years, while growth in extraction and electrification in west Texas was lifting demand before Bitcoin mining was expelled from China.

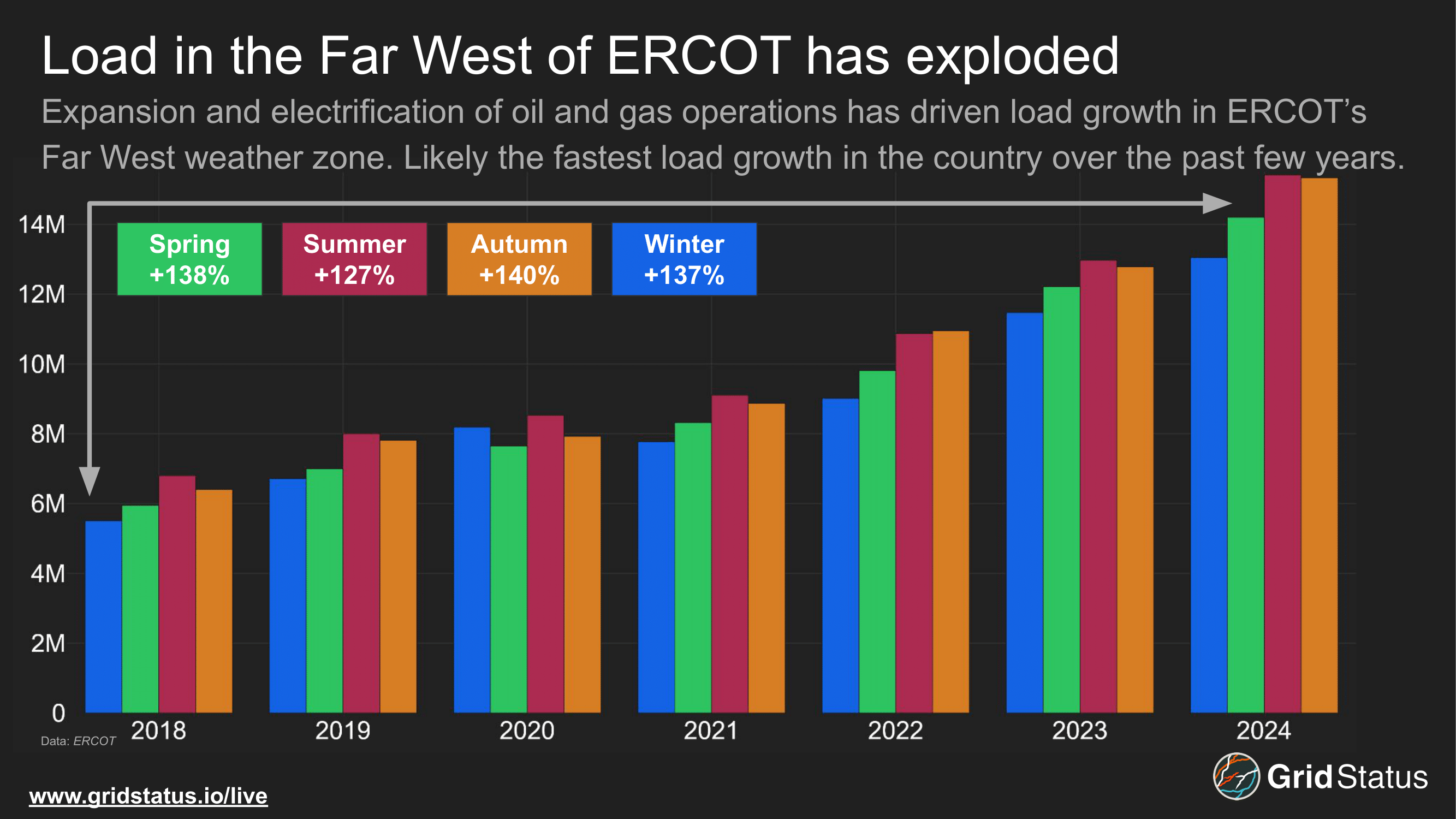

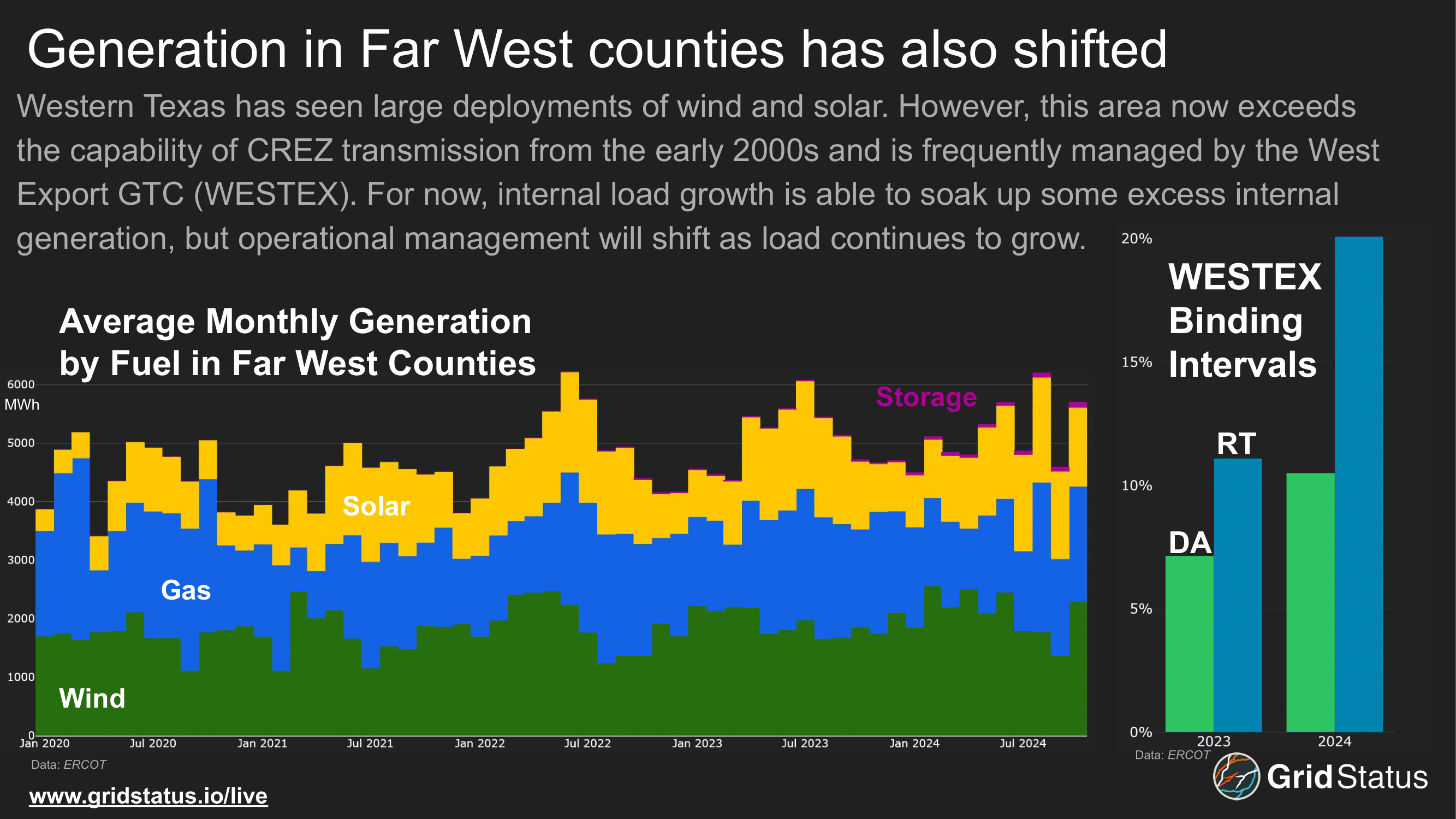

West Texas likely experienced the highest demand growth over the largest area in the US over the last decade, more than doubling typical demand across all seasons. This all-season increase is even more clear when examining month-hour profiles.

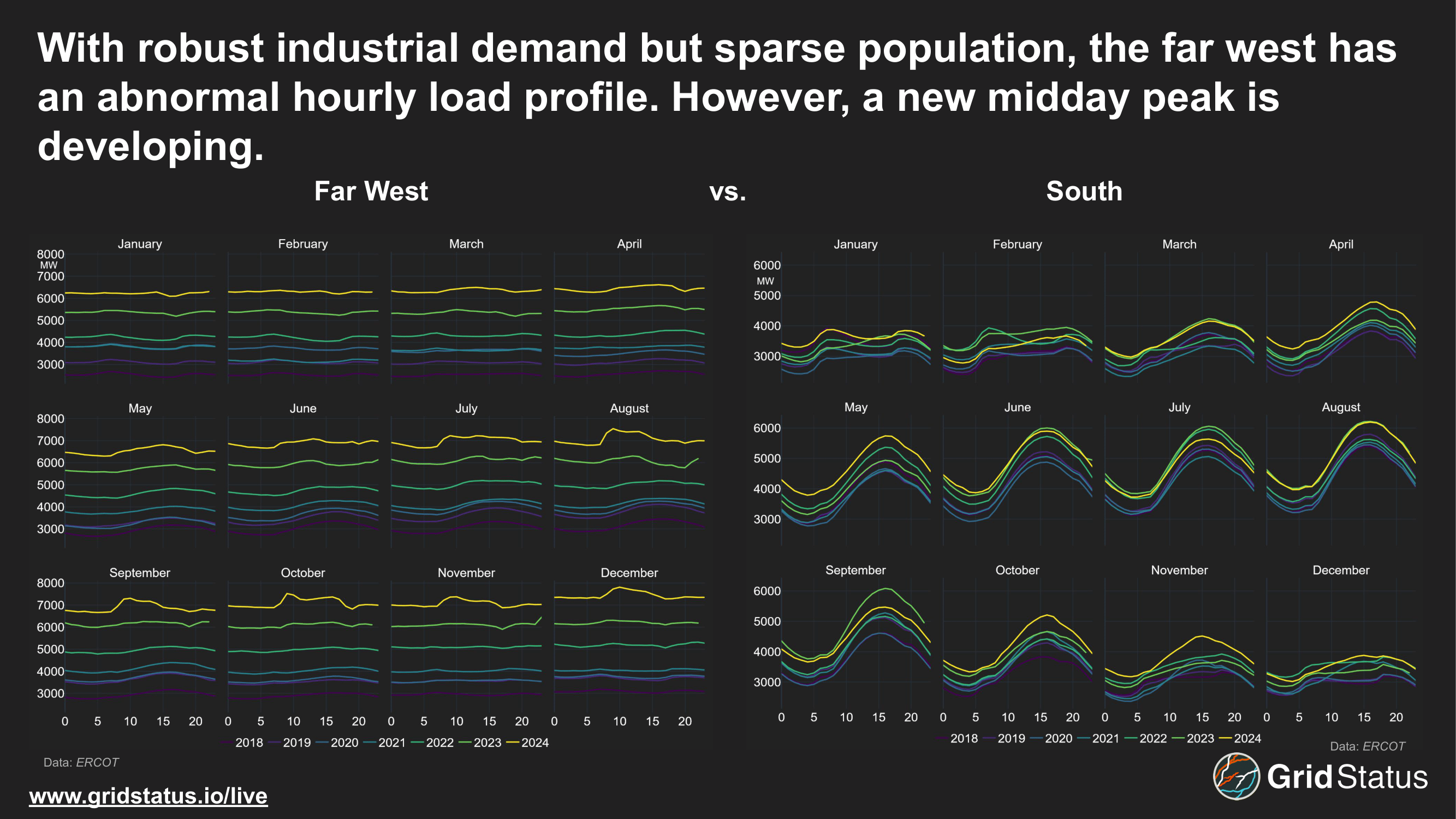

Unlike most regions, the hourly load profile in west Texas has been nearly flat, without the peaks and valleys associated with the circadian rhythm of residential and commercial demand. Contrast this with the South weather zone, which has clear early morning troughs into high demand in the late afternoon and early evening — aligned with AC demand and the heat of the day.

However, in the back half of 2024 a new pattern began to appear.

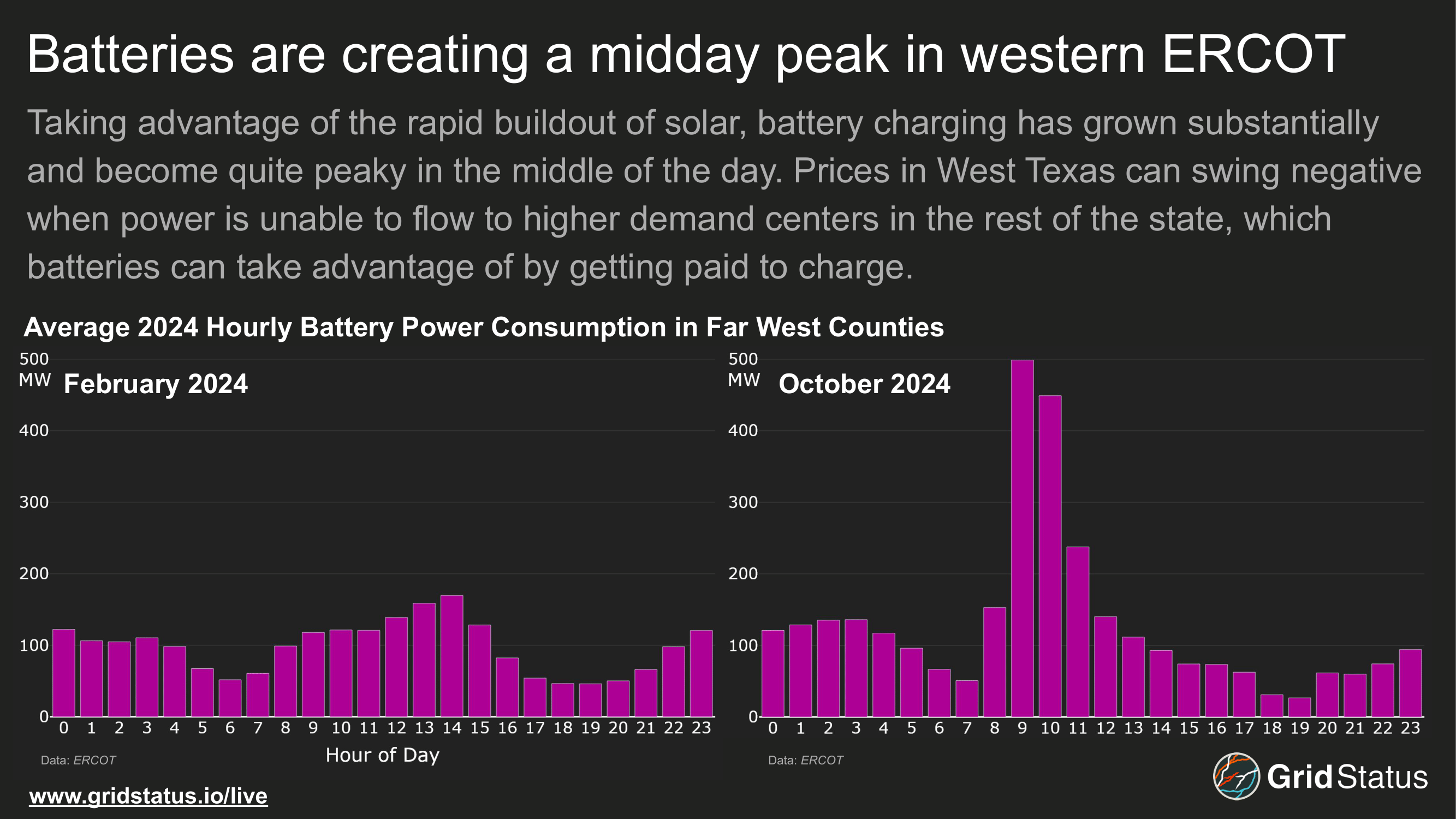

By the end of 2024, midday battery charging in far west Texas had grown by several hundred MWs on average. This new demand appears to be contributing to swelling midday load. We often think about batteries shifting demand around - flattening the curve - but in a region with a flat load profile and prolific wholesale renewable generation, but essentially no behind-the-meter offset, the duck curve transforms into a armadillo bump.

The growth of renewables in west Texas encouraged batteries through the lure of cheap-to-negative midday prices for charging and the possibility of congestion-driven revenues in certain pockets. However, the region as a whole has been increasingly constrained from exporting, reducing the hours of profitable discharge. With its rapid transmission buildout, this area is an excellent example of the value in a strong analytical team, finding durable value for a battery is tough when the topological situation is changing so rapidly.

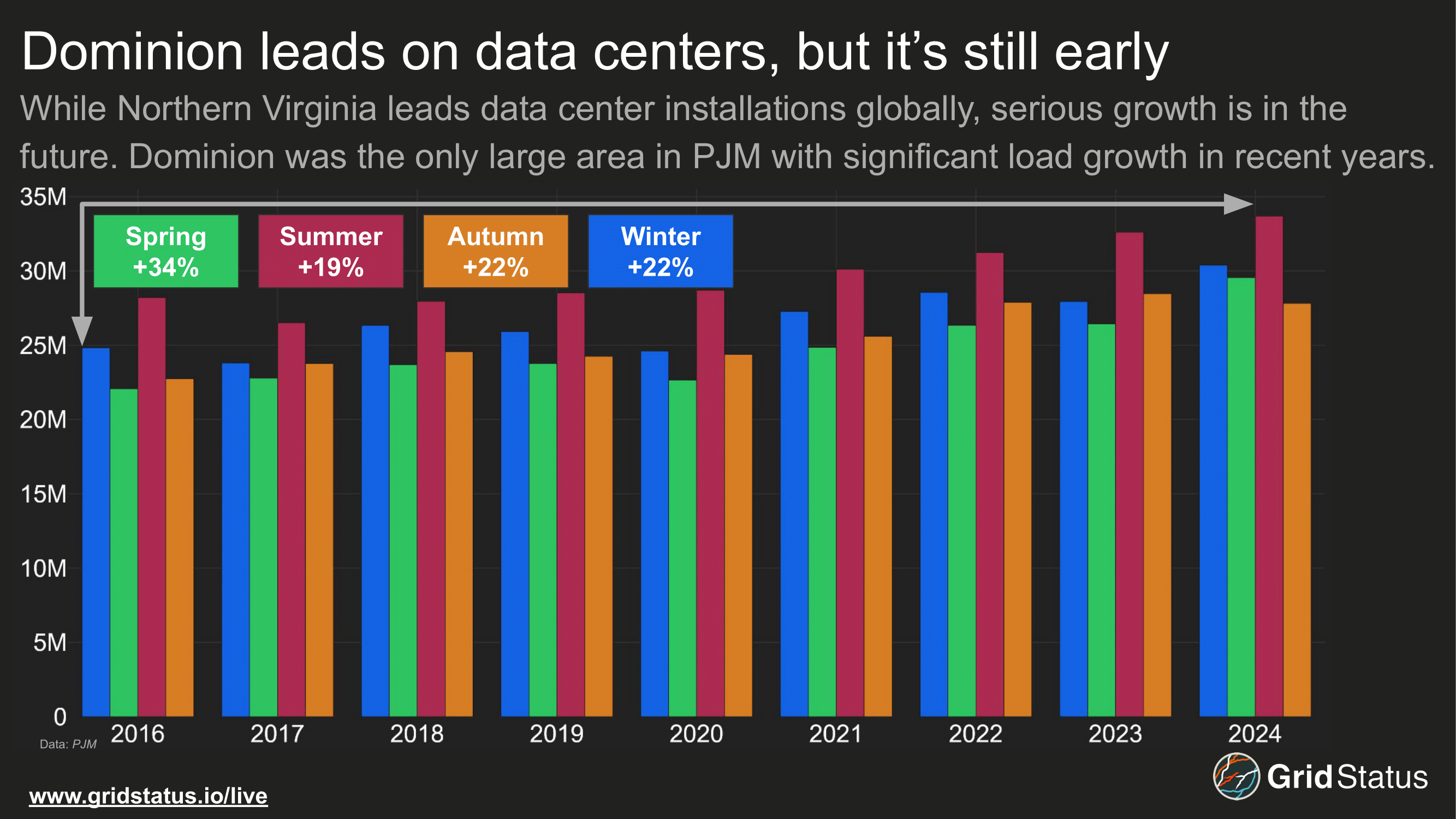

Northern Virginia has been the global capital of datacenters for years. AWS' first region, AWS-East, was (and remains) physically located in and around Ashburn, 20 miles west of Washington, D.C. While growth has not been as eyepopping as in west Texas, Dominion's backdrop of PJM was in steady or declining demand overall.

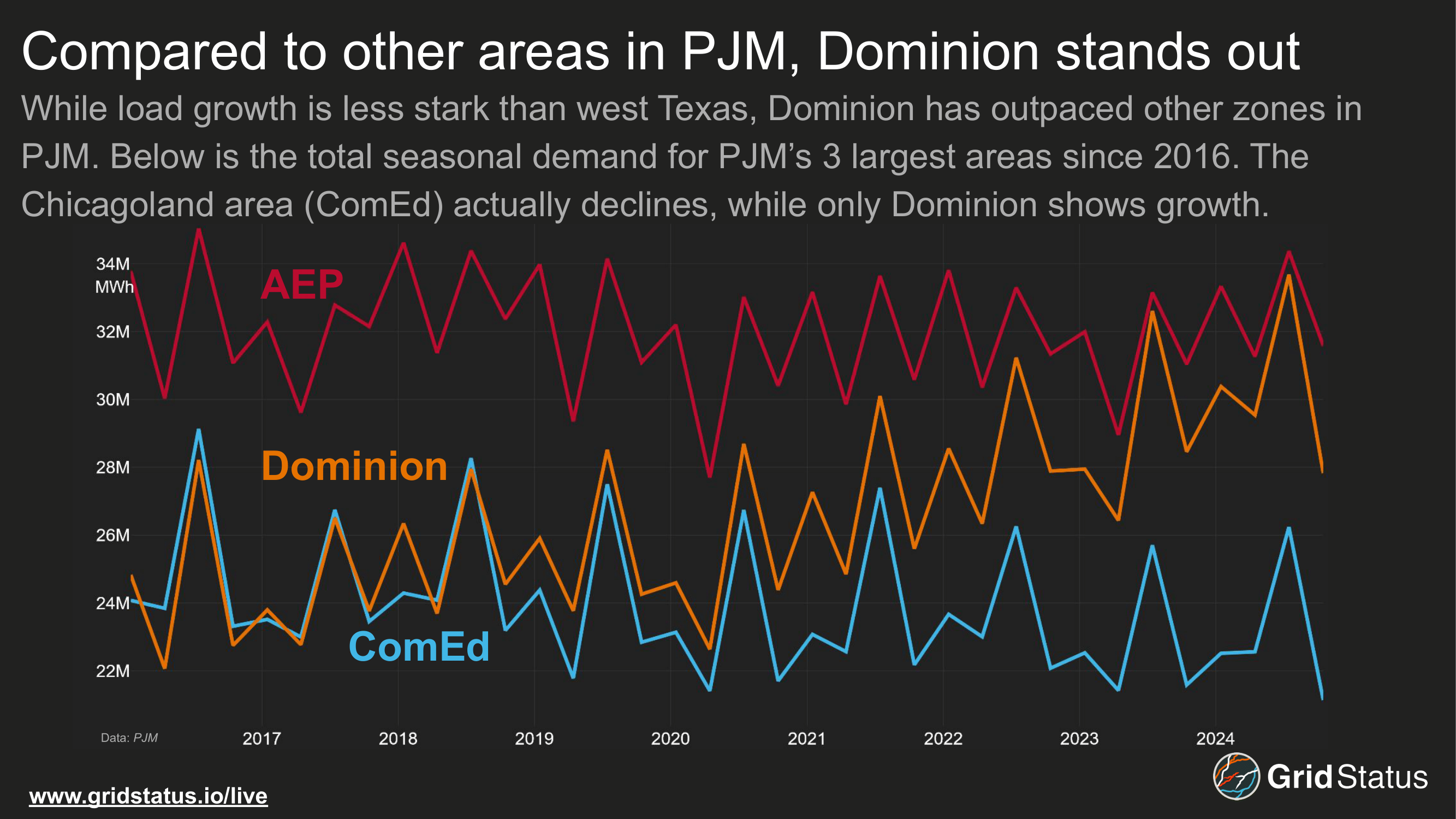

Compared to the other large areas in PJM, Dominion's growth is stark. While Chicagoland's demand (ComEd) has declined, Dominion grew to challenge AEP, the highest demand zone in PJM. Today, Dominion's peaks can regularly outstrip coincidental demand in AEP. However, this growth has come with an increased reliance on generation outside of Virginia.

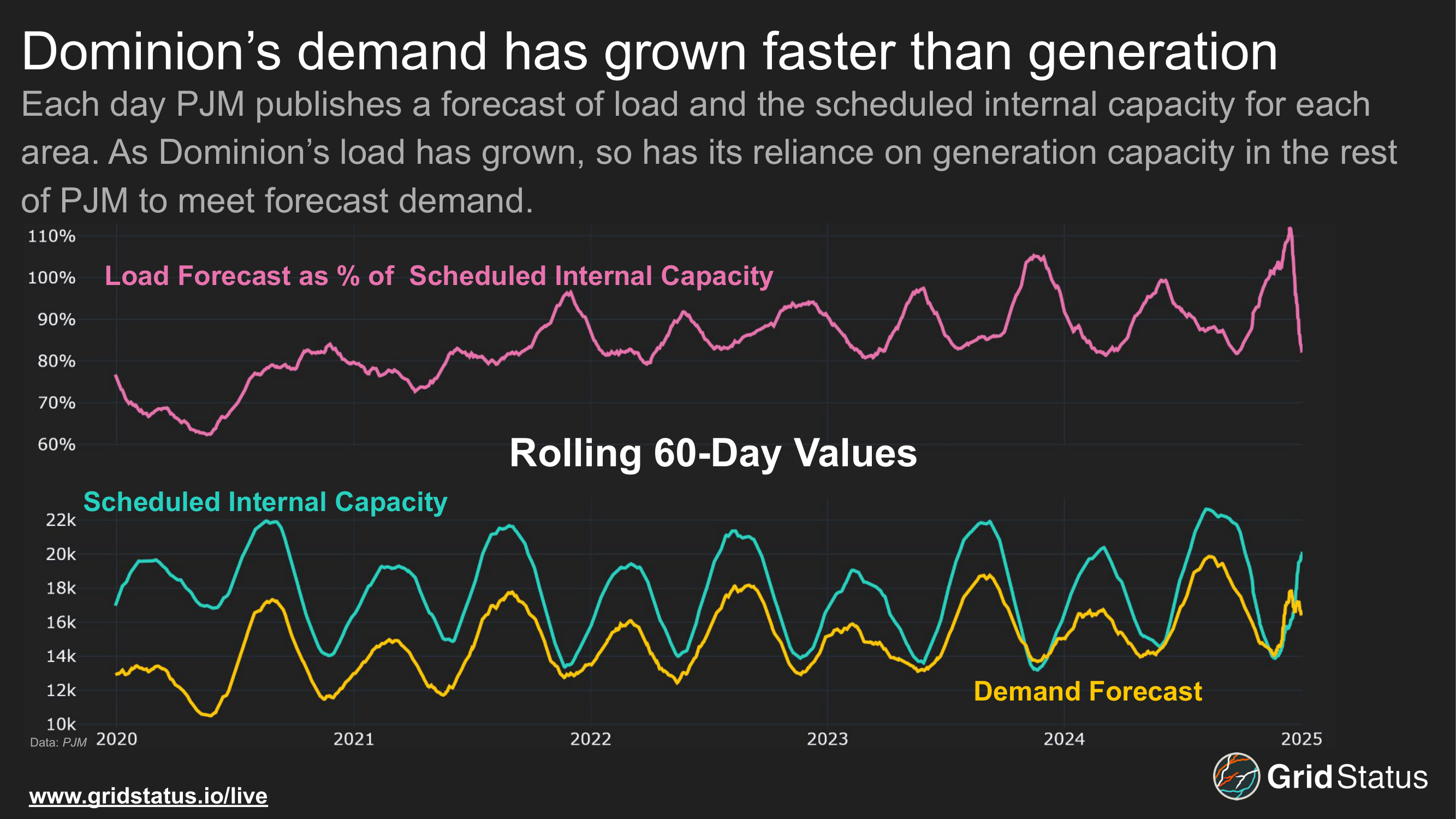

While Dominion is part of a much larger market, local generation does matter to better manage local constraints and plays a role in resource adequacy planning. In the last year, Dominion's load forecast has begun to exceed internal scheduled capacity. This is just a day-ahead schedule and forecast, in total Dominion already relies on external generation to close an internal capacity gap. This was also a key point in Dominion's IRP, in which they were only able to serve ~85% of expected demand with internal capacity for most forward years.

With datacenter development spreading across the country, new hot spots are likely to develop, while existing demand centers will grow and expand, such as Permian basin electrification expanding in to the SPP portion of New Mexico. Track these developments and more with Grid Status.