How Does a Renewed IESO Respond to a Nuclear Trip

Energy prices hit $2,000/MWh in Ontario. What triggered this price spike, and how the renewed IESO market respond?

During the late evening of May 12th, 2025, IESO experienced its highest energy price spike since the Markets Renewal Program went live nearly two weeks ago.

Based on IESO’s Adequacy Report, no nuclear outages or derates were planned for the 12th. However, leading into 21:00, Ontario’s fuel mix showed nuclear generation beginning to fall by over 400 MW in a short period. Using a unique report to IESO, the Generator Hourly Report, it became clear that Unit 5 of Bruce experienced an unscheduled derate that left Ontario without needed generation.

Let's take a look at the drivers of this spike and the steps IESO takes to respond to a nuclear trip in the renewed market.

Gas Generation Responds

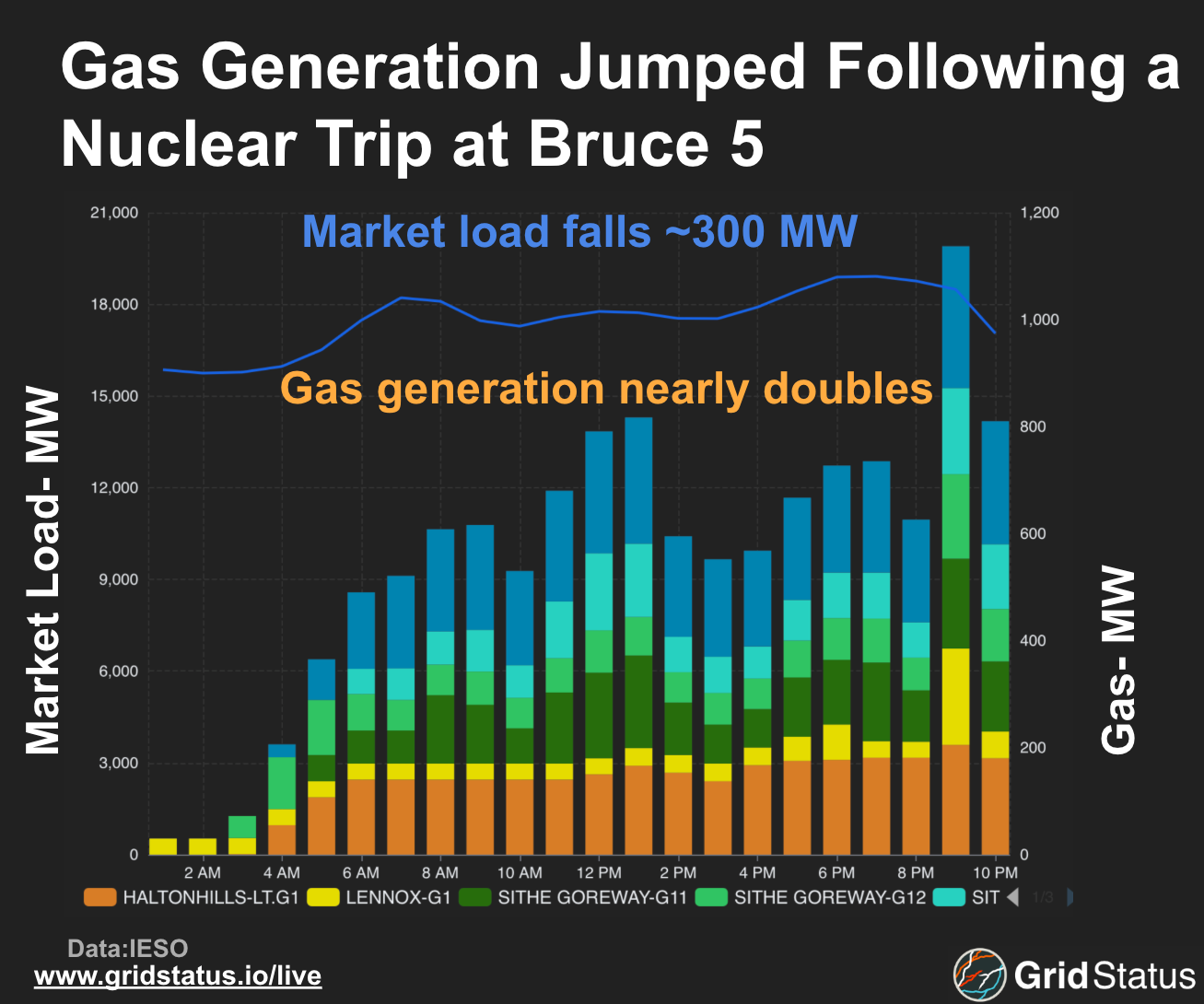

With the sudden loss of nuclear generation, Ontario's gas fleet ramped up to account for the missing supply. Gas generation increased to the highest level seen that day, even more than seen during daytime hours. Notably, market load fell during the hour leading into 21:00, which helps to indicate that the ramp-up in gas was not a planned response for increased market conditions but was in response to system conditions and prices.

Cutting Off Flows

Flows out of IESO responded as well. As noted in our previous blog, IESO’s unique fuel mix helped to establish its position as a large exporter to nearby regions. As internal supply dipped, and energy prices responded, the economics of flowing power from IESO to neighboring regions reversed. As a result, there was a 400 MW drop in flows out of Ontario between the interval leading into and following the price spike.

Nodal Market, Nodal Spreads

Energy prices are only one component of LMPs. While energy prices hit the ceiling of $2,000/MWh, congestion and loss costs kept nodes in Northwest Ontario at the price floor of -$100/MWh. These spreads show the nature of a renewed nodal market where system-wide energy prices can give the clearest signal for all units to generate, while congestion sends some generators the clearest signal not to generate.

The launch of any new market is always interesting, but IESO’s has proven many naysayers wrong by providing various forms of nodal and zonal volatility to a market once defined by uniform pricing. Track the renewed market and its surprising levels of volatility on our renewed IESO live page.