Beyond the Day-Ahead: Bridging East and West, Redefining Hubs, and International Coordination in the West

Beyond the competing day-ahead markets, the West will also see fulsome RTO expansion via SPP, market reform and cooperation in Canada, and independence (today) for certain authorities. We break it all down.

The West is changing fast. In the two weeks since we published part 1, WRAP hit its commitment deadline of October 31st, locking in the 16 initial participants and breaking largely along the lines of EDAM and Markets+.

From the salt beds of Utah to the sands of Los Alamos, the West is no stranger to breaking limits. Now, the region is set to see a new barrier fall as SPP establishes the first cross-interconnect ISO, crossing the barrier between East and West.

Check it out and let us know what you'd like to see covered!

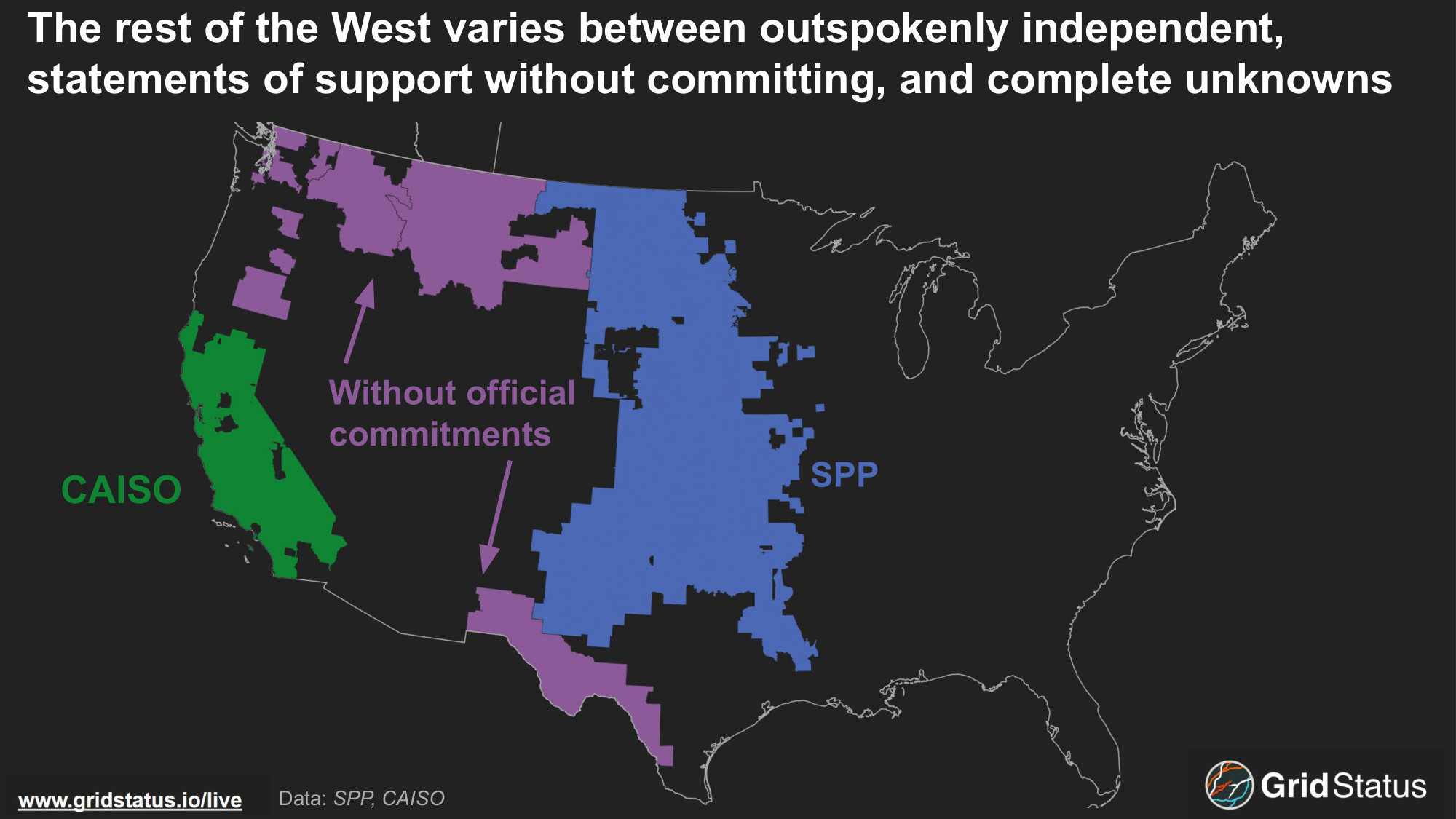

Markets+, EDAM, and SPP itself have claimed their share of BAs, but not everyone in the West is accounted for. The holdouts span the spectrum, from fiercely independent to administratively uncertain, with the totally unknown in between.

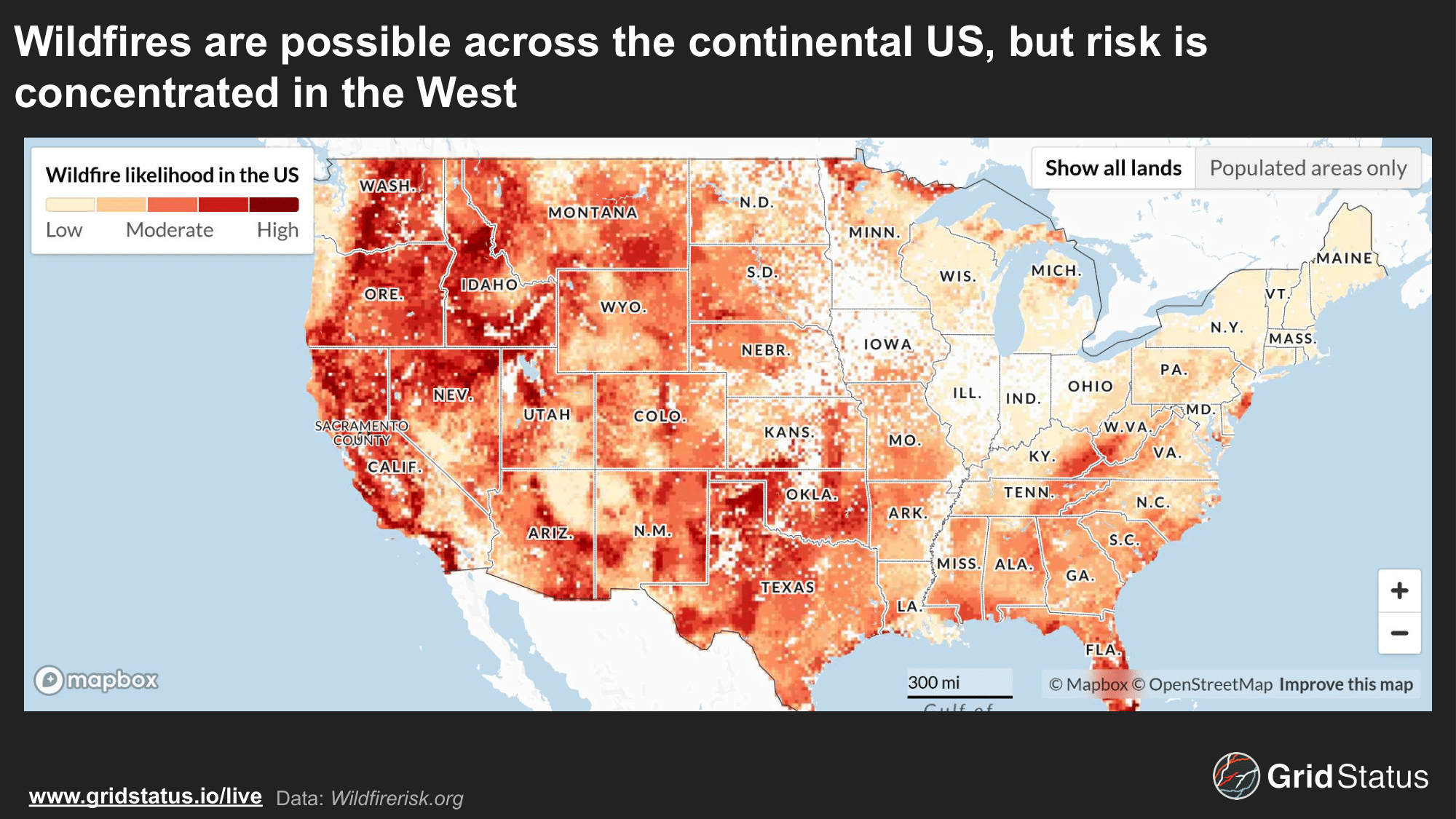

Paralleling the West’s trailblazing history is a series of profound constraints the Eastern Interconnection rarely considers. Water, wildfires, and beautiful but rugged terrain all present challenges now and into the future of the western grid.

Table of Contents

- SPP Western BA

- Independents and Unknowns in the West

- Trading Hub Uncertainty

- The Threat of Fire

- The Challenges of Winter

- British Columbia

- Alberta's Market Reform

- Conclusion

SPP Goes West

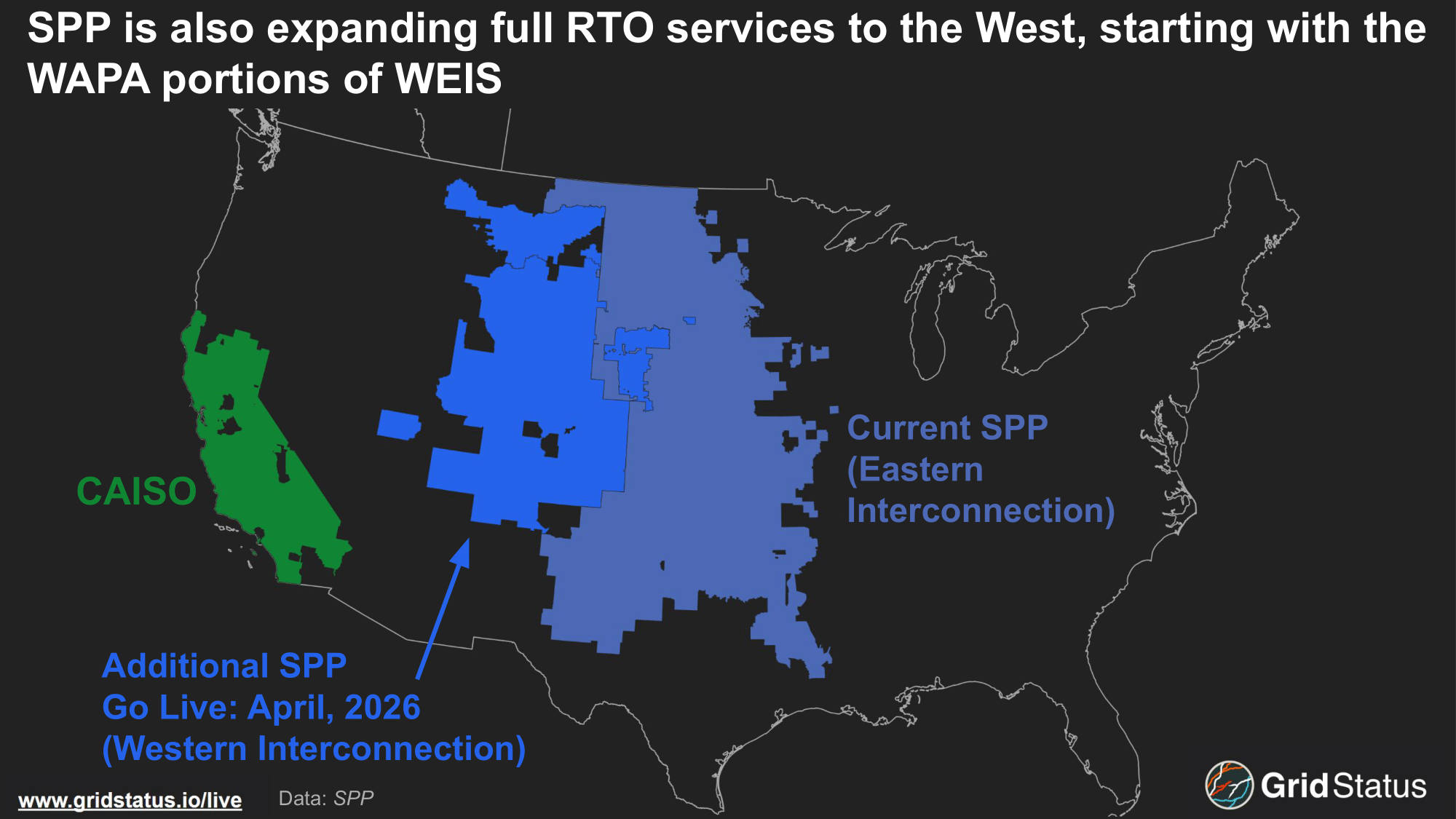

Unlike Markets+ and EDAM, this is a complete expansion of SPP’s RTO services into the West.

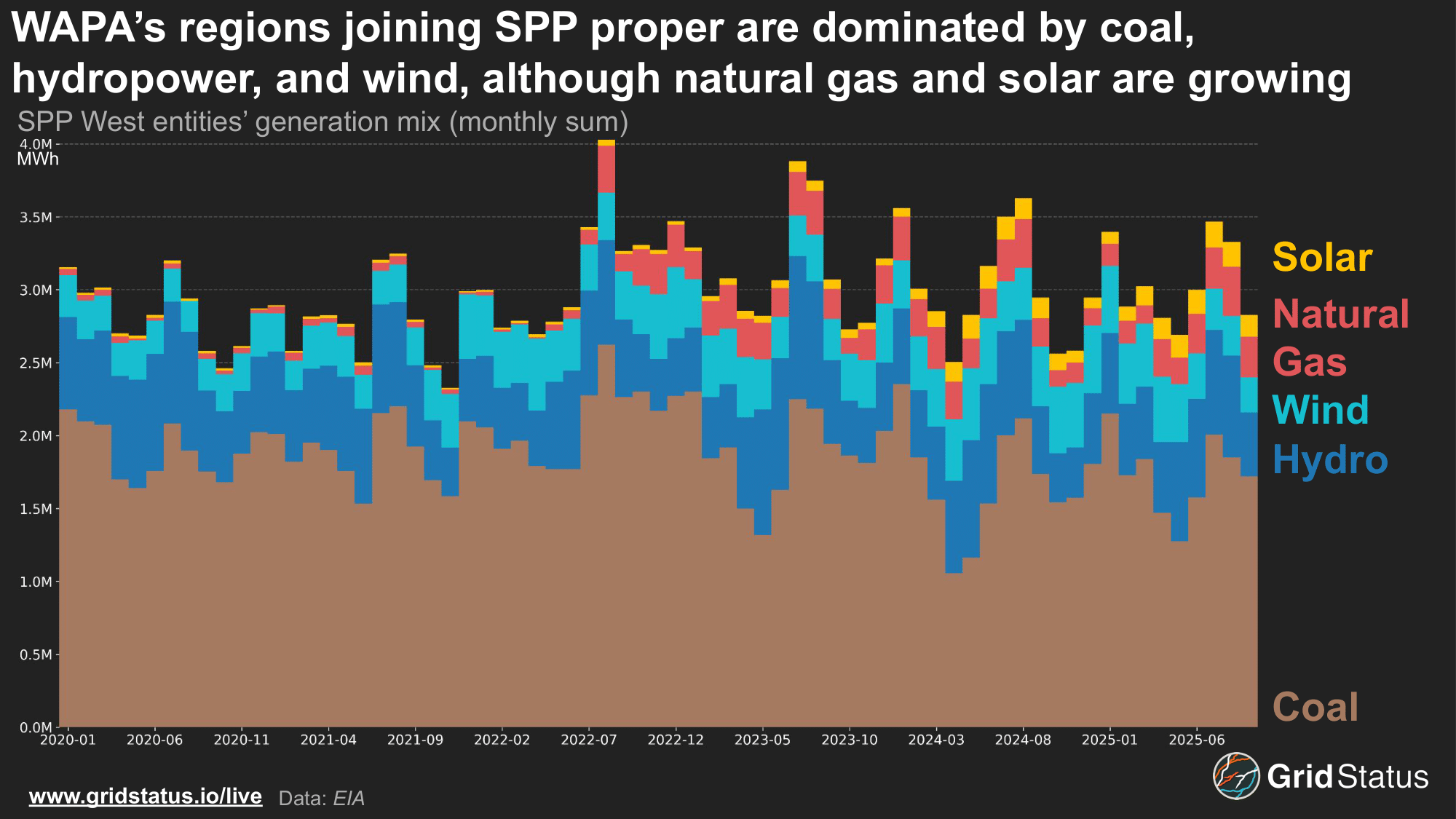

SPP’s westward expansion will gradually subsume the remnants of WEIS. The previous members will choose between full RTO services and a more complete market solution via Markets+ (or EDAM). The initial expansion of SPP proper will only take in the two Western Area Power Administration (WAPA) regions we discussed two years ago, Upper Great Plains West and Rocky Mountain, WAUW and WACM. Together, these regions will form a new Balancing Authority, resulting in SPP managing Eastern and Western BAs together.

The Western BA will immediately add a 3rd Hub to SPP, joining the North and South Hubs. The South hub typically experiences greater volatility in the real-time market than the North, which drives congestion as it flows towards population centers.

West Hub will have less wind and is likely to hold a real-time premium to the North and South hubs as its resource mix is not nearly as wind-driven, resulting in fewer periods of prolonged low prices.

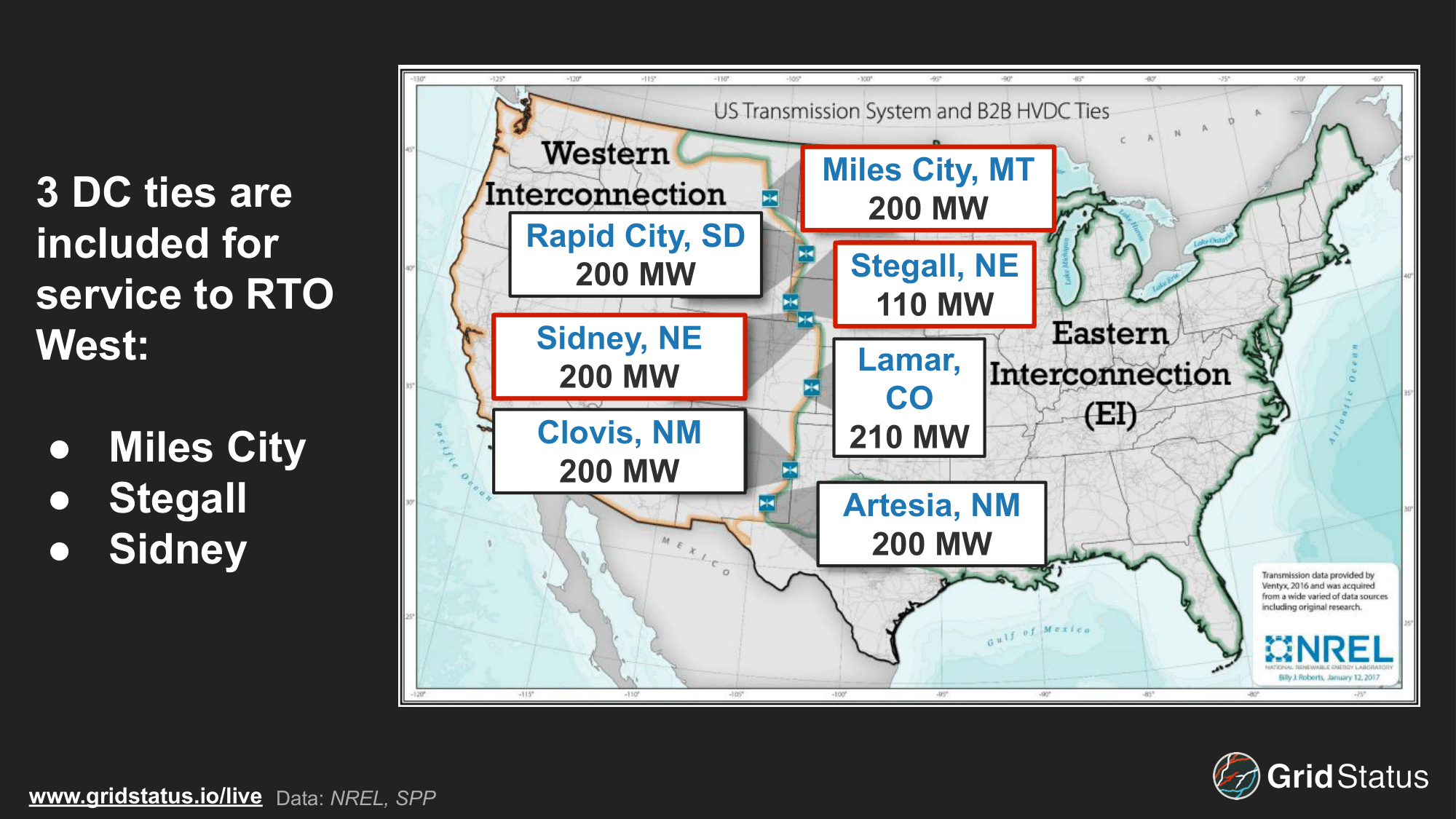

The RTO plans to co-optimize East/West BA’s across DC tie lines in their territory, which provide up to 510 MW of bi-directional DC tie capacity. Nodes already exist on both sides of these ties, but for SPP and WEIS:

- Miles City

- Stegall

- Sidney

One of these, the Miles City Tie, from east to west, is limited to 100 MW currently for planned maintenance. This maintenance began on 10/1/2025 and is planned to conclude on the evening of 4/1/2026, the first day of full operations for SPP in the West, interesting timing given everything else that will be new on the same day.

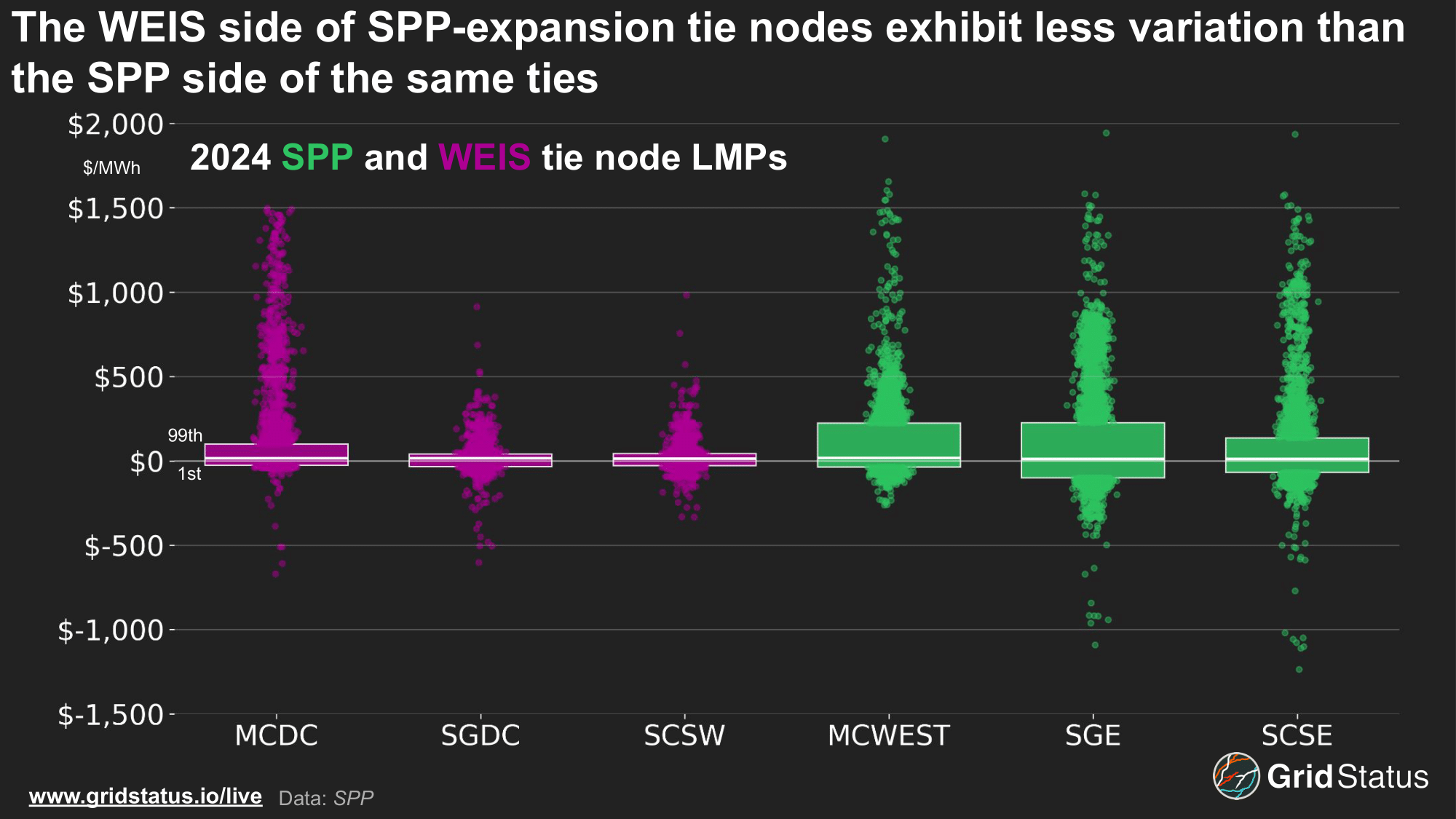

On the WEIS side, the nodes are currently only priced in the real-time market. Price separation between these locations is considerably smaller than the SPP sides of the same ties. This is a function of both the larger market optimization as well as the relatively sparse transmission in the area on either side.

In terms of discovery, the signal from WEIS prices is somewhat coarser and more likely to be similar across the footprint than nodes in SPP, even in the same region. How this changes under the SPP expansion is something to watch.

Virtuals will be similar to the current SPP RTO, but the DC ties will not be a biddable location in the beginning. Congestion hedging will also undergo a transitional period. For the first four years, settlement will be based on Transmission Service Rights (TSRs), with only long-term service eligible, and it will be settled as an option. After this period, settlement will utilize Transmission Congestion Rights (TCRs) along single paths with three segments.

To manage the new dual-BA system, SPP is creating an additional reference bus.

A reference bus is found in every market and represents an imaginary 0 shift factor point.

The LMP at a reference bus becomes the marginal energy component for an entire system, although in this case, there will be separate energy components for each AC Island. The BA conditions and DC tie operating parameters will inform the directional flow of each DC Tie via SCUC and then determine the actual flows via SCED.

SCUC vs. SCED

The energy industry loves acronyms, and market optimization is no less a victim. For SCUC (Security Constrained Unit Commitment) and SCED (Security Constrained Economic Dispatch), the keywords to focus on are at the end: Commitment and Dispatch.

SCUC will determine the direction of the flow, its “commitment” in this setting, and evaluate the optimal direction in each run of the Reliability Unit Commitment (RUC) process, at least every 4 hours. For generator resources, SCUC can be thought of as positioning the assets for operation; a unit is up to bat, but they don’t yet know what base their hit will take them to. While the SCUC process commits resources within the system’s constraints, it’s SCED that produces actual prices.

SCED dispatches, clears, and prices the market projects (energy and reserves) that meet a system’s obligations. SCED determines the outcome of the at-bat. While both SCUC and SCED operate on a least cost basis, SCED is the mother of price in the real-time markets. This doesn’t mean that SCED prices are the final say when it comes to settlements, as markets often settle at less granular frequencies and may have other adders or considerations to reach “final” LMPs.

SCED timestamps may also not conform to perfect intervals. When a market makes SCED data available, it can be provided with the complete timestamp, including seconds. Additionally, because SCED is the real-time solver, markets may need to engage off-cycle runs to solve specific or challenging system conditions. These runs, like NYISO’s Corrective Action Mode (CAM) of their Real-Time Dispatch (RTD), can generate priced moments in between the typical 5-minute intervals. All of these are things to watch out for when working with SCED data. This is also why our dataset catalog annotates ERCOT real-time LMP SCED data as Irregular instead of five-minute.

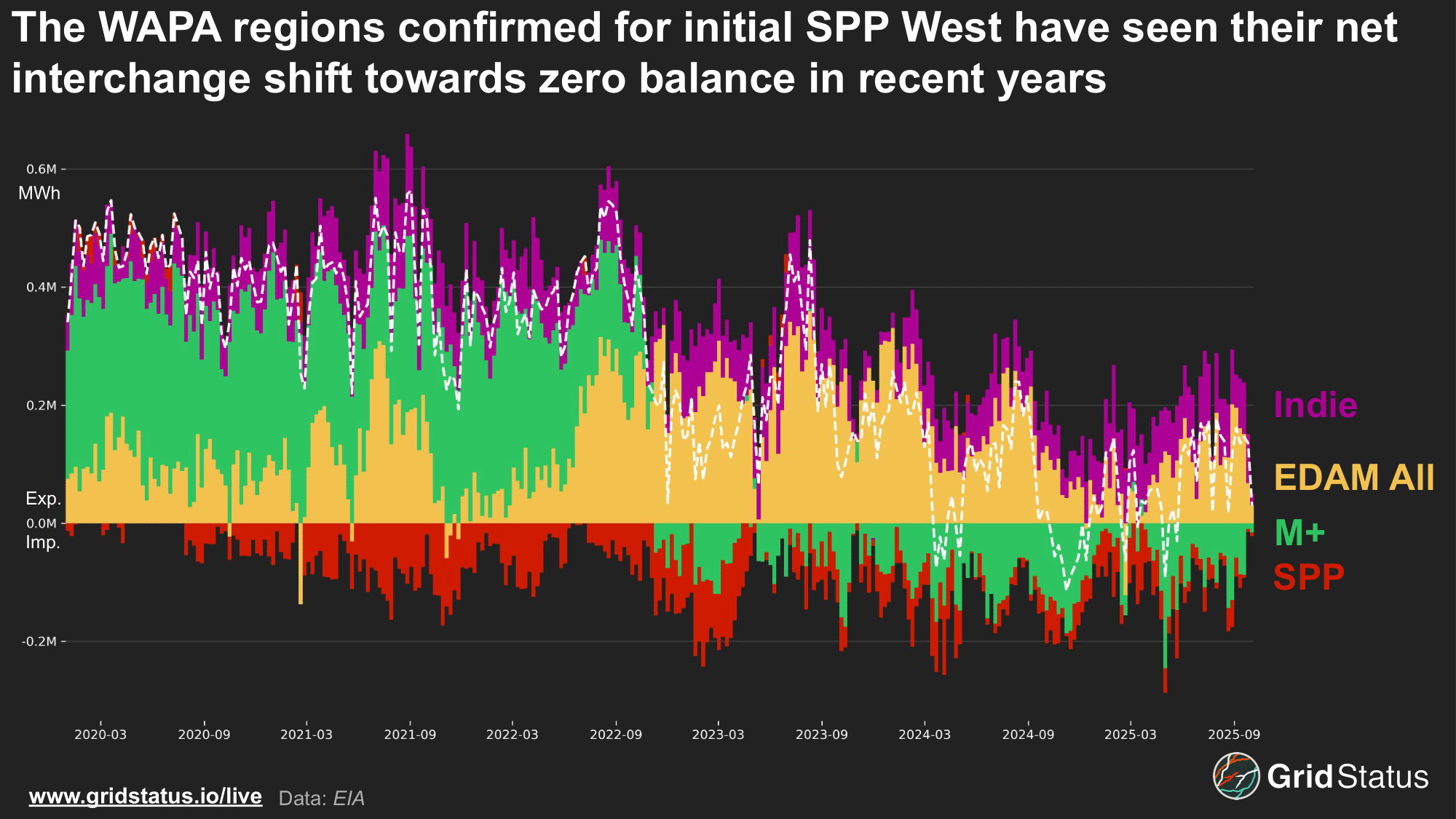

BA’s joining RTO West have traditionally been strong net exporters, but the trendline has occasionally reversed in recent years as more power has flowed in from SPP and through the areas joining Markets+.

The reversal of imports from M+ areas, coupled with an increase to EDAM regions, speaks to shifting patterns of wheeled power as well. To the East, flows from SPP have always been limited by the DC tie lines, with interchange capacity further restricted by outages, as a single line represents a substantial portion of total transfer capability.

One reason for the decline in exports is the retirements of coal units in the region, which are limited in their capability to run as flexibly as modern gas units, and therefore tend to run at higher capacity factors than the units that have taken their place.

The fuel mix in RTO West is still predominantly coal, but as additional units move towards retirement, the utilities' preference for natural gas replacement is already apparent. However, timelines for either replacement or conversion will likely be delayed, given backlogs in turbine orders and limits in pipeline capacity.

SPP has designs on continued westward expansion, but the picture is somewhat muddled. Colorado has passed a bill that requires RTO membership by 2030, but Xcel Energy pushed back on ceding the control required to join a full RTO, instead filing to join Markets+. Chief among Xcel’s concerns was retaining control over planning and building its own infrastructure, as well as well-known interconnection queue snarls. Xcel’s analysis of costs for these options was contradicted by PUC staff, but ultimately, the PUC did approve Xcel’s plan to join Markets+ instead of SPP proper. Xcel’s intransigence is a stumbling block for further expansion in Colorado, but the wider West has seen repeated interest in full markets. While its utilities are EDAM-affiliated, Nevada also passed a bill requiring market participation by 2030.

We discussed M+ extensively in part 1 as a Day-Ahead market, but here is a brief rundown of the structured differences between what SPP is doing with their expanded RTO and M+.

A Group With No Name

Not everyone in the West is hopping on the train to new horizons. There are a number of players we have yet to talk about, so who are they and why might they stay independent?

Before we dive in, it’s important to note that this bucket is a catch-all, including both the openly independent and authorities that have made public statements in support of a particular market but are not officially set to join at a specific date. NorthWestern has not yet committed, but has stated an intent to join one or the other based on final details, while Both UniSource Energy Services and El Paso Electric have verbally committed to Markets+ but are not currently registered per SPP documents.

BAs officially committed to neither market include:

- Avista Corp

- Avangrid Renewables Northwest

- DECA Arlington Valley

- El Paso Electric

- PUD of Douglas County

- NorthWestern Energy

- Seattle City Light

- Puget Sound Energy

- Unisource Energy Services

Bolded BAs are those that have committed to WRAP, which ended up breaking largely along the lines of Markets+ and EDAM.

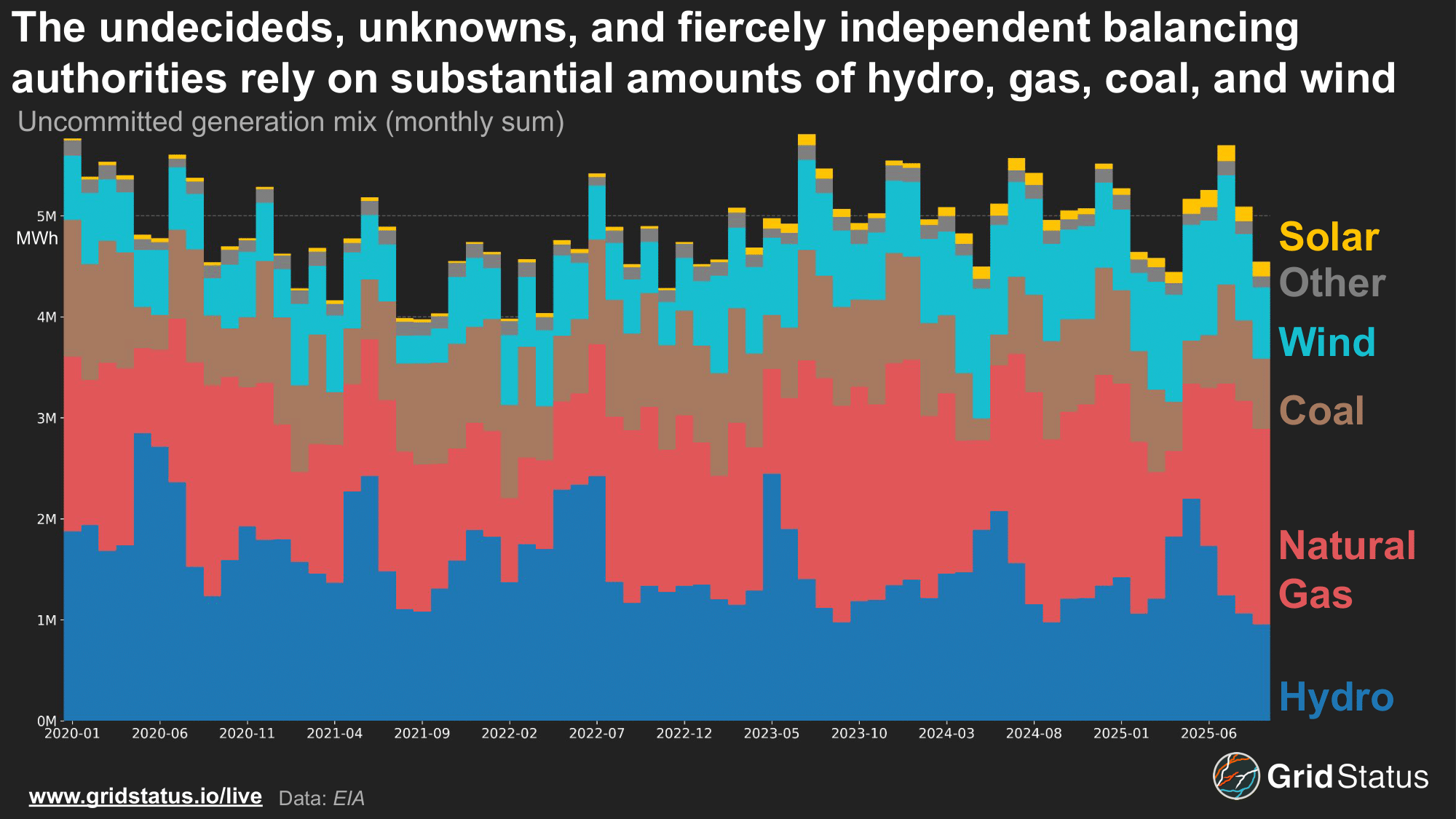

With many of these uncommitted BAs in the Pacific Northwest, it should come as no surprise that hydropower makes up a substantial portion of their existing fuel mix. Natural gas and coal still have a stronghold on thermals, while wind makes up the bulk of renewable generation. With plenty of dispatchable generation present in these BAs, an independent track is certainly possible; however, fragmented coordination may become pricier compared to greater levels of generation, transmission, and prices in the EDAM and M+ blocs.

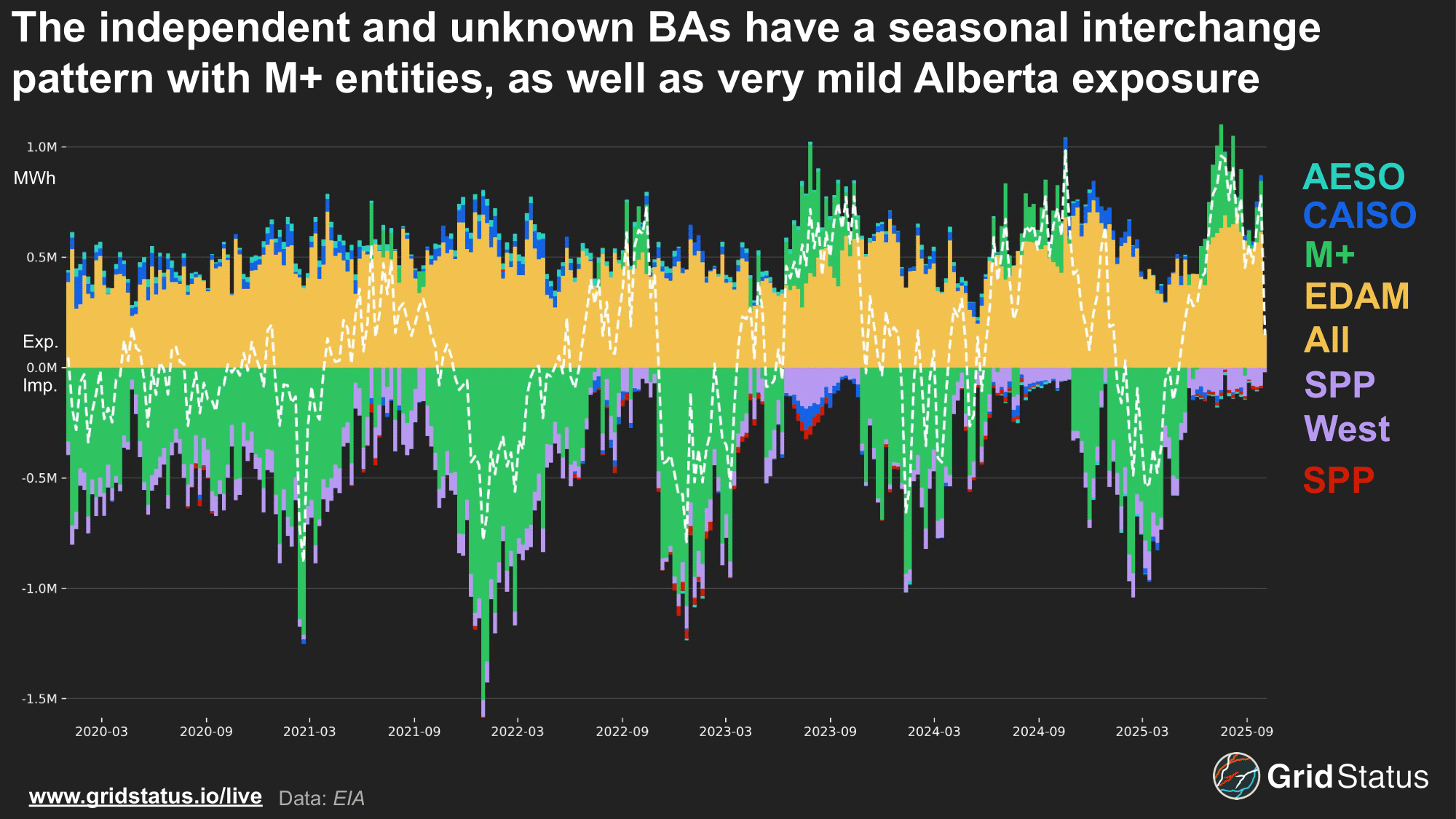

Control of flows and allocation of resulting rents has been a driving reason for why certain BA’s are joining one market over the other. EDAM tends to favor direct ownership of lines, while controlling transmission rights more broadly is beneficial to participants in Markets+, which allocates congestion rents via rights. For the independents, interchange has been relatively consistent over the last several years.

Interchange between independents and the rest of the West has the starkest seasonal pattern we’ve seen so far.

Imports from the Markets+ bloc peak during the winter, while exports to the same group almost exclusively occur during the summer.

This reflects recent challenging winters in the Northwest as well as the broader geographic diversity of the West, where summer and winter present starkly different challenges across the Interconnection.

Wherefore art thou price hub?

While the West’s markets have always been fragmented, some power trading hubs predate the markets themselves. Mid-Columbia (Mid-C), as well as Palo Verde, have been priced trading hubs by Platts (now S&P Global Commodity Insights) since October 1994, making them some of the earliest power trading hubs in the US.

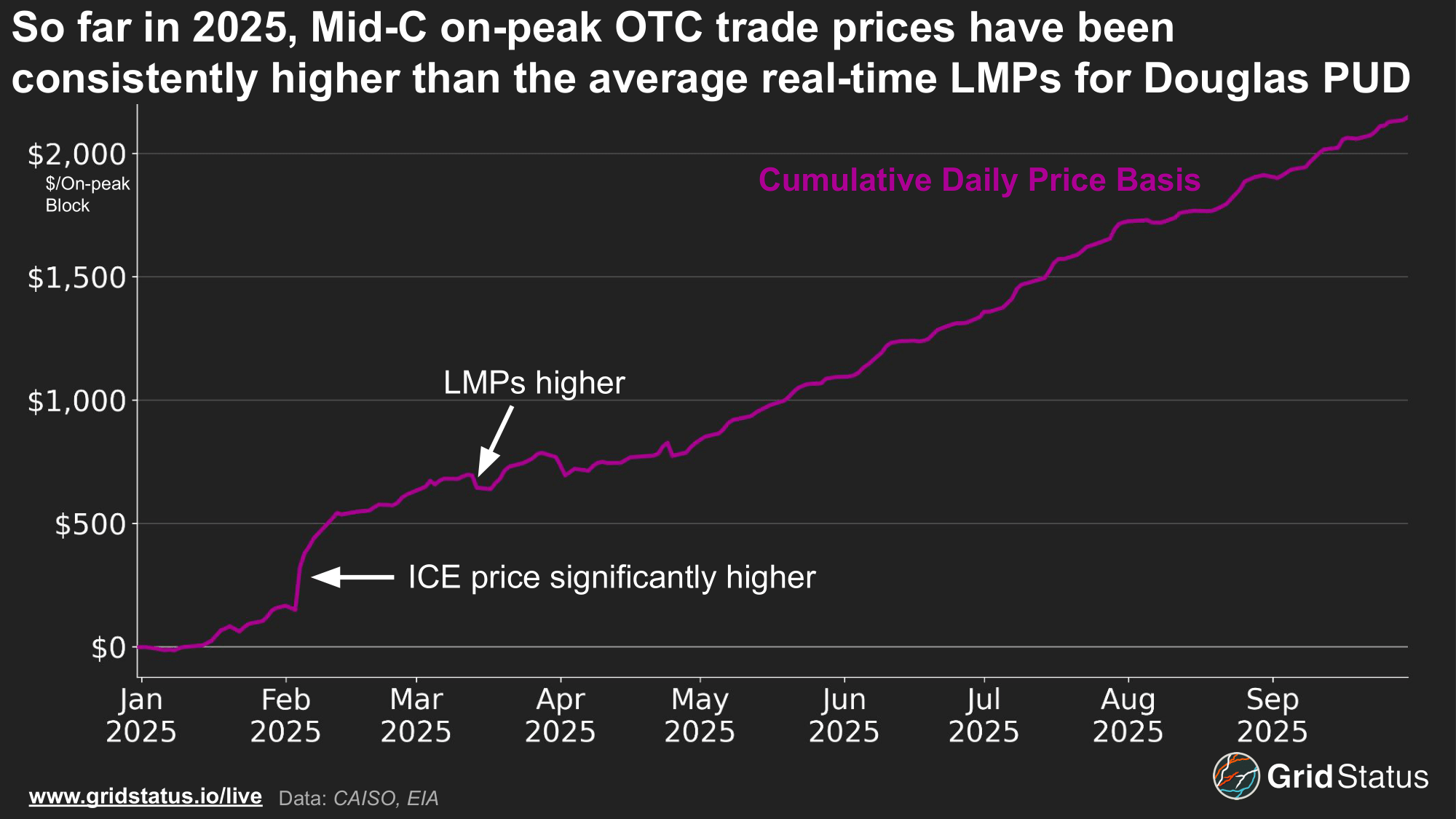

Mid-C is comprised of the hydropower facilities owned by three PUDs: Grant, Chelan, and Douglas. Grant and Chelan have committed to Markets+, but Douglas’ lack of commitment may complicate Mid-C pricing. Despite managing less than a GW of generation and demand, Douglas PUD has long played an outsized role in western power pricing due to its inclusion as part of the Mid-C hub price.

To give a sense of how liquid this relatively rural region is, Mid-C on-peak day-ahead ICE futures have open interest out through 2030 and regularly trade through 2026, while bilateral volume averaged more than 20k MWh for on-peak power per day through September in 2025. In a region with limited price signals compared to more fulsome markets, Mid-C is a critical power trading touchpoint.

So far in 2025, real-time LMPs saw CHPD typically settle the highest, followed by Douglas and Grant. During higher solar penetration months, Mid-C often settles above TH_NP15. This is driven by the midday price dips that TH_NP15 sees from the high solar concentration in California. These solar-driven flows can contribute to better management of hydropower reservoirs across seasons by creating the operational flexibility to retain water later into the hydrological year.

The largest recent shift in flows from the Pacific Northwest to California occurred after Washington State enacted carbon pricing in 2023. This reduced flows to the South due to an increase in the marginal cost of power flowing from Mid-C to CAISO, but increased flows in the opposite direction.

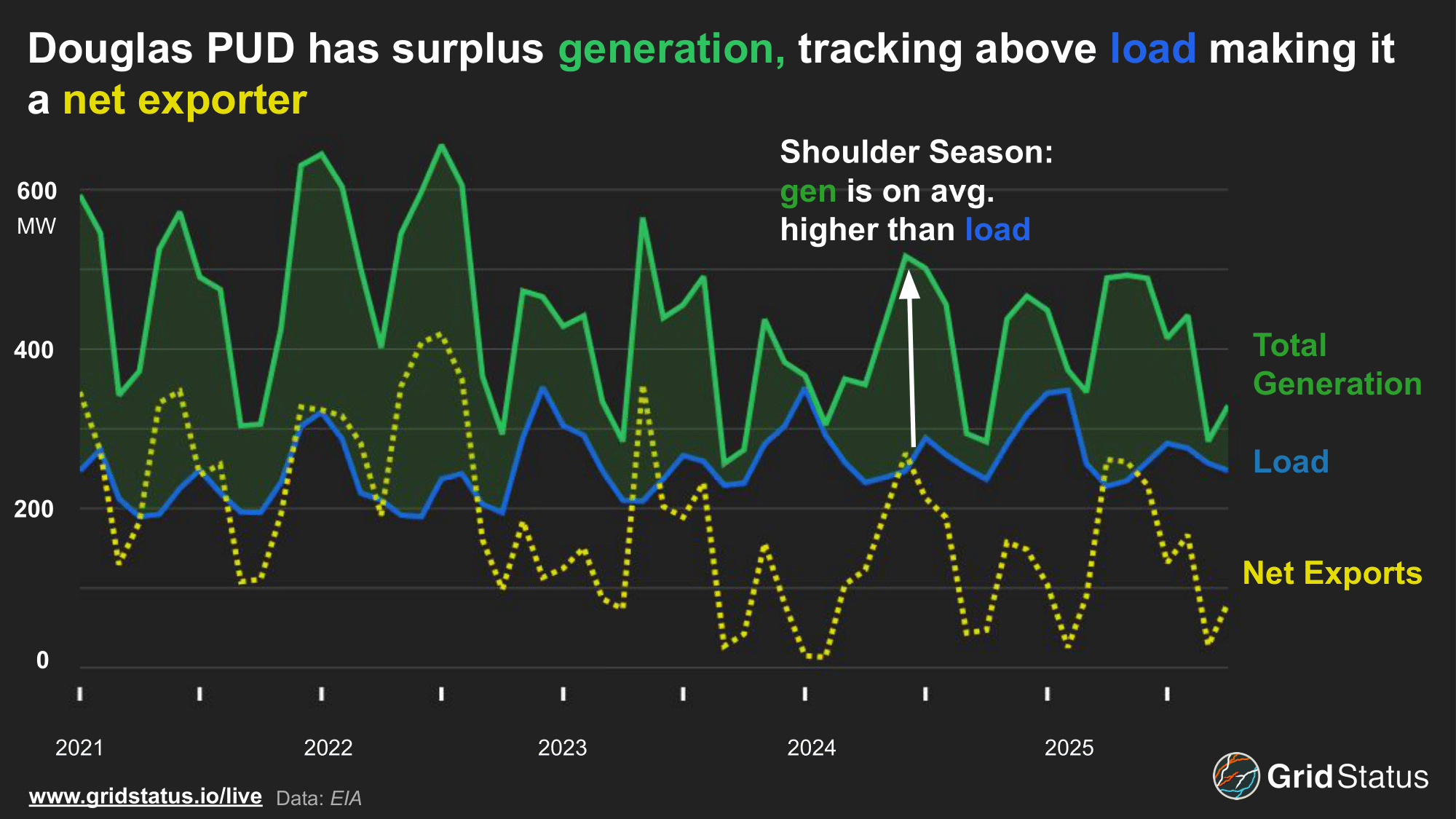

Douglas County PUD itself is a small hydro-based balancing authority with load averaging less than 300 MW.

With its combination of relatively weak load and stronger hydroelectric resources, Douglas is often a net exporter, mainly to BPA, while importing from Chelan as power flows through the region. In recent years, hydro generation has declined, reducing its total exports, while still maintaining a healthy margin in most months. Despite their independence, Douglas PUD will undoubtedly be subject to indirect influence from the new markets due to their historical and physical relationships with surrounding balancing authorities. Given its geography, the PUD hydro will be an export flow, likely into Markets+.

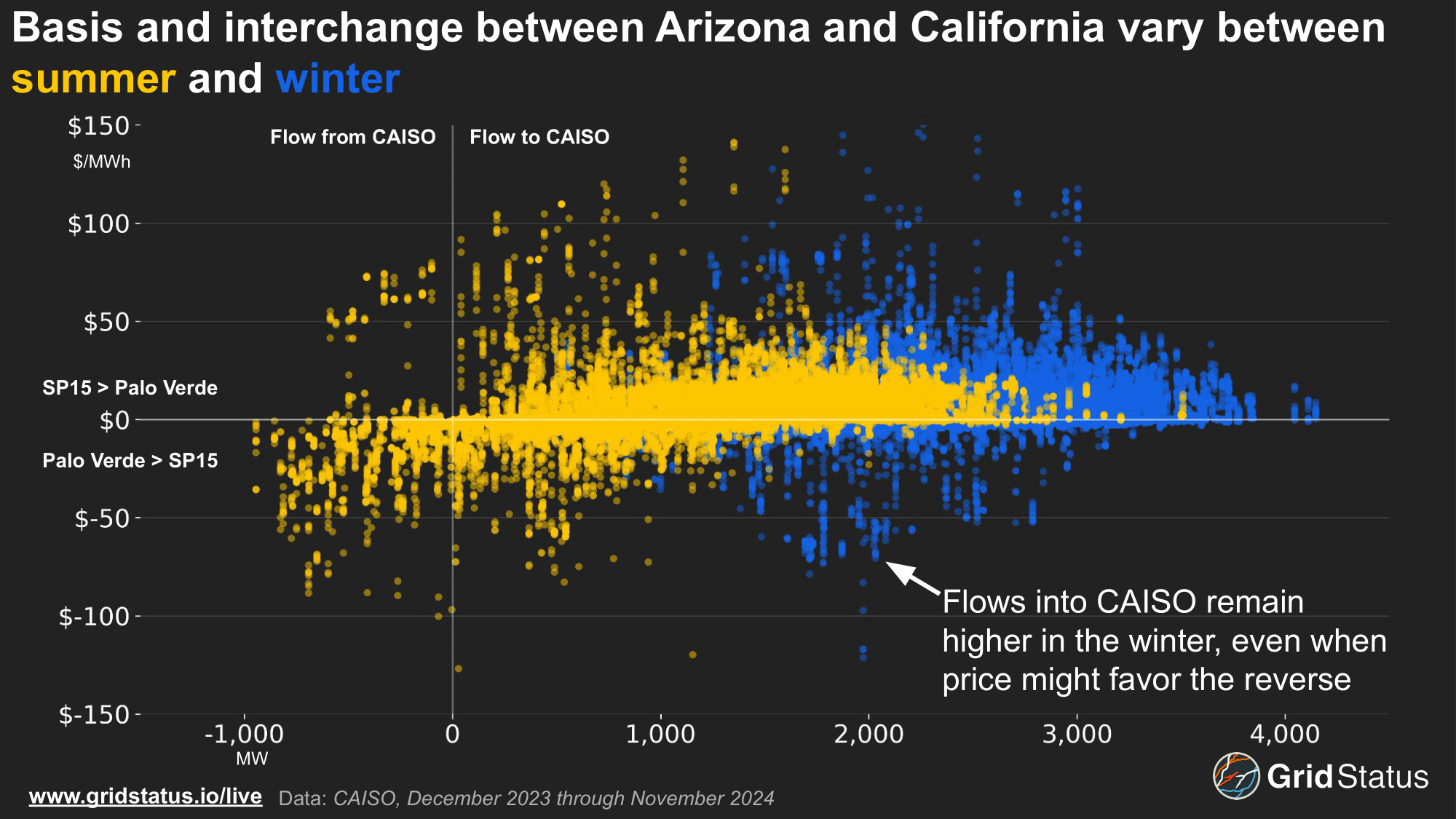

In the Desert Southwest, we have Palo Verde, comprised of the switchyard at its namesake nuclear station, located west of Phoenix, AZ, and a part of the Salt River Project (SRP). In the context of the wider West, SRP is joining Markets+. Palo Verde is the reference point for many PPAs in the Desert Southwest, and are traded spot on ICE, although futures for various Palo Verde contracts have limited volume on either ICE or Nodal Exchange. The Palo Verde price is often used as a reference point against CAISO’s TH_SP15 trading hub in particular, due to their relationship in terms of regional flows.

Unlike most regions, CAISO pricing is often strongest over the off-peak, primarily a result of the region’s high concentration of solar. Renewables push prices down over the on-peak, when the sun is shining. Natural gas is dispatched during the evening ramp and remains online over the off-peak, increasing energy prices compared to the on-peak.

A Land of Fire. . .

An increasingly arid climate is exacerbating decades of wildfire management focused on suppression at all costs and collectively increasing the risk of larger fires in the West, which create challenging grid operations. While wildfires in California have gained the most infamy, these risks and their impact on the grid are not limited to the Golden State. Arizona also suffered from the significant Yarnell Fire in 2013, and fire mitigation is a growing concern throughout the entire region.

If you take a look at any map of generating resources in California, you’d see a smattering of small hydroelectric facilities located throughout the Eastern portions of the state. Many of these dams, often over 100 years old, are remnants of the early days of electrification when entrepreneurs tapped into the vast resources of the state to electrify major load centers.

In a cruel twist of fate, transmission delivering the water power of these far-flung resources has been the source of disastrous fires in the past.

Leading up to the Dixie fire in Paradise, CA, the state and wider west were under extensive drought conditions, increasing fire risk and reducing hydropower operations. But the Dixie Fire has an even deeper tie to hydropower and the grid at large. The initial ignition was traced to a 12kV distribution line near Cresta Dam, and ultimately spread throughout much of the area. Cresta Dam is part of the Upper North Fork Feather River Project, which totals ~360 MW and consists of three dams and five power plants, managed collectively for generation and water control.

2021 and 2023 stand in stark contrast as exceedingly dry and extremely wet years, leading to few acres burned and elevated hydro output in the latter. Wildfires of all sizes pose a risk to the grid, but the grid itself can create opportunities for ignition. In California’s case, the Legislative Analyst’s Office reported that while only 10% of wildfires were started by utility equipment, 8 of the 20 most destructive fires in California’s history were started by powerlines. For example, the most destructive fire in state history was the Thomas fire, caused by strong winds, leading a SoCal Edison power line to arc. The grass below caught fire, and the strong Santa Ana winds carried the fire, ultimately burning 281,000 acres in less than two months.

. . .and Ice

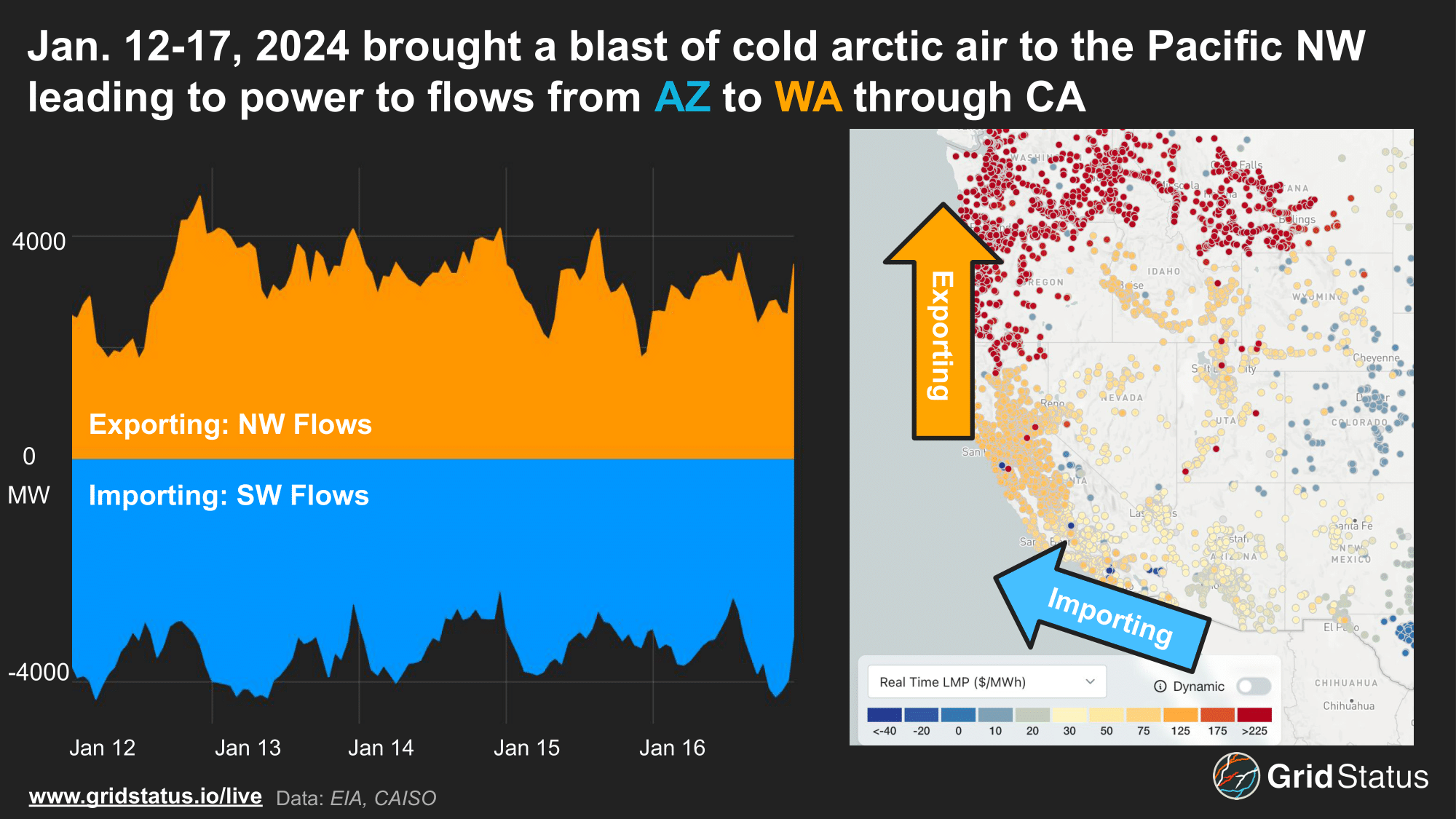

Western extremes don’t end with fire, but extend into the winter. In January 2024, arctic air pushed down into the Pacific Northwest, bringing freezing temperatures to the region. Load exceeded regional net generation due to the winter conditions. More than 50% of homes in WA and OR use electric heating for their homes, so as temperatures decrease, load increases at a higher rate than grids with more diverse heating sources. The region had to import to meet load, and most of these flows came from the plentiful supply located in the summer peaking desert southwest. However, for this supply to get to the northwest, it had to flow through CAISO.

Sustained volatility occurred in the Northwest as LMPs spiked beyond $1,000/MWh and remained elevated for hours. However, generators in the Desert SW did not profit from these prices. As power flowed through CAISO, California collected ~$111 million in profits from these exports. This didn’t go unnoticed by the surrounding balancing authorities. Multiple BA’s, such as Pacificorp and Powerex, publicly dissected the event, its pricing impacts, and likelihood to continue under EDAM. CAISO took notice of unrest among the WEIM (and prospective EDAM) ranks and responded by accepting all but one of the proposed revisions from Pacificorp, which were all ultimately approved by FERC (following revisions to the EDAM access charge).

While California’s AB825 may open the door for an independent CAISO around the time of Markets+ wave 2, it may be too little too late. Currently, many of the BAs who received power, as well as the BAs who sent power during the 2024 winter storm, are planning to join Markets+. (APS, SRP, TEPC, Powerex, BPAT, etc). BPA serves load through PacifiCorp transmission system; conversely, PacifiCorp serves loads in areas that rely on BPA transmission. Added complexity arises from contract path arrangements between BAs and through their territories. A system to manage congestion in the West is not currently in place.

Beyond the dams themselves, BPA owns 15,000 miles of transmission lines in the Pacific Northwest. This has driven tension between smaller balancing authorities and utilities that get the bulk of their power from BPA as many have expressed concerns that BPA’s choice will force their own hand. BPA has announced joining M+ for 2028, but could that be their ultimate stop in the great battle in the west?

Despite the current relationship, BPA stands out not just for their outsized presence, but long history of collaboration with both CAISO and California itself.

The centerpiece of this relationship is undoubtedly the Pacific Northwest - Pacific Southwest Intertie, the longest and highest voltage DC line of its time.

The concept of this tie was first proposed in the early 20th century, but didn’t come to fruition until the involvement of the federal government in the 1960s. Its approval was intertwined with international cooperation via the Columbia River Treaty, ratified in the same year that Congress passed a bill authorizing construction of the tie.

Despite this history, the traditional arrangement has sometimes flipped in recent years.

Typically, BPA sends flows to CAISO, but with higher winter demand this past year, CAISO was actually a net exporter to the north that month. From fire to ice, transmission management becomes an issue to serve these load events.

The British ( Columbia ) Invasion

The borders of the Western Interconnection don’t stop at the 49th parallel. British Columbia and Alberta play important roles in powering the West. Powerex, the power marketing arm of BC Hydro, is joining Markets+. BC Hydro is the west coast counterpart to the east’s Hydro-Québec, a hydro-dominated provincial powerhouse in the form of a crown corporation. Unlike Hydro-Québec, BC Hydro is part and parcel of the Western Interconnection.

Authorized to participate in the American side of the grid for decades, Powerex most recently filed a renewal of its Canadian export capability with the DOE on November 18th, 2024 and received approval on June 10th, 2025. A time that must have seemed particularly ominous in terms of cross-border relations, as the specter of tariffs was repeatedly raised in the context of electricity.

Despite what was likely the most attention ever paid to the topic, not a single comment was filed on Powerex’s application.

Powerex is quite active in the West and is a member of WECC. British Columbia is connected to the lower 48 through two 500kV transmission lines running parallel between British Columbia and Washington State along the coastal region and a 230kV line between BC and WA on the eastern side. To the east, BC is interconnected with Alberta across three lines, a main 500 kV line and two smaller 138 kV lines, which collectively form the BC-Alberta intertie, or Path One.

Powerex has a history of discontent with respect to CAISO’s price setting. Disagreements extend beyond the 2024 winter storm, with Powerex leveraging a Pacificorp EDAM filing to demonstrate perceived design flaws in CAISO’s new day-ahead market. These issues tie back once again to congestion rents and the Pacificorp filing mentioned above. Unlike other US power markets (including Markets+), EDAM congestion rents were not planned to be allocated based on transmission rights, but rather modeled congestion bottlenecks.

With most bottlenecks occurring within the CAISO-administered system, its customers would have received the lion’s share of rents as power moves through the West, resulting in a downstream cost shift from ratepayers within CAISO to those without.

These issues were partially ameliorated this past summer as CAISO accepted amendments from Pacificorp, but complications remain with respect to self-scheduling. CAISO’s market monitor also approved of the changes, but noted the need for a more durable solution in the future.

The Calgary Stampede

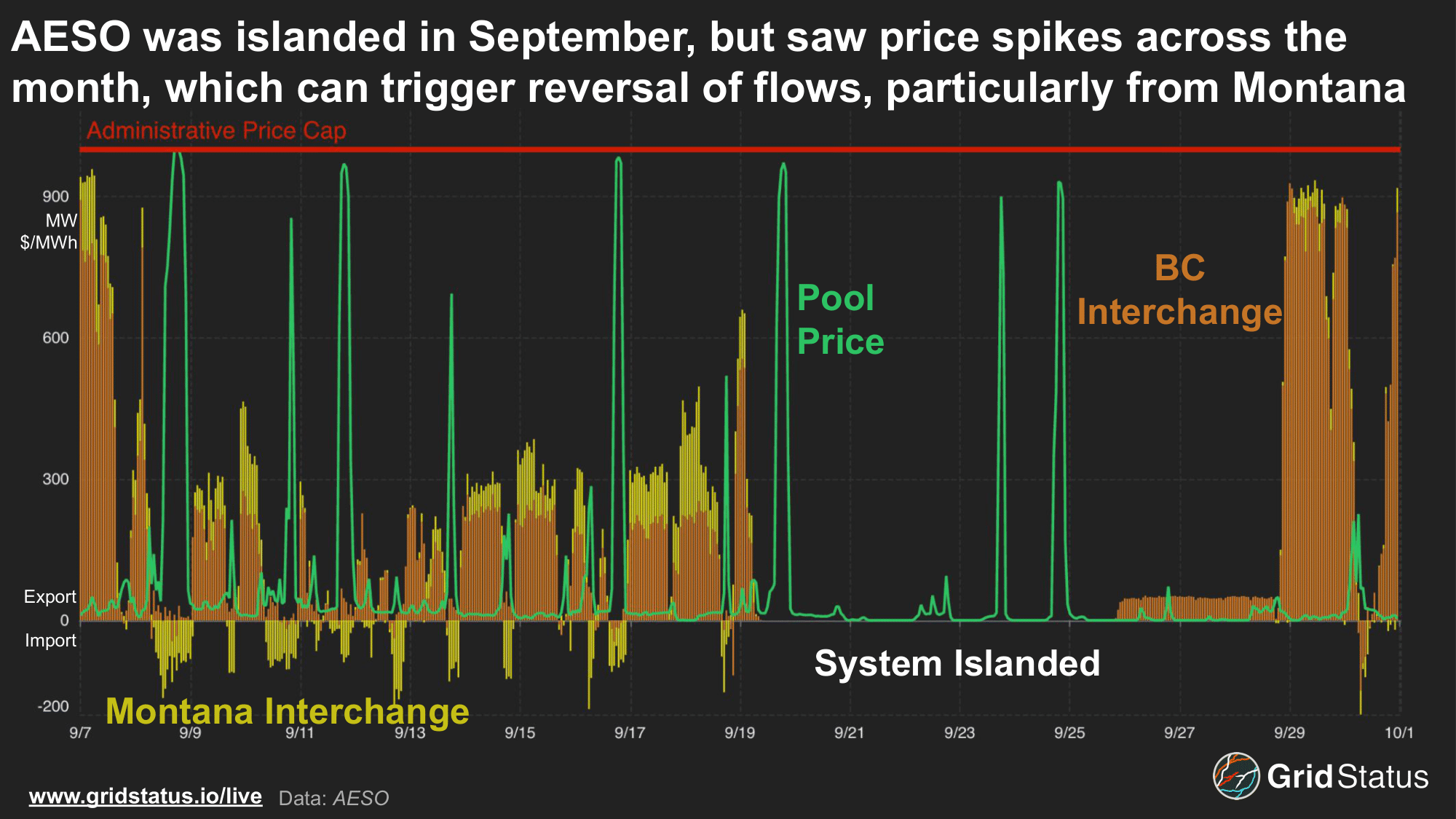

Our western neighbors don't stop at the coast, and we must also head inland, to Alberta Electrical System Operator, AESO. This grid has traditionally operated as an energy-only model that only compensates generators for the energy that they produce. The grid is compiled of a majority of natural gas with some wind and moderate solar penetration. In recent history, AESO has been a net exporter, sending flows to BC, Montana, and Saskatchewan. AESO load peak this year was 12 GW, and is generally dual peaking, with similar peaks in both winter and summer.

Prices can be volatile in AESO, particularly when solar comes offline or right before it comes online. Interest in data center development has been strong, leading to reforms and imposition of order on the formerly overwhelming capacity of requests. A tendency to island coupled with the smallest peak demand of any North American market did not position Alberta to readily take on fresh GWs of demand, or at least not quickly. Without the heft of ERCOT, load growth in a weekly interconnected system can push it to the operational edge.

Although the line capacity is greater, AESO has even fewer individual ties with the wider west than SPP’s Eastern and Western BAs will have with each other. Additionally, while SPP’s East/West ties are independent, any outage of Path One also necessitates taking Path 83 out of service (Alberta’s tie with Montana).

Following in Ontario’s footsteps, AESO is restructuring its grid, under the Restructured Energy Market (REM) process. Unlike previously planned reforms (such as the aborted capacity market of nearly a decade ago), REM is approved and moving forward. We’ll take a more detailed look at REM closer to launch. For now, these are some of the key features, many of which will sound familiar to those who followed IESO’s Market Renewal:

- LMPs via nodal pricing

- Increases to the offer and price caps, eventual transition to lower price floor

- New real-time ramp product

- Enhanced day-ahead market

- Market power mitigation.

The timelines here vary. Stakeholder engagement is ongoing today, and initial implementation will begin in mid-2027, but certain characteristics, such as the lower price floor and higher-frequency settlements, won’t be implemented until 2032. Alberta will also rely on temporary FTRs to offset the impacts of new congestion prices. These ephemeral rights will be phased out over 8 years.

To the Future

Infrastructure of the past is visible in the physical fabric of the future, and in the West, rail’s impact remains clear. Today, transmission lines track alongside cars full of coal, as electrical and latent chemical energy ride side-by-side under wide open skies. Supplied by Wyoming, coal remains prevalent in the fuel stack across the intermountain West, although this is shifting as units retire. Preferred replacements vary widely across balancing authorities. Wyoming's windy plains are targeting airborne turbines. Nevada is looking towards geothermal. The Southwest is looking at solar, and speculative SMR promises have proliferated.

Against this evolving backdrop, power markets in the West are changing in big ways. Across thousands of words and millions of datapoints, we’ve only scratched the surface of the complex interplay as authorities reconfigure the digital engine of the grid while it's in transit. Seams in particular will play a large role, and we’ve barely touched on them. Modeling in the West largely relies on contract-based paths with inconsistent processes across areas, in contrast to the flow-based modeling and well-developed coordination in much of the Eastern Interconnection. FERC recently released a staff whitepaper on the history and state of play that’s worth reading if you’re looking to come up to speed on this issue (oddly, after we published this, the FERC whitepaper was taken down, but then was republished on 11/21/25).

Much remains to be seen, and dynamics on the ground have multiple opportunities to change as market milestones approach. From authorities yet to fully commit to the potential for CAISO independence, to the specter of datacenter load growth above all, power markets in the West are on track for an exciting denouement to the 2020s. Track the action and more with Grid Status.