Market Renewal in Ontario: Navigating IESO's Shift to a Nodal System

Ontario's power market administrator, IESO, is about to undergo major changes. We explore the history of the ISO and examine the impact these reforms will have on participants.

One of North America’s biggest success stories in power sector decarbonization isn’t the past few years in Texas or California, but Ontario’s coal retirements a decade ago. In doing so, Ontario demonstrated a model for rapidly completing a major transition of their energy system.

Despite this success, Ontario’s energy markets administered by the Independent Electricity System Operator (IESO) have been outdated since their inception.

Now, after years of preparation, significant changes are set to reshape Ontario’s electricity landscape when IESO’s reforms go into effect on May 1st, 2025. These reforms, via the Market Renewal Program (MRP), will change settlement, unit commitment, and introduce a nodal market to IESO, aligning it more closely to the operations of ISOs and RTOs in the US.

With a unique resource mix and somewhat checkered history we’re taking a deep dive into Ontario’s power markets: where they’ve been, where they’re going, and what this means for everyone involved, both now and into the future.

What we cover in this post

A new nodal market is rare, and broader market reforms could lead to new opportunities and unexpected outcomes. To fully prepare for market launch, we’ll break down these changes from the perspective of three classes of participants: generators, loads, and traders.

Fair warning: This post is not a casual introduction to Ontario and IESO. So buckle up because we’re going to catch you up on everything you need to know.

Please reach out at contact@gridstatus.io if you want early access or have any suggestions on the types of research or content you'd like to see.

Glossary

While we define each term as we come to it, given the length of this piece we also wanted to provide a handy glossary of terms for reference.

AESO - Alberta Electric System Operator

CAD - Canadian Dollars

CAISO - California Independent System Operator

CSMC - Congestion System Management Credits

DACP - Day Ahead Commitment Process

DAM - Day Ahead Market

ERCOT - Electric Reliability Council of Texas

ERUC - Enhanced Realtime Unit Commitment

FTR - Financial Transmission Right

GA - Global Adjustment

HOEP - Hourly Ontario Energy Price

ICA - Incremental Capacity Auction

IESO - Independent Electricity System Operator

IMO - Independent Electricity Market Operator

ISO - Independent System Operator

ISO-NE - Independent System Operator of New England

LDC - Local Distribution Company

LFDA - Load Forecast Deviation Adjustment

LMP - Locational Marginal Price

LSE - Load Serving Entity

MCP - Market Clearing Price

MISO - Midcontinent Independent System Operator

MMBTu - Million British Thermal Units

MRP - Market Renewal Program

MWh - Megawatt Hour

NDL - Non-Dispatchable Load

NQS - Non-Quickstart Unit

NYC - New York City

NYISO - New York Independent System Operator

NYPA - New York Power Authority

NYSERDA - New York State Energy Research and Development Agency

O&M - Operation and Maintenance

ONZP - Ontario Zonal Price

OPA - Ontario Power Authority

OPG - Ontario Power Generation

PD - Previous Day

PJM - Pennsylvania, Jersey, Maryland Regional Transmission Organization

PPA - Power Purchase Agreement

RT - Real-Time

RT-GCG - Real Time Generation Cost Guarantee

RTO - Regional Transmission Organization

SPP - Southwest Power Pool

SSM - Single Schedule Market

TWh - Terawatt-hour

IESO Today

IESO’s Resource Mix

While Ontario is similar to other Canadian provinces with its extensive fleet of hydropower facilities, it breaks from national averages via its embrace of nuclear power.

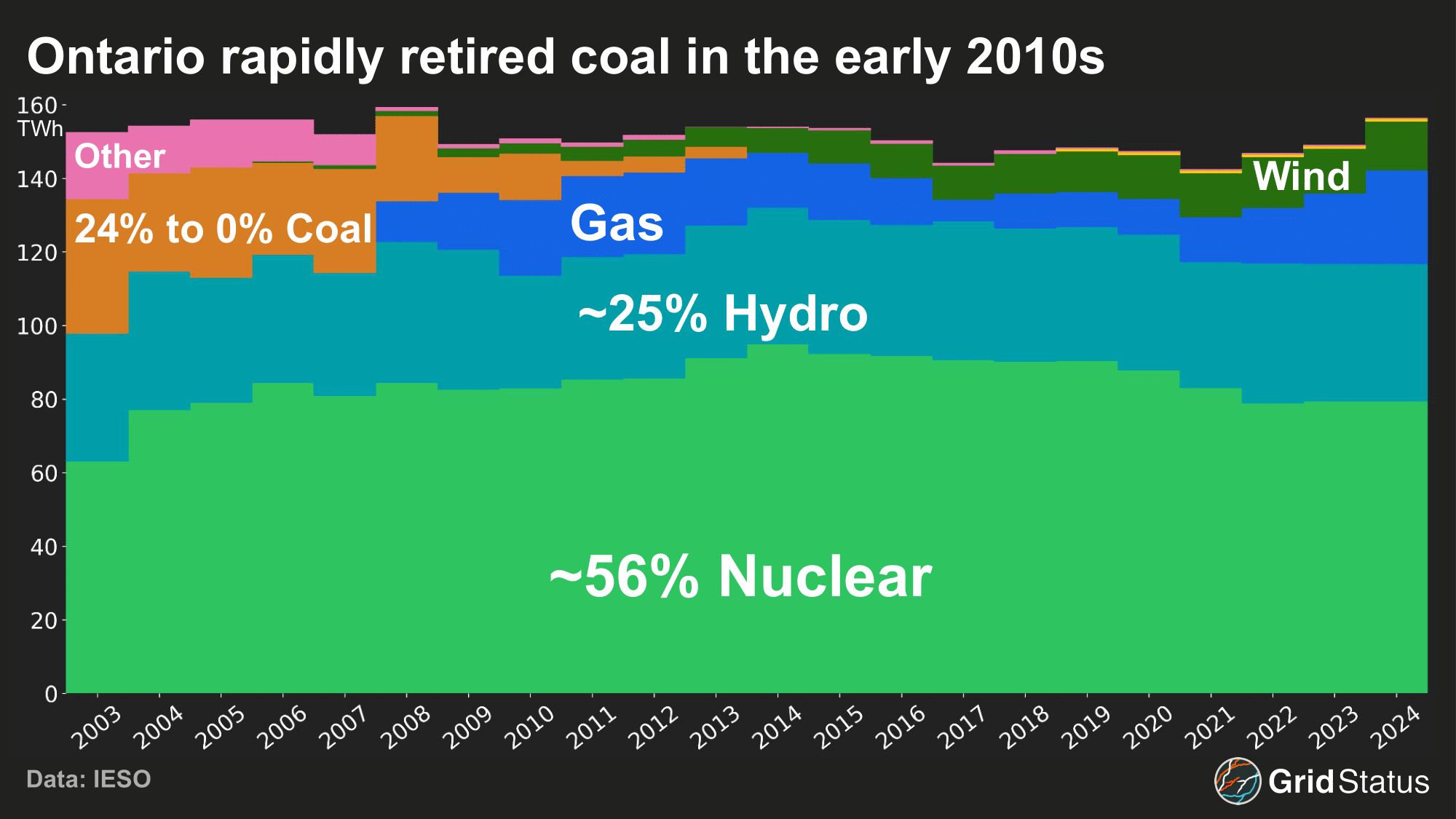

Nuclear and hydro have been the main sources of generation in Ontario for decades, but for most of that time the third pillar was coal. Starting in the early 2000s, Ontario moved to aggressively retire its coal fleet, eliminating it from the resource mix within a decade.

The final coal station closed in 2013, a feat not replicated by another system operator in North America until the end of the decade.

While nuclear generation has risen somewhat in the absence of coal, gas and wind have largely worked to close the gap. You can track the generation mix in real-time on our IESO live page, and get down to the generator level with this dataset.

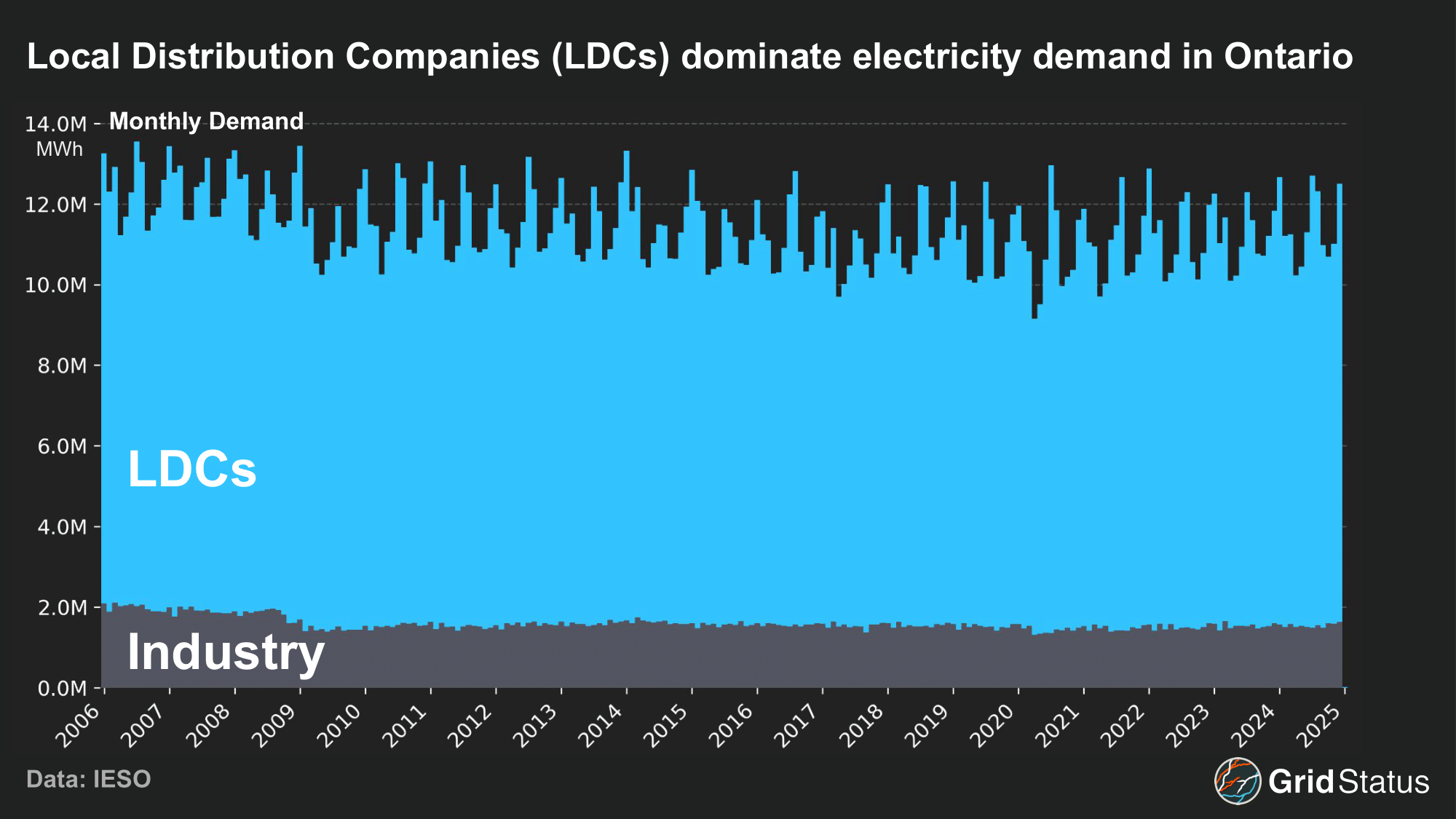

Demand in IESO

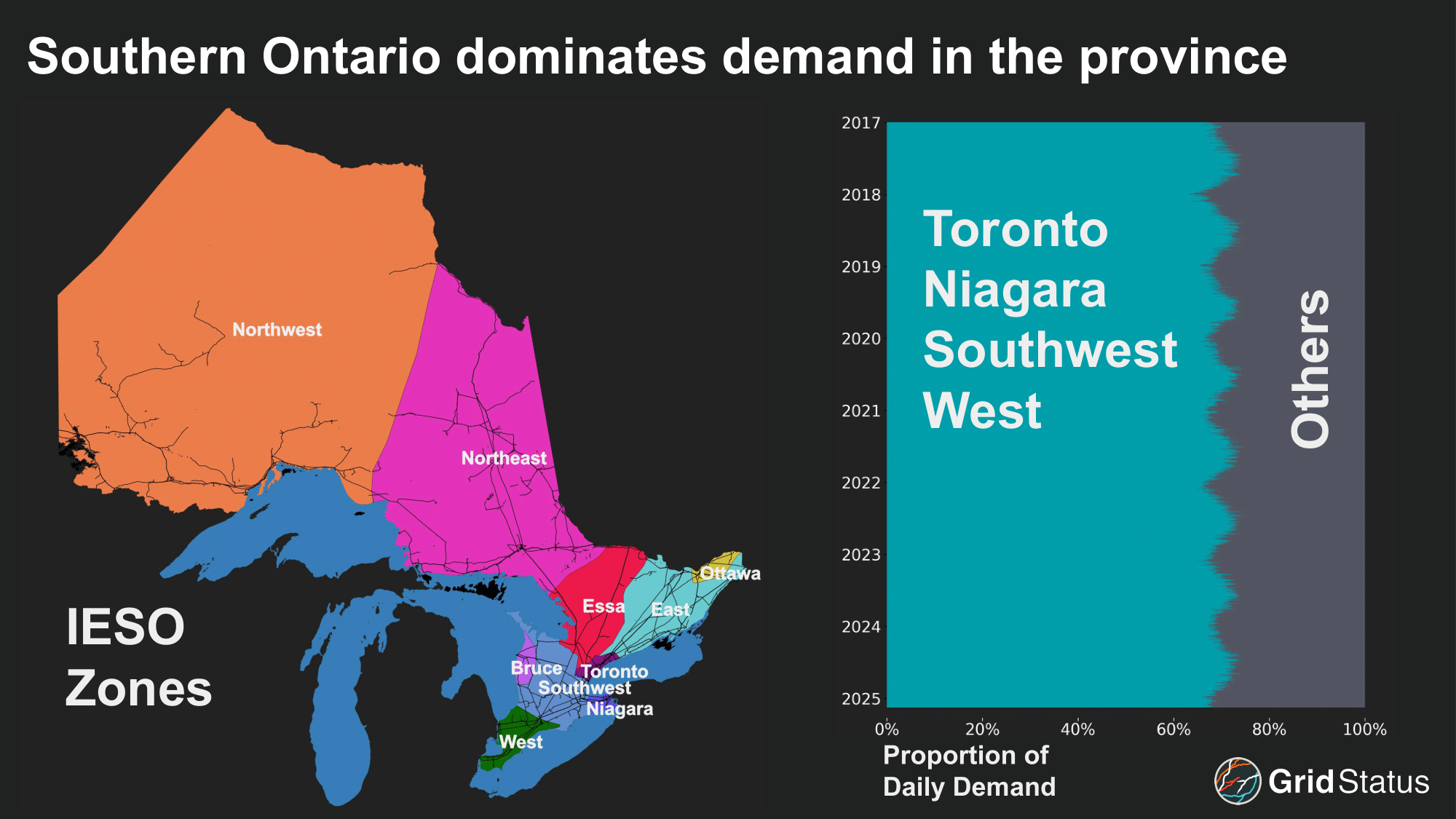

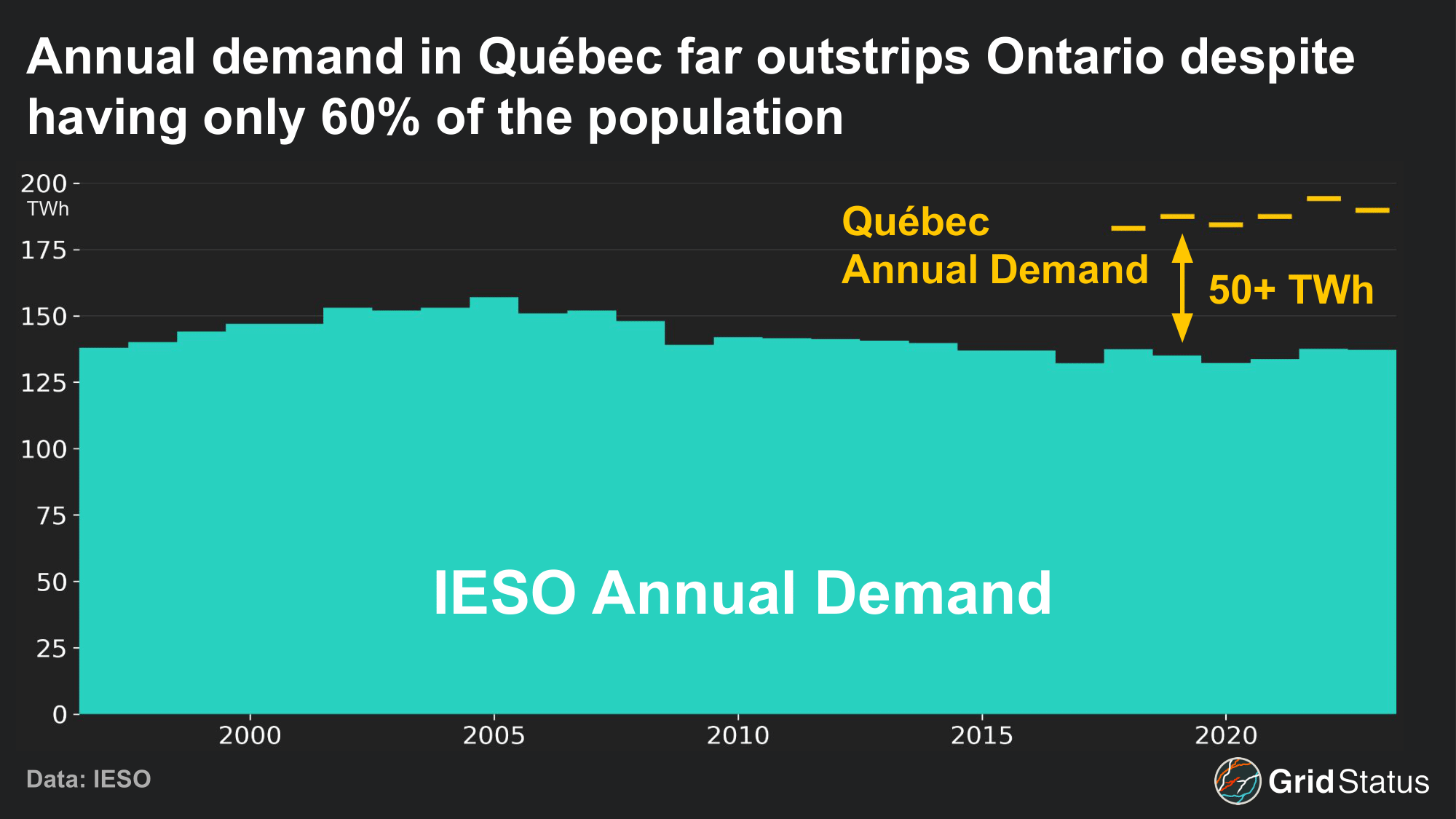

Many Canadian provinces are geographically large, but Ontario is also the most populous. With more than 15 million residents Ontario contains almost 40% of the national total. This population is skewed towards the southern extent of the province, with more than 40% living in the greater Toronto area. This population distribution leads to heavily concentrated demand levels in southern Ontario from both residential usage as well as commercial and industrial demand, which, to date, have been somewhat insulated from congestion via the legacy systemwide pricing scheme.

An Interconnected Province

IESO manages a physical system without a single US analogue.

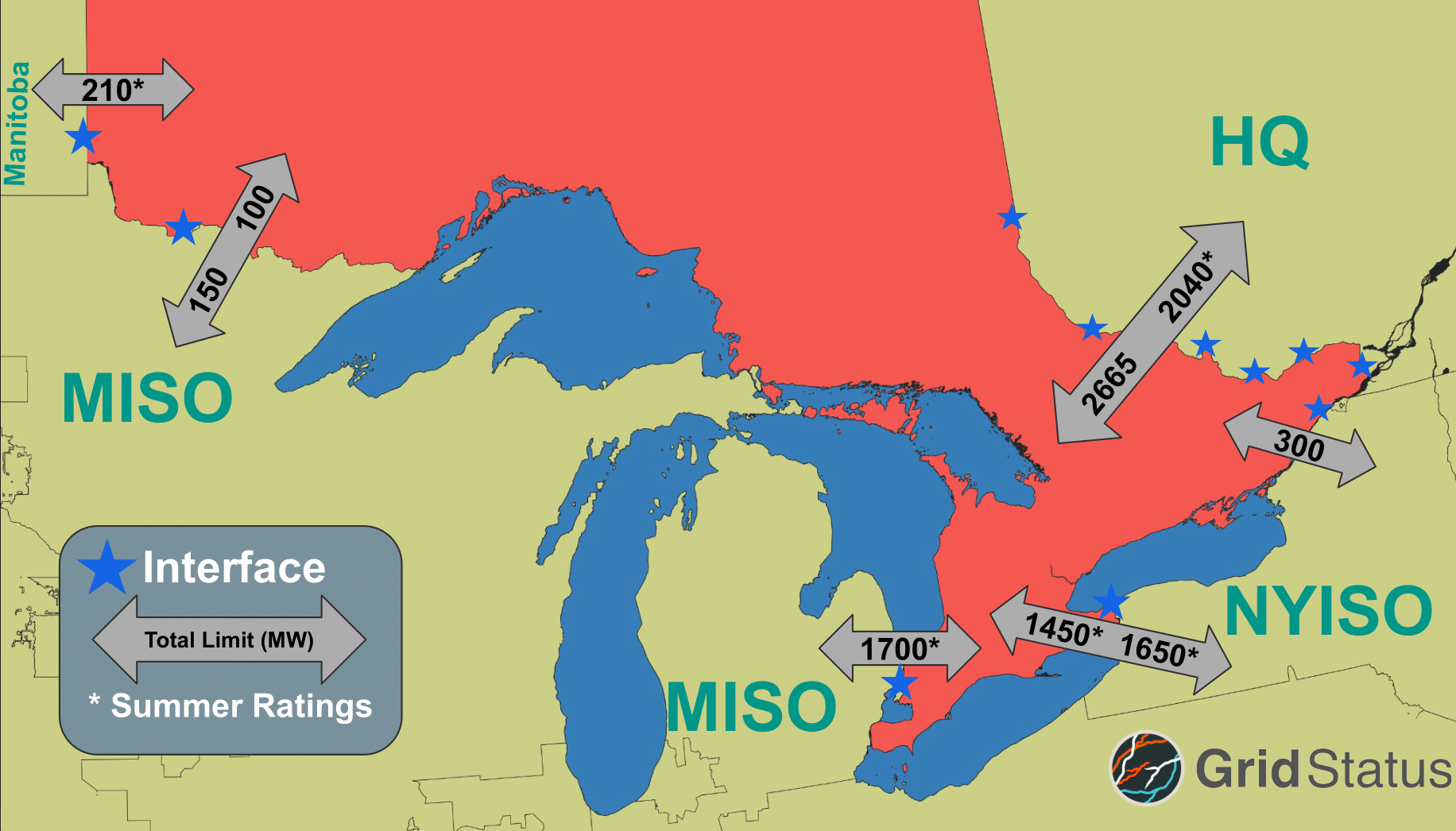

Ontario covers 150% of the geographic area of Texas, maintains many interconnections with both market and non-market regions like PJM, and has heavily concentrated load in Toronto like NYC in NYISO.

With respect to independence, IESO sits somewhere in the middle in terms of single-state system operators, with CAISO and ERCOT at one end and the NYISO at the other. Some of these characteristics have been masked by the existing market structure, but will play a larger role going forward. Let’s start by taking a look at those neighbors.

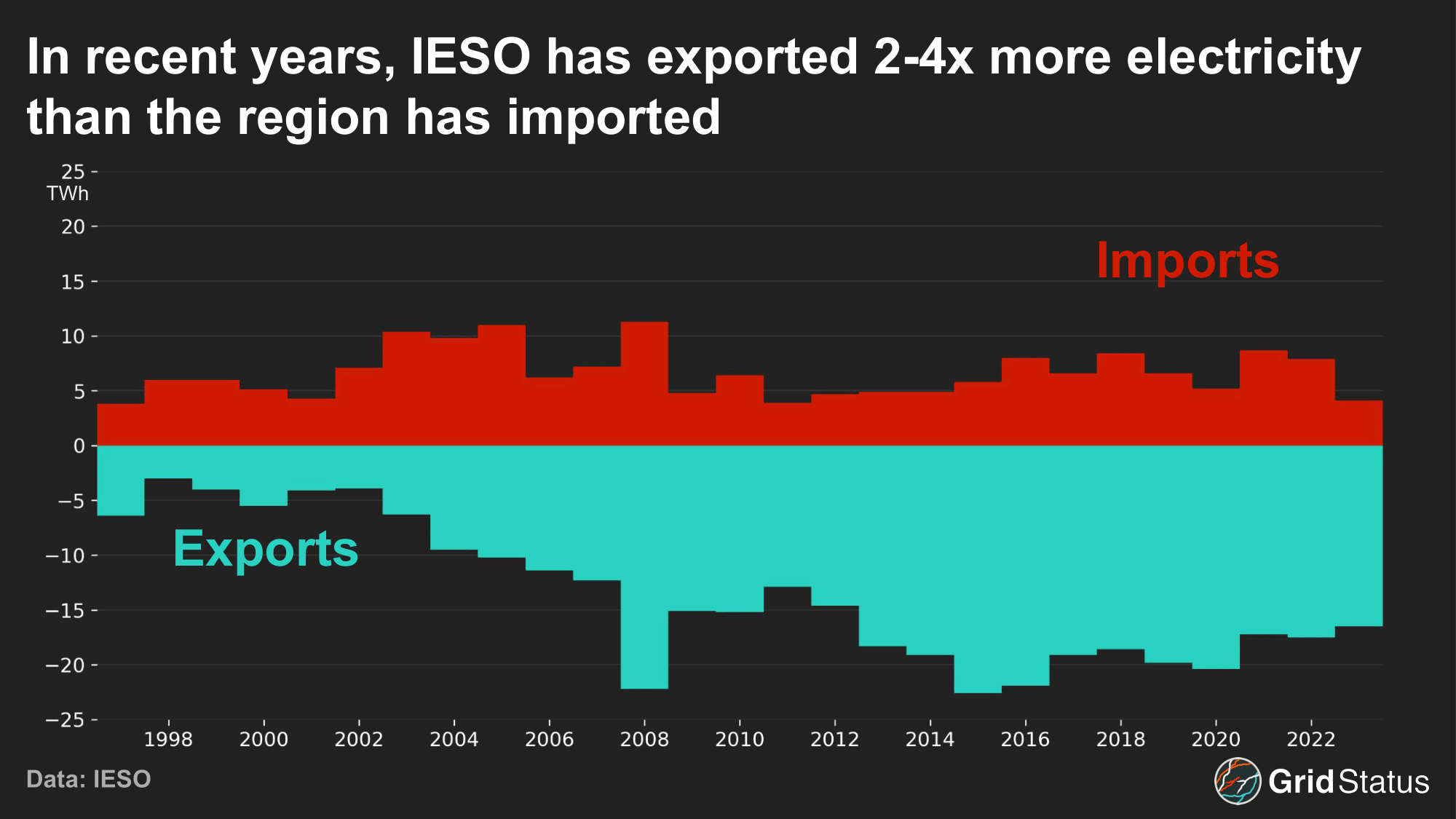

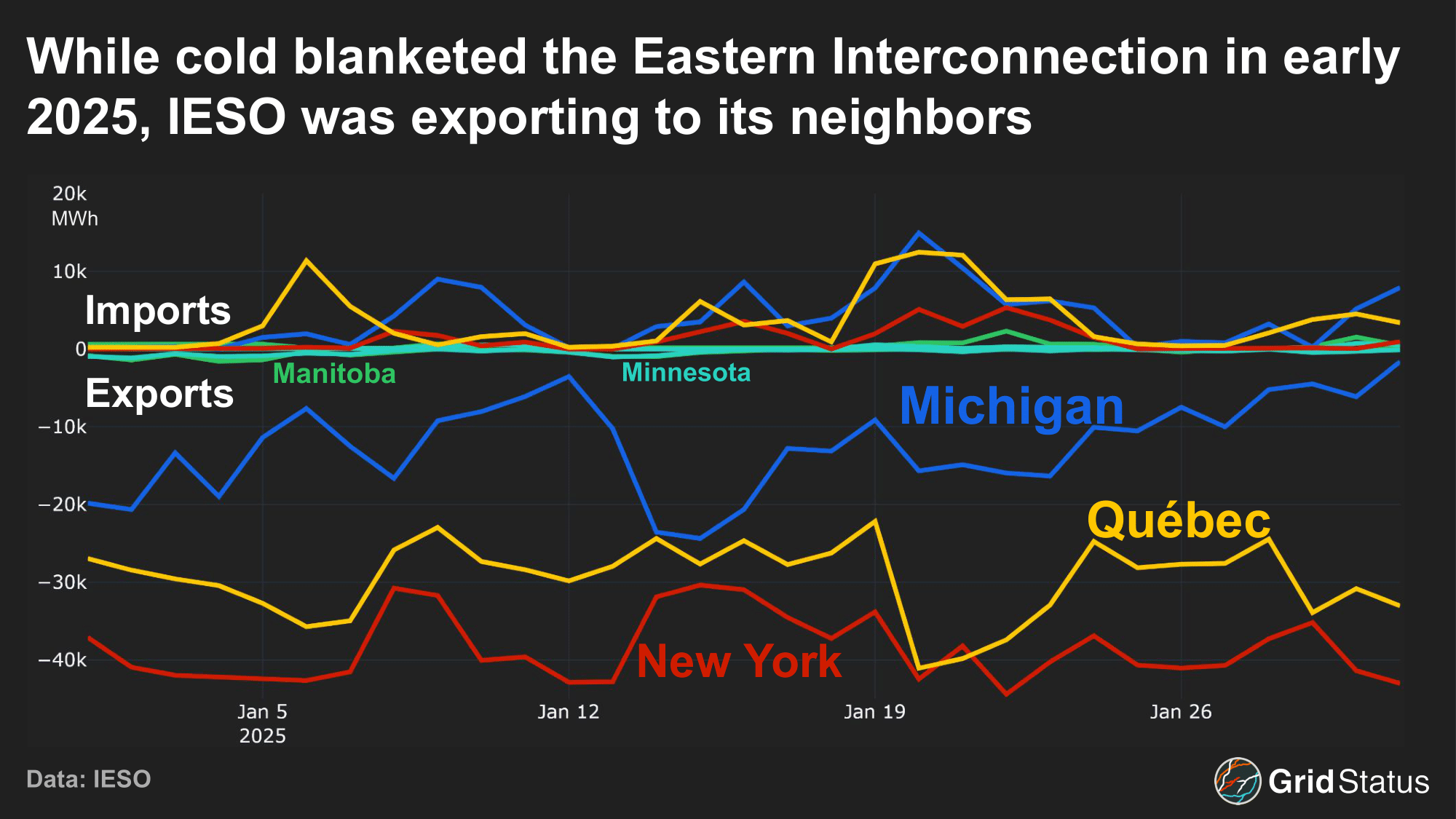

IESO is connected to domestic provinces to the east (Québec) and west (Manitoba), and maintains multiple international connections with both NYISO and MISO. New York, Michigan, and Minnesota all have direct connections with Ontario. International interchange between these regions and Ontario has been important for decades, with total interchange exceeding 20 TWh per year.

The current state of IESO and other major players in Ontario electricity is a result of the breakup of a single entity in the late 1990s, Ontario Hydro.

Ontario Hydro’s Legacy

Before diving into the future, let’s take a trip through the past to understand some of IESO’s unique quirks and the state of play in Ontario writ large. Background on the major players and provincial government involvement is important context to parse both Market Renewal’s initial goals and final implementation.

Initial Deregulation

Ontario’s power system was deregulated on a similar timeline to neighboring regions, with legislation appearing in the late 1990s and go-live date of May 1st, 2002.

In contrast to neighbors like MISO and NYISO, market development was more restrained, with limited additions in the years since. Notable absences include the lack of a day-ahead market, and, aligned with the European experience, a nodal system.

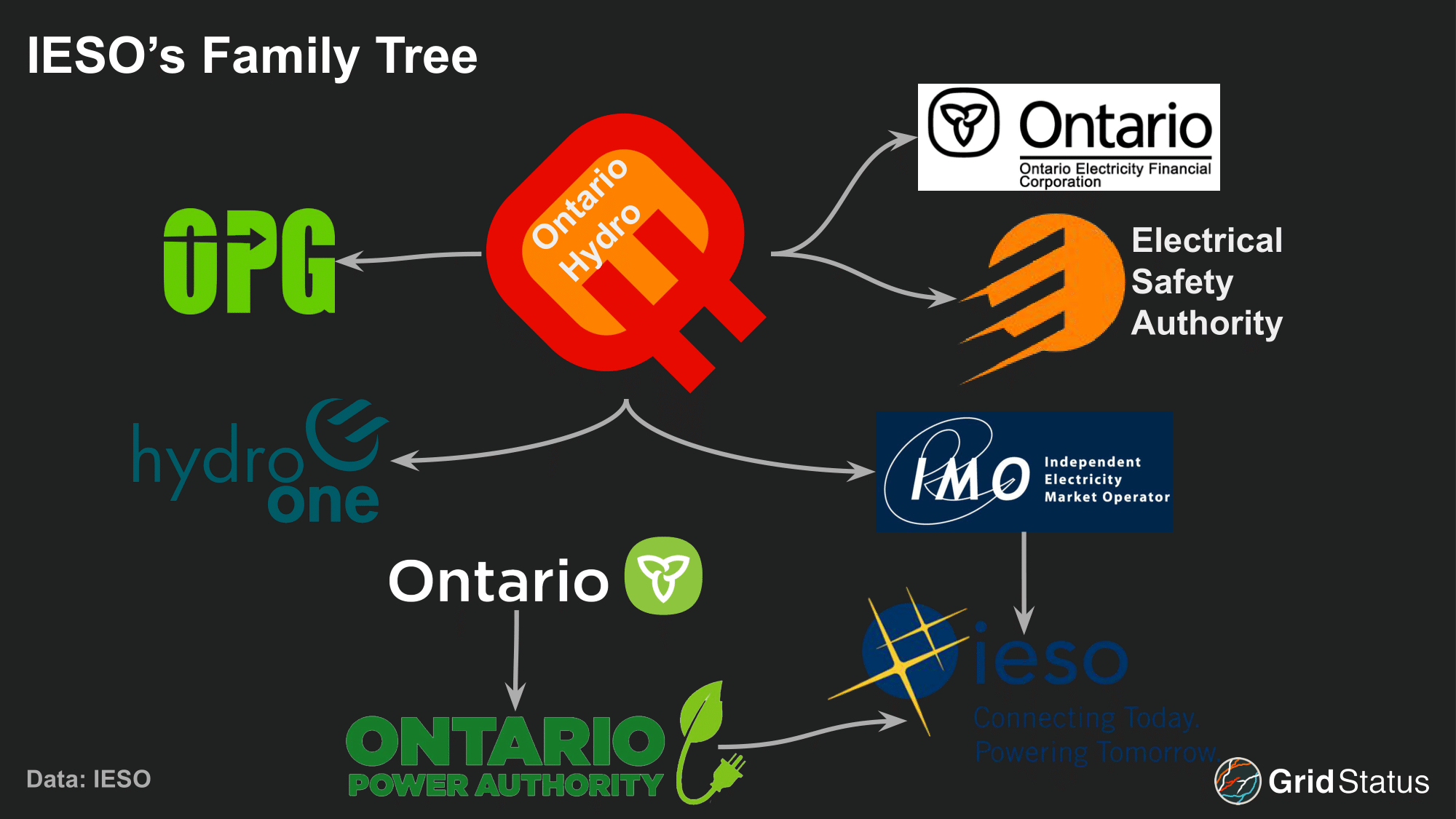

This market’s original incarnation was as the Independent Electricity Market Operator (IMO) — part of the breakup of the insolvent Ontario Hydro.

Ontario Hydro had its functions spun out into multiple crown corporations: transmission and distribution utility functions became HydroOne; Ontario Power Generation (OPG) as a generator owner and operator; the Electrical Safety Authority regulatory body; the Ontario Electricity Financial Corporation to manage Ontario Hydro’s debts and new financing; and finally IMO in the same market and system operator role as other ISO/RTOs.

Crown corporations are a form of state-owned enterprise, in this case part of the provincial government, although with significant separation compared to a direct agency or department. Crown corporations fill a sort of middle role where a service may not be viable for a private enterprise to provide, but also does not directly fall to a particular ministry, with a mix of commercial and public objectives.

This breakup couldn’t fully resolve Ontario Hydro’s debts, so from early 2002 to 2018, Ontario ratepayers were paying down a portion of Ontario Hydro’s more than $19B in stranded debt via a Debt Retirement Charge.

The Crown Children

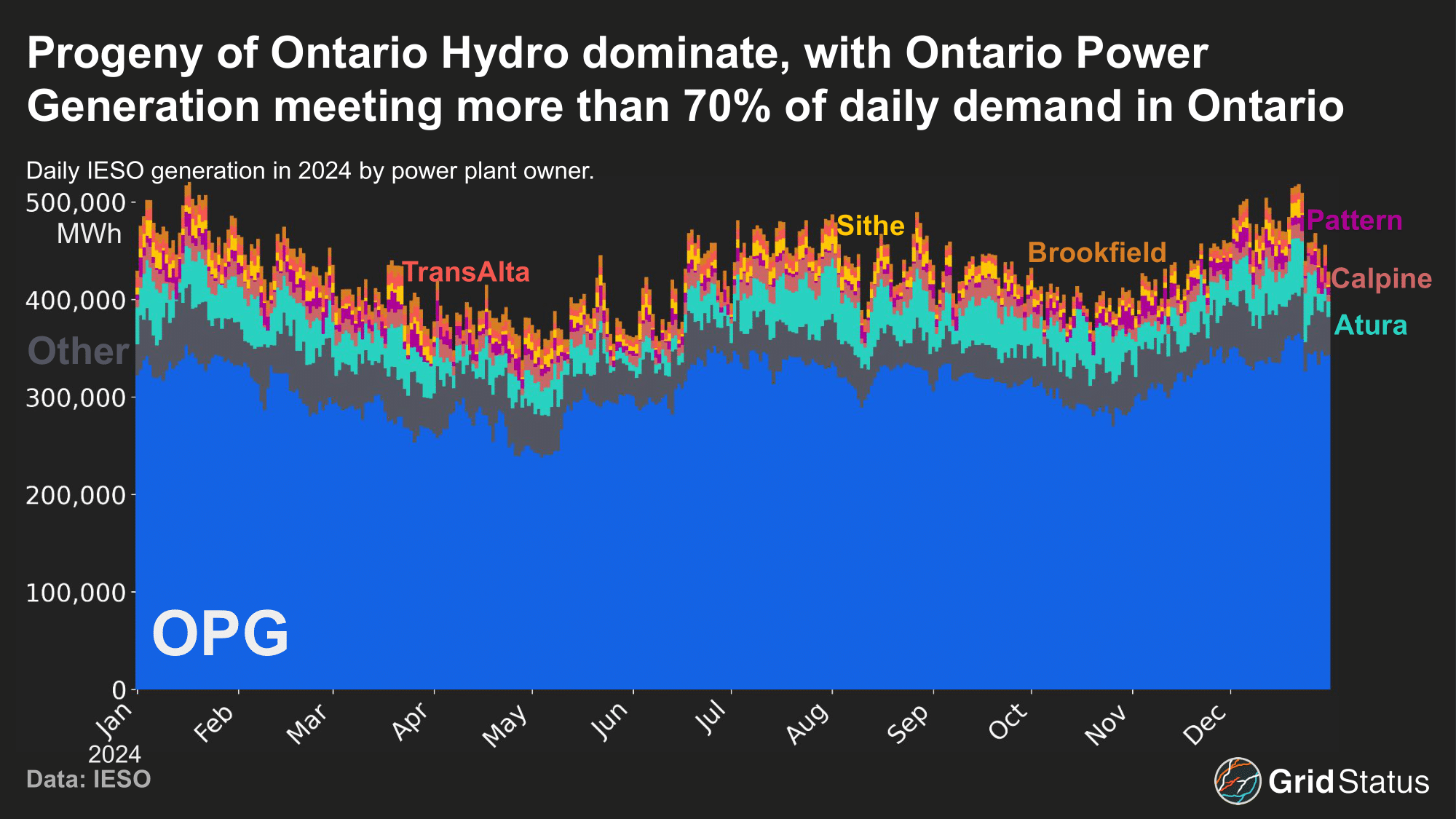

HydroOne was privatized in 2015 and is still the largest transmission operator and distributor of power in Ontario, serving over a quarter of the province’s customers (1.5 million) while operating nearly 90% of transmission in the province. On the generation side, the vast majority is owned by OPG, a crown corporation owned by the provincial government. OPG produces nearly three fourths of the province's electricity, owning over 70 plants, with the majority being hydroelectric.

While the aspiration of deregulation was to increase the number of participants in the market, the vast majority of transmission and bulk of generation still remain under the control of the entities founded in the wake of the break up of Ontario Hydro.

The first few years of deregulation were challenging. High prices caused the provincial government to freeze supply rates in November of 2002, only six months after implementation. This left the market with few price signals and unclear direction to address what many saw was a failing system. In the wake of this rough start, the Ontario Power Authority (OPA) was established in 2005 to streamline grid planning and procurement of new generation.

Alongside the creation of the OPA, IMO was rebranded into IESO. The OPA was focused on long-term planning and resource adequacy. IESO and the OPA were merged in 2015, bringing day-to-day market operations under the same roof as planning and competitive procurements. The original breakup and following reforms cemented another quirk of Ontario - the lack of competitive load serving entities (LSEs). Under the current structure, IESO ensures resource adequacy and essentially is the province’s LSE, while hundreds of Local Distribution Companies (LDCs) were established to serve end customers.

While both LSEs and LDCs ultimately exist to distribute power to end consumers, a key difference between the two is the more active approach LSEs take in the future planning of their service territory, such as contracting out new generation via agreements with independent power producers, or in the case of some regions, operating their own fleet of assets. In contrast, LDCs exist primarily to distribute power to end-use customers.

IESO’s Many Hats

Taken together, IESO today is a crown corporation that fills the roles of ISO/RTO, LSE, and planning and procurement authority.

IESO’s structure is unique in North American power markets, acting as if its neighbor, NYISO, also contained the New York Power Authority (NYPA), the New York State Energy Research and Development Authority (NYSERDA), and were a state-owned corporation.

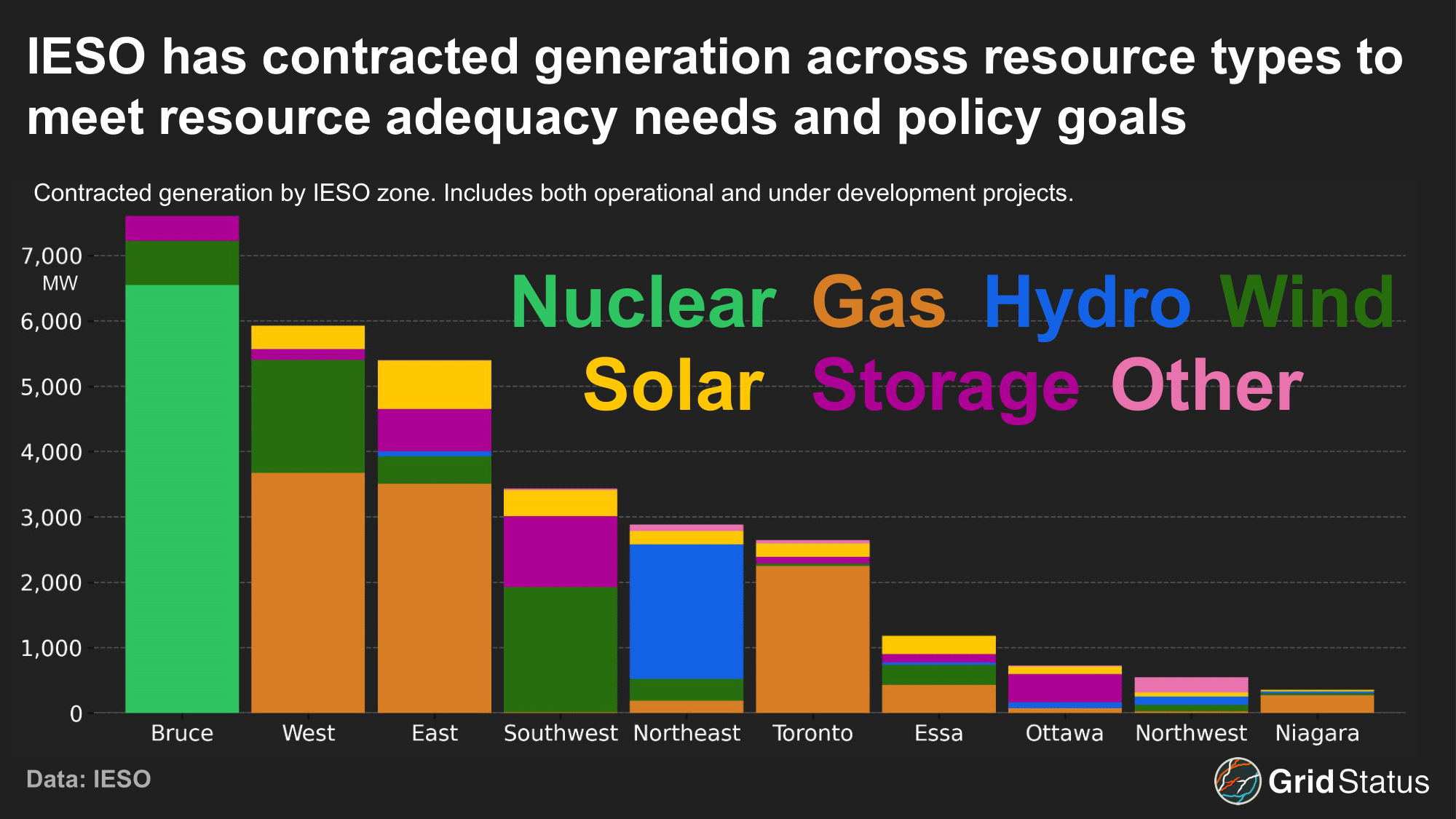

In fulfilling these responsibilities, IESO has contracted with nearly every kind of generating technology.

While IESO’s many hats could streamline operations by bringing day to day operations and long term planning under one roof, a lack of competitive pressure and a 1000-foot view can also lead to costly mistakes. During its tenure, OPA contracted for the construction of multiple gas plants to address reliability issues surrounding Toronto. These plants were eventually cancelled, costing rate payers more than $1.1 Billion CAD. A study commissioned after this failure argued that a local LSE would have been better equipped to address local reliability issues than OPA.

In this context, IESO has set out to reorganize its market under the Market Renewal Program (MRP).

Market Renewal Program (MRP)

The MRP officially kicked off via a 2017 study, introducing the biggest changes to IESO markets since its inception. MRP touches everything from price formation to unit commitment, but some planned updates had major design changes in the interim years, and one major feature was dropped entirely. In part due to these alterations, IESO’s anticipated savings of $700 Million CAD over the first ten years of operation are down substantially from the $3.4 Billion estimated in 2017.

After years of preparation, these changes go into effect on May 1st 2025. Overall, the program is expected to increase overall market efficiency, in part by surfacing the true cost of locationally-varied generation and consumption. The MRP has three major pillars, with the following directly from the IESO website:

- Replace the two-schedule market with a single schedule market (SSM) that will address current misalignments between price and dispatch, eliminating the need for unnecessary out-of-market payments.

- Introduce a day-ahead market (DAM) that will provide greater operational certainty to the IESO and greater financial certainty to market participants, which lowers the cost of producing electricity and ensures we commit only the resources required to meet system needs.

- Reduce the cost of scheduling and dispatching resources to meet demand as it changes from the day-ahead to real-time through the enhanced real-time unit commitment (ERUC) initiative.

Big Changes for Generators

Arguably, the most impactful changes are for generators. From how they’re scheduled to what they’re paid, daily operations are shifting significantly.

In most North American power markets generators can be scheduled in the day-ahead at a “locational” price associated with their bus or gen node. Their ultimate settlement is determined by the difference between their real-time operations, at the same price location, and their financially binding day-ahead schedule (ignoring out-of-market payments).

Currently, Ontario lacks a day-ahead market or locational pricing for generators, and leans on out-of-market payments to manage inefficient commitment. The MRP addresses each of these and more.

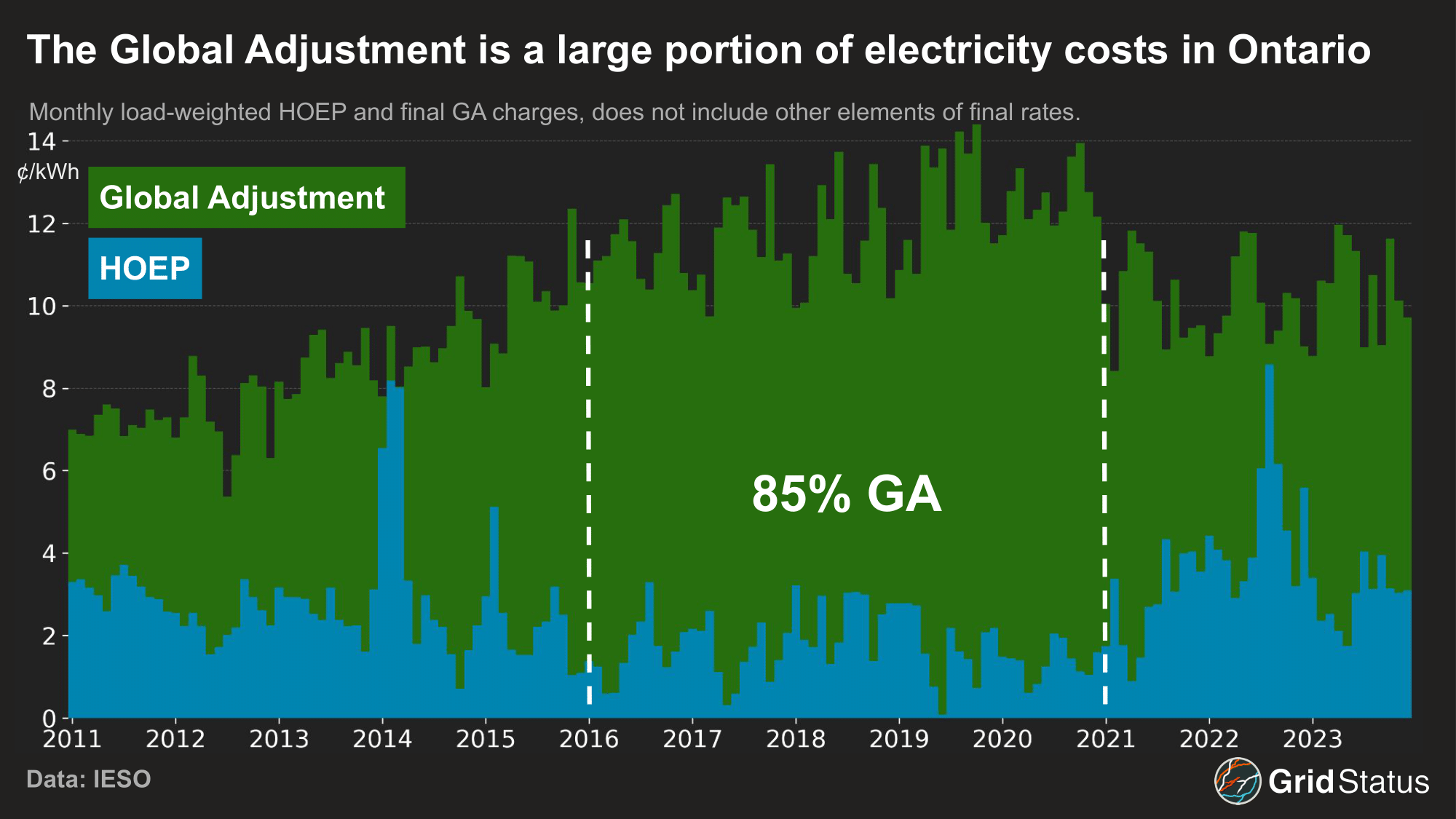

Today, IESO’s price formation and ultimate settlement is a mishmash. Actual settlement prices are derived from 5-minute, marginal clearing prices (MCPs) and the Hourly Ontario Energy Price (HOEP) which is a load-weighted average of the MCPs. Then, for consumers, an additional Global Adjustment charge is also layered in. The MCPs and HOEP will be replaced by Locational Marginal Prices (LMPs).

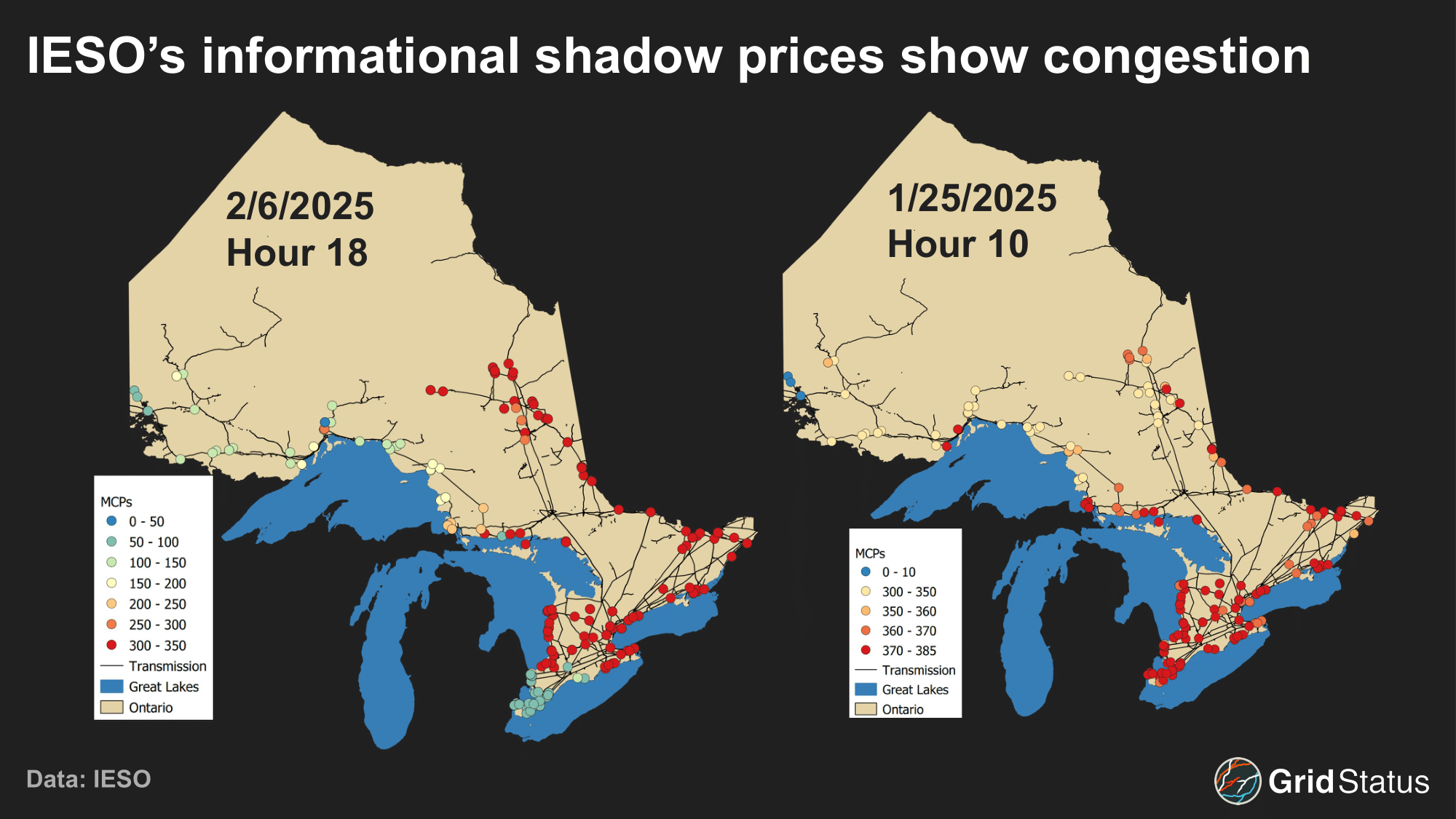

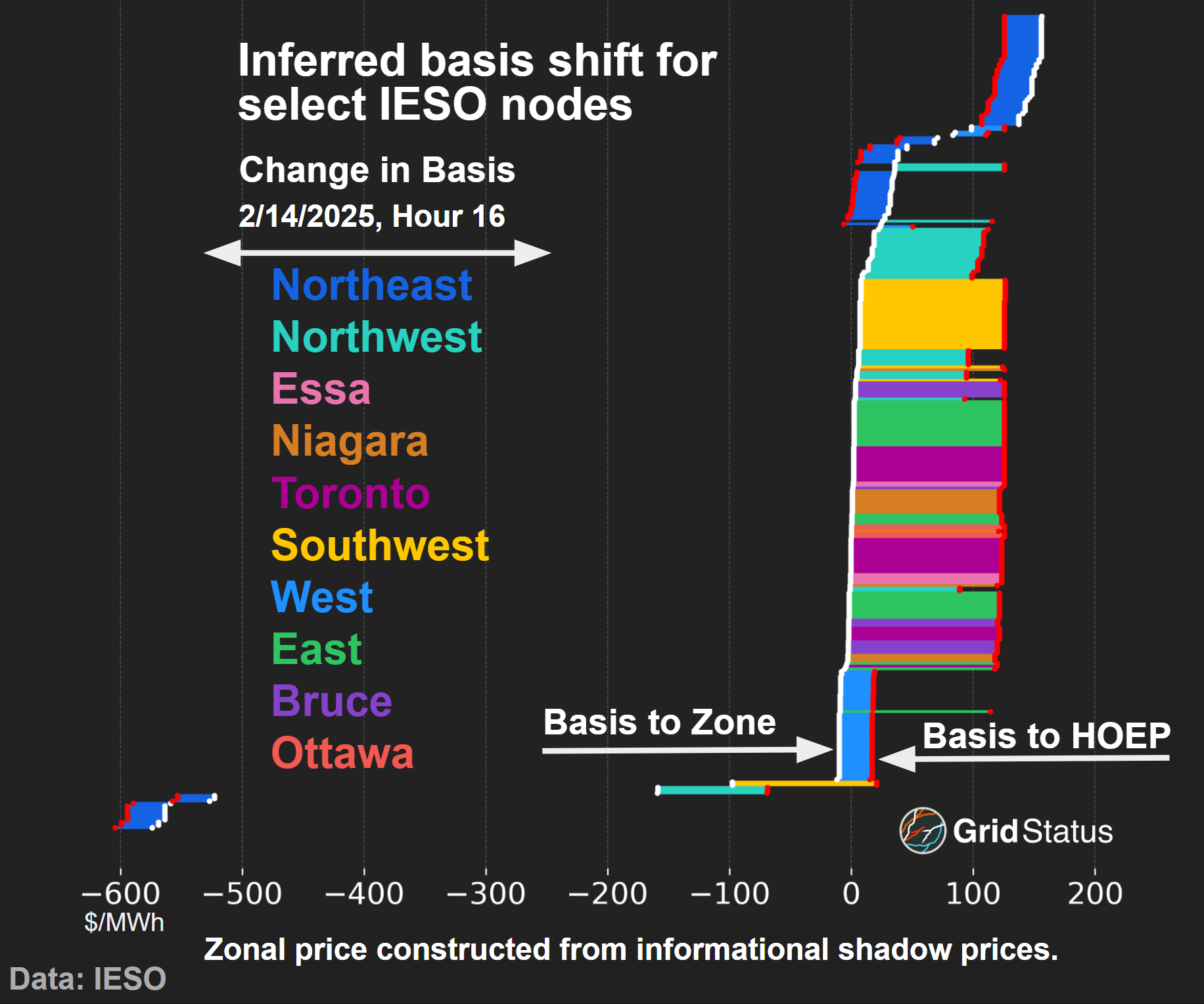

Even though IESO isn’t currently nodal, they do publish “informational” shadow prices at a number of locations.

In reviewing the shadow price data, we have observed a handful of regular patterns. Perhaps intuitively, the area around Toronto is regularly priced higher than the rest of Ontario, but there are also many intervals with a large divergence between prices along the Michigan border in the West zone and the Southwest/Toronto/Niagara region. IESO itself has discussed periods of extreme negative shadow prices as well, particularly in the Northwest. Currently, the systemwide pricing scheme means that this isn’t reflected in energy settlements. It will be interesting to see what, if any, changes to these patterns occur once generators and (some) loads are exposed to local prices.

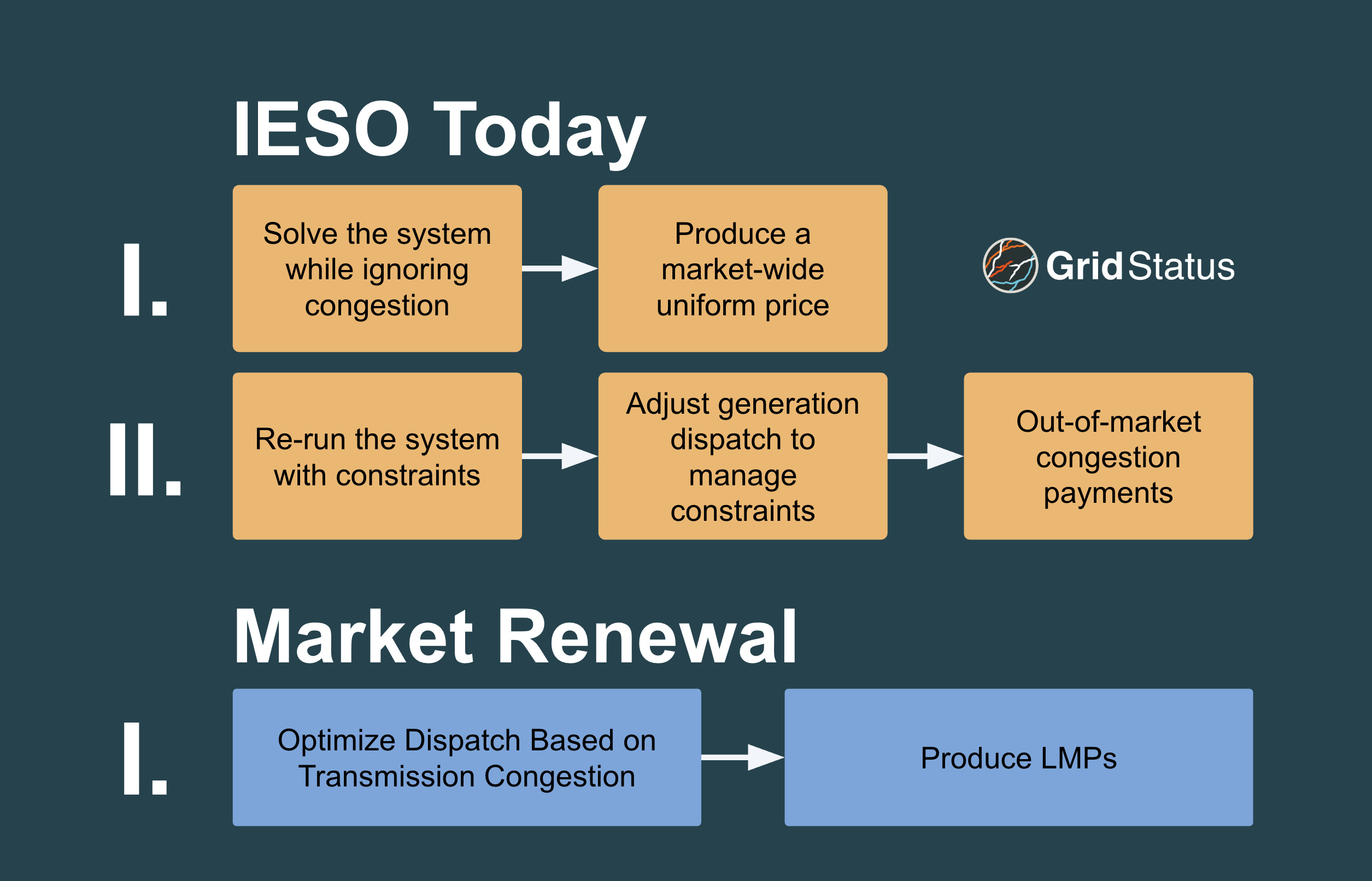

Two Schedule System, One Big Headache

Many benefits of a nodal system arise from congestion prices. Currently, the HOEP in Ontario lacks this component.

To manage the mismatch between price and dispatch, IESO operates under a two-schedule market, which distorts prices by failing to accurately reflect the actual costs of generating and consuming electricity in IESO.

Under the two-schedule system, the first schedule ignores physical congestion on the grid in order to establish a province-wide uniform market price. This price is further used to settle financial transactions within IESO.

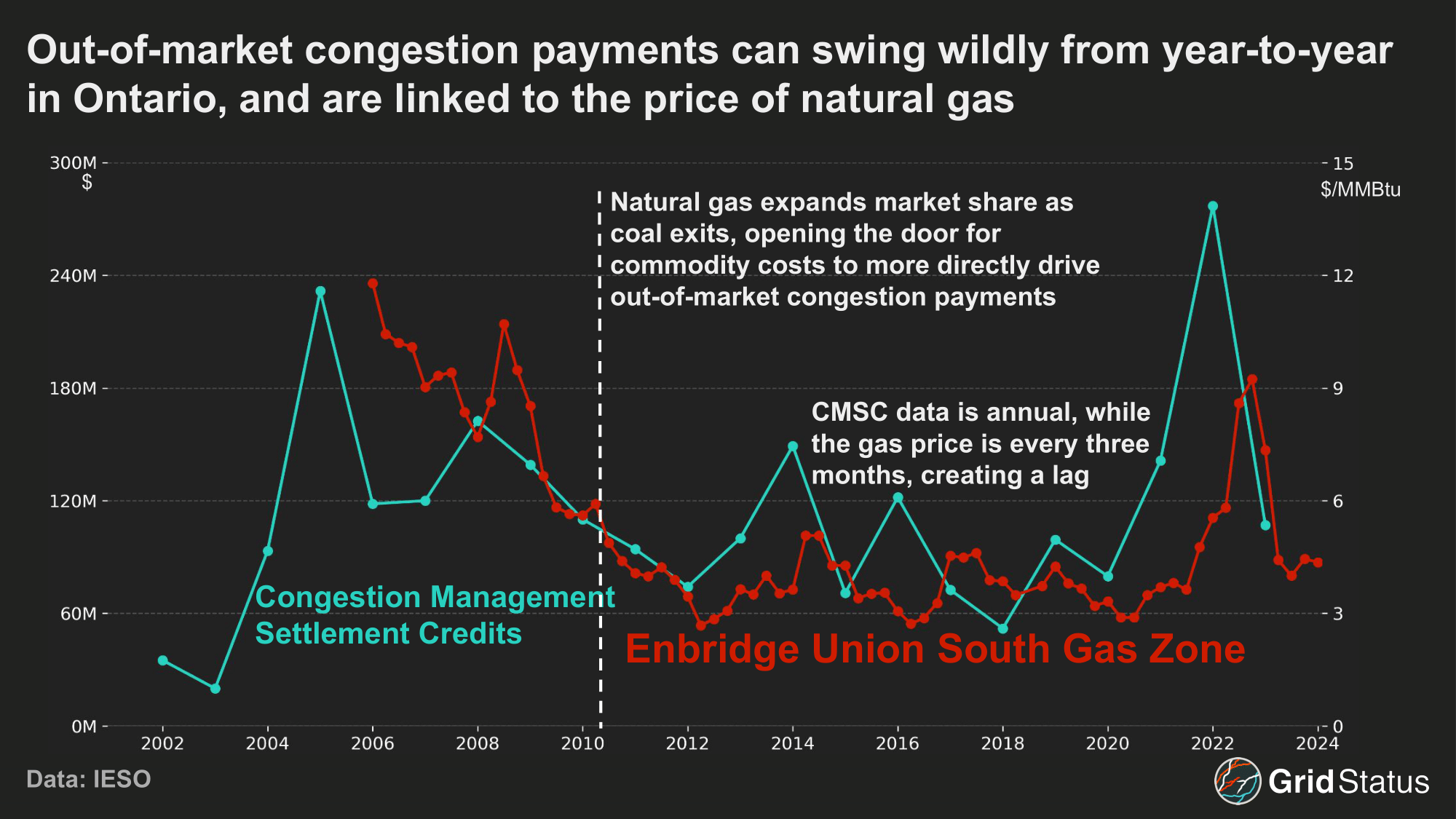

The second schedule takes system constraints into account and is used by IESO to dispatch units. Units that may have cleared higher levels of generation under the first schedule will have actual levels limited as congestion on the grid is taken into account. When the two prices do not match, the discrepancy is handled via congestion system management credits (CMSC). Under the current rules, these payments amount to around $100 Million CAD per year.

Dealing with congestion costs in this way subsidizes inefficient power flows across the region and prevents the most efficient outcomes with respect to generator schedules.

Under the new approach laid out in IESO’s Markets Renewal program, the two schedule system will be replaced with a single schedule market that takes congestion into account using LMPs. With congestion calculated and published by IESO in both the day-ahead and real-time markets, CSMCs will be eliminated.

Aligning Markets with a Two Settlement System

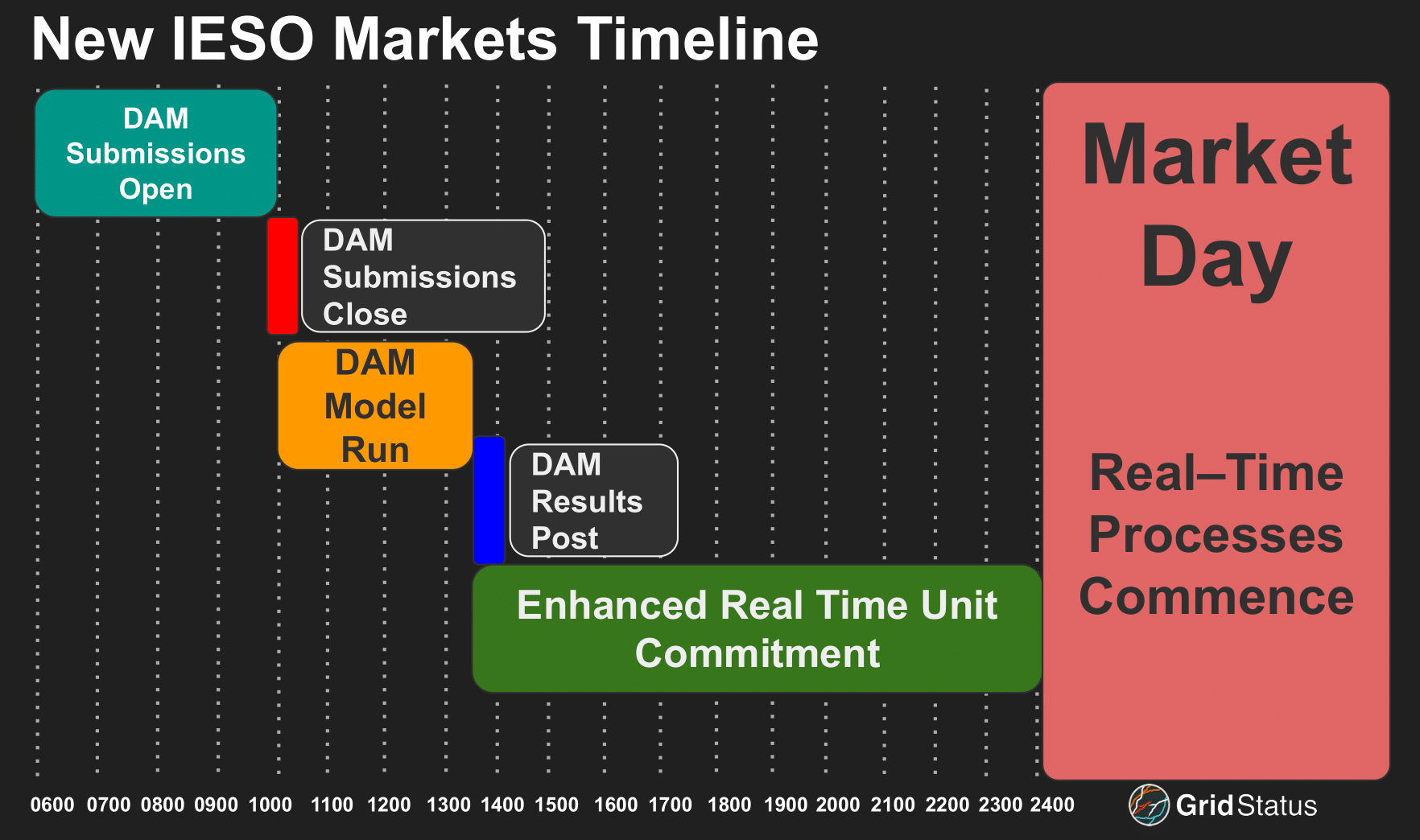

Currently, IESO only operates a Day-Ahead Commitment Process (DACP). While the name may seem similar to the day ahead markets (DAM) of traditional ISOs, DACP is rife with inefficiencies compared to a standard DAM.

Under the DACP, generators declare their ability to run and an intended output for the next day. This system is not financially binding as the market settles only in the real time, so discrepancies in the level of generation IESO expects compared to real time operations are not penalized.

Under the MRP, IESO will transition from the DACP to a binding DAM with a two settlement system.

Yes, this is confusing. IESO is moving from a two schedule system to a single schedule system at the same time as they are replacing their single settlement process with a two settlement setup. Bewildering language is an unfortunate hallmark of power markets.

The DAM submission window will open at 6AM EPT and close at 10AM EPT, the same schedule as the existing DACP. Offers submitted into the DAM will be scheduled to match forecasted market load levels. Offers cleared under this system will have financial obligations to meet their day ahead commitments in the real time.

- Transactions are scheduled in the day-ahead, and;

- Are settled in real-time against actual operations.

The two settlement system provides greater financial certainty for operators and consumers as they can lock in their pricing in the day ahead, and barring any discrepancies from their awards, be paid that price regardless of how high or low the real time market spikes. This structure allows for IESO to have greater certainty in its real time operations as generators are committed to following pre-established output schedules.

For generators, these price formation and scheduling reforms are already major changes, but their actual commitment is also undergoing an evolution.

Unit Commitment Enhancements

A financially binding day-ahead market helps to align price and cost, but can’t alleviate unit commitment issues during the interim period between the posting of day-ahead results and commencement of the operating day. Without unit commitment in this period, a market leans more heavily on high real-time prices to meet challenging conditions. Since 2003, IESO has utilized the Real-Time Generation Cost Guarantee (RT-GCG) program to commit units in this period and allow for cost recovery.

For more than 20 years, the RT-GCG process has only considered energy cost offers. This means that the commitment process is incapable of assessing the total costs that result from other cost-based and physical parameters units might have, such as no load costs and minimum run times. This is where the “Cost Guarantee” comes into play, with IESO guaranteeing the costs of units committed in this process. These are make-whole payments, a line item that most ISOs strive to reduce or eliminate as they are both inefficient and particularly vulnerable to gaming and fraud. IESO, with its unique resource mix, has a high penetration of both non-quickstart (NQS) generators and quick-start, but uniquely constrained, hydropower units. Each of these groups’ characteristics are not adequately captured by energy-only bids.

IESO’s dispatch data parameters have two NQS facility types: Nuclear and Other, which in turn map onto either single cycle or combined cycle generation facilities. Entirely new parameters are limited to the “Other” category for NQS generation facilities, while quick-start hydro-electric generators also have a suite of new parameters. The current system’s failure to account for non-energy costs can drive up systemwide costs. For example, a unit that offers a lower $/MWh, but high startup costs, may clear instead of a unit with lower total costs because RT-GCG only considers energy costs.

Unsurprisingly, the existing RT-GCG program has had issues with unscrupulous behavior. Initially only covering fuel costs, the program was expanded in 2009 to cover O&M as well.

During the 2010s, IESO’s enforcement division carried out audits that led to clawbacks and penalties exceeding $200M. In a 2016 review of 2015 operations, the Ontario Energy Board’s Market Surveillance Panel found that RT-GCG commitments were needed for reliability in less than 1% of situations.

Enhanced Real-time Unit Commitment (ERUC) is meant to ameliorate these issues.

After market renewal, ERUC will consider a three-part offer:

- Start Up Cost Offer: Costs associated with bringing a generating unit from offline to grid synchronized.

- Energy Cost Offer: Costs associated with the generation of an additional MW of power, such as fuel costs, emissions costs, and other O&M costs.

- Speed-No-Load Cost Offer: Costs units incur to keep a unit online without the unit sending power to the grid.

In addition, these characteristics will be optimized over all remaining hours of the operating day to meet system and unit constraints. The current RT-GCG process optimizes each hour independently, further reducing the opportunity for efficient unit commitment, as many generators have minimum run times that span several hours.

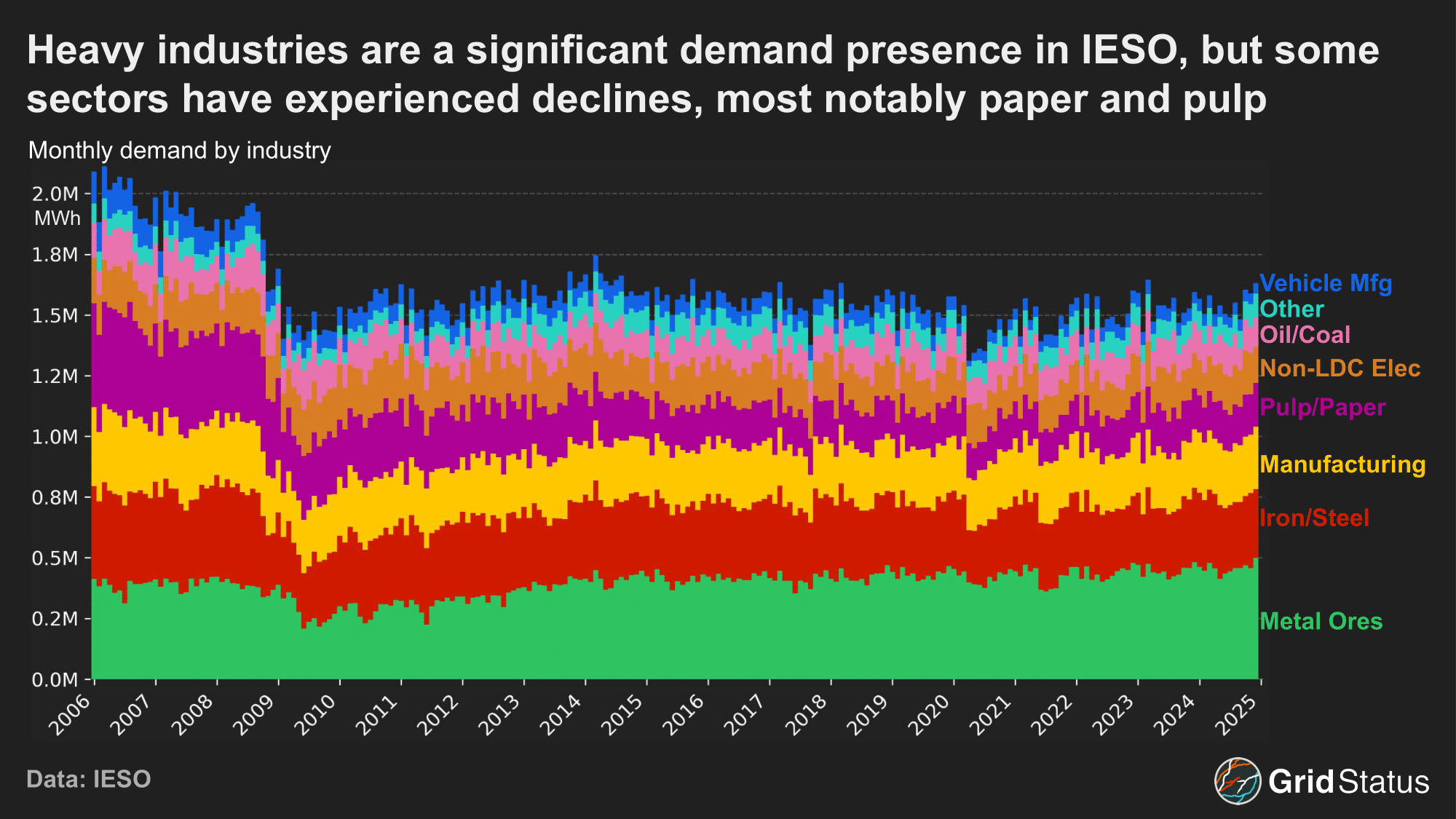

Load Tension: Active vs. Passive

Today, despite the concentration of demand in Toronto, charges to a load in the city incorporate the same system-wide energy price as one in Bruce or Northwest. This type of discrepancy is handled in other markets by load zones. Zones have different specific definitions in each market, but generally they are defined by a combination of demand profile and topological conditions that group a particular area together.

Initial plans included the use of aggregate zonal prices to settle transactions for passive loads, but after negative stakeholder feedback, IESO decided to revert back to an Ontario Zonal Price (ONZP). The ONZP is a load weighted LMP across the province, which may sound familiar. Concentration in Ontario energy isn’t limited to generation, transmission, and operations, it also extends to loads, who remain very powerful in the stakeholder process.

Specifically, zonal pricing was abandoned to address “concerns regarding potential price variability” as well as implementation challenges for LDCs which cross multiple zones. While this may be a valid concern on the part of some ratepayers, it also eats away at the benefits of a nodal market as local costs to loads will be even further from local payments to generators. Non-dispatchable loads (NDLs) will be subject to the Load Forecast Deviation Adjustment (LFDA), which can increase or decrease the ultimate settlement across all NDLs depending on the consumption of energy in real-time relative to the day-ahead forecast, but this is not a locational price.

This change demonstrated the power of LDCs in Ontario’s unique stakeholder milieu.

While non-LDC industrial demand remains important, the LDCs make up the vast majority of load in IESO.

IESO classifies load into two categories, active and passive. Active loads currently make up around 14% of the system demand. IESO’s planning assumes a higher degree of responsiveness from price-sensitive loads that are no longer shielded from real-time congestion costs. Despite this, it is difficult to imagine all extant active loads in newly congested areas will continue to participate when they can elect to become passive and settle at the ONZP. Passive loads lose their ability to participate in the full DAM, which active loads can use to lock in the cost of their expected consumption and hedge against potential price spikes that occur in the RT.

While moving from active to passive limits the ability to hedge real-time risk, not all loads can, or want to be, price responsive.

In this context it remains important to understand the HOEP’s Global Adjustment (GA) charge, as it will continue to exist following implementation of the MRP. The GA is shaped by a set of after market payments to generators that have entered agreements with IESO depending on how high or low the HOEP settled that month. GA varies with the HOEP; months with higher energy prices have lower GA payments as higher revenue means fewer dollars are required to make generators whole via aftermarket payments.

The global adjustment factors to specific Class A loads (large industrial and commercial customers) are in turn influenced by a peak demand factor, which is similar to coincident peak pricing in other regions. Because the HOEP was materially preserved for loads, as the ONZP, this system should continue to function in a similar way, but with the caveat that individual generator returns will now have greater variability due to the nodal system.

Virtuals and Murky Zonal Dynamics

Traditionally, IESO has been somewhat closed off to fulsome financial participation compared to other markets. While traders will undoubtedly be involved in the financial and operational changes discussed above, IESO is also adding the purely financial virtual transactions to provide additional day-ahead liquidity.

Virtuals are financial positions that pay out based on the difference between prices in the day-ahead and real-time markets. IESO’s market design is similar to NYISO’s rather than PJM’s or MISO’s in that virtuals will only be allowed between aggregated locations and not individual buses or nodes on the grid. So while zonal prices will not be used in settling load transactions, these zones will be used for virtual trading in the DAM. As with other DAM transactions, these will be financially binding. While virtual transactions will settle to RT zonal average prices, the lack of these prices for load poses unique challenges for deal structuring in IESO.

In markets with zonal average prices, market participants use these as hedges in transactions such as power purchase agreements (PPAs) and in trading. In these scenarios, transactions would be settled to the basis between a nodal LMP, such as a generator's LMP, and the Hub or Zone the unit is a part of.

The lack of zonal pricing for loads raises the issue of basis settlement in IESO. Contracts settled to the ONZP may result in wide pricing differences based on the actual congestion patterns that emerge with market renewal.

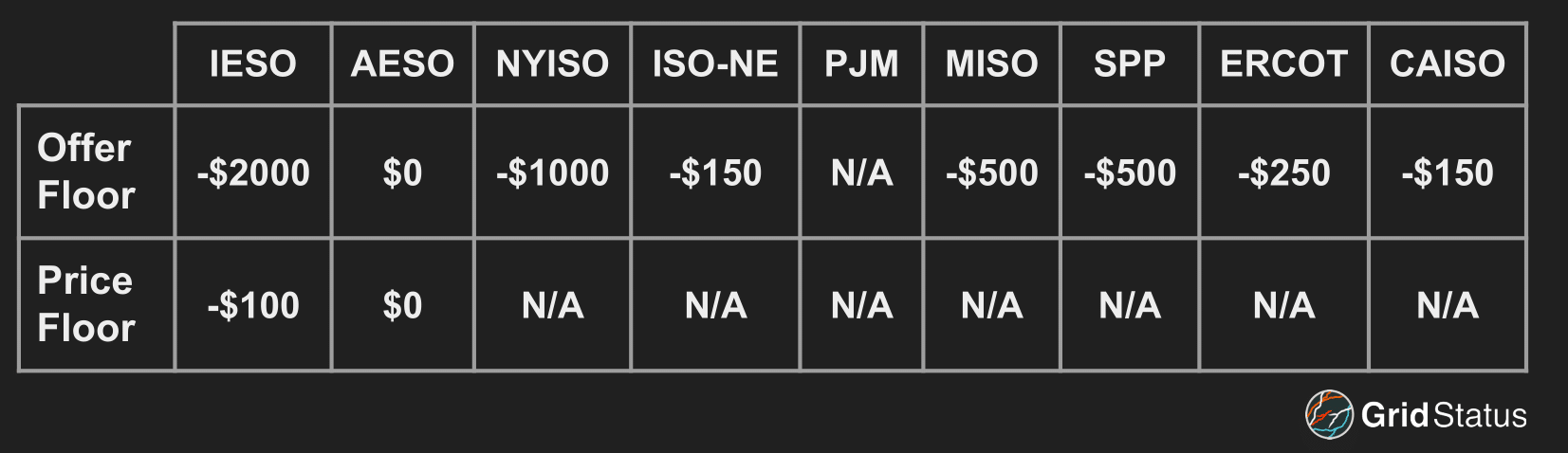

The uniqueness of the IESO market with no LSEs and charges influenced by quasi-market structures such as the global adjustment payment may help to limit the general pricing risks taken by units entering the market, but they also limit opportunity and will continue to obscure price signals. Odd price decisions are also evident in the disconnect between settlement and bid floors.

As part of the MRP, IESO is introducing a market settlement floor system. Minimum settlements will be set to -$100/MWh while the maximum settlement will remain at $2,000/MWh. Interestingly, this market change will not impact bids and offers. Under the MRP, market participants will still be able to submit offers to the current -$2,000 limit, but settlements will be limited to -$100. IESO argues that this system will do more to protect consumers from higher payments to generators under the GA system while giving both asset operators and traders clear market signals.

This system is another example of conflicts between IESO’s many hats. In a normal system, negative nodal pricing is a useful signal, but IESO is not normal. Because the GA increases as the market price decreases, negative market prices lead to very high GA charges to make up payments to the same generators that IESO itself has contracted with.

In one sense, with costs still flowing through either IESO or the other post-breakup entities, even the new system begins to look more like shuffling deck chairs rather than steering the ship in a new direction.

Intertie Trades

Under the existing market structure, exports have few incentives to participate in the DACP. Currently, only imports that clear are given cost guarantees, so exports are primarily RT scheduled. IESO believes that implementation of the DAM and its financially binding contracts will increase convergence between day-ahead and real-time prices by encouraging additional participation.

Interchange with neighboring regions is a major aspect of day-to-day IESO operations. Ontario is even a net exporter to Québec, whom both New York and New England lean on in turn for imports. This was particularly apparent during the cold snap in January 2025, when demand in Québec, a winter peaking region, was quite high.

Congestion pricing will now be a larger component of intertie pricing for imports, while exports will continue to use the current methodology. Under the current market structure, congestion is calculated by the difference between the Pre-Dispatch (PD) intertie price and the PD Ontario clearing price. Settlements are determined by adding this congestion value to the RT clearing price. Under the new system, imports during congested hours will settle to the lesser of the RT LMP or Final PD Intertie LMP.

Settlement Price for Import-Congested Interties

Settlement Price = Min(Internal Node LMP, Final PD Intertie LMP)

Settlement Price for Export-Congested Interties

1. Pre-Dispatch Intertie Congestion Price (PD ICP) = PD Intertie LMP - PD Internal Node LMP

2. Settlement Price = Real-Time Internal Node LMP + PD ICP

IESO expects that these changes will allow for more efficient scheduling of flows and increase convergence between the DA and RT markets.

These changes also set the stage for Financial Transmission Rights (FTRs) to play a more active role in hedging against congestion at interchanges. FTRs in IESO today are unique in that they are limited to interties and can only be settled in the real time market as a hedge against the inability to transfer due to congestion. Under this system, if the holder of an FTR for the same path and quantity of MWs sees negative real time congestion, their FTR allows them to hedge against this downside and be paid, “the price paid by the consuming loads located within Ontario.” Under the MRP, FTRs can be settled in the DAM and account for congestion rather than against negative RT congestion.

However, unlike other markets, Ontario will continue to not have internal FTRs. Congestion costs will be returned to consumers as a percentage of their usage each month. IESO believes that this method will be incentive enough for participants to adjust their generation or consumption in the absence of internal FTRs.

Capacity Reform Hits a Snag

IESO’s stakeholder process was not without setbacks, as one major element was dropped within the first year of feedback.

Initially, the implementation of an incremental capacity auction (ICA) was a key feature of the MRP. The ICA was meant to gradually replace the current system of direct procurements for long term capacity from generators. In turn, this would eliminate the global adjustment charges used to bridge the gap between HOEP and generator subsidies. This plan was heavily featured in studies that IESO touted for cost savings, comprising more than $2 billion of the projections, which ranged from $2.2 billion to $5.4 billion. The ICA was also meant to avoid risks of oversupply as suppliers would respond to market needs via the auction bids.

Despite those projections, the plan was contentious. Stakeholders argued that the proposal would harm renewable generation, while natural gas units exiting their contracts with IESO would disproportionately benefit.

By July 2019, IESO announced they were abandoning the ICA, and instead would be implementing reforms to their existing demand response capacity auction to allow for additional resource types to participate.

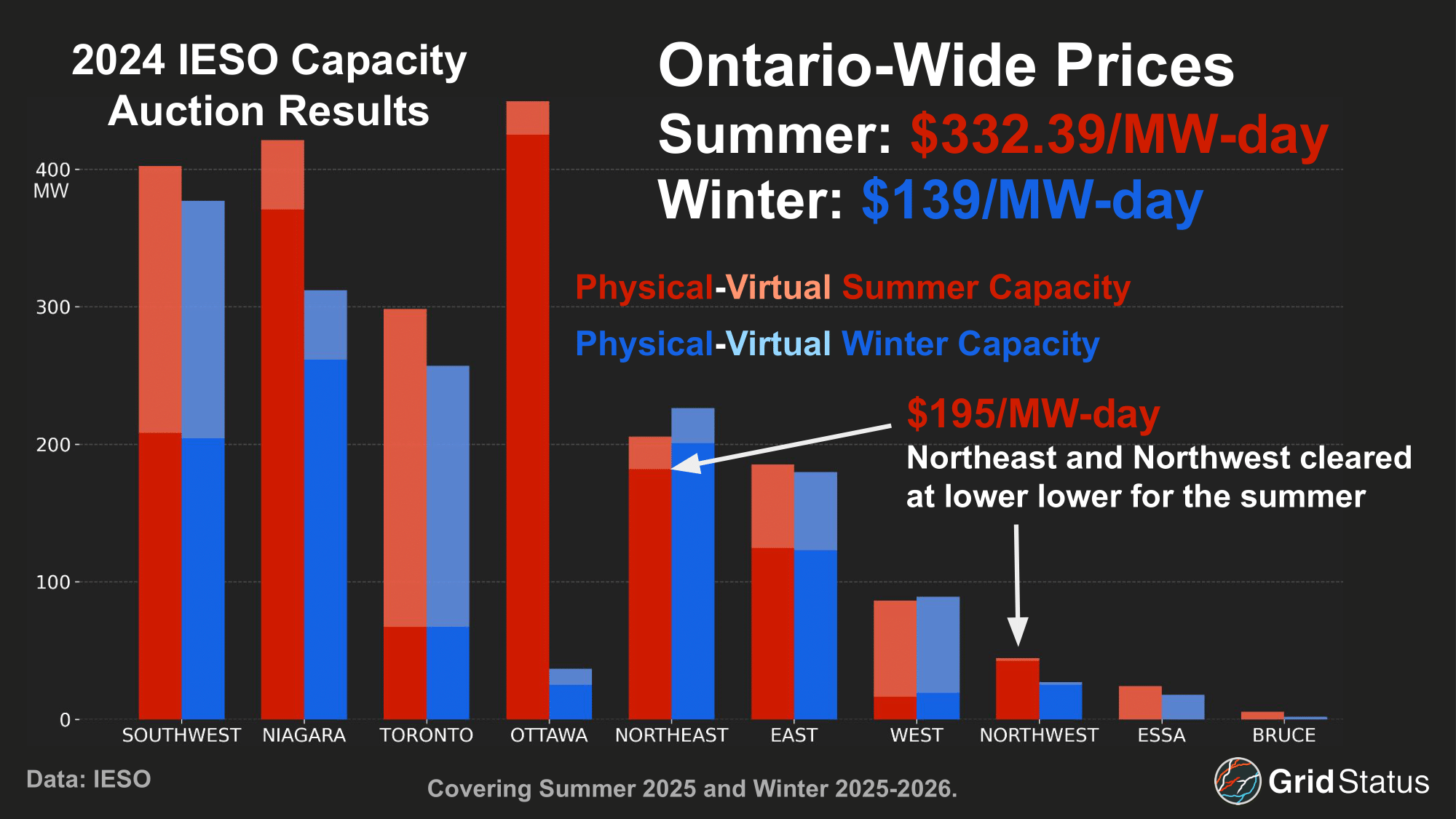

Under the current capacity auction, demand response programs, firm imports, and generation not under obligation contracts with IESO may bid to meet obligations during both the summer season (May 1st through October 31st), and winter (November 1st through April 30th). Despite these changes, the capacity auction’s legacy as a demand response construct remains clear in current results.

IESO calculates both an Ontario-wide capacity price as well as zonal level prices. Zonal prices may be adjusted to be lower than the provincial clearing price based on pre-published zonal constraints, with zonal clearing prices setting to the lesser of the zonal clearing offer or the Ontario wide price.

In 2019, IESO commissioned a new study to estimate the impacts of the energy system improvements without the ICA. The updated savings over ten years totaled ~$1 Billion, a large reduction relative to the initial estimates. With load settlements having reverted to the mean as well, meeting even this reduced savings may be a challenge.

The Future

While Ontario is Canada’s largest province in terms of population, its annual electricity demand has decreased since the early 2000s. The province’s peak was ~27 GW during a heatwave in August 2006, and its top 10 demand records are approaching the twenty year mark. In contrast to two decades of muted demand in Ontario, neighboring Québec, a winter peaking region, broke its own record demand multiple times in the last few years, going from 38 to 40 to 43 GW, exceeding their internal capacity of ~40 GW.

A recent IESO study forecast a 75% increase in total energy consumption by 2050, with a coincident peak at ~36.7 GW, 6 GW below Québec’s 2023 peak and only ~10 GW higher than the current demand record, which would be 44 years in the past at that point. IESO anticipates greater increases in winter load demand than summer, with Ontario expected to become dual peaking by the end of this decade.

An important caveat to IESO’s load projections is that they take a relatively conservative approach to the new classes of large loads such as data centers. IESO refers to these as large step loads, and recognizes that there is significant uncertainty as to when, or whether, these facilities will interconnect. Their solution is partial consideration of this demand.

IESO’s skepticism makes sense in the context of decades with no growth, but should new loads materialize more quickly than anticipated the market may have to scramble.

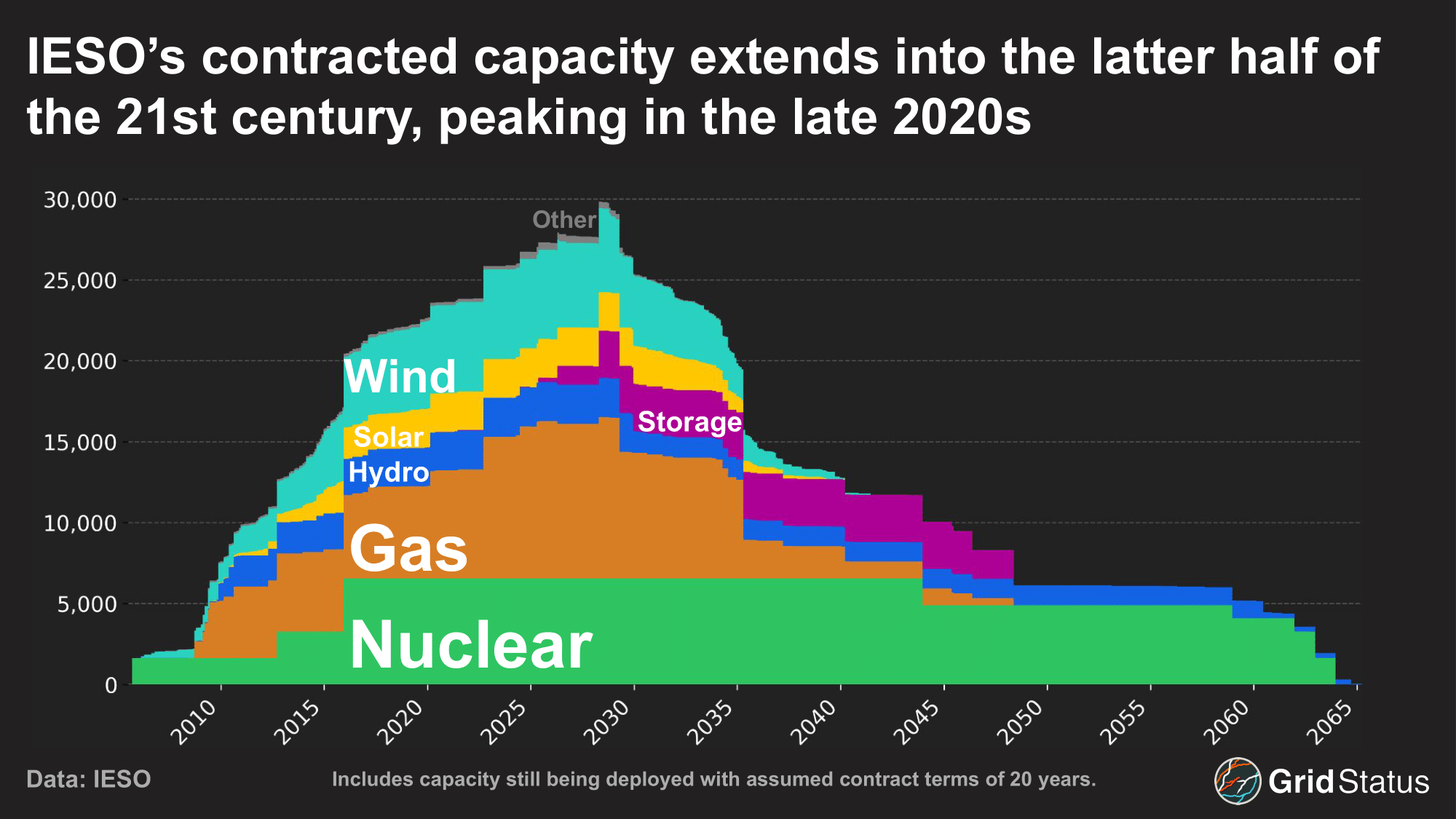

As a net exporter, IESO’s internal demand isn’t the entire picture, and despite a load forecast unlikely to break into the breathless coverage elsewhere, the provincial government is planning to more than double its current capacity by 2050. IESO’s currently contracted capacity drops off significantly by the mid-2030s, so there will likely be multiple rounds of additional contracting over the next decade to maintain their resource adequacy outlook.

Conclusion

Ontario is not alone in embracing market reforms. As we previously discussed, CAISO and SPP are pushing to further integrate the West while SPP recently received approval for its ambitious cross interconnection market expansion at the start of next year. Closer to home, Alberta is also taking steps to further liberalize their power market, pursuing the implementation of a day ahead market by 2027, although this is not the first time AESO has taken steps to materially change their market structures. Final implementation of the MRP will be closely tracked both inside Ontario and beyond. We’ve been adding new datasets behind the scenes and launched an IESO live page alongside the American ISO/RTOs to track Ontario in real time. Come May, we’ll be live with IESO’s new nodal data - watch for the map in particular to get more interesting as we transition its data away from the systemwide MCPs and to the new LMPs.

Please reach out at contact@gridstatus.io if you want early access or have any suggestions on the types of research or content you'd like to see.