Winter is Here, its Risks are Growing

As the first major winter storms of 2025 unfold, the unique risks of winter weather on the grid are coming into focus. Let’s explore winter's impact on the grid and how regions are adapting to these evolving challenges.

Through the first week of January 2025, a significant portion of the country has already experienced its largest winter event in years. By mid-January, this area is anticipated to expand — mostly into the southern United States, where winter weather can present a particularly high risk.

To track forecasted conditions and ongoing outcomes throughout the winter, you can use our Winter Hazards, Outlook, and Operations dashboard for free. We'll also be posting short snippets on social media as events unfold, like the congestion impacts of PJM's AP South interface as the first winter storm settled in over the Mid-Atlantic.

In this post, we review some of the reasons why winter is different from summer, what the outlook and history is for market-regions, as well as the role NERC plays in grid planning and risk forecasting.

Jump to section:

Why is winter unique for the grid?

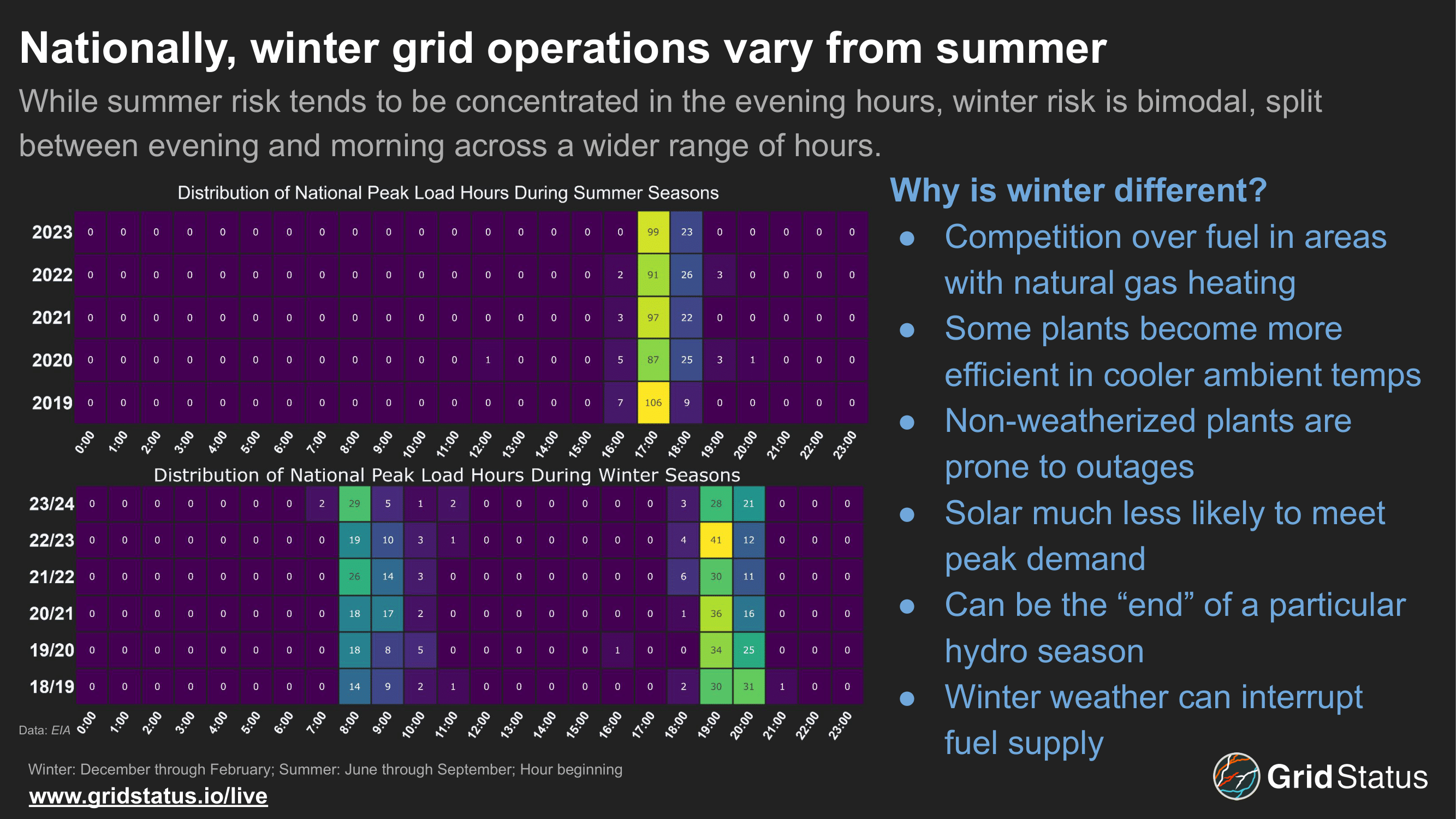

Summer risk is concentrated in the evening, before the sun sets, but when cooling load is distributed across a wider array of locations: commercial spaces, offices, residential, and more. Traditionally, grid planning in the United States has centered around summer demand peaks and their associated risks as they were generally also the annual peak.

Quebec has been the largest North American outlier. A nearly complete reliance on hydropower has led to electric heating as the dominant residential technology. Cheap rates in turn have done little to incentivize a shift towards heat pumps, so most households rely on more energy intensive technologies. Together with the climate, these factors make Quebec a winter peaking region.

Improbable as it sounds, the American South in particular could gain from Quebec's experience. As another region with high rates of electric heating following government-led industrialization, there are likely useful lessons in Quebec's management of tricky winter peaks.

Markets Breakdown

ERCOT

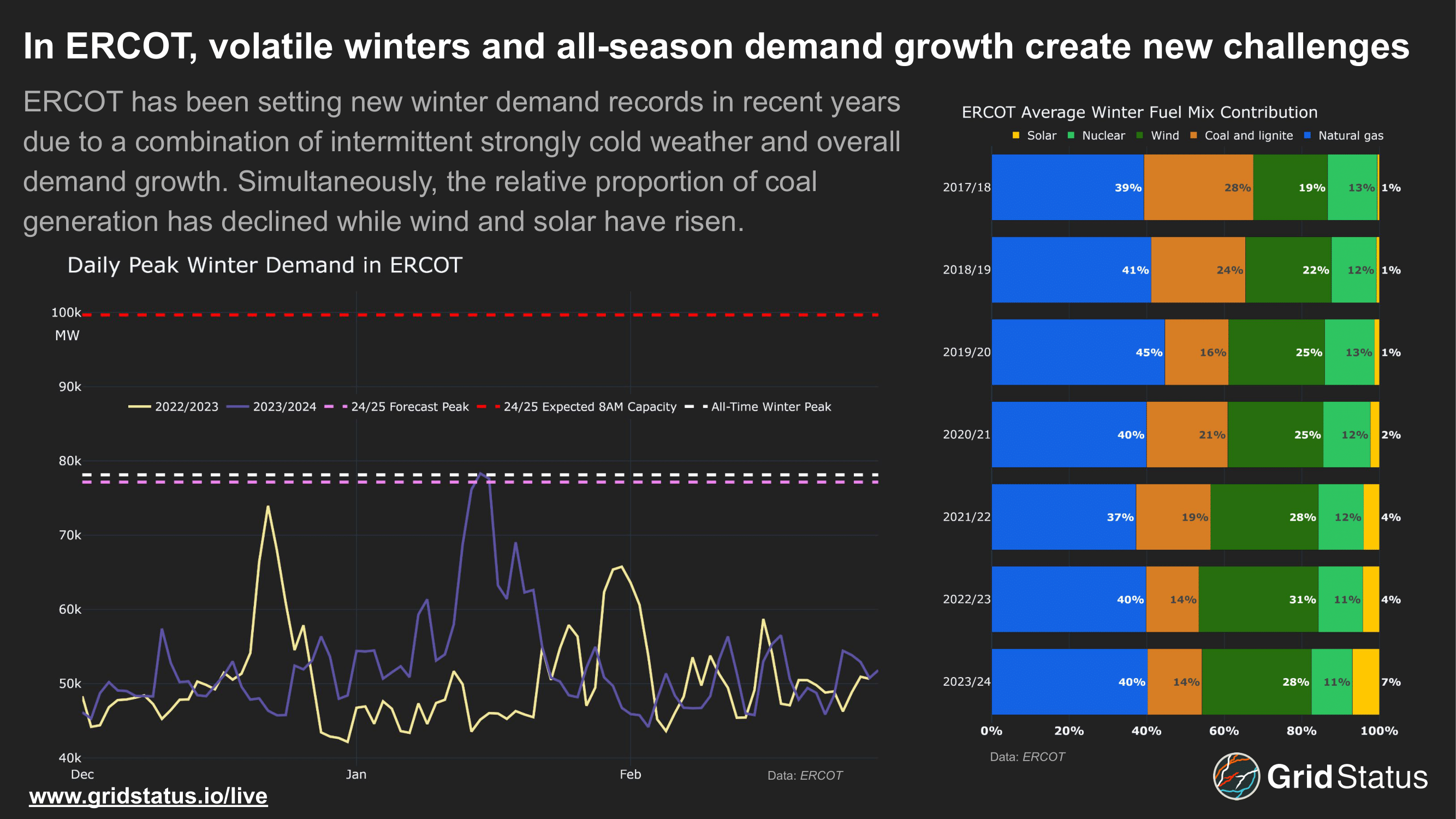

Everyone knows what happened in Texas in 2021. What people may not realize is that recent winters in ERCOT have now handily beaten even calculations of likely demand (considering load shedding) during Uri. While the relentless expansion of the state's resource base has surely been a boon to winter resource availability, questions remain on the ultimate outcome of weatherization initiatives.

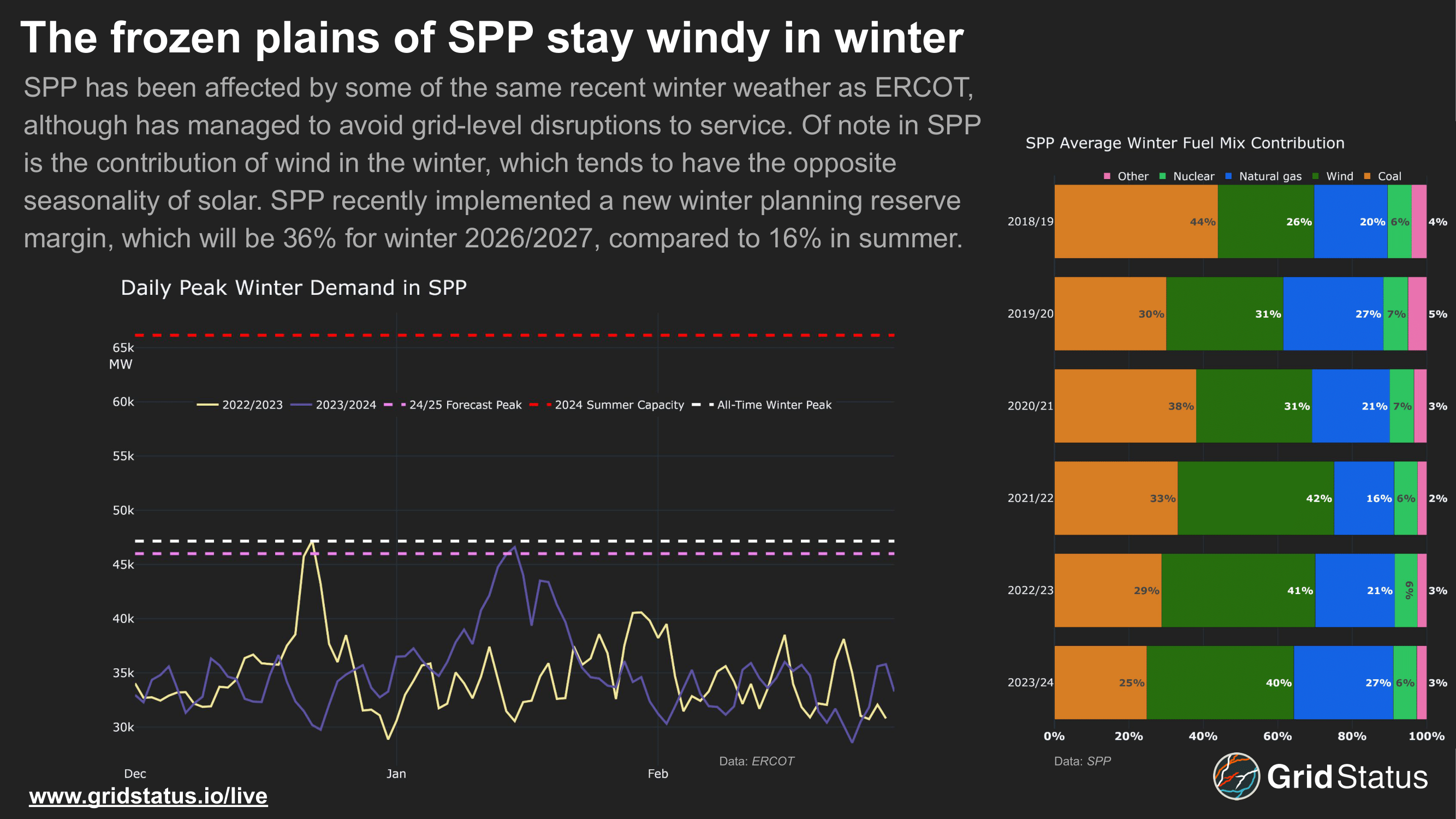

SPP

Over the last 6 years, coal's share of winter generation in SPP has declined while wind's has risen. Like ERCOT, seasonal peaks have occurred in recent years, while the current capacity outlook provides plenty of headroom. However, concerns do exist with respect to winter resource adequacy. This manifested in recent changes to SPP's requirements, including the implementation of a winter planning reserve margin (PRM).

This was the second attempt by SPP to have FERC approve a winter requirement. The original order was remanded back to SPP in order to address the lack of availability requirements for resources claiming winter availability. Given recent winter demand and an expectation of continued growth (between SPP and its Load Responsible Entities (LREs)), the Winter Obligation became a Winter Resource Adequacy Requirement, including deficiency payments for non-compliance.

PJM

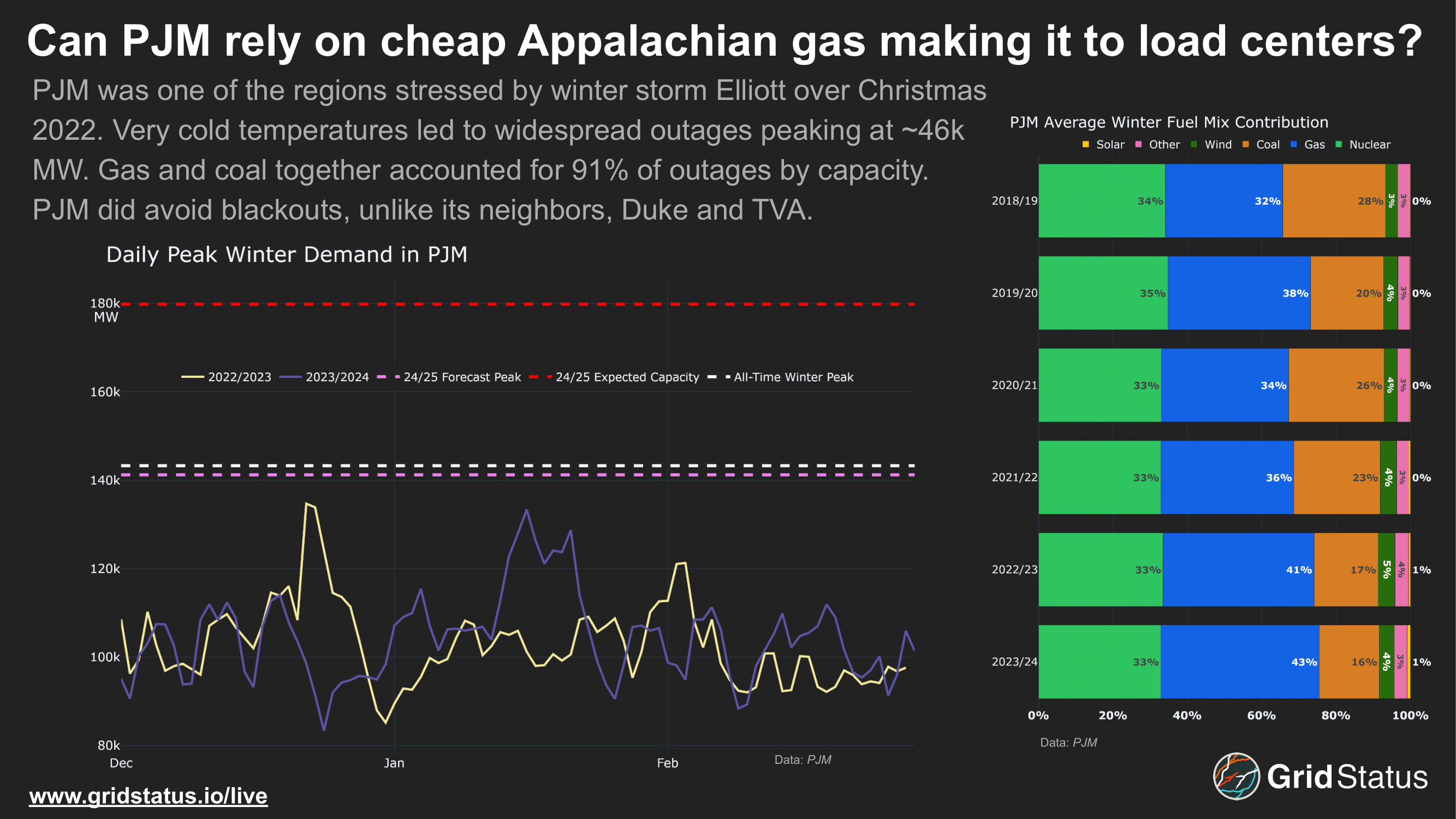

While winter peak demand in PJM remains in the past, recent years have been closer to their record than peak summer demand to its own. Changes in generating output have largely been confined to a war between gas and coal. With the tightening of environmental regulations in the densely populated PJM region and the massive expansion of gas supply out of Appalachia, coal has been disadvantaged while gas has gained ground on cost.

Winter storm Elliott was a particularly challenging setup for this mix, with most adjacent control areas struggling to serve demand while gas infrastructure also faltered. While TVA set a winter demand record (which was surpassed on January 17th, 2024) PJM peak demand did not crack its winter top ten list, and neither Duke Energy Carolinas or Progress set their own records. Despite this, both Duke and TVA were forced to shed load and PJM saw an average shortfall of more than 38GW in terms of resource performance over the event, but managed to avoid load shed itself.

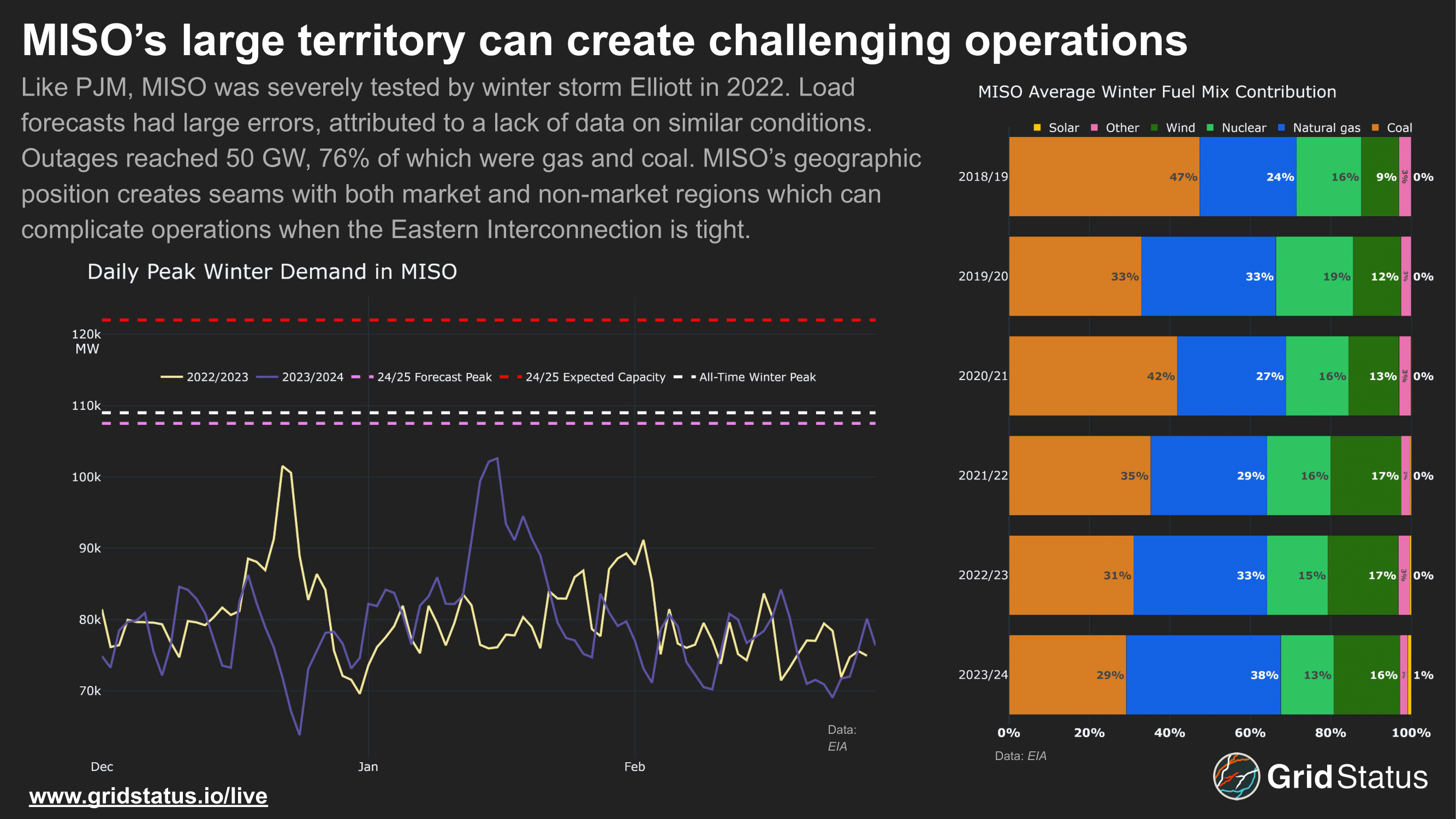

MISO

MISO's winter resource mix trajectory has been a combination of SPP and PJM, with both wind and gas generation rising and taking share from coal. Like PJM, MISO's peak demand days remain in the past, although load growth is also expected to change this over the coming years.

Within MISO's milieu of states exist some very ambitious plans with respect to emissions reduction and deployment of clean technologies as well as some on the opposite end of the spectrum, this makes the region one of the most fractious in terms of planning. Either way, substantial retirements are already occurring, and future reliability will hinge on the ability to interconnect new resources at a faster rate and execute on the recently approved $21.9 billion transmission plan. The 765kV backbone will also interconnect with PJM's system, strengthening regional ties.

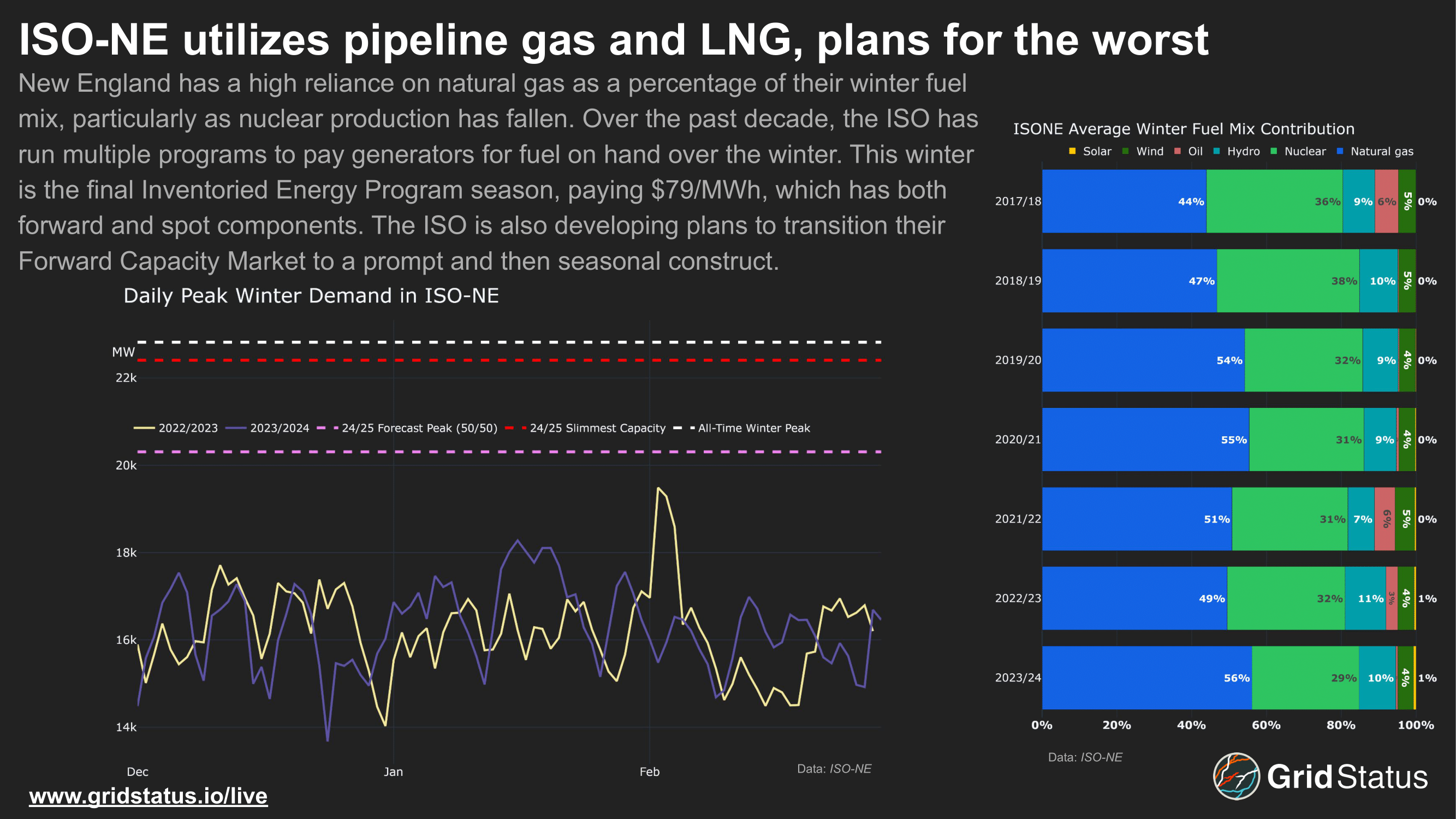

ISO-NE

ISO-NE has long been wary of winter. The region was winter peaking until 1989, and dual-peaking in the early 1990s. Given the longevity of folks involved in energy systems planning, some active today probably still remember those pre-ISO years.

With the retirement of some nuclear generation, the biggest change on the transmission side has been the expansion of gas. ISO-NE has built out a substantial amount of BTM solar, which is not included and contributes less during the winter with shorter days. The biggest resource change story in recent years is the final retirement of Mystic on May 31st of 2024 after remaining online under reliability contracts past its original date. Unlike other gas-fired units in ISO-NE, Mystic was supplied by the Everett LNG terminal. Adjacent to Mystic, its fate was a source of substantial uncertainty prior to the execution of long-term supply contracts with utilities in the region. Now, Everett will continue to operate through the 2029-2030 winter season.

A further oddity within New England's reliance on occasional LNG shipments is that despite the expansion of export capabilities elsewhere in the US, a lack of Jones Act compliant vessels prevents deliveries from, say, Texas. Instead, Trinidad and Tobago has long been the primary supplier of LNG at Everett.

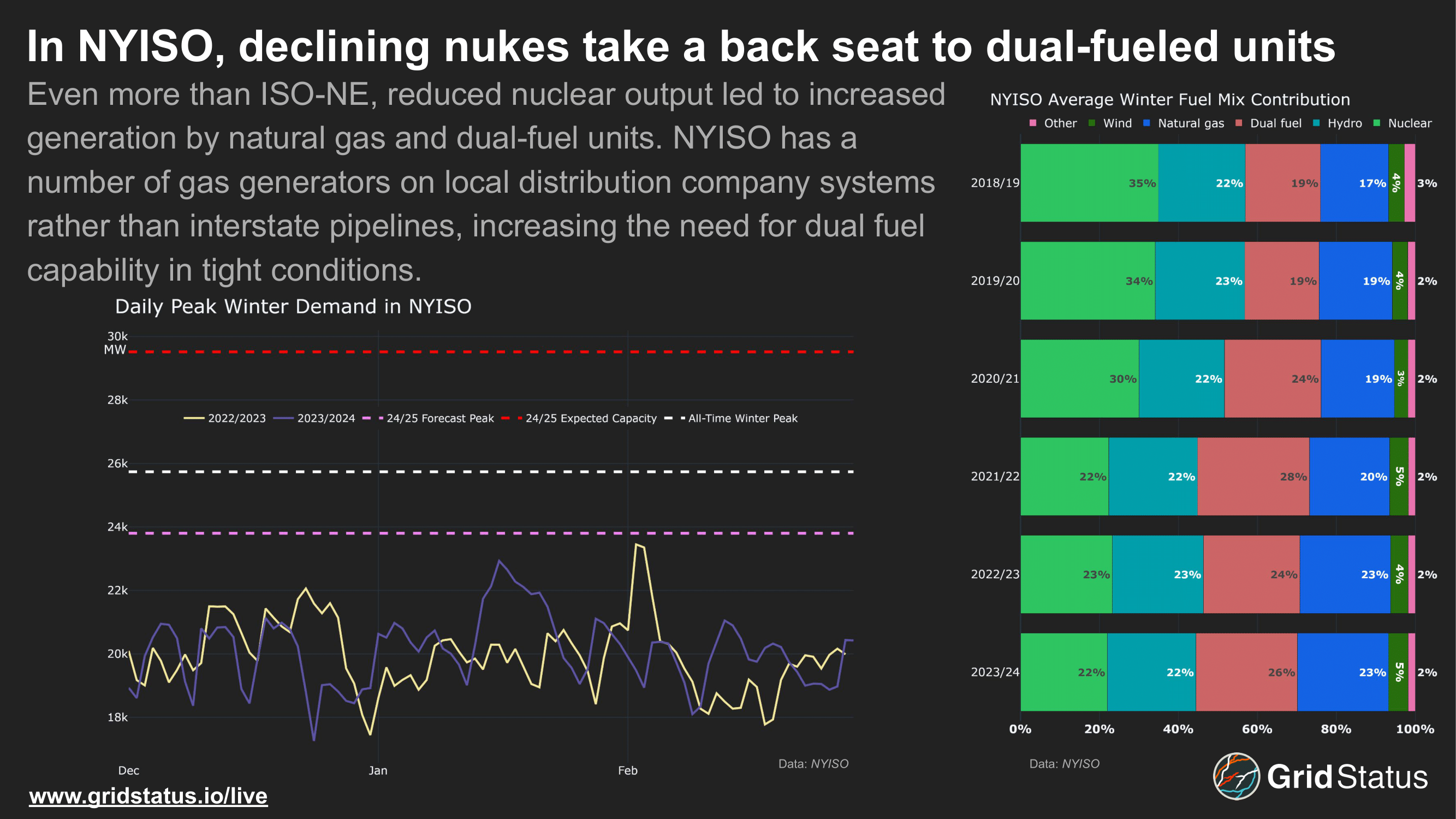

NYISO

Last on our list (CAISO mostly experiences what the rest of the country knows as "winter" in ski towns) we have NYISO. Like ISO-NE, a reduction of nuclear capacity gave gas room to expand, but in this case throughout the day as New York has a smaller behind-the-meter capacity. NYISO does, however, also have the highest penetration of hydropower in the eastern interconnection. Completed maintenance at Niagara and transmission upgrades have enabled some additional generation as flows face less impedance when seeking demand in the opposite corner of the state.

The current mix of gas, nuclear, hydro, and dual-fuel is also complemented with a robust interchange with neighboring authorities. With offshore wind (outside of Virginia) encountering financial struggles in 2024 and uncertain relations with foreign neighbors over the next four years, NYISO may need to reassess where future high-capacity winter resources come from.

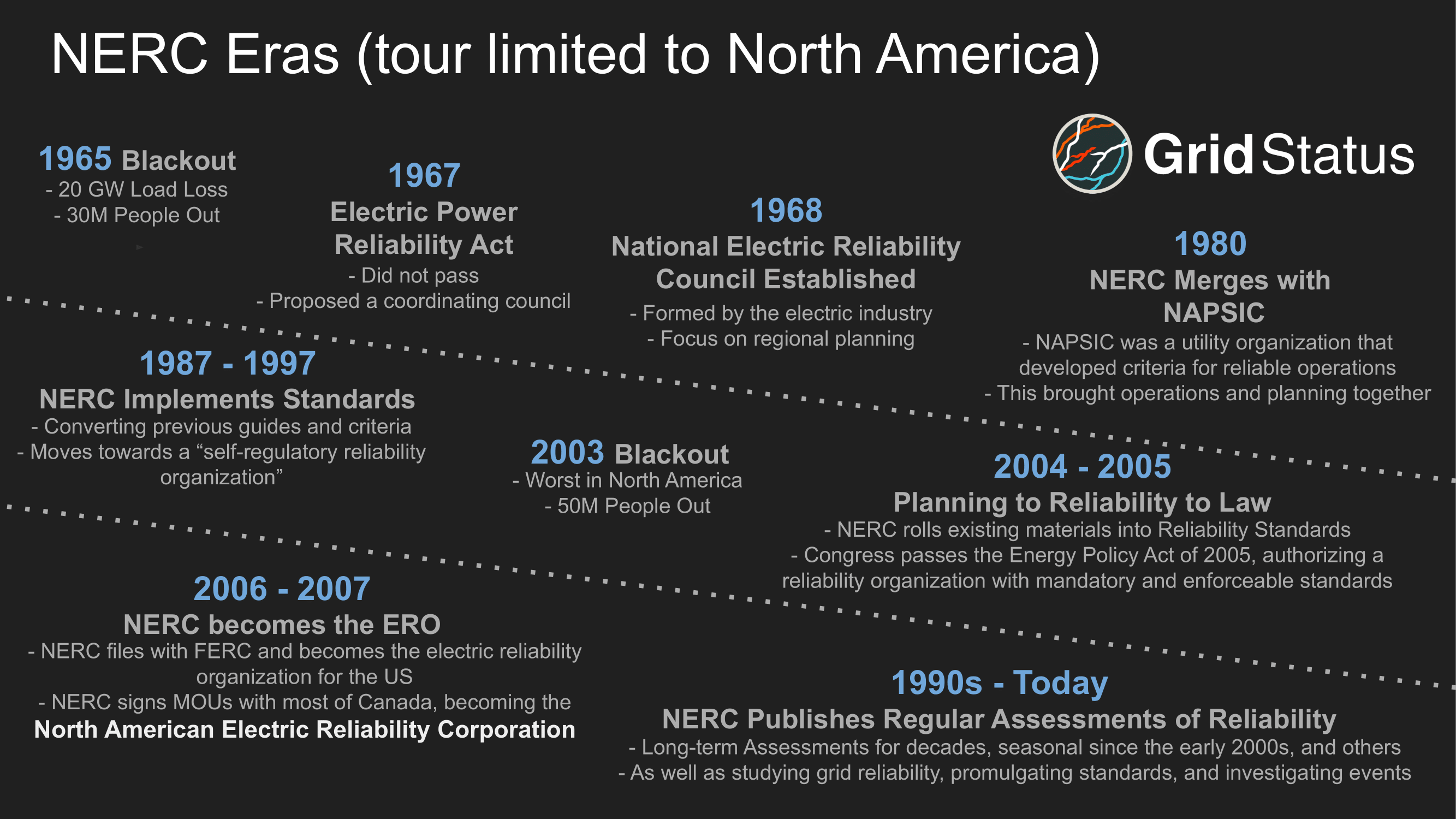

The North American Electric Reliability Corporation

NERC has been a fixture in US and North American energy systems planning for decades. Reliability during extreme weather events, safe integration of inverter-based resources, and general risk assessments have been key focuses of the organization in recent years, but it didn't always have the authority to promulgate standards. Hopefully the more proactive NERC of the 21st century can help us avoid repeats of past events which precipitated the expansion of its remit.

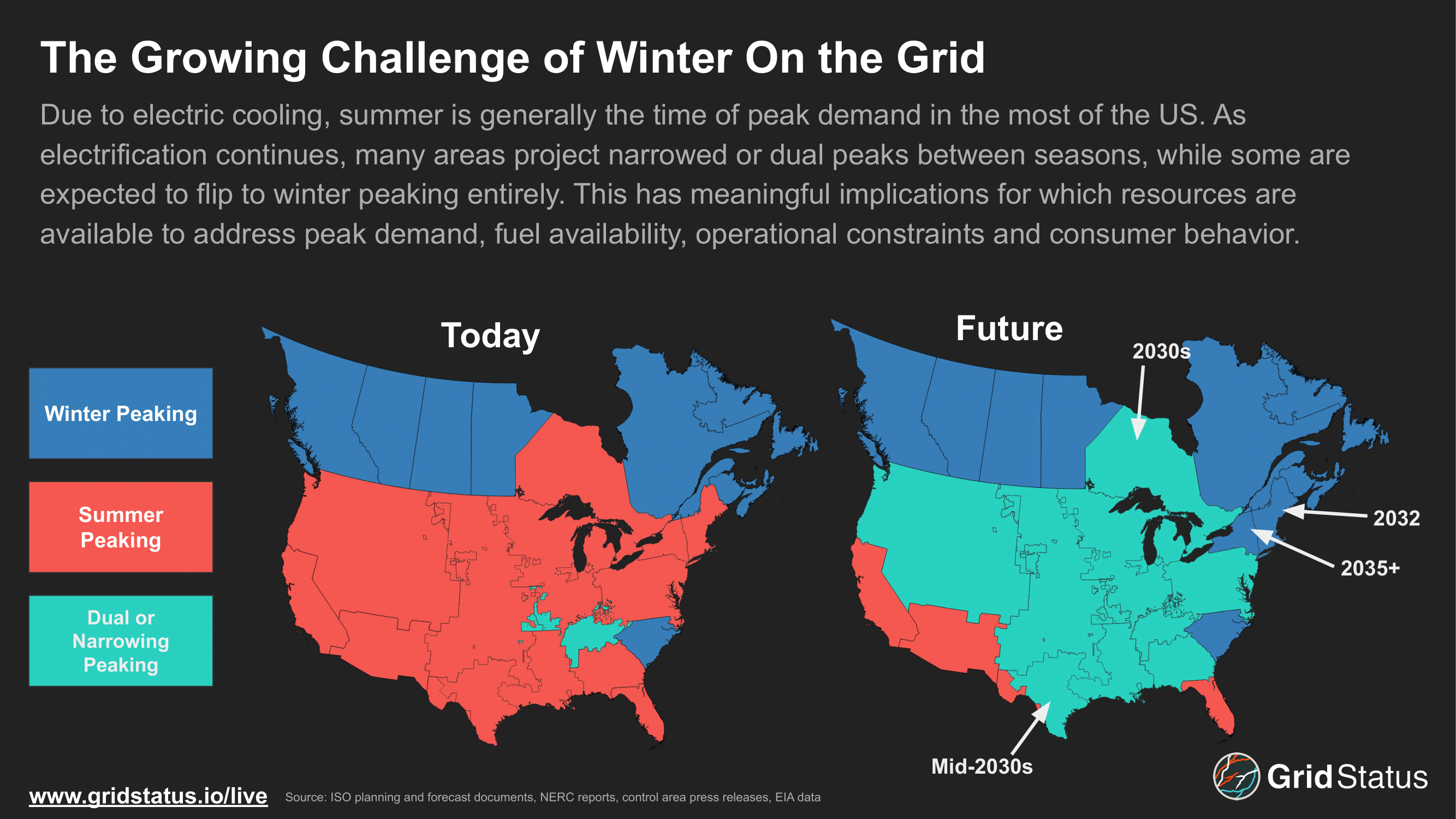

While winter risks have felt prevalent in recent years, few regions of the US are currently winter peaking. Currently, winter or dual peaking regions tend to be in Canada or regions of the US which heavily rely on electric heating. Some adjacent areas in the southeast which may have had brief all-time peaks during winter months are still considered summer peaking due to the relative rarity of that winter peak. However, this does speak to the extreme variance possible in winter events.

By the mid-2030s, many more regions of the US are expected to have narrowed the summer-winter gap, moved to dual seasonal peaks, or flipped entirely. NYISO and ISO-NE have predicted a flip towards winter peaking for years due to electrification, although as the rate of home upgrades has proved unpredictable estimates have been shifted further out.

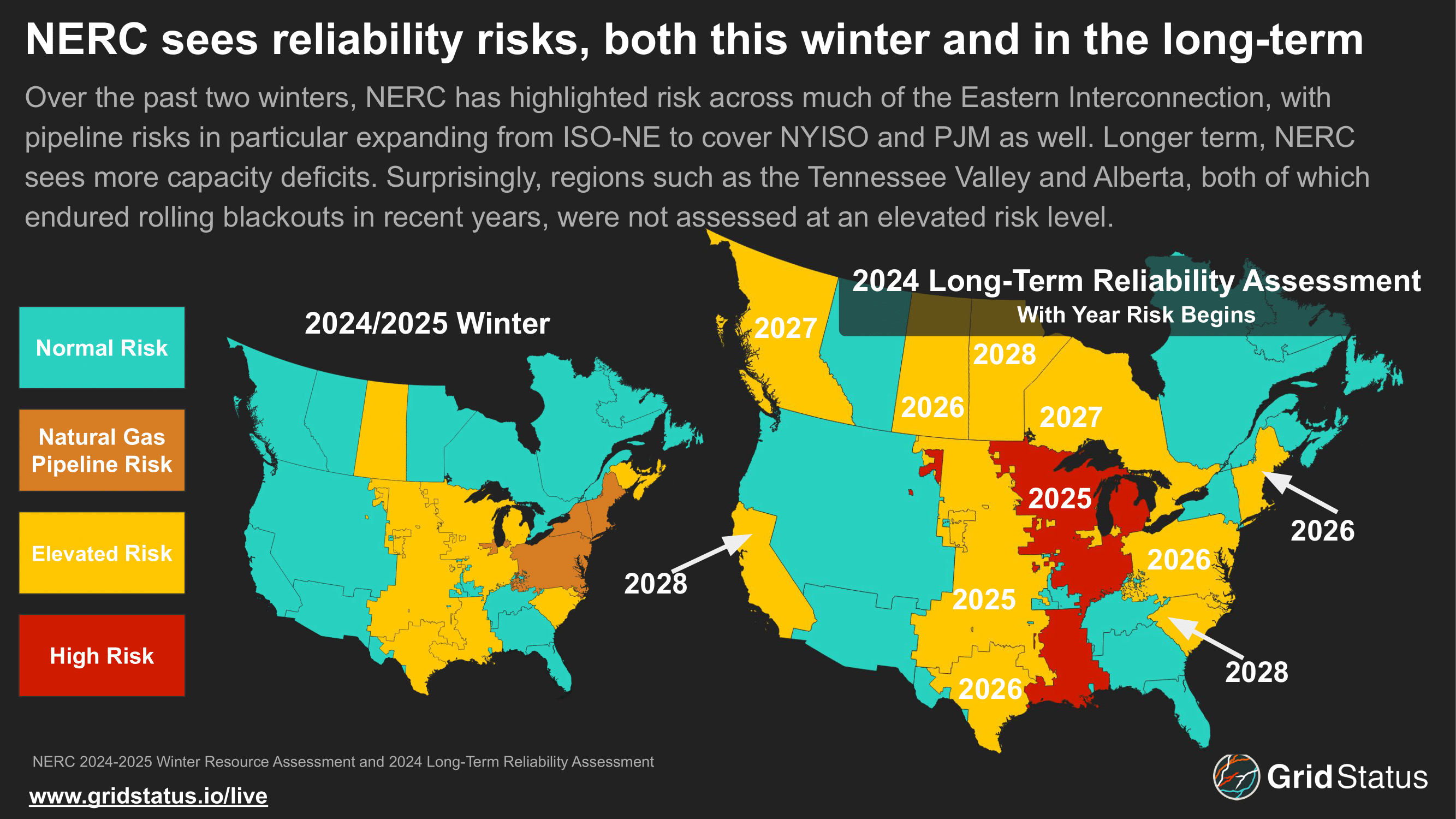

With several major winter events in just the 2020s, NERC's regular release of seasonal outlooks has been an inflection point at the beginning of the winter months. Dovetailing with predictions from each ISO, NERC takes a larger look at the entire system as well. NERC also released a long-term reliability assessment this past December, which detailed capacity risks through the remainder of the 2020s. These reliability risks are more broad than just winter and rely heavily on reported retirements and estimates of resource and load interconnection.

Already in 2025 we've had one multi-ISO winter storm and staring down the barrel of another. Understanding risk and planning appropriately will be key to navigating the sudden load growth being layered on top of a system in transition.

Look for more from us on system risk, operational challenges, and the evolution of the grid throughout 2025.