Peak Western Conditions Reveal a Changed CAISO

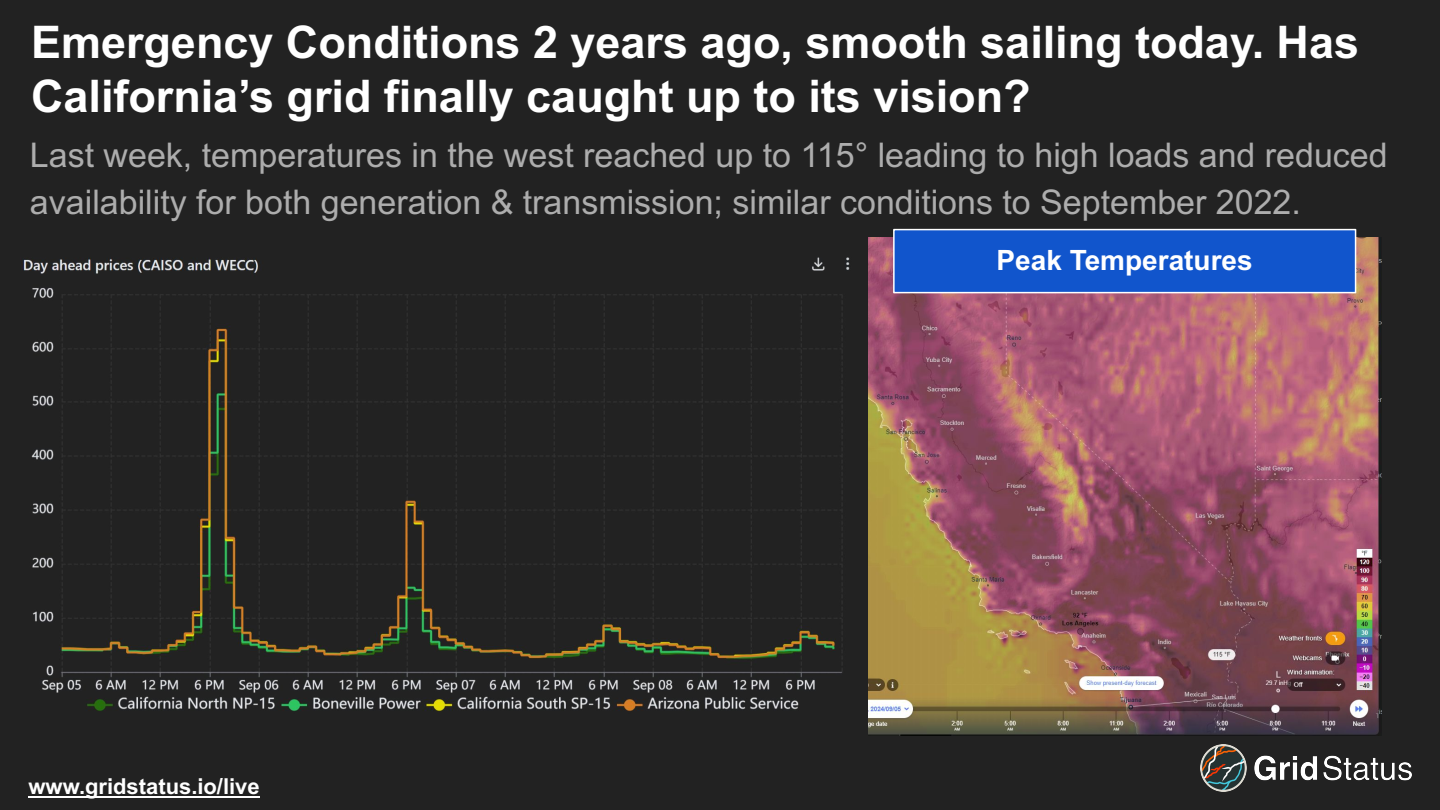

On September 5th and 6th, 2024, the California ISO (CAISO) was under stress from both within and without. High temperatures, spiking day-ahead prices, import cuts, and wildfires — a problematic milieu. Despite this, real-time prices remained low and neither conservation calls nor emergency alerts made an appearance. Let's dig into conditions on the ground and lessons learned.

In this post:

Heat Drove High Demand

Temperatures in the southwest reached - and in spots exceeded - 115°F, but even outside of these extreme pockets it was quite hot, contributing to problematic conditions for wildfires.

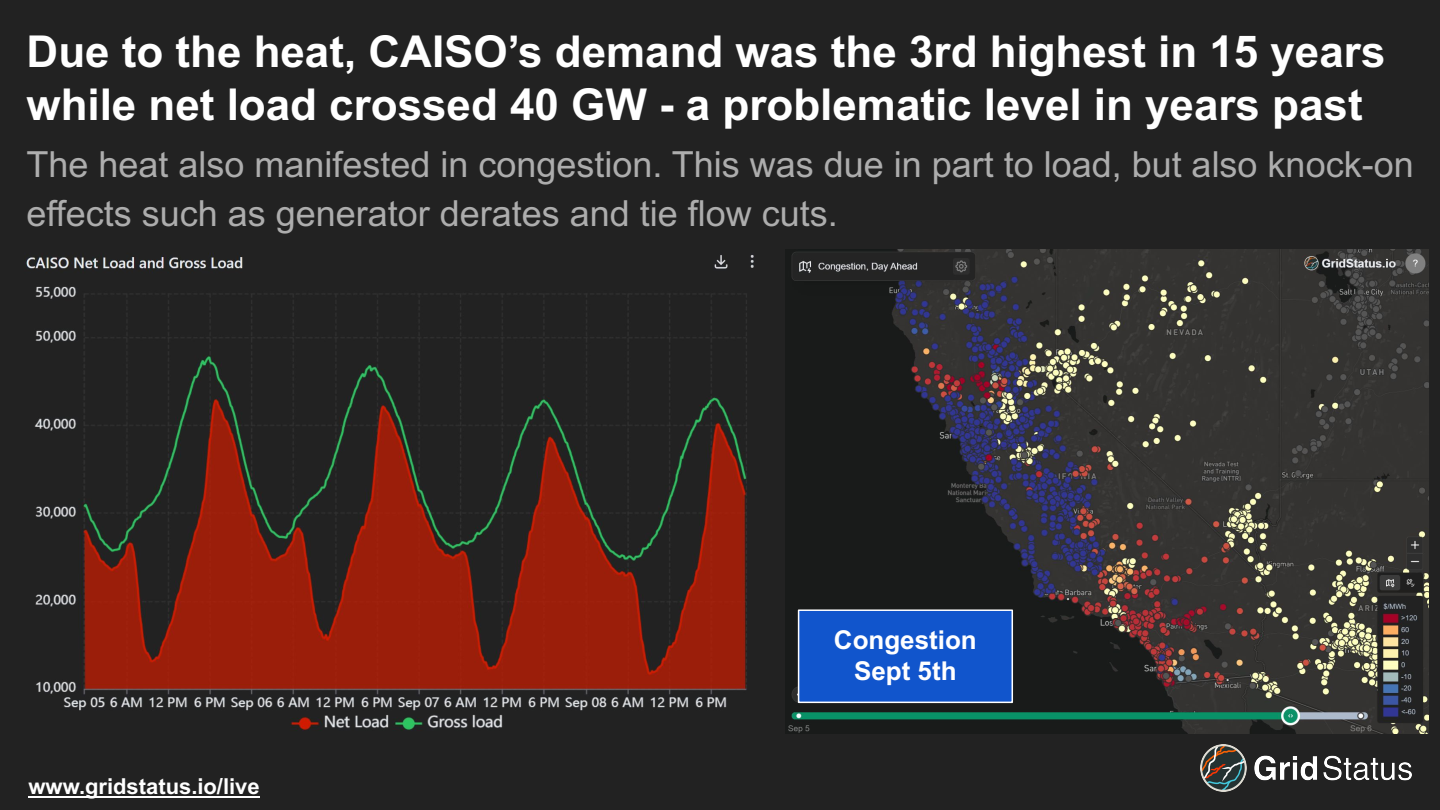

High temperatures manifested in increased demand, both gross and net. The pattern of demand and acute issues we'll get into below led to congestion in the day-ahead LMPs and higher prices. Next, let's take a some of the acute issues faced by CAISO in navigating 2024's peak period.

Cuts, Derates, and Wildfires

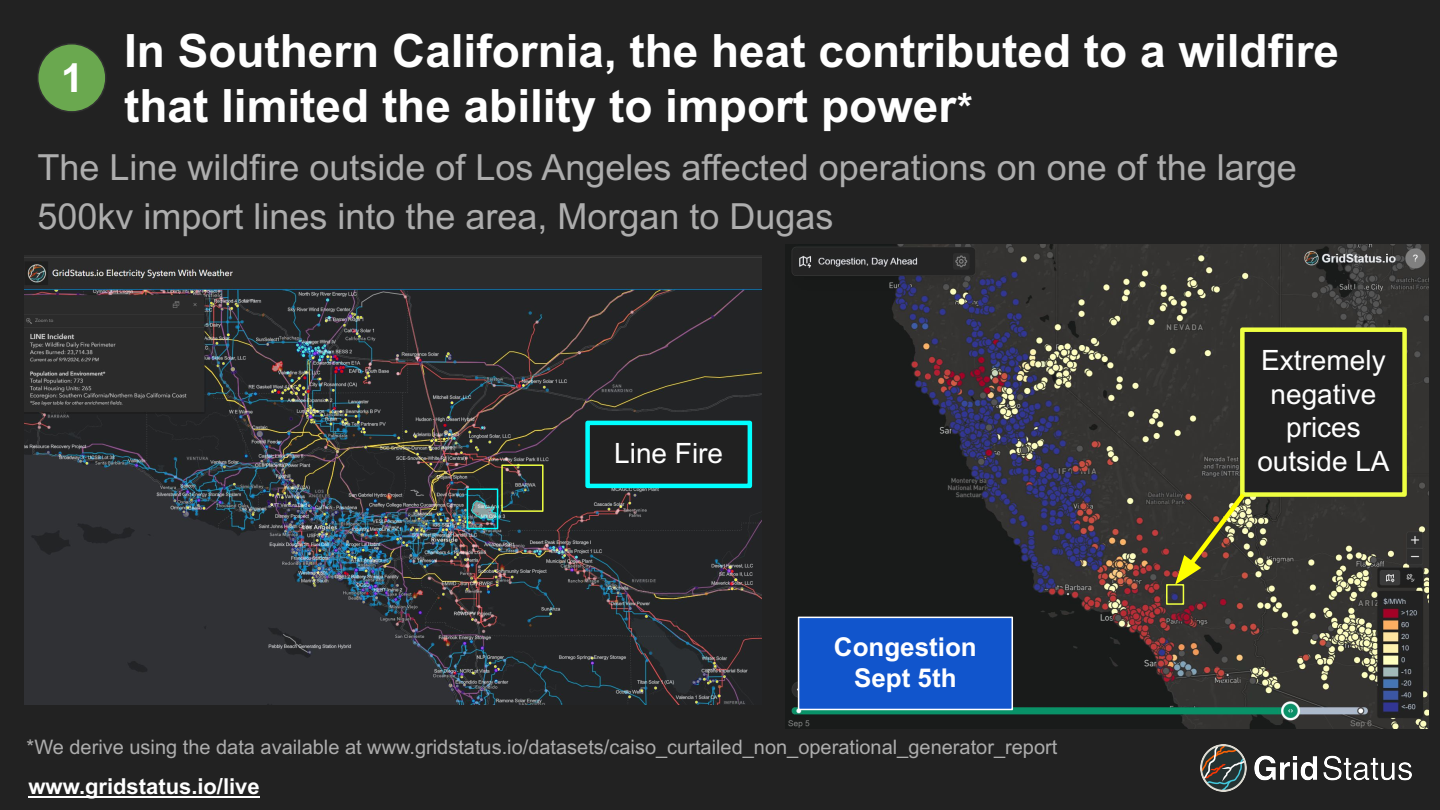

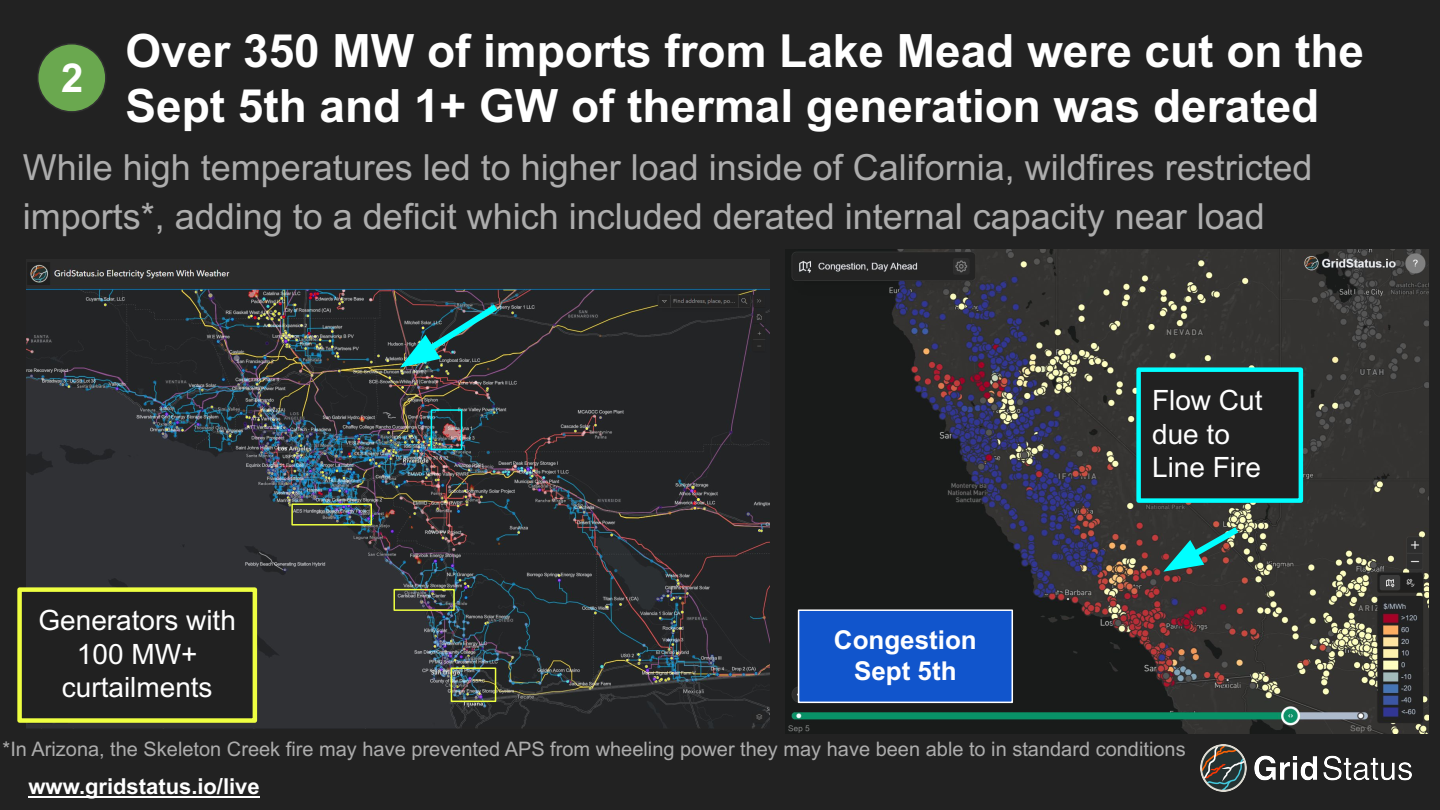

Somewhat infamously, during past tight conditions CAISO has relied quite heavily on imports from the wider west. This reliance was particularly problematic when weather conditions affected a wider area than California itself. In this case, the Line fire in San Bernadino county limited the 500kV Morgan to Dugas line, but this wasn't the only issue in the Los Angeles area.

While flows from Lake Mead were cut, a substantial amount of generation within California was also derated. All generators have limits on operations based on ambient conditions, but thermal generators can face particularly acute constraints given the efforts made to manage heat rejection during normal operations. Beyond the loss of generic dispatchable MWs, these generators were situated near load, making them more critical for efficiently meeting the heat-induced demand.

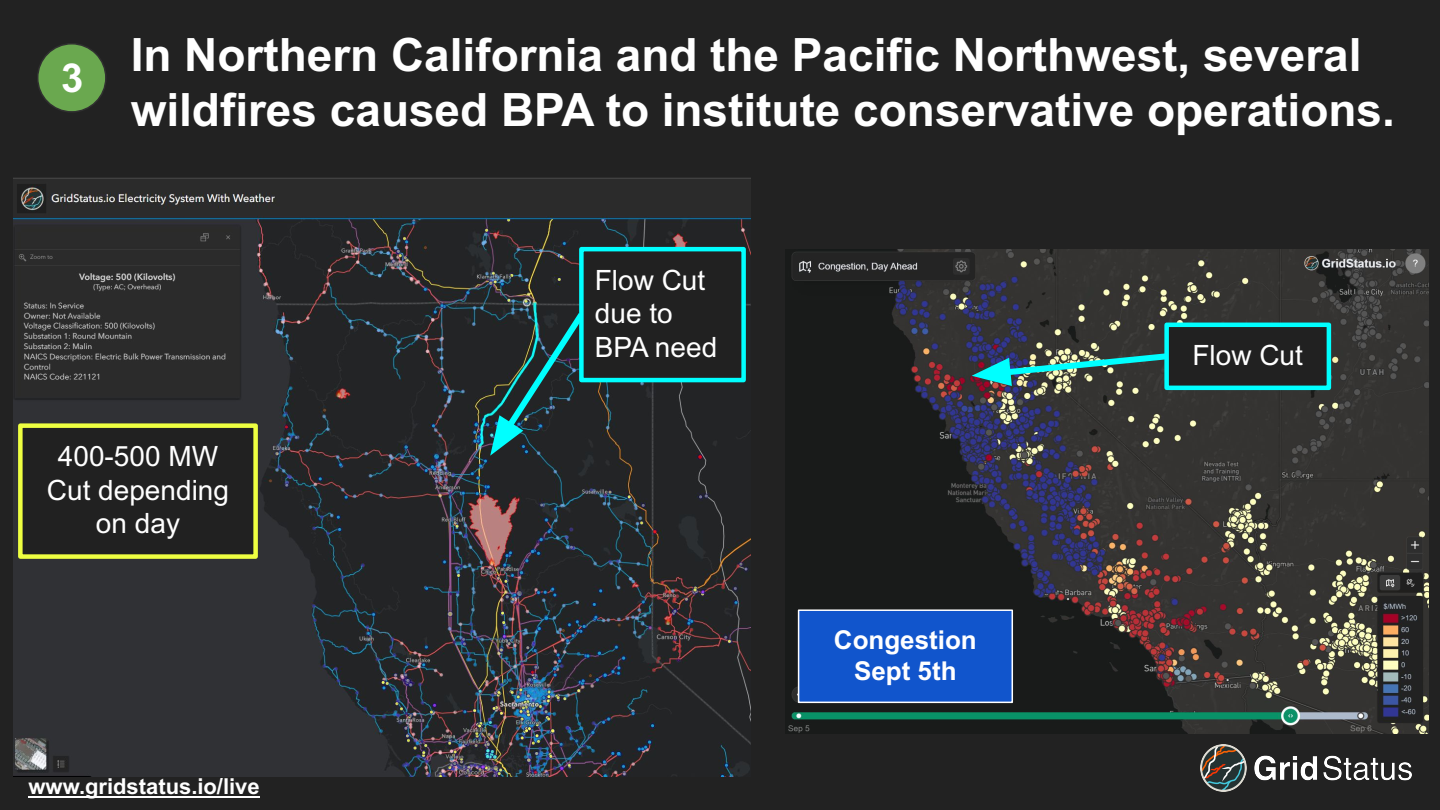

Operational challenged weren't limited to southern California. On the northern end of the estate, tie flows were also cut as BPA instituted conservative operations. As in the southern portion of the state, wildfire risk drove this decision.

This combination of wildfires, import cuts, and regionally difficult conditions could have left a reasonably-informed CAISO watcher with the expectation of high real-time prices and the potential for emergency action, but neither occurred. Let's explore a major piece of the puzzle below.

Batteries' Eureka Moment

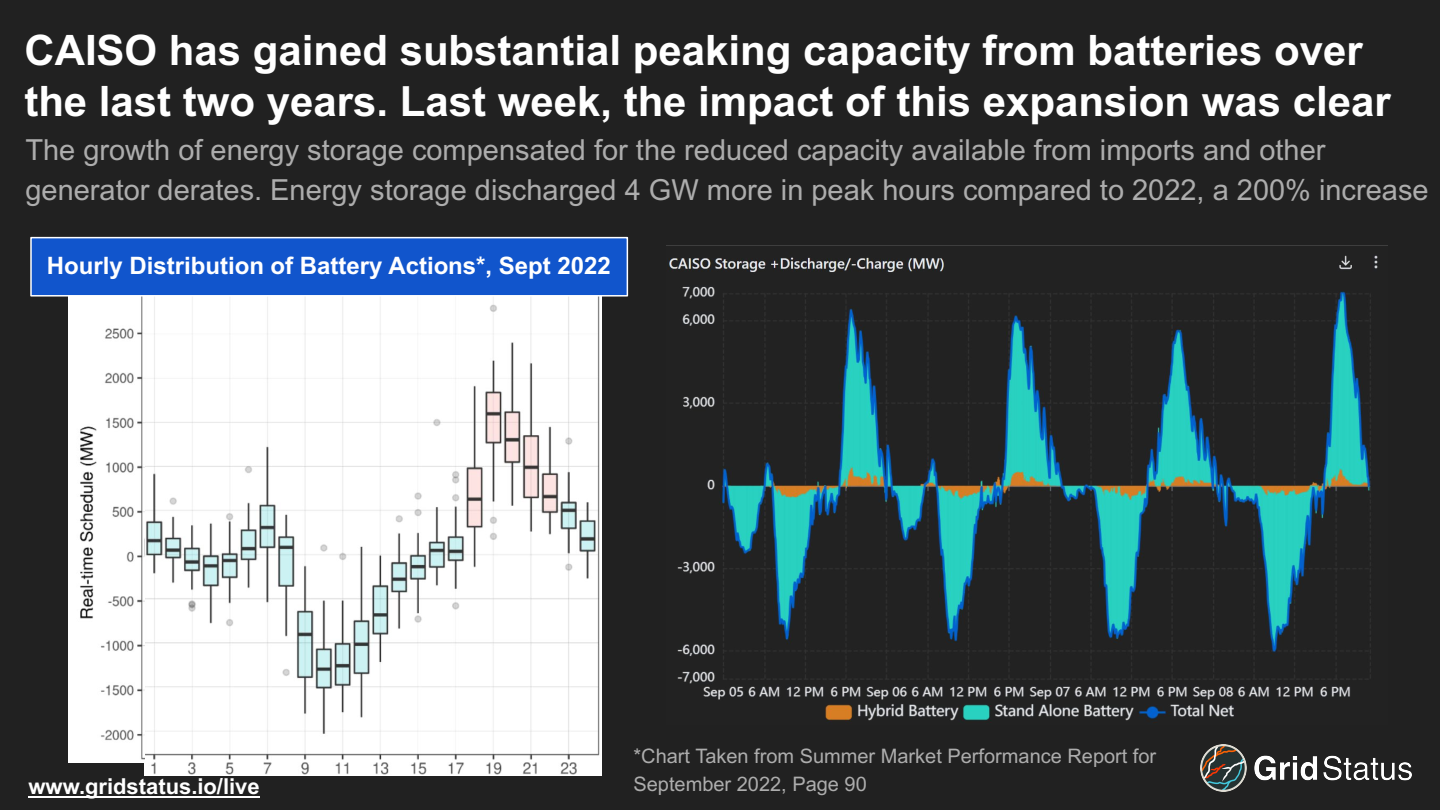

Since the last challenging stretch in CAISO, battery storage has expanded dramatically. Last week, batteries discharge peaked from ~5 to ~7 GWs on each day. In 2022, the peak day was around half of that 7GW value, while most days throughout the week peaked well under 3 GW.

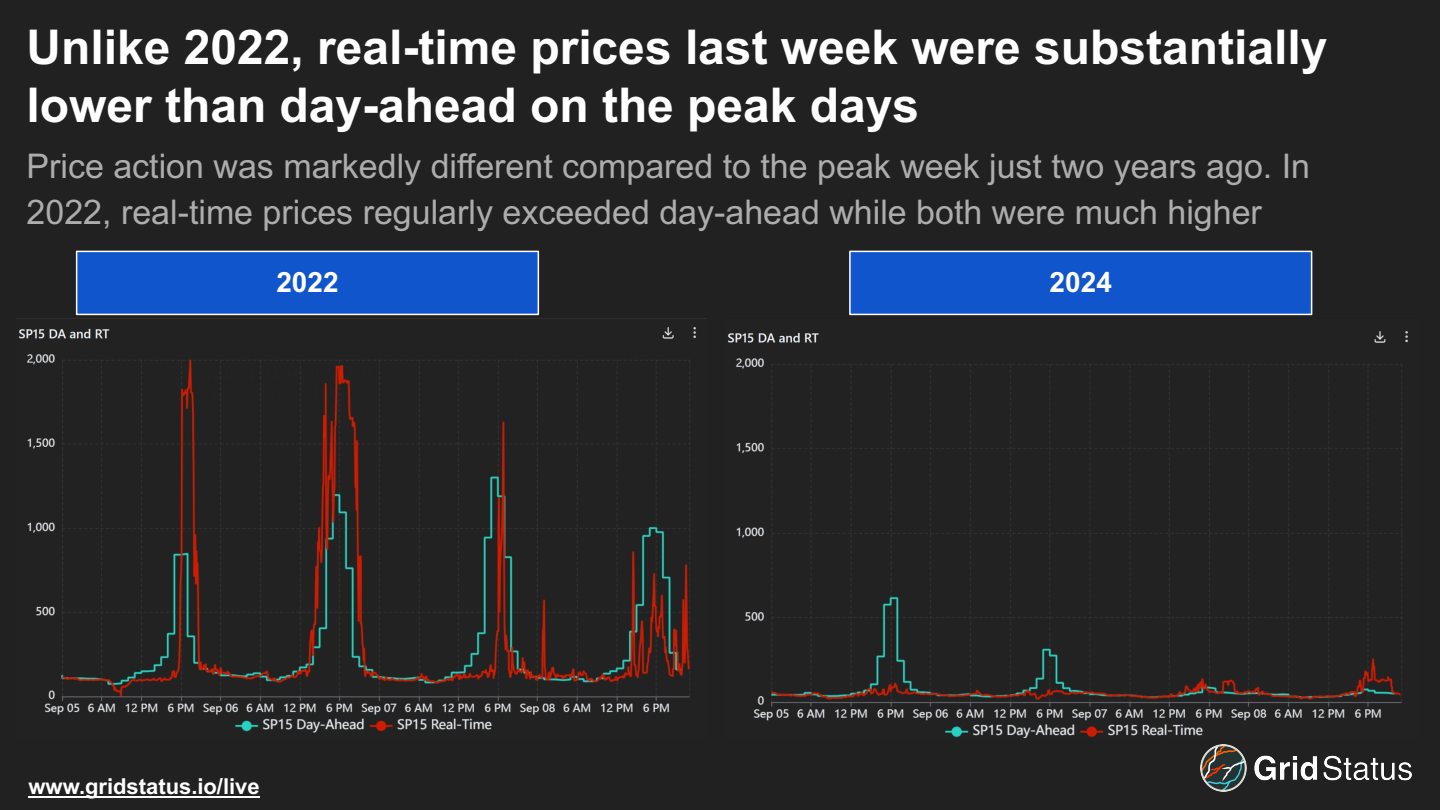

On peak days in real-time, prices were substantially lower than in the day-ahead, a reversal from 2022's event, as well as a sign that conditions were not as challenging as anticipated. CAISO was able to avoid the very tight conditions that lead to extreme pricing despite the aforementioned stressors.

While solar generation has also increased, batteries play a more substantial role than ever in CAISO's operations. The Electric Reliability Council of Texas (ERCOT) has also been lauded for its growth in storage, but when put into perspective of load, the gap remains quite large. Comparing all-time peak load and peak storage discharge (non-coincident), ERCOT's battery fleet would have met less than 5% of demand, while CAISO's battery fleet would have met about 16%, more than triple the value in Texas.

This point is often lost when comparing raw MWs deployed in different regions. Different control areas have disparate fundamentals, and 1 GW in CAISO or NYISO is not the same as 1 GW in ERCOT or MISO.

So batteries were able to offset a larger portion of demand, but that doesn't inherently mean lower prices, what happened?

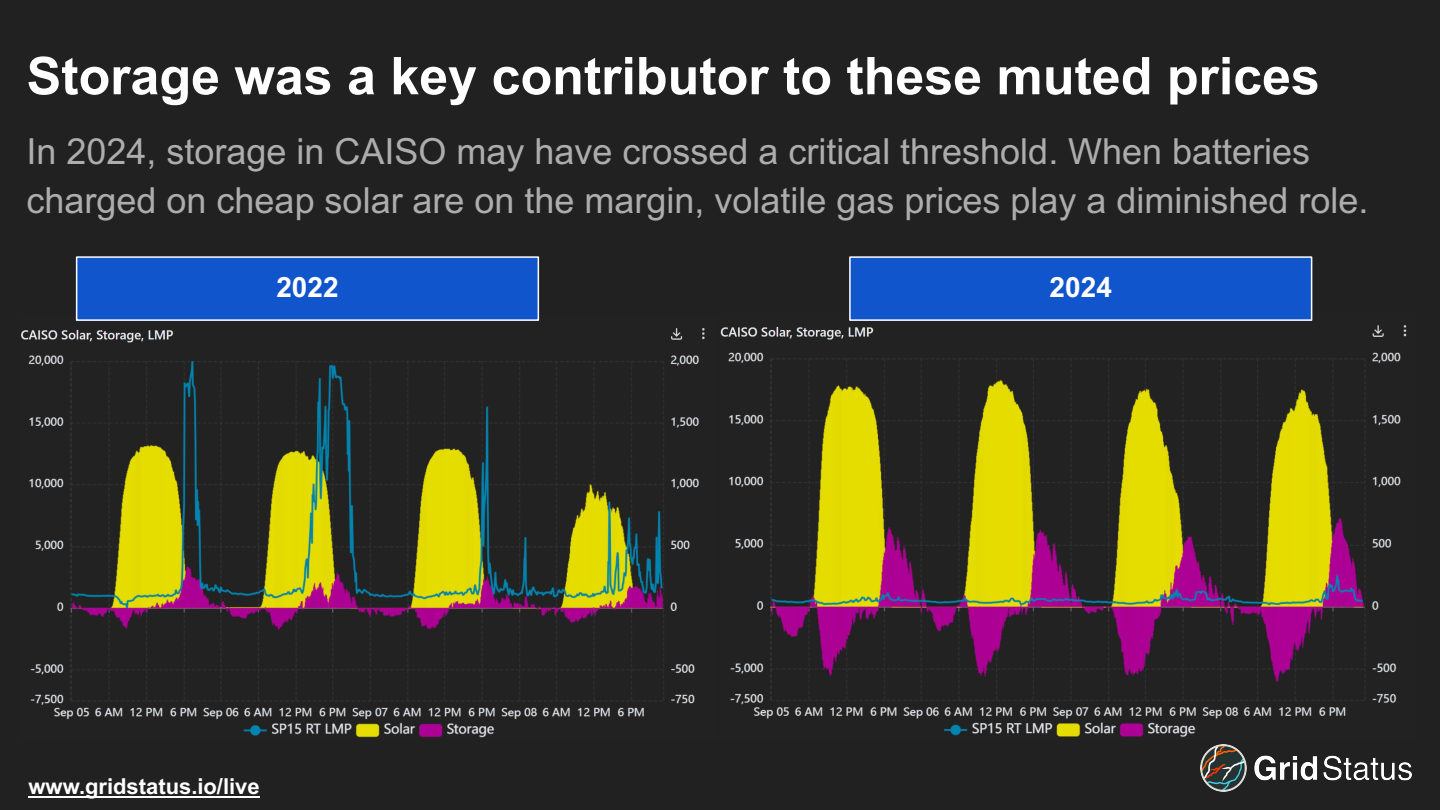

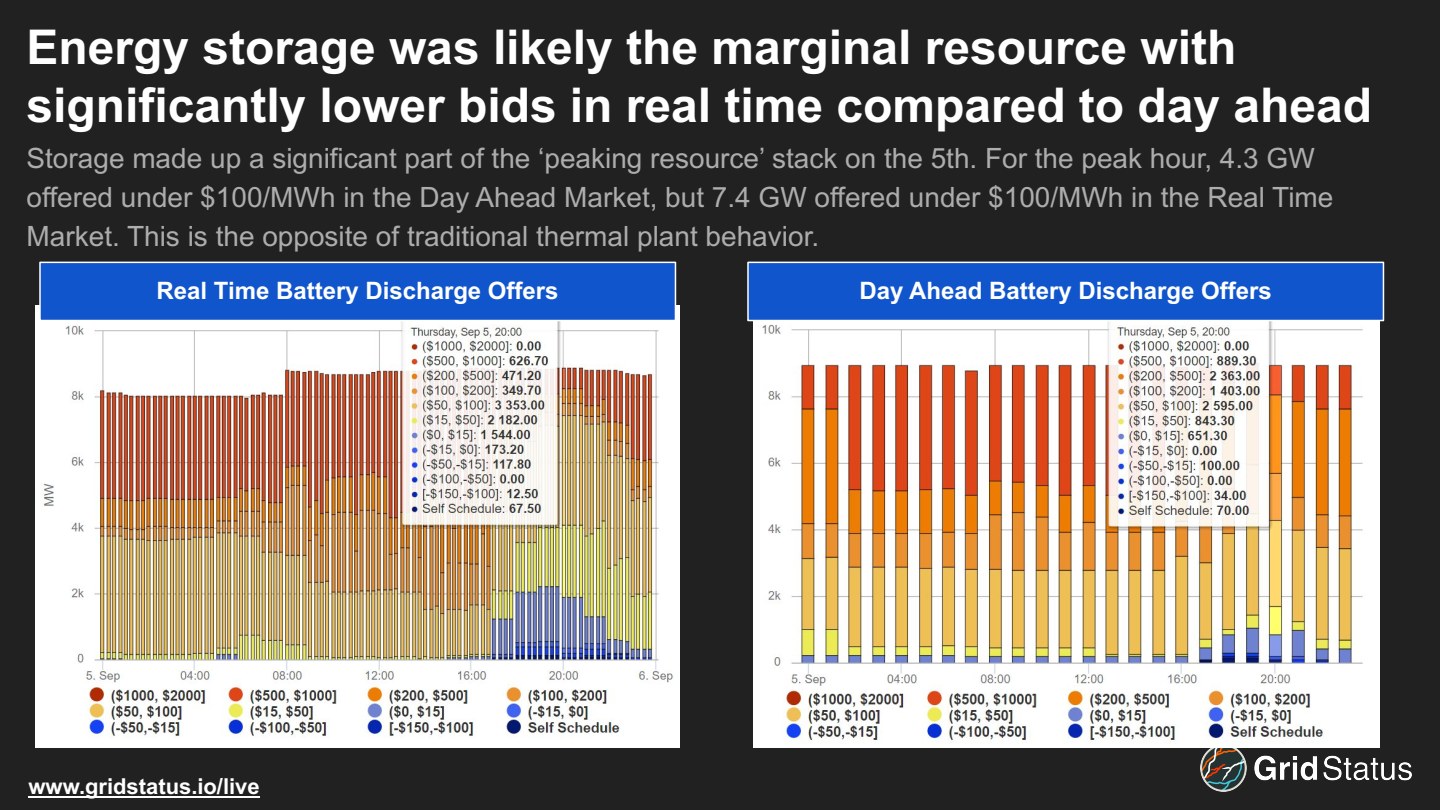

A major factor was reduced bid levels in real time. 3 GWs of additional battery capacity was offered below $100/MWh when compared to day-ahead, with the bulk of that capacity (~2.4 GW) priced even lower, below $50/MWh. It's worth mentioning fuel prices as well, since there was a substantial difference between 2022 and 2024.

Even when natural gas prices are relatively low nationally, as in this moment, CAISO has never been fully inoculated from fuel-based price volatility. Unlike the marginal unit of mid-day solar which is still likely to be priced near $0, each marginal unit of gas generation moves down the efficiency curve and up the cost stack in terms of O&M, heat rate, and other factors. There's also the broader point at which generators on the same pipeline expect full utilization and drive up the overall price of gas being traded in that particularly opaque niche of the energy ecosystem.

Conversely, the economics of batteries are much more straightforward (which has led to a Cambrian explosion of companies offering revenue calculators and optimizers). Several new GWs of capacity charging at near-zero prices have substantially more flexibility to offer below inefficient plants that would otherwise be on the margin.

Conclusions

While this was relatively smooth sailing for CAISO given the conditions, operators and planners shouldn't (and won't) take that as a sign for complacency. Wildfires continue, and cause issues whether or not heat has juiced demand. The thermal fleet, particularly in southern California, is still needed and susceptible to ambient-temperature-induced derates, and the specter of long-term drought is always near.

The Western Interconnection is in a moment of change. Over the next several years, multiple new market constructs are likely to be implemented as CAISO expands services and the Southwest Power Pool moves more fulsomely beyond the Eastern Interconnection. With these expansions will come new challenges with new solutions, but this past week demonstrated breakthrough success that will likely be in play for decades to come.