What to Expect on the Grid During the Total Solar Eclipse

The eclipse is a rare event that has real implications for electric grid operations. Here's what to watch in each of the affected regions.

In just a few days, we will welcome another North American Total Eclipse, the last one to impact the contiguous United States until 2044. These events are rare and predictable, but nevertheless have real implications for electric grid operations.

To highlight these impacts, we created a live dashboard with data from the four main affected markets (ERCOT, MISO, PJM, and ISO-NE) to track things as they unfold on Monday, April 8th.

However, before the live data starts to roll in, we can have a clear idea of what to expect based on material published by the grid operators. In particular, it will be the bookends to watch, starting with ERCOT, the grid operator in Texas.

Electric Reliability Council of Texas (ERCOT)

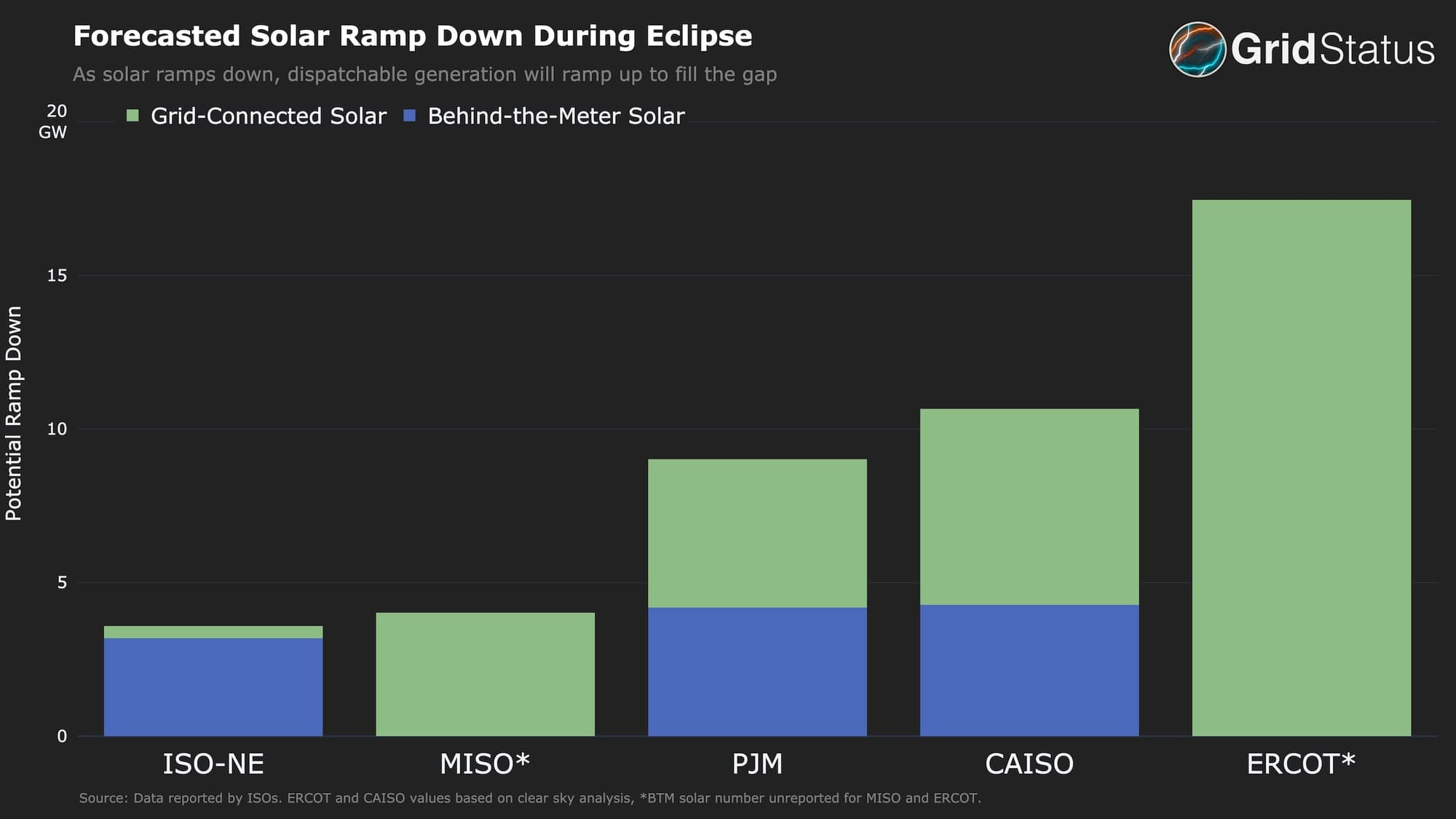

Most market participants will understand why ERCOT will be a place to watch on the day of the eclipse. While solar generation as a percentage of load remains lower than CAISO (which is also prepping for a lower % drop, but still meaningful ramp down), the raw MWs of utility-scale solar in ERCOT have put it in the lead on grid-connected solar capacity.

Despite obliterating previous solar generation records so far in 2024, ERCOT probably has little to fear from the anticipated drop in solar during the eclipse, despite the possibility that it exceeds 17 GW. The ISO had a chance for practice as recently as last October, and that operational experience coupled with low shoulder-season demand should leave operators with plenty of dispatchable room - particularly as they have been bringing units back from outage.

Midcontinent Independent System Operator (MISO)

The eclipse’s path takes it over MISO after (and during!) ERCOT. While solar capacity in the market remains small relative to total demand, it’s growing, and fast. MISO and PJM represent the vast middle territory of the eclipse’s impact (yes, we’re mostly skipping NYISO), and are the markets that should have the fewest operational stresses.

The last eclipse to materially affect MISO was in 2017, when only ~100 MW of solar was on the grid. Today that number is over 5,000 MW, and MISO anticipates a 4 GW drop followed by a 3 GW rebound. Like several ISOs in the path, MISO is increasing their Regulation Reserves, and, for extra support, their Short Term Reserves as well. One interesting note from MISO’s planning and others is that school closures are occurring along the path of the eclipse. Whether this contributes to an increase or decrease in demand is up for debate, but it’s a great example of the level of detail load forecasters go into for these outside-the-norm events.

PJM

To the east, PJM has a higher total solar capacity, although larger overall demand in the market. As of 4/2, their planners foresee a 4.8 GW drop in grid-connected solar, and 4.2 GW from behind-the-meter (BTM) installations. These drops come via an installed resource base that has increased by 13x for grid-connected and 2.7x for BTM since 2017.

MISO and PJM are similar in their large territories and diversity in both geography and policy. These attributes make this a great early case for the kind of system-wide planning that will only become more crucial in the coming years.

ISO New England (ISO-NE)

And now we come to ISO-NE, the grid operator in New England. It may surprise some energy market observers, but this market is one of the more interesting among those affected by the eclipse.

ISO-NE is the smallest ISO by demand, but has an incredibly high penetration of BTM solar. At the end of March, the region set a new BTM solar record, exceeding 6 GW. This resource is particularly tricky for grid operators as they have very limited visibility and no control over the individual generators. In this case, ISO-NE will have to be prepared with a number of much larger generators to quickly close the gap.

Meanwhile, the average peak load over the last 30 days hasn’t cracked 14.5 GW. System operators in New England are predicting swings of just 365 MW down and 230 MW up in utility-scale solar, but 3200 MW down and 2260 MW up on the BTM side.

ISO-NE is taking additional operational measures, such as restoring the 345kV line Berkshire to Northfield for a single day before placing it back on outage. This line is an important piece of the ISO-NE network, particularly in enabling flows from its neighbor, NYISO.

If you have early access to our Nodal Price Map (a very cool club you can join simply by clicking that link), you can find a node on either end there as well and try to spot any congestion pricing when it goes back on outage.

ISO-NE is also raising their regulation requirements to 400 MW, a substantial increase over the sub-100 MW standard procurement for the month and hour.

Regional Help

In terms of the greater region, New York Independent System Operator (NYISO) and Ontario's IESO are also implementing a one-off increase in their regulation procurement to support their systems as well as their neighbors during the event. Additionally, NYISO is implementing hourly scheduling on the coordinated transaction scheduling (CTS) interface with ISO-NE for the hours preceding and following the event.

Conclusion

While the specific challenges of an eclipse are derived from a set of unique conditions, they represent a type of system event that will be more common in the future with higher renewable penetrations. Grid operators have stepped up to the task in terms of preparation and we expect this eclipse will result in a relatively uneventful day in power markets. However, large ramping events under non-eclipse conditions do not come with decades of warning.

We’ve already seen ramp conditions contribute to the implementation of a new ancillary service in ERCOT through ERCS, and discussion on additional ramping or uncertainty products has been a fixture across ISOs in recent years. In fact, the temporary increase in regulation procurement in several ISOs could be seen as an admission of future need for additional procurement of fast-responding ancillary services.

In a twist of fate, as the energy transition proceeds, the actions operators are taking for Monday will converge towards normal system planning, perhaps rendering the 2044 eclipse just another day in the office.