CAISO's EDAM and SPP's Markets+ Arrive to Tame the Wild West

With new day-ahead Western markets just over the horizon, it's time to take stock of the field of play. Who's joining what, what do these aggregations look like, and what does it mean for the wider West?

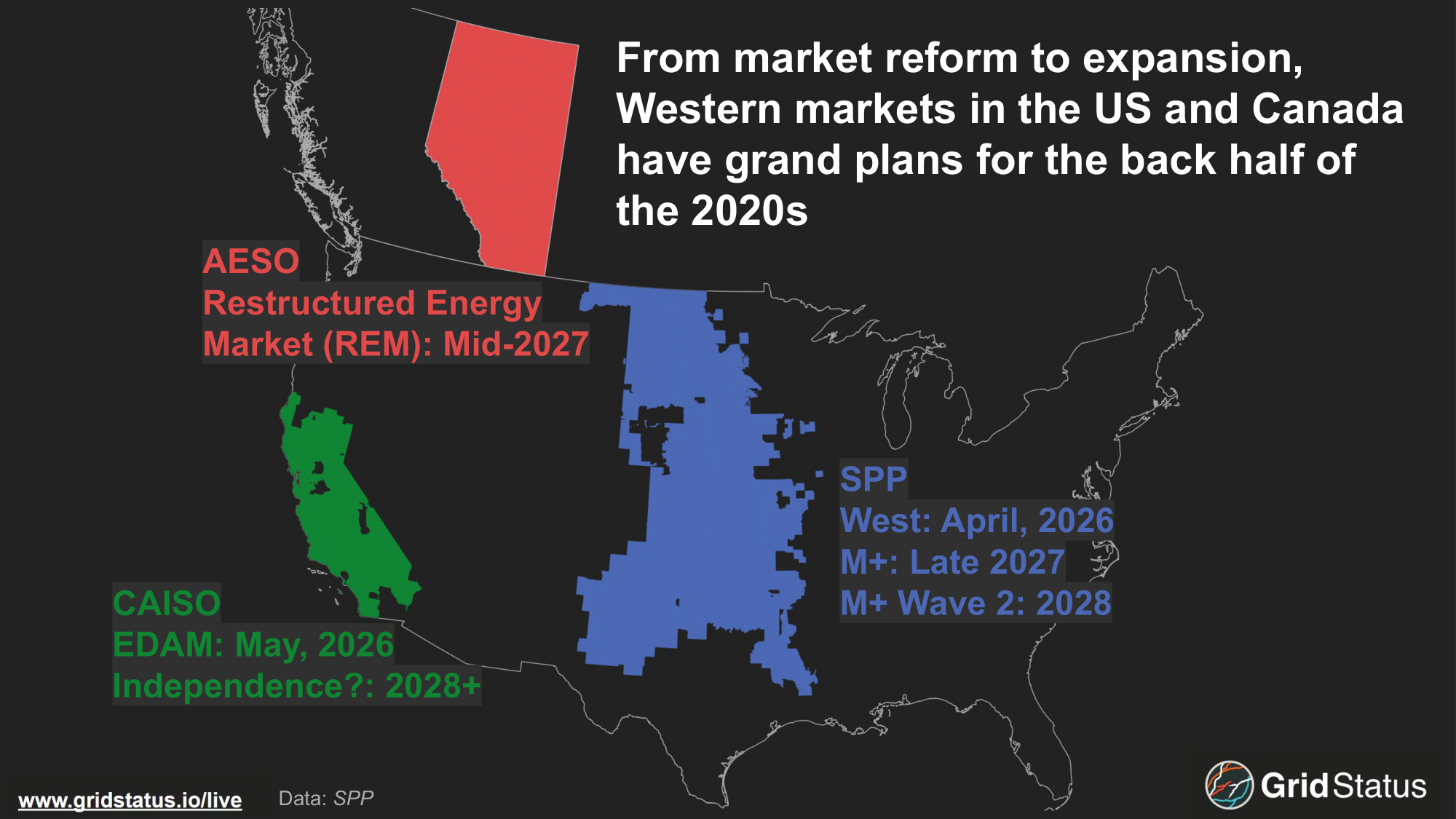

With the final green light from FERC earlier this year, the day-ahead fate of 37 Balancing Authorities is up for grabs. Over the next few years, the three organized power markets with a presence in the Western Interconnection, CAISO, AESO, and SPP, are engaging in various flavors of expansion and reform.

The topic is big enough that we’re splitting this blog into two parts. Here, in part one, we’ll focus on Markets+ and EDAM, the competing market constructs from SPP and CAISO that look to further organize wide swathes of the Western grid.

Staying up to date with the stakeholder process in one ISO is tough enough; synthesizing the rearrangement of a balkanized interconnection is even tougher. We’re here to help you understand the foundation that the West’s future is being built upon.

Some lines were drawn in earlier planning phases, some allegiances have only been determined in recent months, and starting lineups under each umbrella represent only a portion of entities committed to joining at a future date.

We cover existing markets in the West, who’s on which side of the day-ahead divide, what their pooled resource mixes will look like under the new configurations, and how their positioning creates new blocs of interchange across evolving seams.

Check it out and let us know what you'd like to see covered!

Wholesale shifts in grid management are infrequent in the well-entrenched markets of North America, but following the launch of Ontario's renewed market earlier this year, we’re heading West to track SPP’s Markets+, CAISO’s EDAM, and everything in between.

Table of Contents

- What is the “West”?

- Administration to date in the Western Interconnection

- CAISO’s Position

- The Extended Day-Ahead Market (EDAM)

- A Seat at California’s Table

- The Westward Ambitions of SPP

- SPP’s Markets+

- Outro

- Appendix

The Ties that (barely) Bind

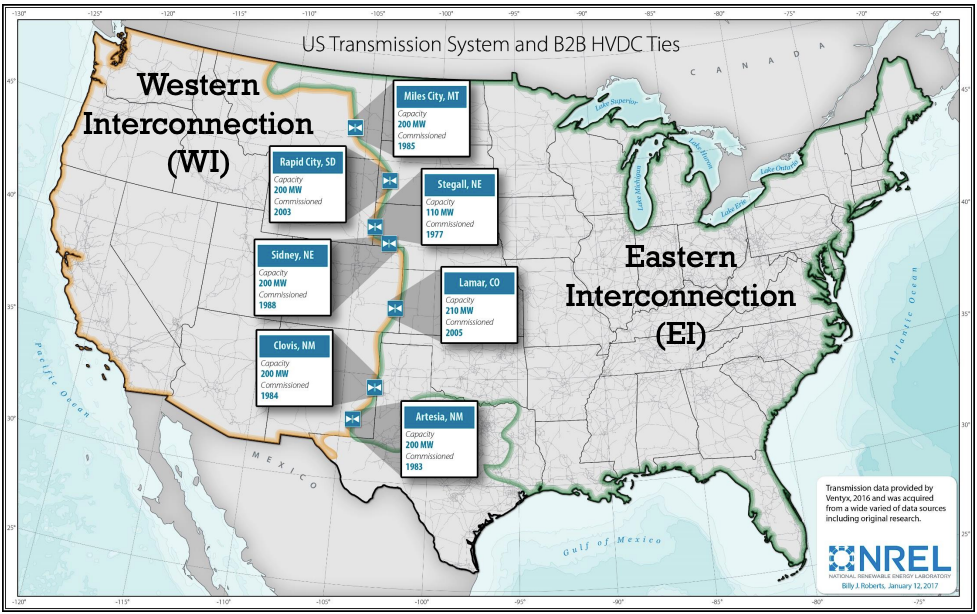

On a map, where the “West” begins is somewhat unclear (transmission lines and straight-line administrative boundaries are strange bedfellows). You can think of the eastern edge as beginning on the northern border between North Dakota and Montana, then down through the Colorado-Kansas border and around the west side of the Texas border. The borders here are messy. Transmission topology and topography do not get along under the best of circumstances, and a balkanized West layered with administrative boundaries is even more difficult to visualize.

The historical separation between the East and the West has been maintained because the grids, despite sharing a frequency of 60Hz, are not, in themselves, in sync. It’s like jumping rope; you can swing and jump the same number of times in a minute, but if they’re not in sync, the same total count won’t keep you from ending up in a tangled mess on the ground.

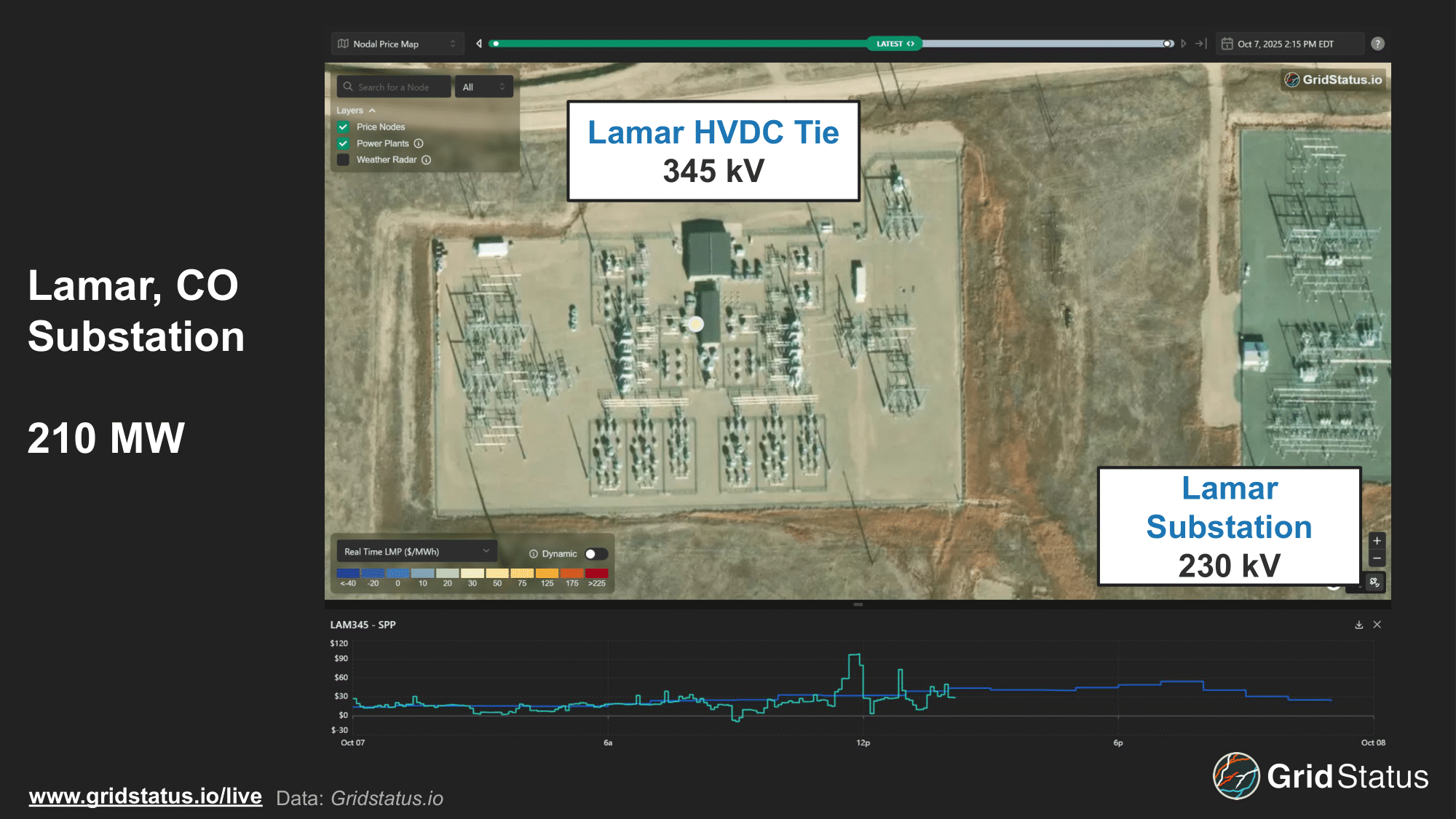

There are 7 main HVDC ties between the Western and Eastern Interconnection from north to south. None have been commissioned in the last 20 years, and their total capacity is less than 1.5 GW, far from a difference-maker for Interconnections with orders of magnitude more demand.

While DC transmission is more efficient over long distances and high voltage, the bulk of grid-level systems in North America are AC. Converting power from AC to DC, and vice versa, requires additional equipment and is therefore more expensive, limiting the number of ties. These are not the only connections between East and West; there are indirect hops through ERCOT’s own DC ties and oddities like Fort Peck’s dual substations, but in general, connectivity is limited.

Below is the SPP node at the Lamar tie, located in southeastern Colorado.

Within the West itself, there are vast basins of energy potential above, below, and running through the earth. From the hydropower of the Pacific Northwest to solar insolation in the desert southwest, the wider region can certainly power itself, but fragmentation generates friction, which has challenged wider resource coordination even as some overarching structures have emerged.

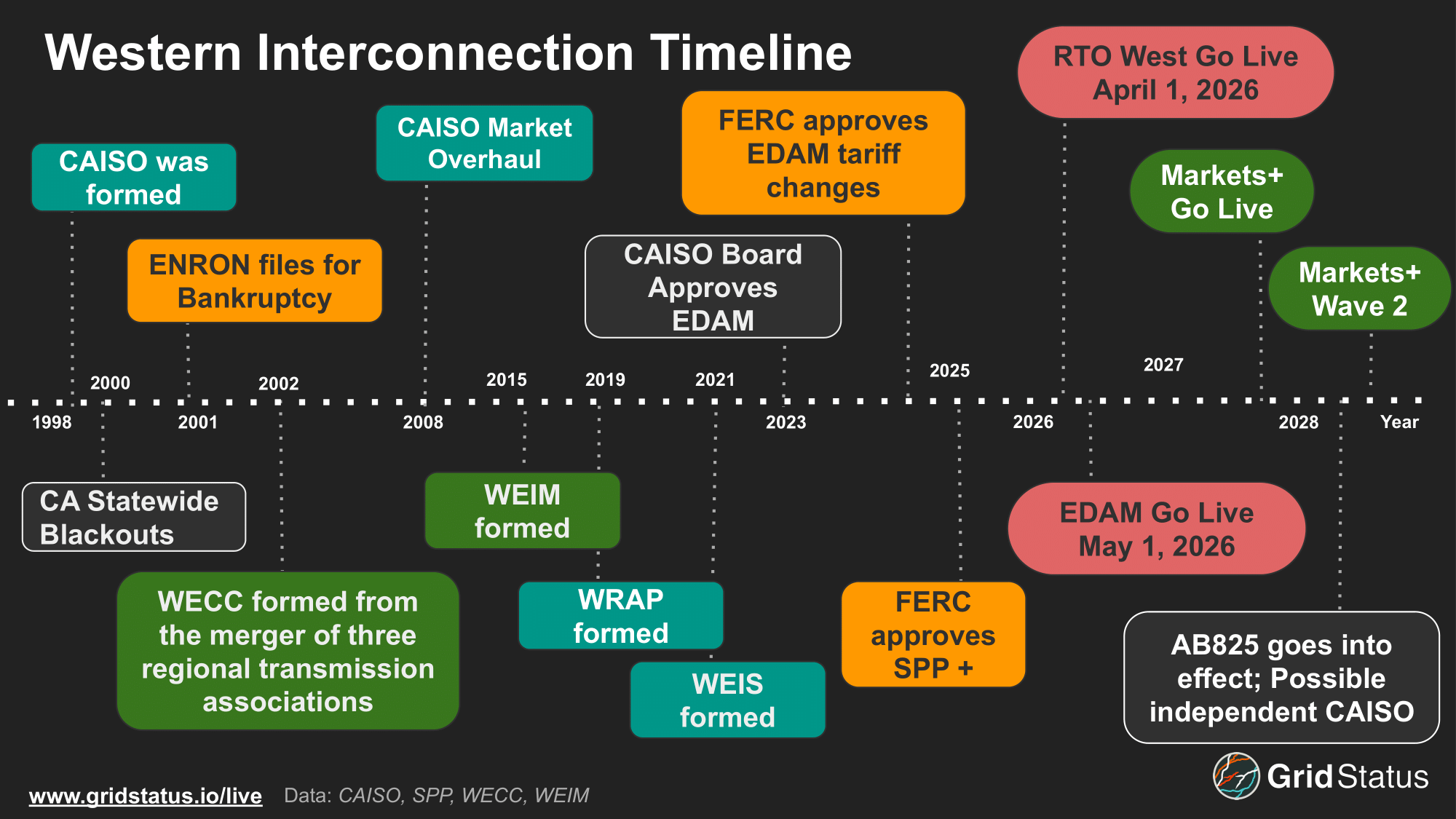

From Enron to EDAM, 30 Years in the West

Despite the long-term balkanization of the Western Interconnection’s transmission, the grid is no stranger to either regional entities or markets. The wild early history of CAISO and its susceptibility to predatory energy trading has been well documented, so we’ll focus on the more stable aftermath.

Right now, the West is overseen by the Western Electricity Coordinating Council (WECC), which includes 2 Canadian provinces, 14 Western States, and Northern Baja Mexico. WECC has exercised delegated authority from FERC since 2007 to create, monitor, and enforce reliability standards as the Regional Entity for the Western Interconnection.

In 2014, CAISO launched WEIM, the Western Energy Imbalance Market, a real-time balancing market to optimize energy dispatch across western entities. Over the past decade, WEIM has grown from 2 to 23 participants in 2024. With 80% of the West's load currently participating and total gross benefits estimated at $6.25 billion since its inception, it would be hard to assess WEIM as anything but a success.

Despite this, discontent with a CAISO-centric Western system has continued to simmer below the surface.

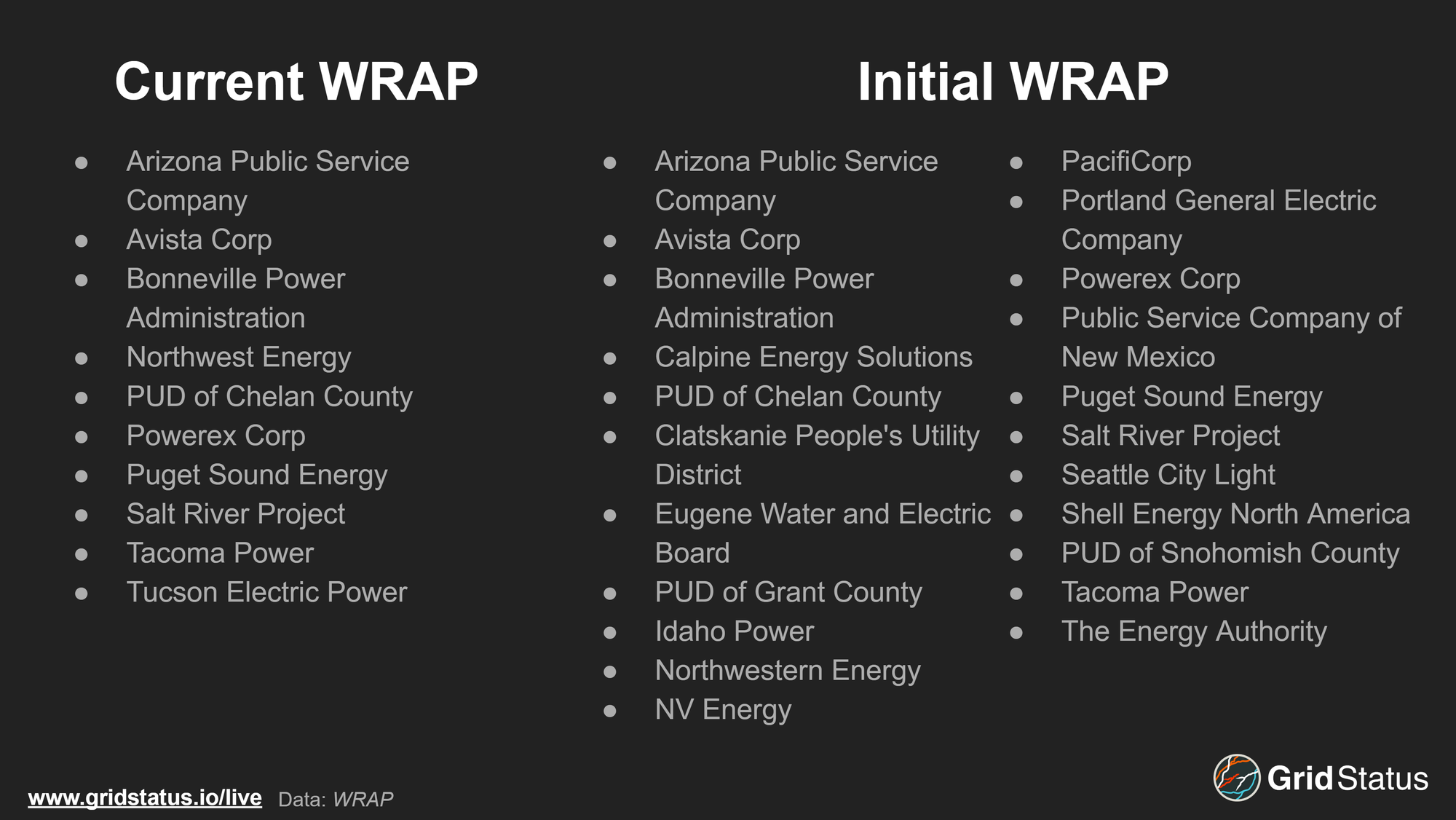

Next, the Western Resource Adequacy Program (WRAP) came into the picture. WRAP was proposed in 2019 to address concerns related to resource adequacy, and perhaps surprisingly, SPP, yet to launch a Western market, was named as the program operator. While participation is voluntary, many Western authorities viewed the program as a way to align on greater regional supply challenges. To date, the requirements associated with WRAP have yet to be implemented, delayed after the initial scheduled launch in the summer of 2025. The delays have caused some balancing authorities from the original list to back out, most recently NV Energy.

The delays are driven by a variety of factors, but one key element appears to be that balancing authorities are struggling to demonstrate an appropriate amount of generation to meet the resource adequacy requirements.

SPP moved its management footprint further west by launching WEIS, the Western Energy Imbalance market, in February of 2021. At the end of its first year, WEIS had 7 participants, mostly along the eastern edge of the Western Interconnection across two balancing authority areas, the Western Area Power Administration’s (WAPA) Rocky Mountain Region and Upper Great Plains West BAs. In its first years, WEIS’ annual benefit to members was estimated at ~$30 million. By 2023, the market had more than doubled in size with the addition of members in Colorado. While still far smaller than the CAISO-administered WEIM, WEIS made clear that SPP’s ambition was not limited to the Eastern Interconnection.

Finally, we arrive at the current day. In short order, two different day-ahead markets will be active in the Western Interconnection, and SPP itself will have crossed that porous border to bring full RTO participation to a handful of current WEIS participants. To start, let’s look at the longest-tenured market in the western US, CAISO.

CAISO’s Constructs

With WEIM already a decade deep into service, it’s not unreasonable to assume that CAISO would have solidified its hold over the West by 2025, but one rather large obstacle has always been in the way: California. Historically, CAISO’s vision of a unified West has had a major impediment, the unwillingness of California’s legislature to divest ultimate control, but decades on from CAISO’s inception, that immovable object has left the market operator facing a new future for the fractured West: competition.

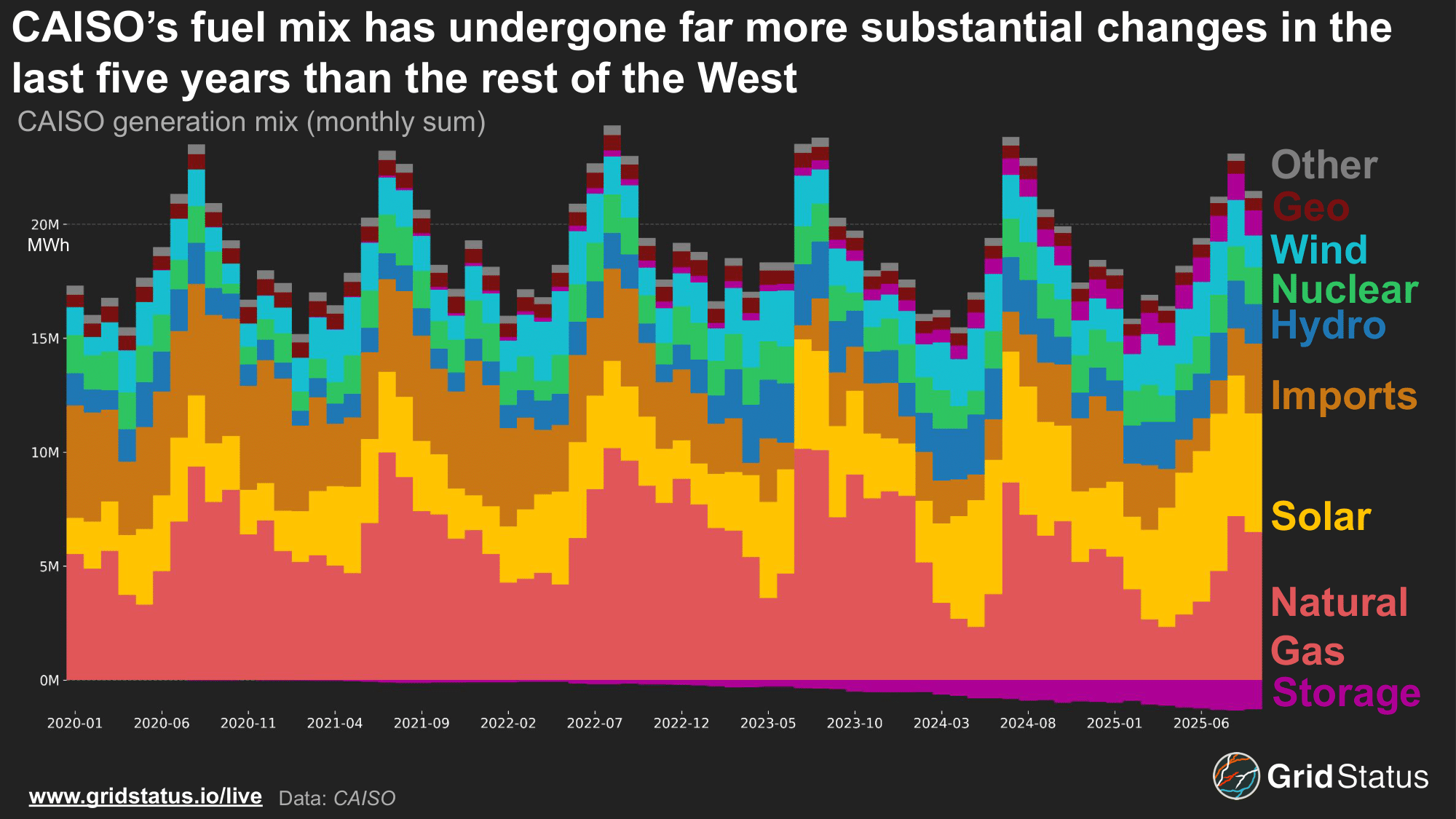

Currently, CAISO exists within California’s borders, but unlike NYISO in New York, it does not manage the entire state. For example, the Los Angeles Department of Water and Power is its own balancing authority within the city limits of Los Angeles. The grid is summer peaking, albeit in some years into the portion of summer that can often be mistaken for autumn on the East Coast. This past summer, CAISO reached a peak load of 43.8 GW. CAISO has the largest percentage of solar to load for any major grid in the US, and has coupled solar growth with a battery sprint. Record storage discharge now exceeds 9.5 GW, and peak daily discharge often reaches 20-30% of simultaneous grid demand.

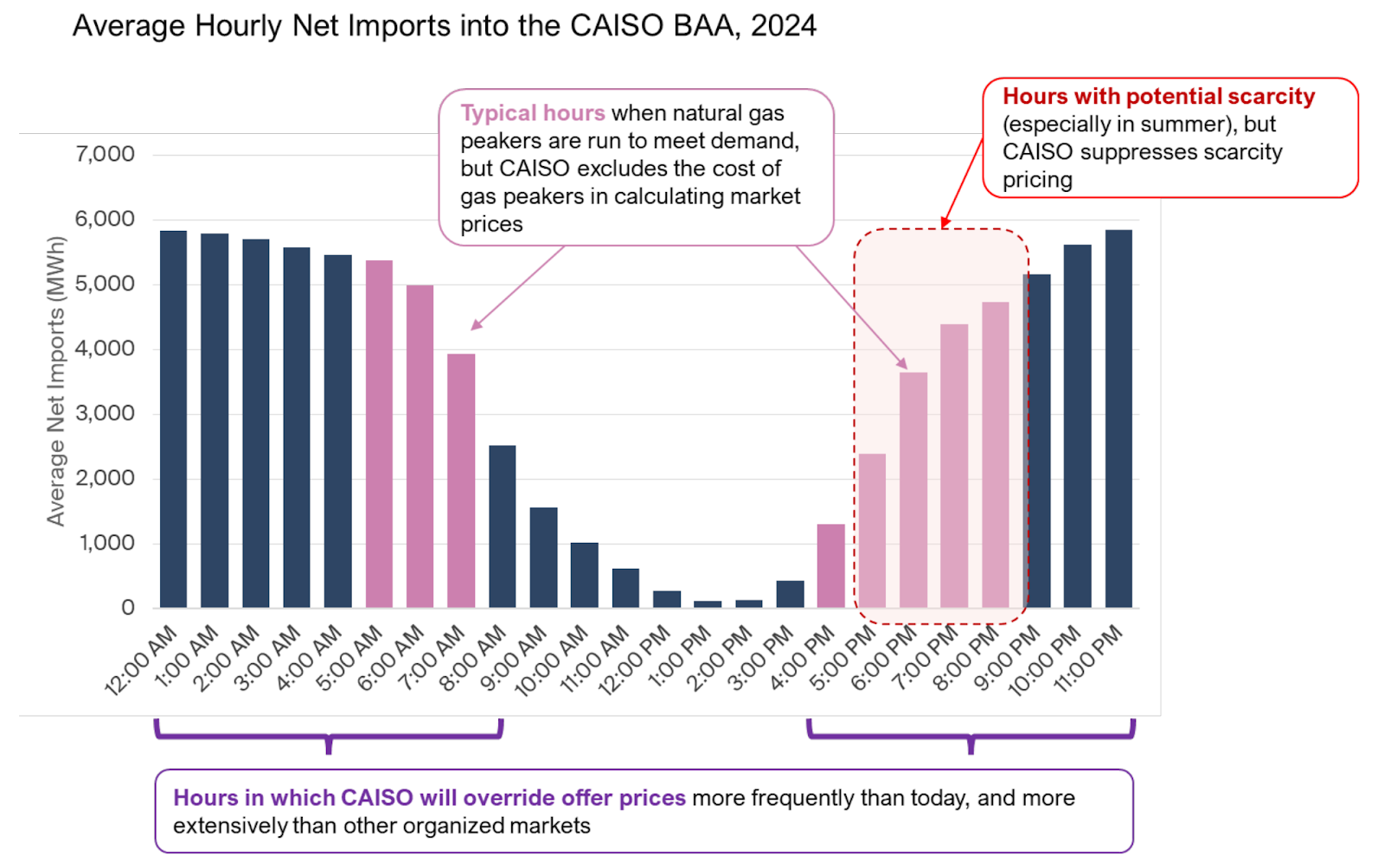

CAISO is one of the few markets that reports imports within its fuel mix data directly, perhaps due to its longstanding importance to the system. Their critical role even ties into national policy, as it was JFK who kicked off the construction of the Pacific DC intertie, which brought power from the hydro-rich Pacific Northwest into the Los Angeles Basin. Growing renewable penetration has shifted the dynamics. Solar generation suppresses midday pricing, but once the sun goes down, imports help fill the gap and capitalize on higher off-peak pricing even with weaker load.

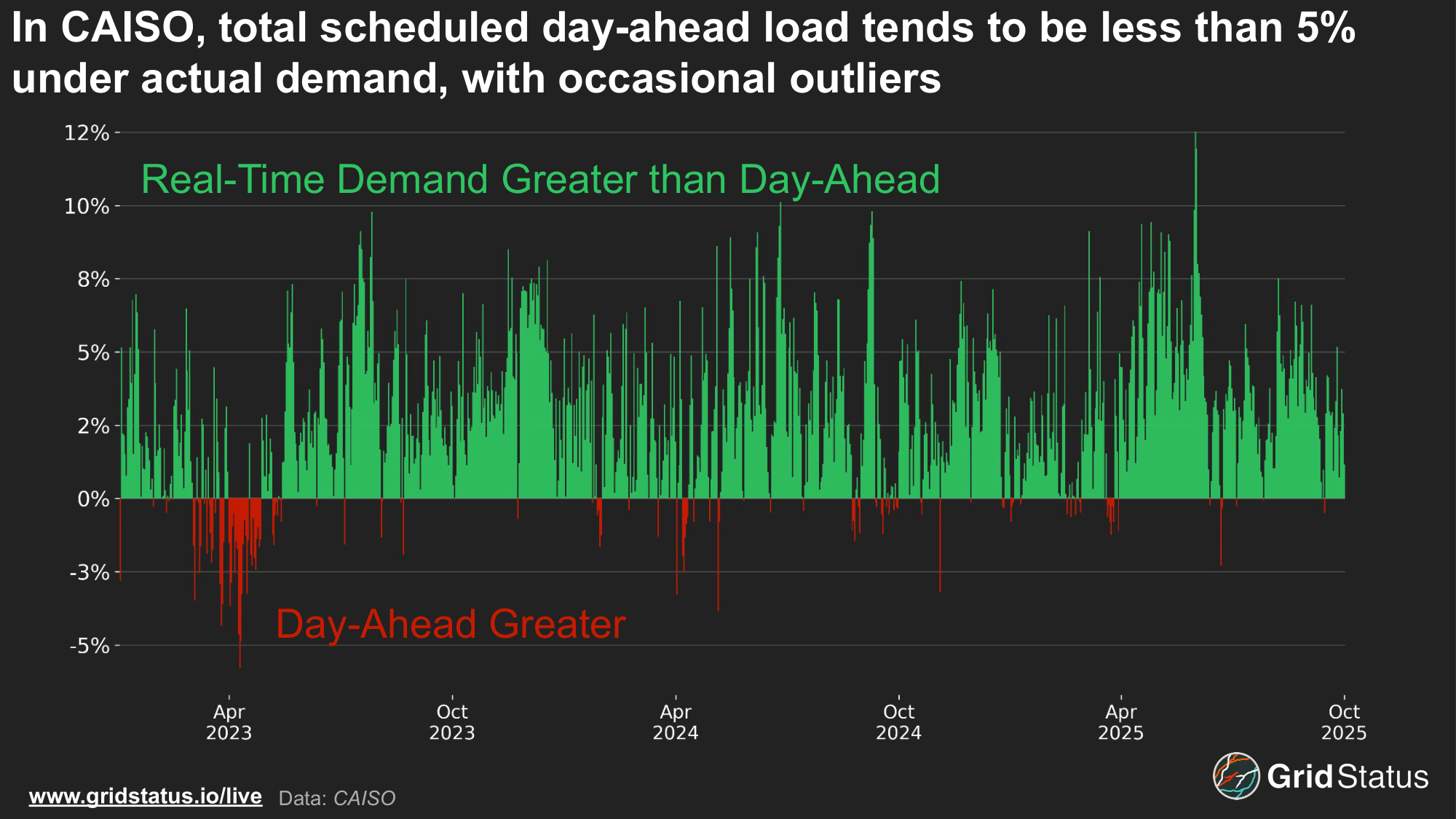

Across the organized markets, decades of infrequent price excursions in real-time have captured significant attention and downplayed the day-ahead in popular consciousness (if not in the minds of operators and traders).

While “balancing” has fallen out of “real-time balancing market” in most conversations on the grid, WEIS and WEIM still center this concept via Imbalance. This distinction might seem pedantic, but it is crucial to understanding why the implementation of day-ahead markets is so impactful.

The vast majority of energy and grid services are scheduled in the day-ahead market. Real-time markets are meant to smooth out perturbations in supply and demand due to unforeseen circumstances. While that last 5% can be expensive, the bulk of business is handled in the day-ahead.

We can verify this by summing daily demand in CAISO from actual load and scheduled day-ahead demand. Most days have a total deviation of 5% or less, with actuals coming in greater than scheduled most of the time.

EDAM

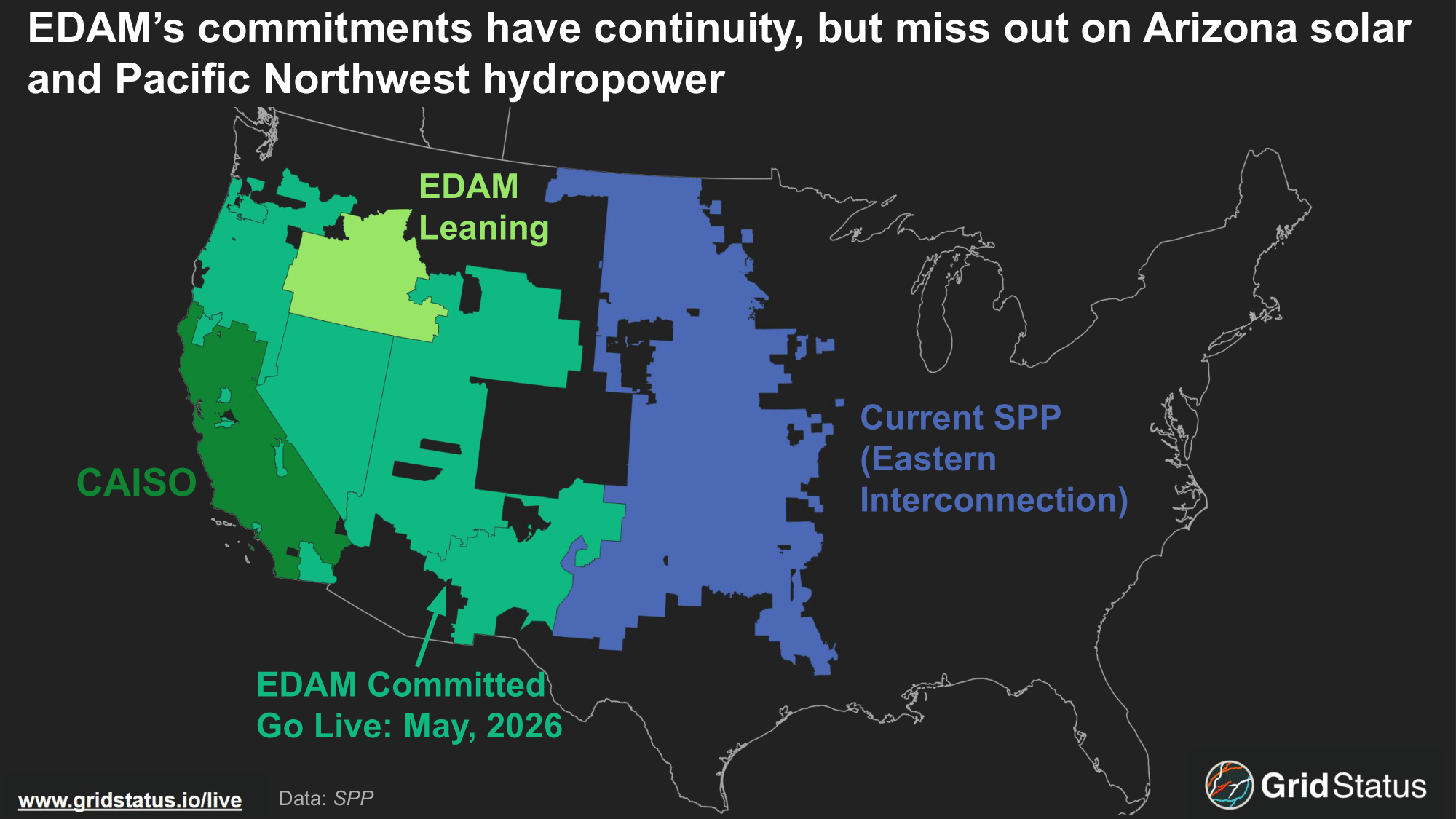

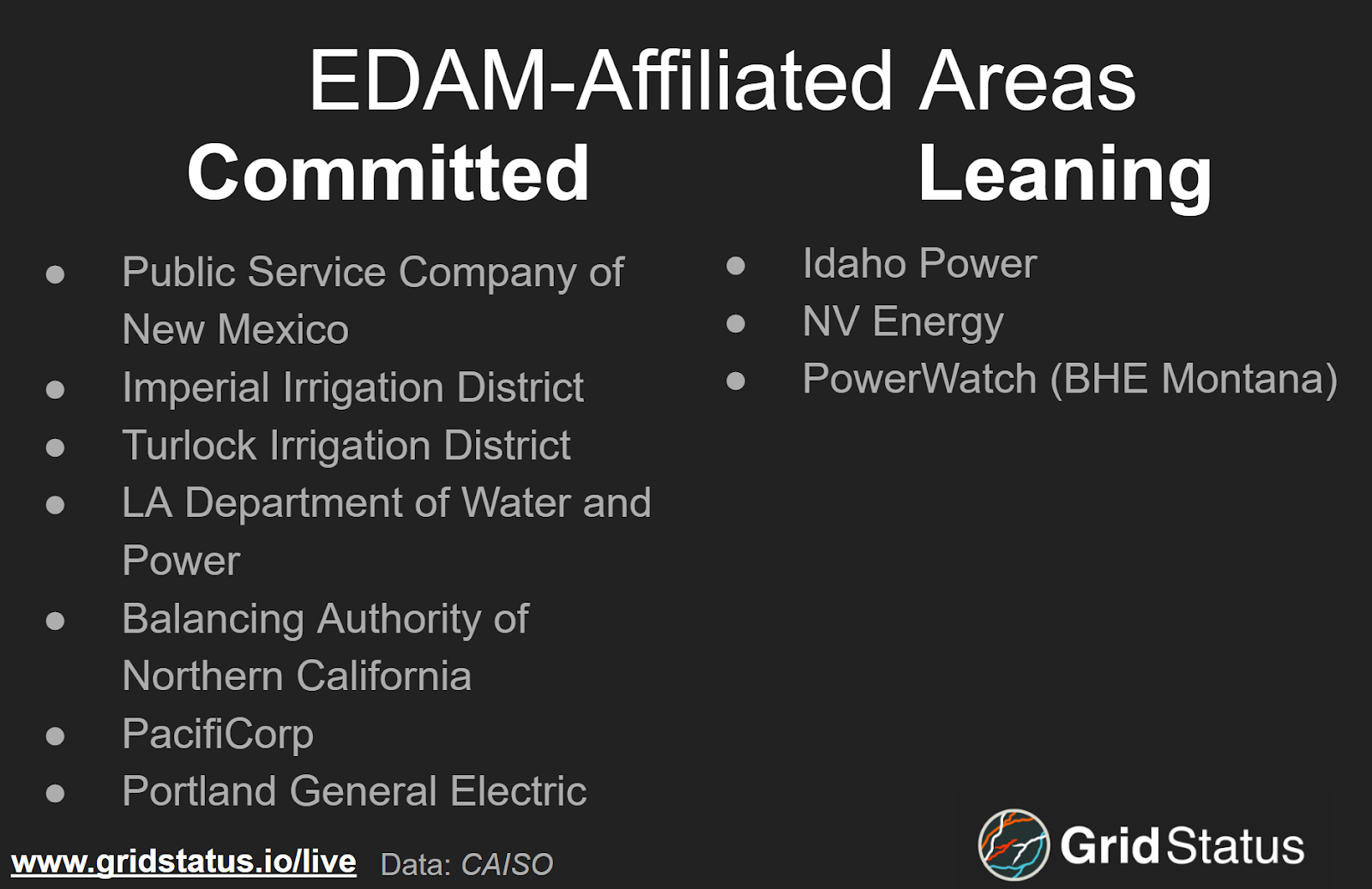

To expand coordination in the West, CAISO has designed the Extended Day Ahead Market (EDAM). EDAM brings day-ahead commitment, scheduling, and an element of resource adequacy, extending the real-time market, WEIM, which many of its committed balancing authorities already participate in. However, this expansion is not a full RTO (regional transmission organization), as participants in EDAM will continue to plan and control their own transmission system.

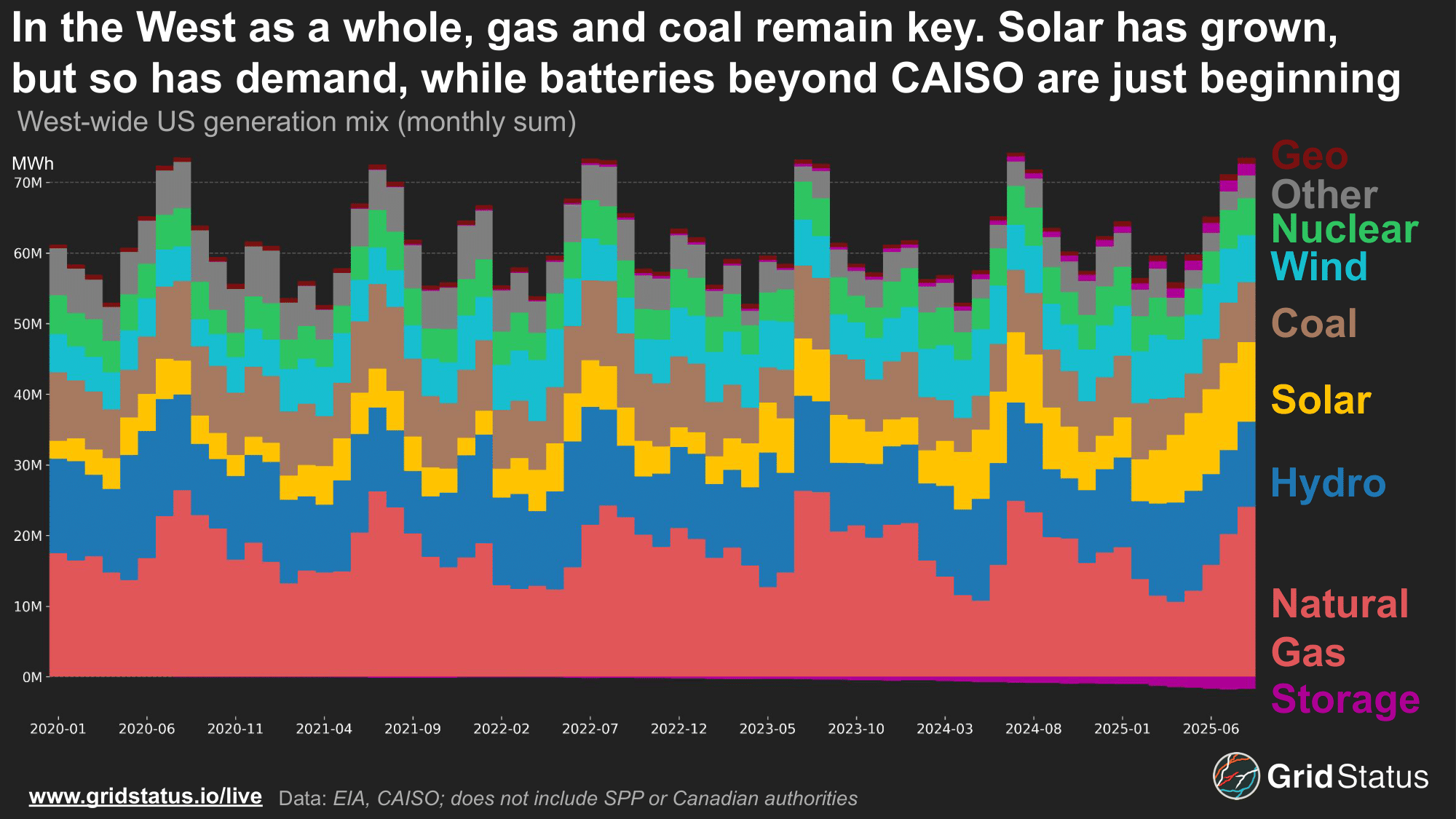

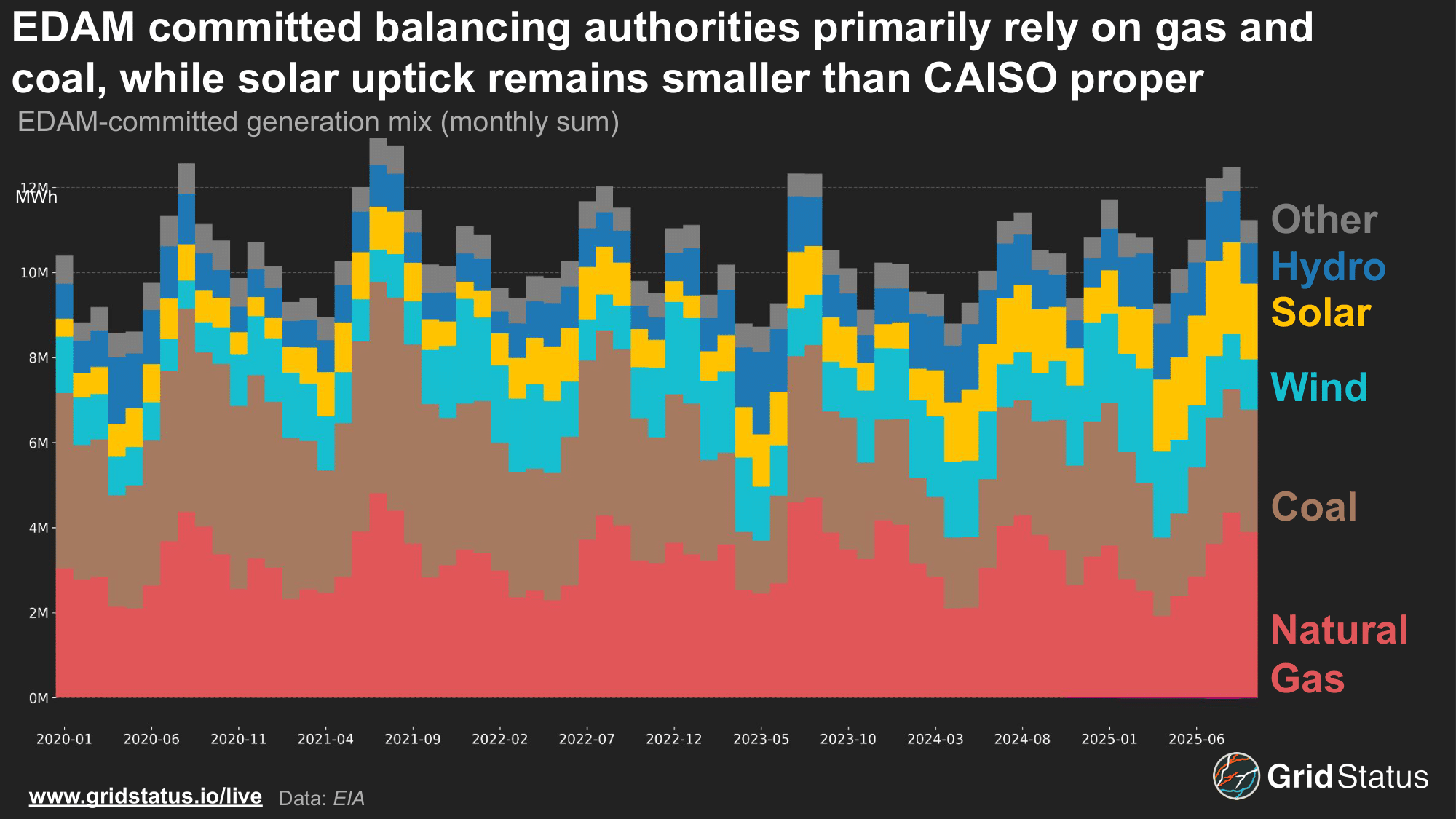

Thermal generation will be prominent in EDAM, as natural gas and coal generation dominate the stack. In recent years, coal units have begun to retire, while more solar and wind have come online.

Among EDAM-committed authorities, wind is likely to be the key complementary piece. CAISO itself is extremely solar-heavy, and another net-zero resource that supplements solar on both diurnal and seasonal cycles is useful. Unfortunately, given the state of federal opinion, future projects are under threat.

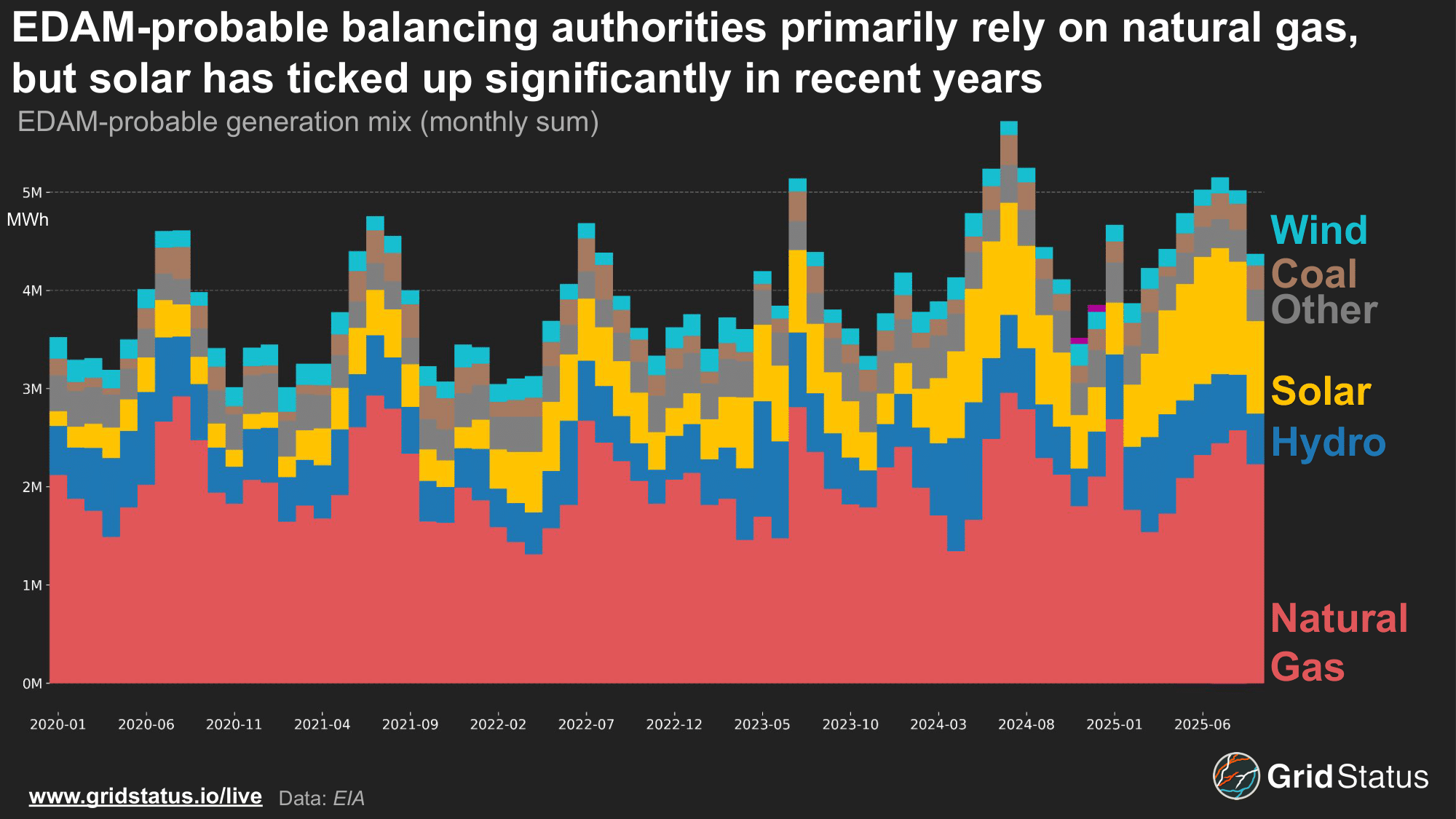

Among the probable balancing authorities, natural gas dominates. Five years ago, hydropower was the second-place fuel, but in the last few years, solar has eclipsed it in generation, with Nevada and Idaho Power companies bringing meaningful amounts of sun-based generation.

Combining these two EDAM fuel stacks would paint a starkly different picture from the CAISO of today, but have strong similarities to the CAISO of the past, before solar and batteries took over.

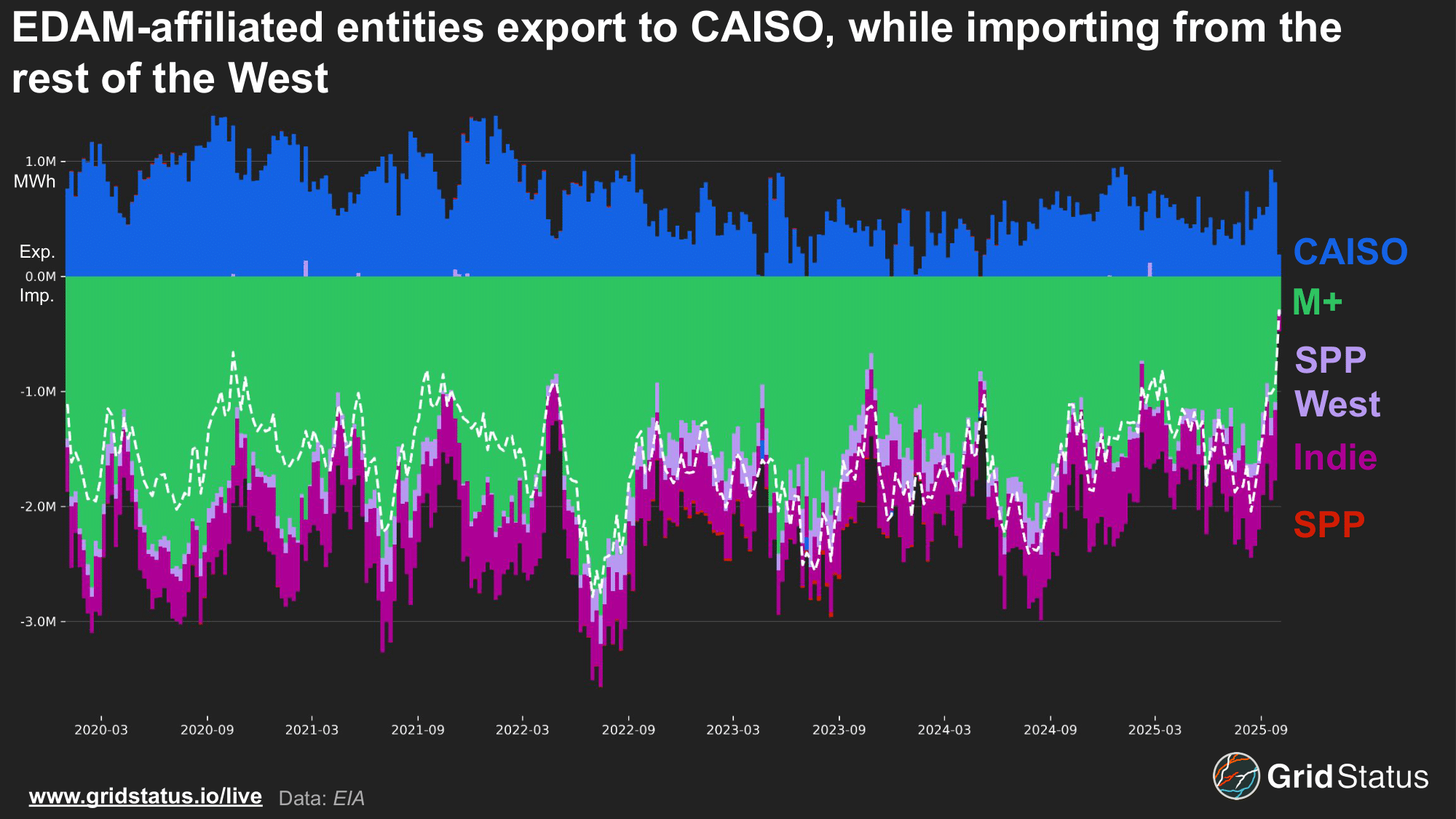

Aggregated together, the BA’s of EDAM are net importers, although this is related to their position in the middle of the Western Interconnection as power is wheeled through their control areas. The primary source of the net import flows comes from BA’s slated to join Markets+, to the North, South, and East. To the West, these balancing authorities export into CAISO, as many of the BA’s joining EDAM abut the borders of either CAISO or the state of California itself.

For example, the Imperial Irrigation District (IID) is located in Southern California and flows geothermal power into the southern region of CAISO. BAs further from California may also import power from others. PNM in New Mexico is one such example. When regional wind dies down and load outpaces generation, they import from both Arizona Public Service (APS) to the West and El Paso Electric (EPE) East. This increases the complexity of flows as APS is slated to join Markets+ and EPE is currently not officially committed to either market (although, confusingly, they have made public statements that they intend to join Markets+).

EDAM Overview of Balancing Authorities:

The California Conundrum

Despite disjointed dispatch, the West is relatively well-interconnected. Its larger fragmentation and the presence of large power marketers placed it on a different path than the vertically-integrated and tightly controlled southeastern US. In its pursuit of a fully net-zero grid, California has long eyed the energy-rich hydro and solar basins to its north and southeast, but convincing its neighbors to relinquish their independence has never been an easy task. Pressure to leverage and expand on the interconnected West has grown in recent years, but the same issues of CAISO governance remain.

In light of this pressure, the California Legislature recently passed AB825, which would:

… authorize the ISO and the electrical corporations that are participating transmission owners whose transmission systems are operated by the ISO to use voluntary energy markets governed by an independent regional organization… on or after January 1, 2028, to implement tariff modifications accepted by the Federal Energy Regulatory Commission to operate the energy markets whose rules are governed by an independent regional organization… require the PUC to make a determination through a formal decision in an existing or new proceeding that these requirements have been satisfied before electrical corporations participate in an energy market governed by an independent regional organization…require the ISO to maintain the necessary technical capability to operate energy markets, as specified, and would require the ISO to continue its functions and responsibilities as a balancing authority, as provided.

This law only provides the option for CAISO to operate under an independent regional body; there is no guarantee that an independent body will ever run either CAISO or EDAM.

Surrounding balancing authorities have never been overly enamored with CAISO’s gravity. As recently as September of this year, Powerex (which is not joining EDAM) filed strongly negative comments on a CAISO straw proposal on price formation enhancements:

Taken together, the CAISO’s approach in the Straw Proposal represents a suite of measures that will serve to artificially and systematically suppress market clearing prices during the specific hours that the CAISO’s own Balancing Authority Area (BAA) is a net importer of electricity from its neighbors (emphasis original)

The comments go on to specifically cite risks of participation in WEIM and EDAM

Under the Straw Proposal, every entity that participates in the Western EIM and/or in EDAM, or that sells to the CAISO at interties at its boundary, will receive less than the fair, efficient and accurate market price they should receive for supplying electricity to California (emphasis original).

At its core, Powerex believes that CAISO’s proposal would suppress prices during the hours in which the ISO is more likely to be importing from the rest of the West, referring to this practice as a “transfer of wealth” from ratepayers outside of CAISO to those within it. Of additional interest is a complaint around the EDAM benefits studies, relying on simulations of generic market rules and not CAISO-specific price formation mechanisms. This is almost less a complaint than a statement of fact across nearly all consulting studies in nearly all markets. Individual price formation rules can be arcane and tend to change via projects large and complicated enough that no one individual can internalize the processes, let alone the possible consequences.

This perception of a CAISO-centrism, even in matters involving their neighbors, is not incorrect; CAISO is a California ISO, ultimately governed by the state. The question of wider Western participation has always been whether the juice of efficiency benefits was worth the squeeze of stakeholder influence imbalance. This question is at the heart of decades of power market design that opened the door for SPP in the West.

SPP isn’t (just) in Kansas anymore

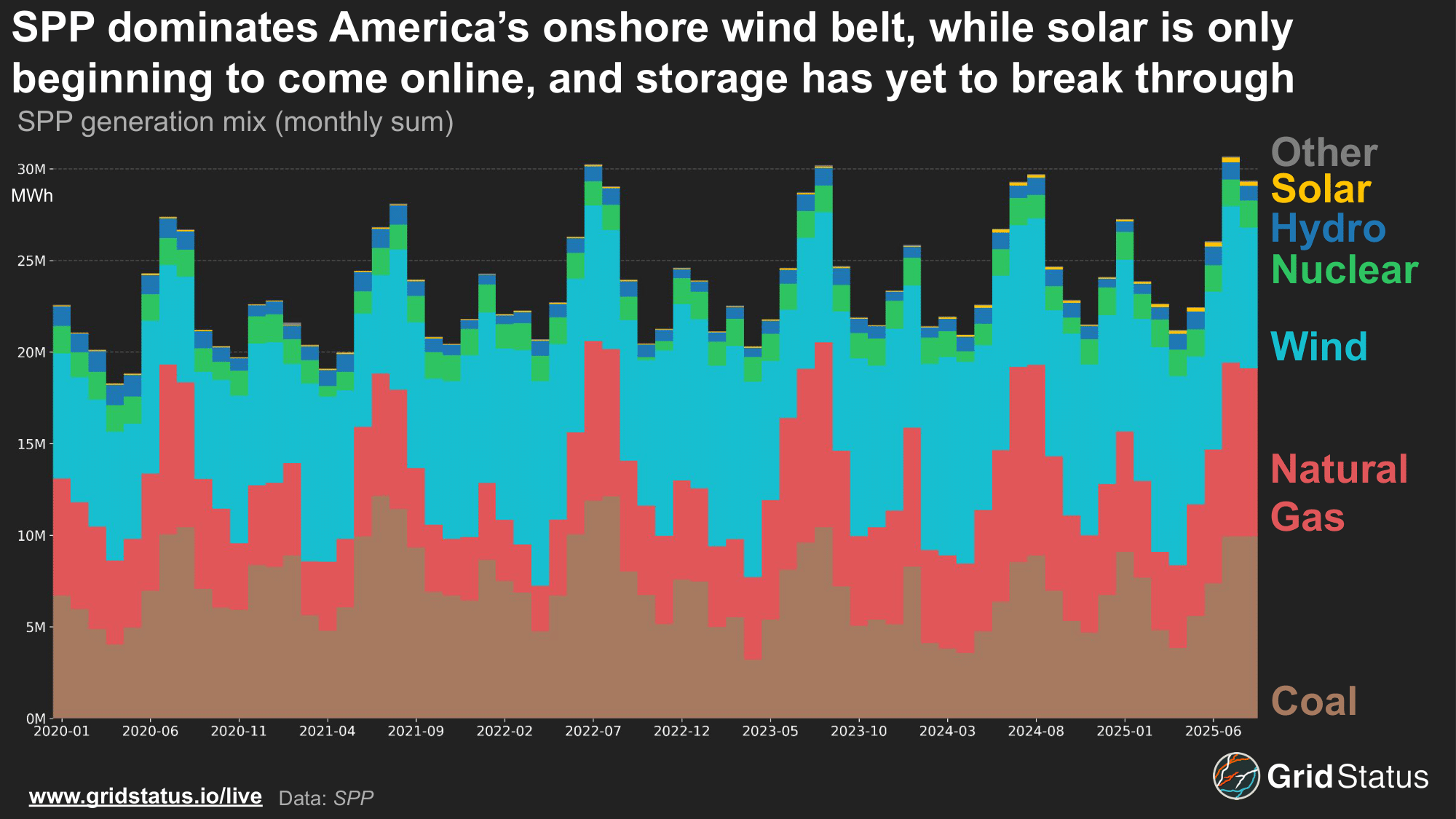

While physically located in the Eastern Interconnection portion of the Great Plains, SPP is heading West. Geographically larger than CAISO, SPP also sees a higher peak load (53 GW this summer) despite serving more than 10M fewer people. While SPP is a summer peaking grid, recent years have seen winter scares. Net load can become a concern in the long, dark months of winter when wind falls off and temperatures challenge unit operations and fuel availability.

On those high net load days with limited wind, SPP has far more dispatchable internal generation from coal and natural gas units than CAISO, which turns more heavily to imports when solar is limited. In a twist of fate, the hydro from Bonneville Power in the north and thermals from Arizona Public Service in the south are precisely the regions committed to SPP’s vision of a Western future.

While both SPP and CAISO are creating a Day Ahead market to expand coverage beyond the West’s current real-time market offerings, SPP is doing even more, and expanding the responsibilities of the full RTO across the AC/DC tie line interconnection barrier.

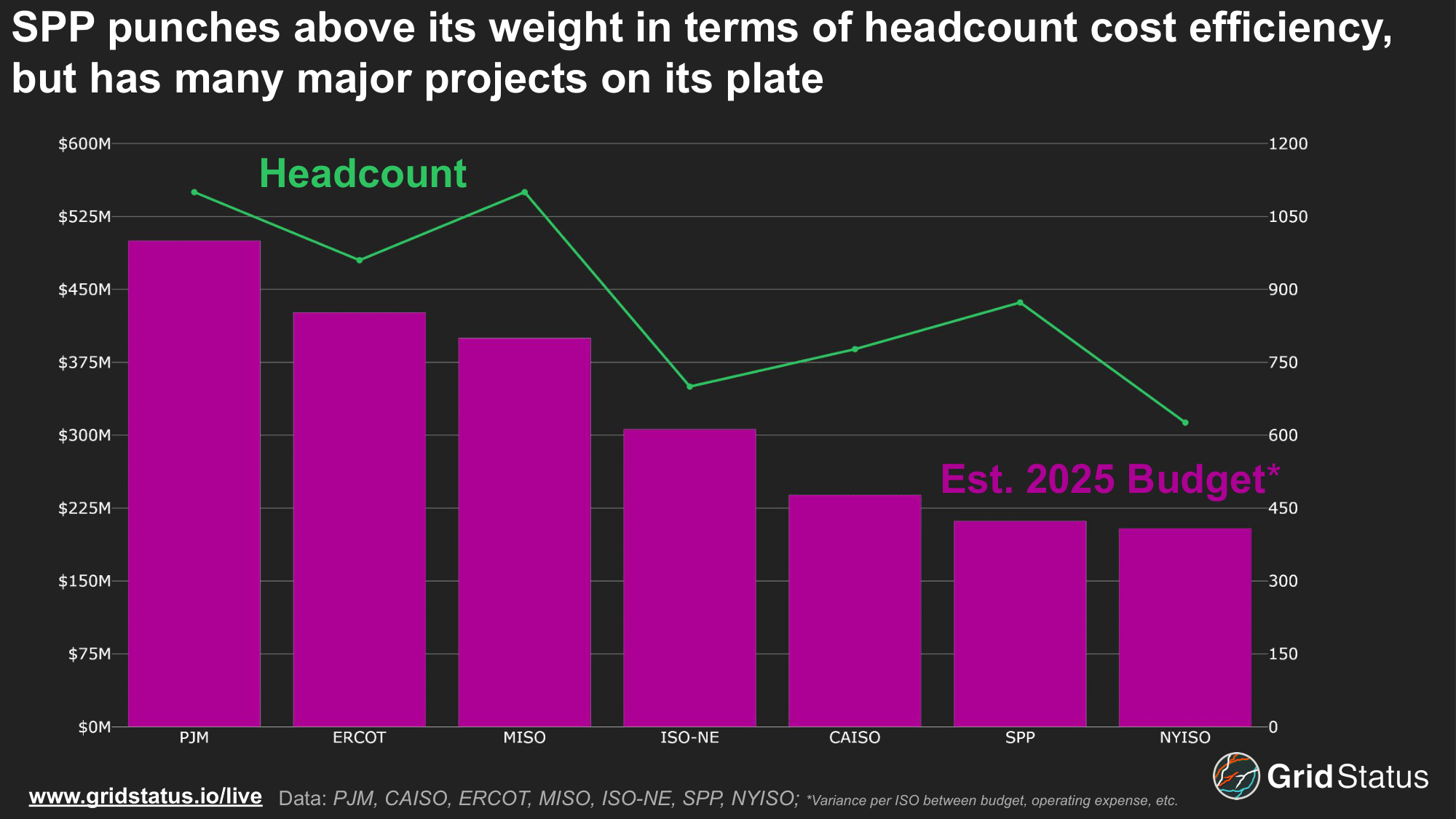

This leaves SPP operating a market that straddles two interconnections, a new day-ahead market in the West, a resource adequacy program experiencing failure to launch, and a soon-to-be-legacy energy imbalance market.

A considerable number of programs for the US market with the second-lowest budget, although SPP’s geographic positioning likely enables the market to do more with less, as their staff count is higher than some markets with larger total budgets.

Markets+ Corners the West

Markets+ (M+) is SPP’s Day Ahead market in the West, although its activities extend into the real-time as well. As with EDAM, transmission operations remain with the original control areas, and SPP will clear units, but the balancing authorities will still be in charge of dispatch. Similar to other market launches, virtuals will not be available at go-live, but are planned for the latter half of the first year of operations. Markets+ notably differs from EDAM in centering congestion rent allocation from the beginning, while CAISO has dealt with increasing stakeholder consternation related to the allocation of specific congestion rents.

In line with the hands-off approach to transmission management, M+ will not have any variant of financial transmission rights. Rather, day-ahead (and not real-time) congestion rent will be collected and then allocated based on Transmission Service Reservations in place of FTR/TCR/ARRs, etc., which are typically used to hedge. The payments will sum congestion across generators, loads, and interchange, net marginal losses, and then be allocated. As SPP put it in their initial M+ proposal, this framework utilizes existing open access transmission tariffs and ensures that economic value is aligned for entities that have secured OATT rights to deliver power over constrained paths.

Conceptually, this plan brings direct value to entities with transmission rights and relieves the possible necessity of self-scheduling to maximize the possible benefits. Instead, rents allocated via market-wide optimization should incentivize more efficient use of the entire network.

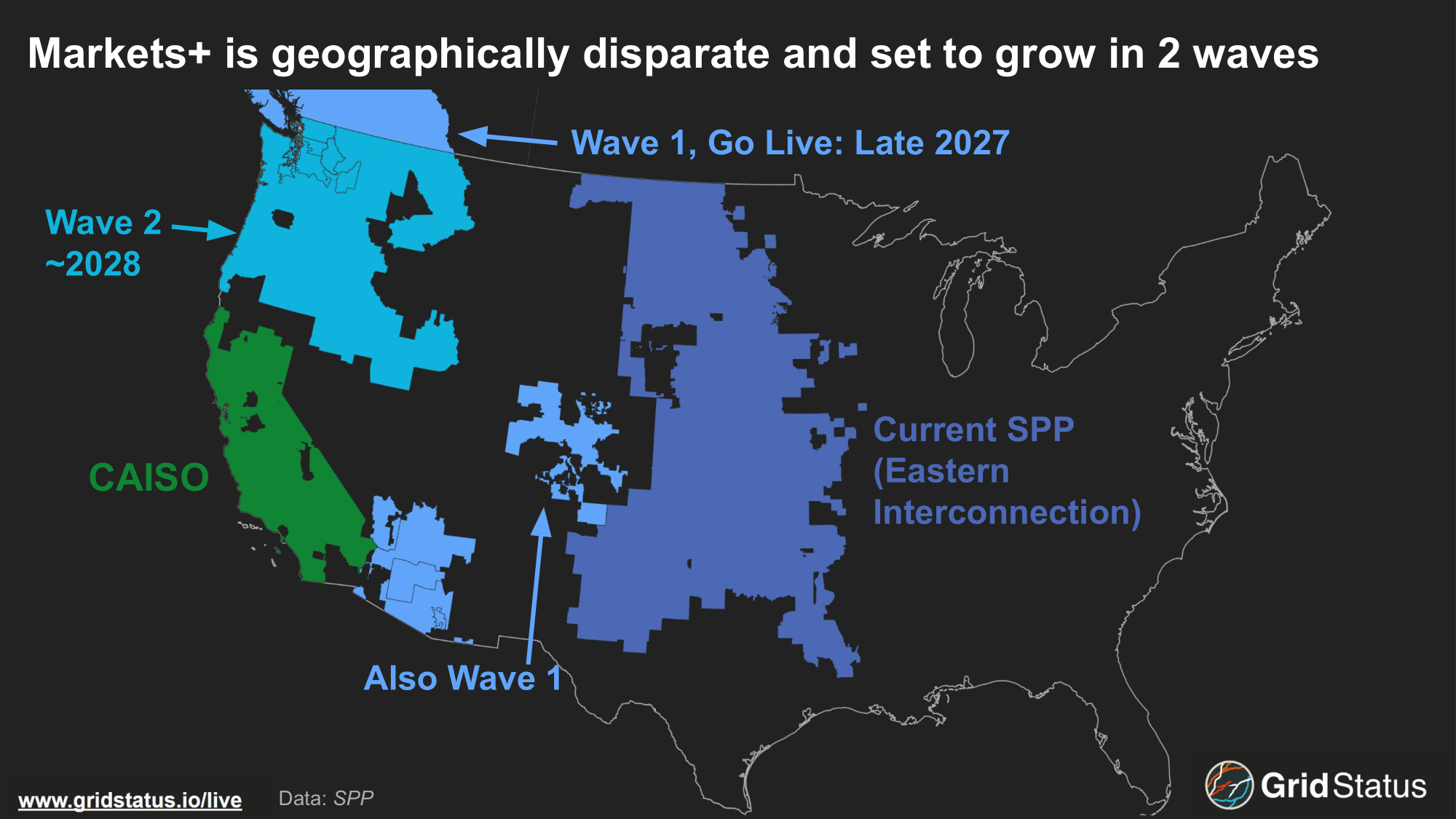

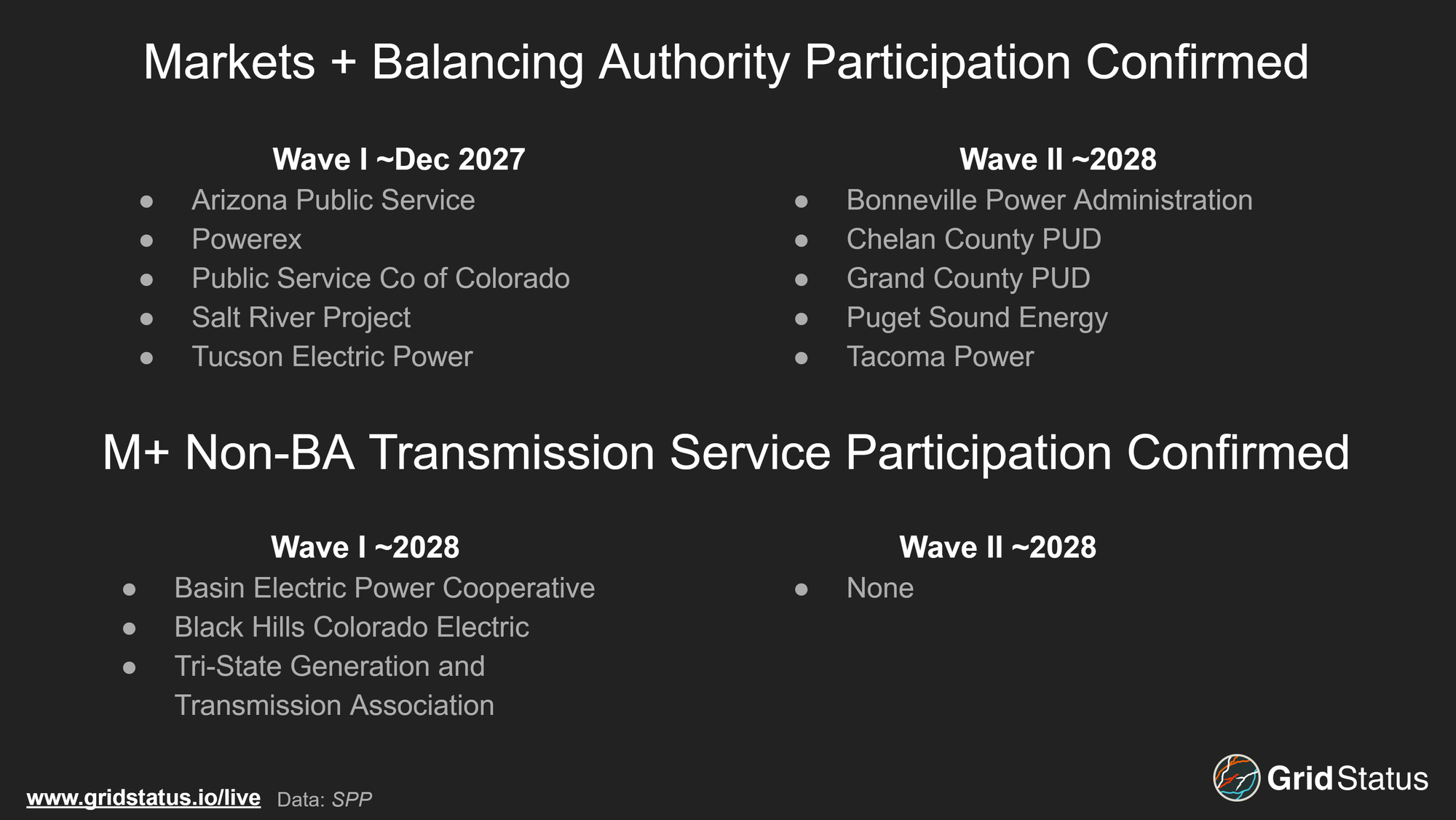

Somewhat confusingly, Markets+ was designed across two phases, and now will see two waves of planned participation. The waves and phases are unrelated beyond each being split in twain. The market first goes live in late 2027, pushed back from October to sometime in December. This initial launch will involve five major balancing authorities listed below and additional transmission service providers, for a total of 11 market participants in the first wave.

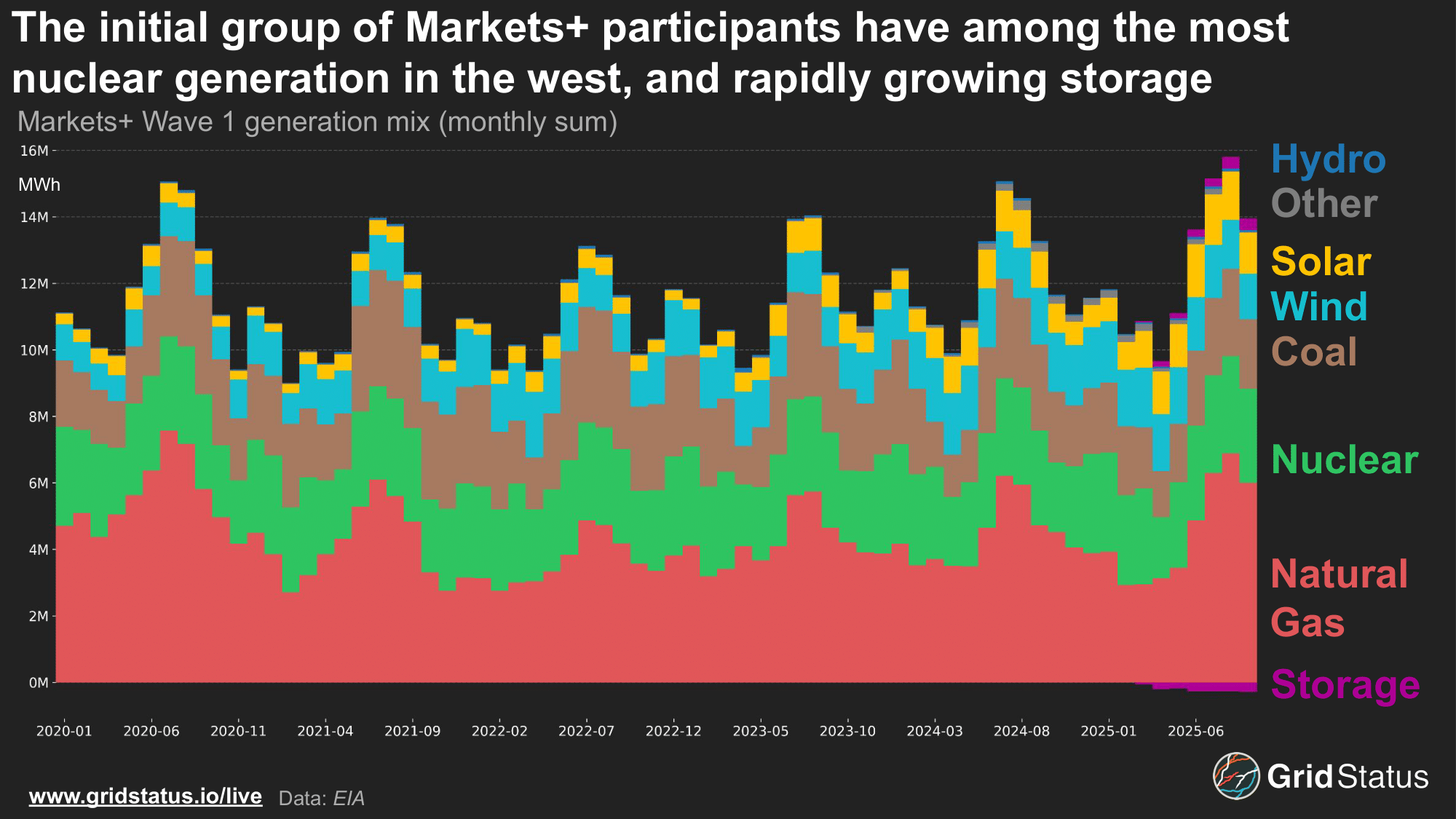

The fuel mix shows plentiful thermal generation with solar and wind slowly being added to the stack as coal units start to retire. Storage has been added in recent years and is expected to continue to increase since APS and SRP's most recent RFP process expresses interest in battery storage. SRP brings Palo Verde nuclear into the stack despite wishing for water near the unit. Powerex, the power marketing arm of Canada's BC Hydro, not depicted below, will bring plentiful hydro to the launch, before the second wave of water comes into play for phase II.

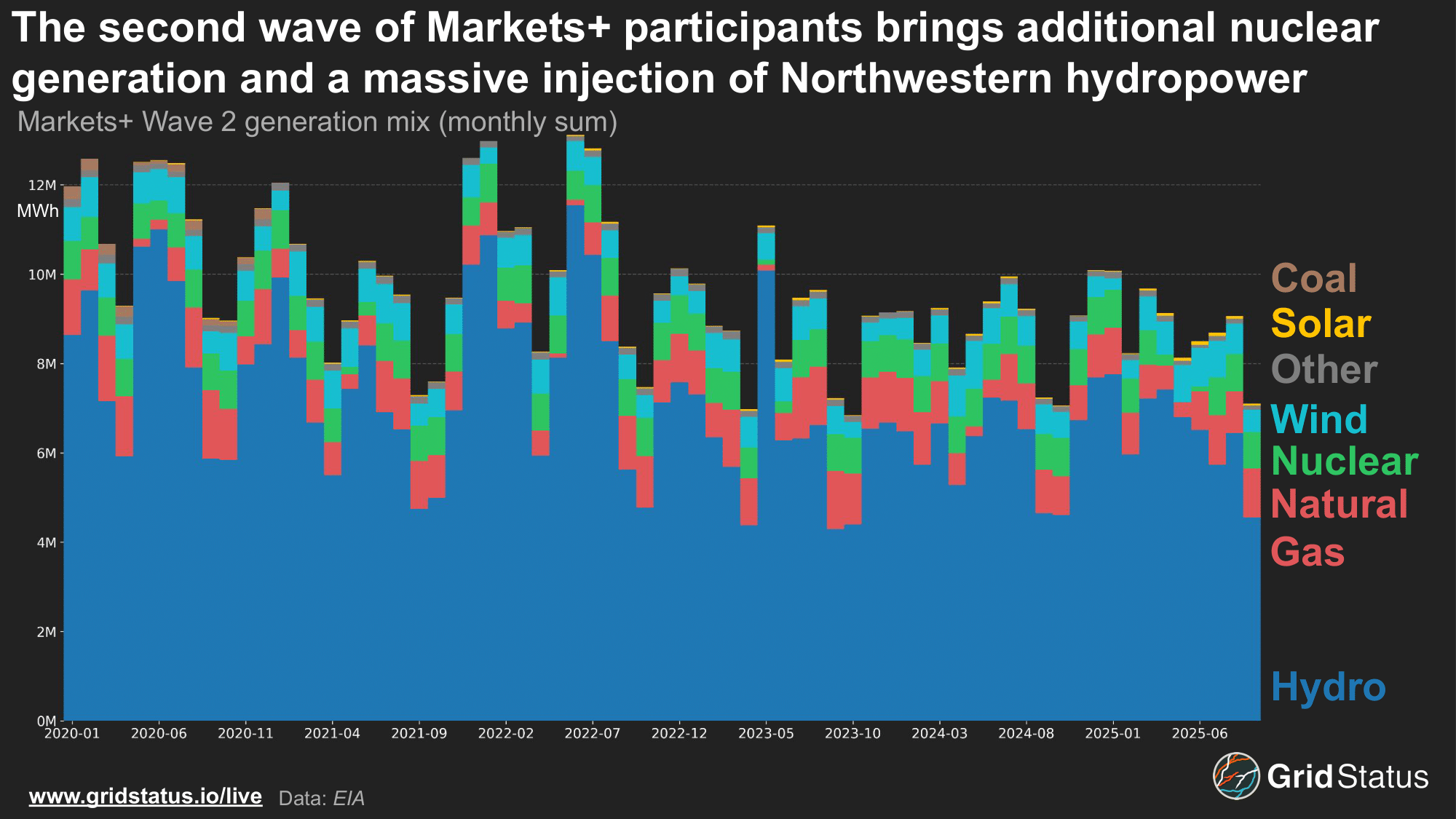

Wave II is scheduled to go live sometime in 2028 with the current list of deferred entities. This list isn’t exhaustive, just the heavy hitters. Wave II is also likely to include additional balancing authorities that have expressed interest but have yet to commit fully at this time.

The second list hits Markets+ with a wave of water as hydro power is the vast majority of the fuel mix, as most of these BA’s reside in the Pacific Northwest. Columbia Generation, home to the NW's only nuclear unit, is slated to join the ranks as well, supplying consistent baseload power. Markets+ fuel mix might seem more at home in the CAISO market, where a renewable-heavy grid is focused; comparatively, EDAM participants seem to be bringing in more thermal generation that doesn’t fall completely in line with CAISO’s carbon-neutral goals. Overall, Markets+ provides a robust and reliable fuel stack across wave 1 and wave 2.

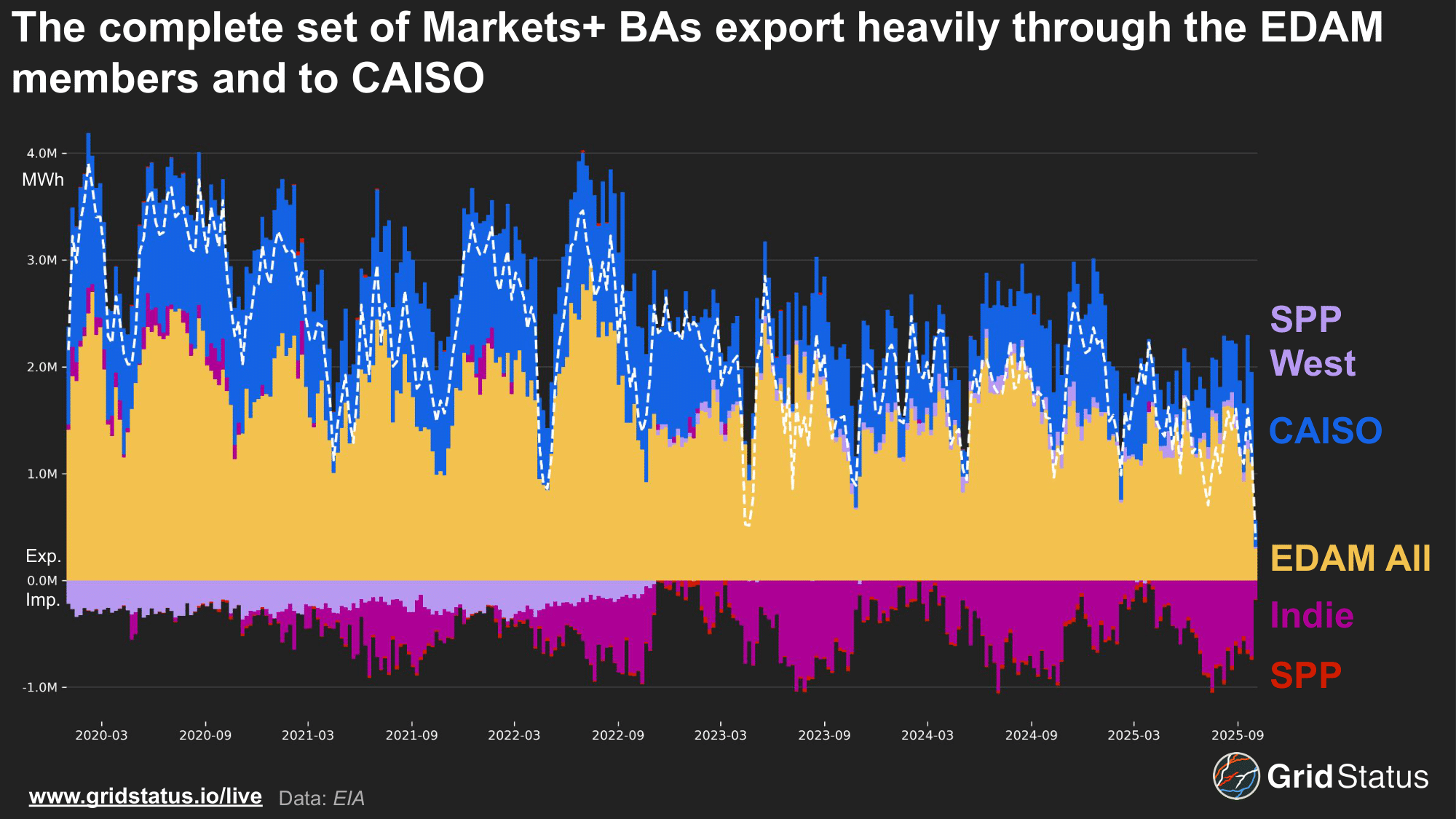

When the BAs are aggregated together, Markets+ tends to be a net exporting grid. Sometimes this gets tricky because APS, SRP, TEPC are very geographically close and import/export large flows into one another. Since these BA’s are all joining Markets+, the flows tend to balance each other out.

Markets+ exports heavily into not only CAISO but also the current BA’s joining the EDAM market. Markets+ has excess thermal generation and plentiful hydro, which helps make it an exporter in the west to markets with higher levels of intermittent resources. Markets+ imports come, in part, from flows through and of Douglas PUD, part of the Mid-C triad that we will explore in part two.

Markets+ Balancing Authority Overview:

*BC Hydro Load

4th and 1

Let's check in. In the first half of 2026, the West will shortly have a new day-ahead market and an expansion of the SPP RTO (more on that in part 2). By 2027, a competing day-ahead market, and by 2028, most of the West will be participating in one or the other, while sure-to-be-acrimonious decisions on the future of CAISO should have reached their denouement.

The guiding element across all of these initiatives is a unified (or at least polycentric) West via the expansion of markets to enable more efficient scheduling and operations across the interconnection. While the DA is a unifying force, things diverge beyond this market process. Western participants in SPP are being fully integrated, participating in the day-ahead, real-time, and critically giving SPP control of transmission. Participants in Market+ and EDAM may participate in generation scheduling, but retain control over their transmission networks. This facet drives an economic efficiency gap between these markets and fulsome RTOs, which in turn has led to some critical differences between the competing constructs.

Western balancing authorities have myriad interconnections, with impactful flows driven by drastically different climates and fuel mixes across the West. EDAM is thermal-heavy, but will be managed by a renewable forward grid. Markets+ has a strong hydro presence moving into a legacy coal and gas grid that itself has shifted heavily into wind. Markets+ is a well-supplied market, averaging net exports, while EDAM averages as a net importer, typically receives flows from BA’s joining Markets+, although this relationship is also driven by the relative position of each within the overarching West. From a reliability perspective, it’s hard not to see a stronger hand in M+’s robust gen stack, but if there’s one thing the 2020s have taught us so far, it’s that energy is back in an era of rapid change.

Western power markets have historically left efficiency on the table due to a necessary reliance on bilateral deal-making. While day-ahead markets will bring optimization to scheduled power, the CAISO-SPP tug of war also subdivides the previously concentrated real-time imbalance markets. WEIS is relatively new and also far, far smaller in terms of coverage than WEIM. By choosing M+, previously WEIM-involved entities will shift their real-time balancing into SPP’s market construct. This will play out across the West, leading to two real-time markets that are more balanced in size, but with far more seams. Trends in real-time trading volumes will be critical to track as they face increased transaction costs, loss of price transparency, and scheduling hurdles.

Like Markets+' phased participants, we’ll be following up with more on RTO West, the balancing authorities not committed to either EDAM or Markets+, challenges in the west, and the Canada of it all. Stay tuned in the coming weeks. Until then, track CAISO and SPP on our Live pages and get timely market notes from our new Insights feed.